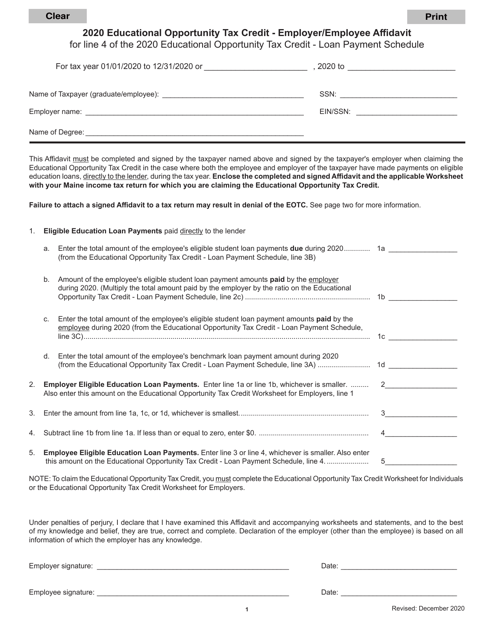

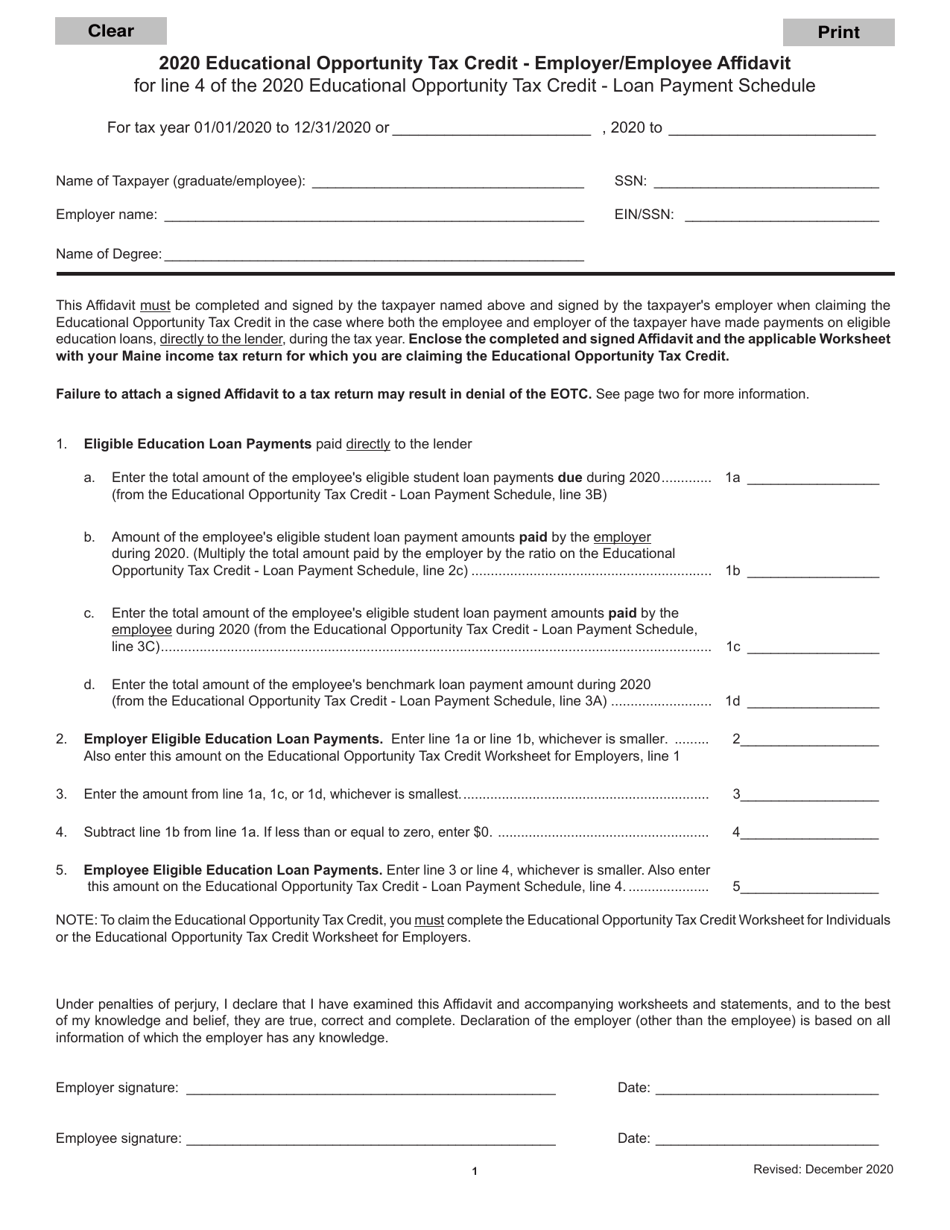

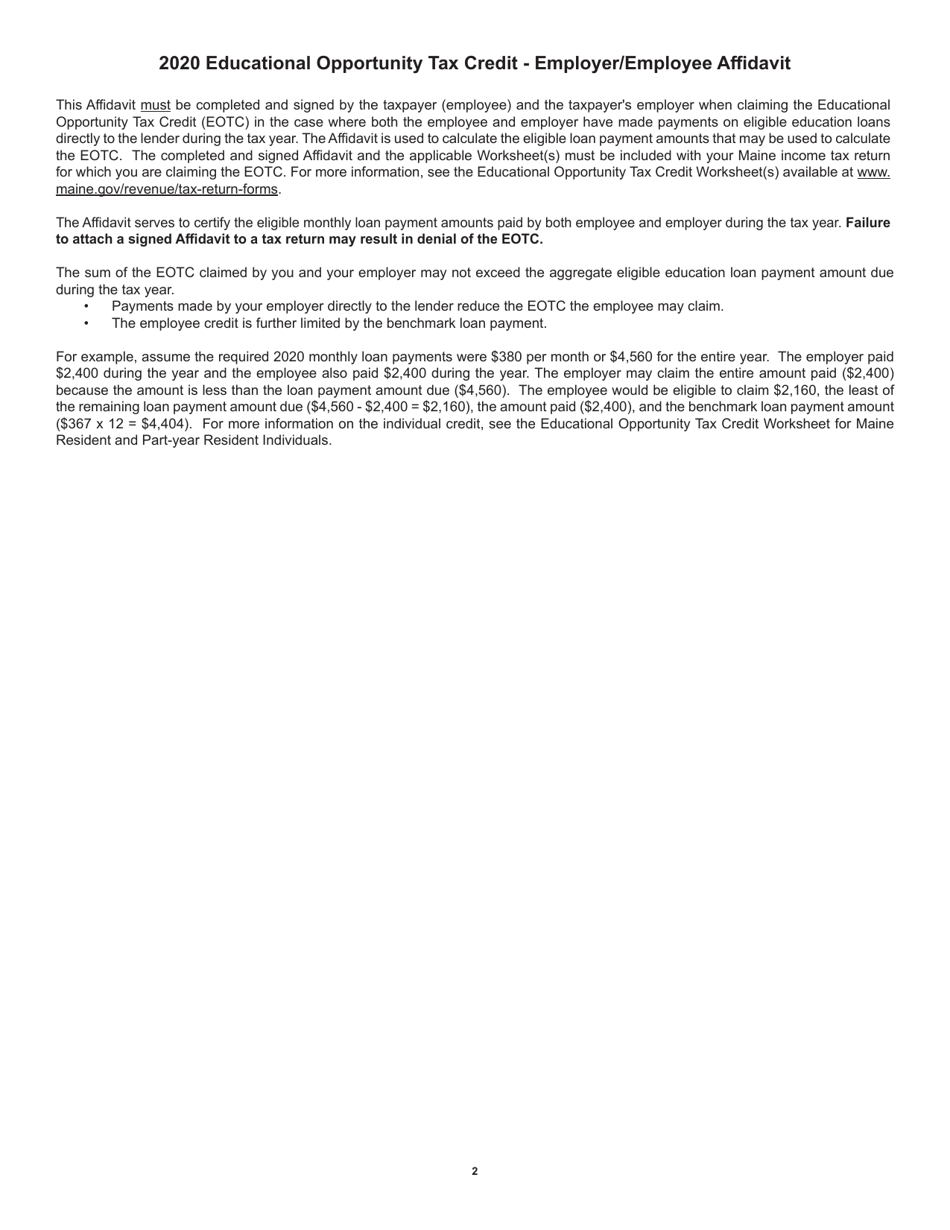

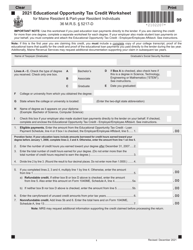

Educational Opportunity Tax Credit - Employer / Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit - Loan Payment Schedule - Maine

Educational Opportunity Tax Credit - Employer/Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit - Loan Payment Schedule is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

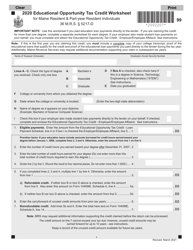

Q: What is the Educational Opportunity Tax Credit?

A: The Educational Opportunity Tax Credit is a tax credit available to residents of Maine who have student loan debt.

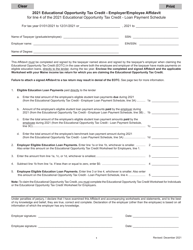

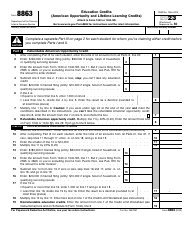

Q: What is the Employer/Employee Affidavit for Line 4 of the Educational Opportunity Tax Credit?

A: The Employer/Employee Affidavit for Line 4 is a form that needs to be filled out by both the employer and the employee to verify the amount of student loan payments made.

Q: What is the Loan Payment Schedule for the Educational Opportunity Tax Credit?

A: The Loan Payment Schedule is a document that shows the dates and amounts of the student loan payments made by the taxpayer.

Q: Is the Educational Opportunity Tax Credit available in both the USA and Canada?

A: No, the Educational Opportunity Tax Credit is only available to residents of Maine in the USA.

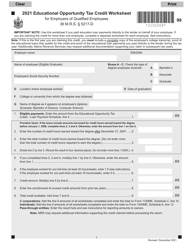

Q: Who is eligible for the Educational Opportunity Tax Credit?

A: Residents of Maine who have student loan debt are eligible for the Educational Opportunity Tax Credit.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.