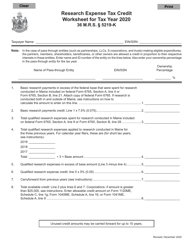

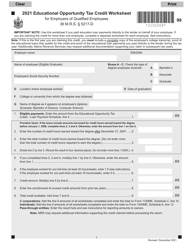

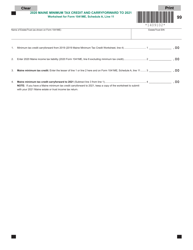

Dual Residence Reduction of Tax Credit Worksheet - Maine

Dual Residence Reduction of Tax Credit Worksheet is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

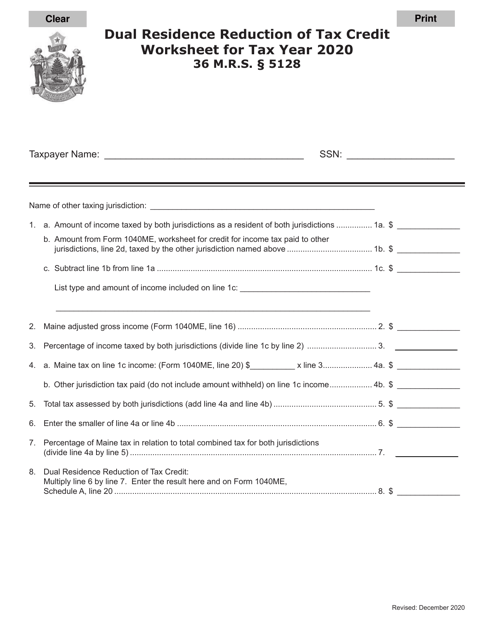

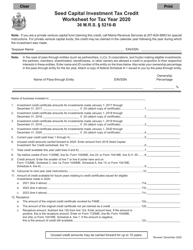

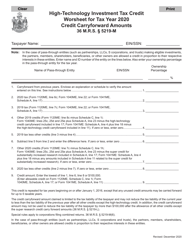

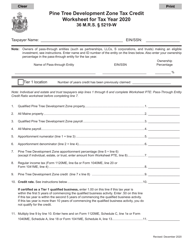

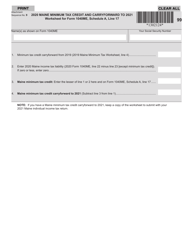

Q: What is the Dual Residence Reduction of Tax Credit Worksheet?

A: The Dual Residence Reduction of Tax Credit Worksheet is a form used to calculate the tax credit for individuals who have dual residence in Maine and another state.

Q: Who is eligible for the Dual Residence Reduction of Tax Credit?

A: Individuals who have dual residence in Maine and another state are eligible for the Dual Residence Reduction of Tax Credit.

Q: How does the Dual Residence Reduction of Tax Credit work?

A: The Dual Residence Reduction of Tax Credit allows individuals to reduce their Maine income tax liability by the amount of income tax paid to another state on income earned in that state.

Q: What is the purpose of the Dual Residence Reduction of Tax Credit?

A: The purpose of the Dual Residence Reduction of Tax Credit is to prevent individuals from being taxed on the same income by both Maine and another state.

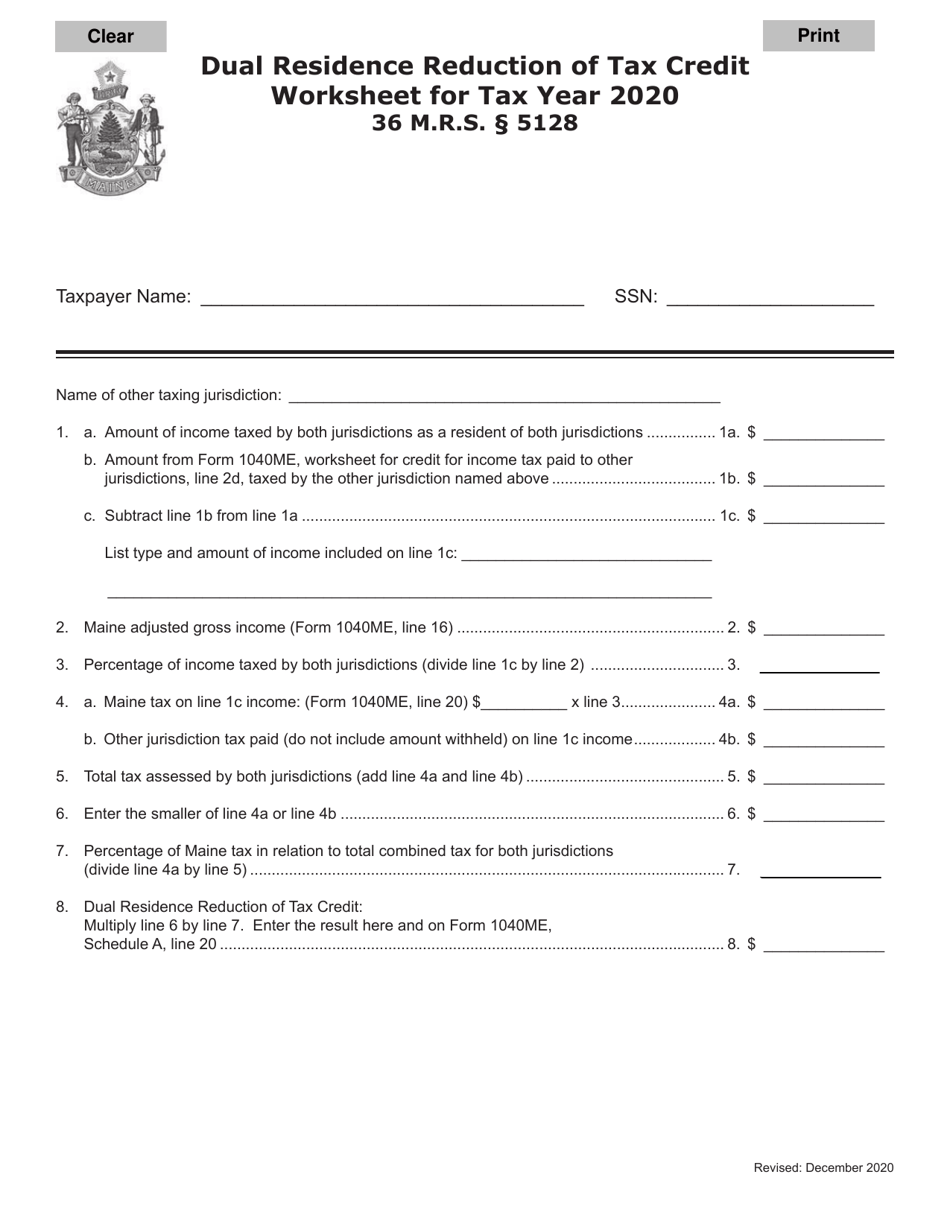

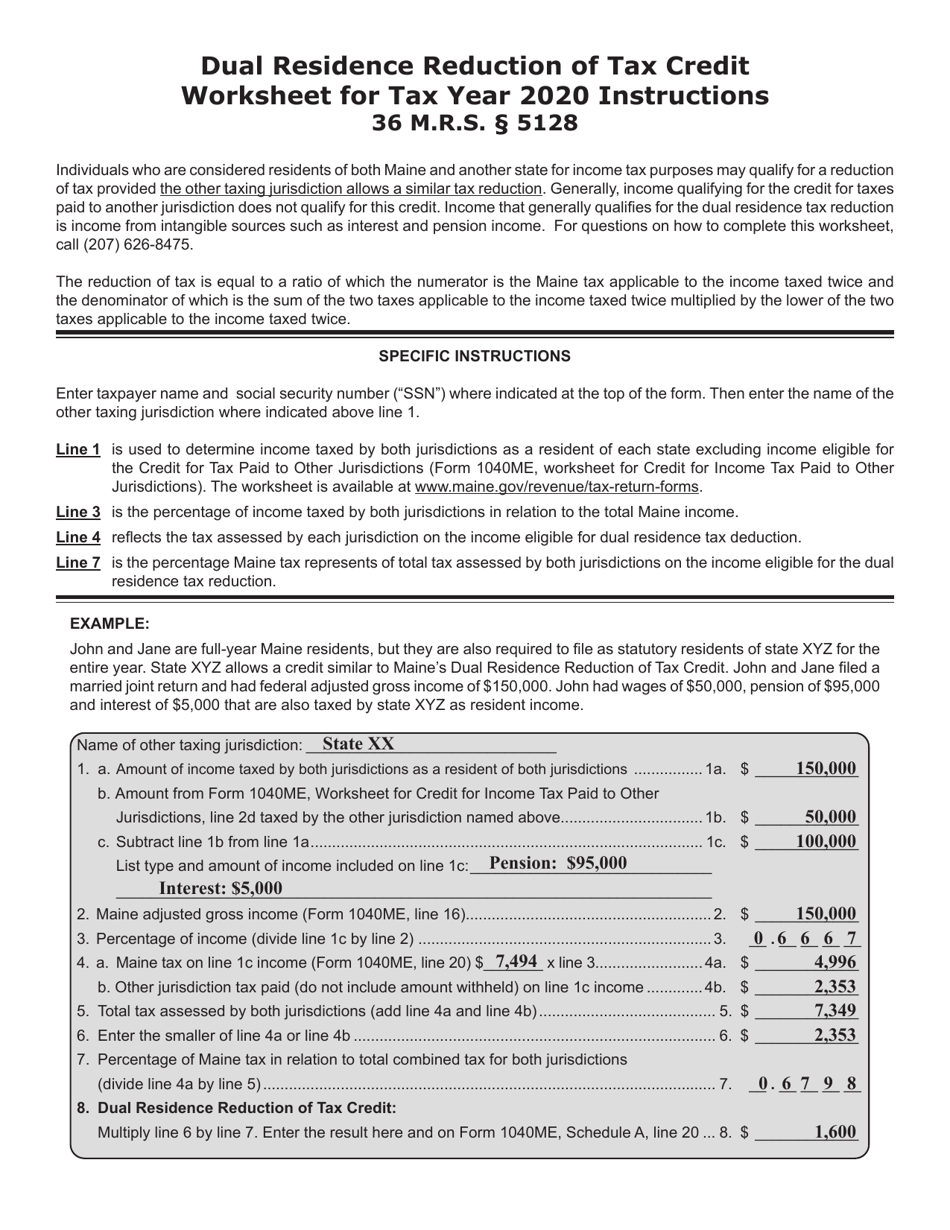

Q: How do I fill out the Dual Residence Reduction of Tax Credit Worksheet?

A: To fill out the Dual Residence Reduction of Tax Credit Worksheet, you will need to follow the instructions provided on the form and enter the required information, such as your Maine income tax liability and the amount of income tax paid to the other state.

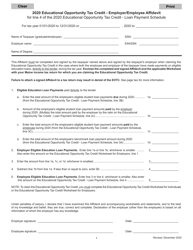

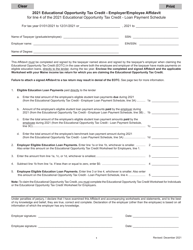

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.