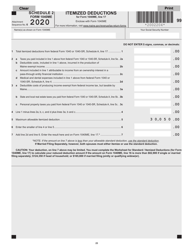

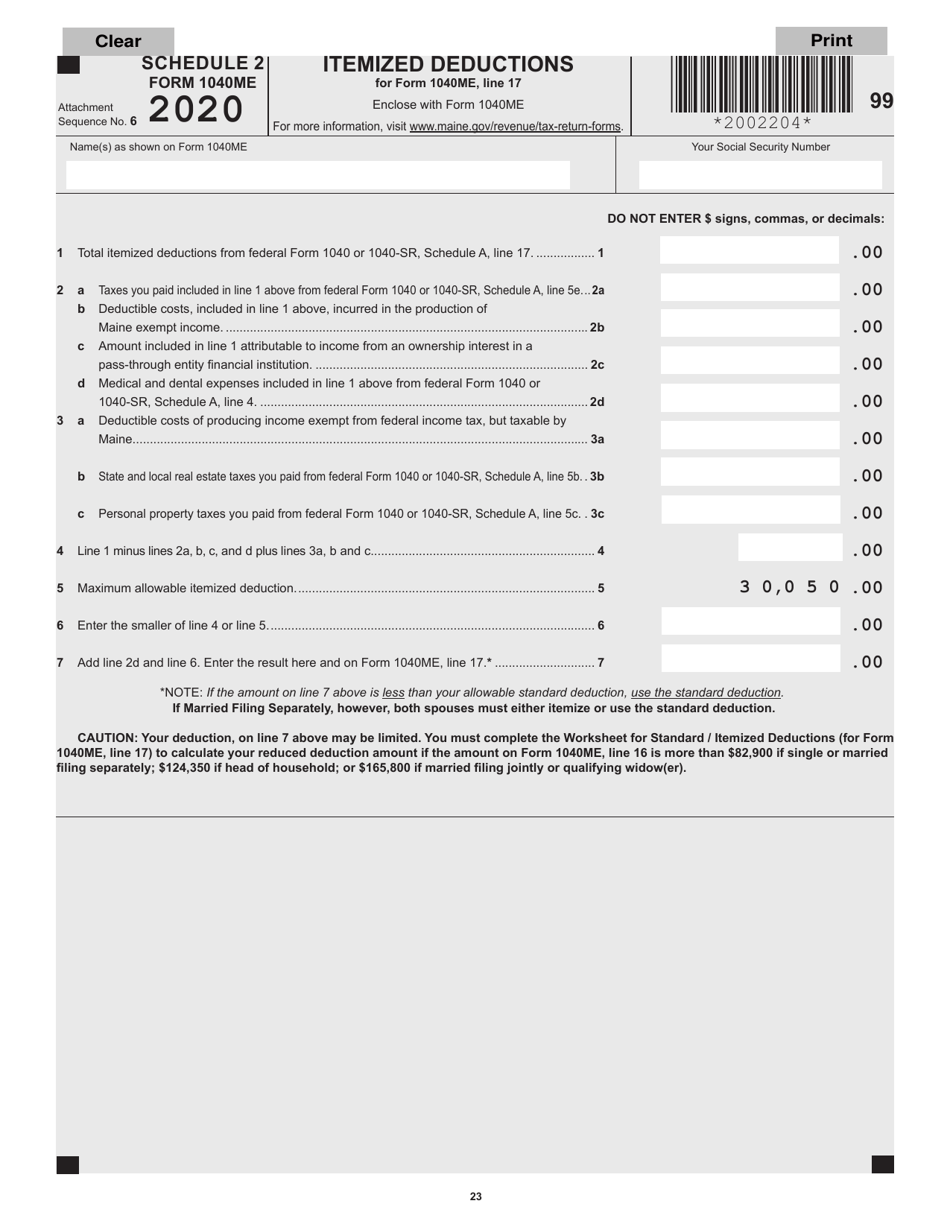

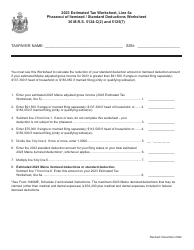

Form 1040ME Schedule 2 Itemized Deductions - Maine

What Is Form 1040ME Schedule 2?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule 2?

A: Form 1040ME Schedule 2 is a tax form specific to the state of Maine that is used to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can deduct from your taxable income, such as medical expenses, mortgage interest, and charitable contributions.

Q: Why would I use Form 1040ME Schedule 2?

A: You would use Form 1040ME Schedule 2 if you want to claim itemized deductions on your Maine state tax return instead of taking the standard deduction.

Q: What expenses can be deducted on Form 1040ME Schedule 2?

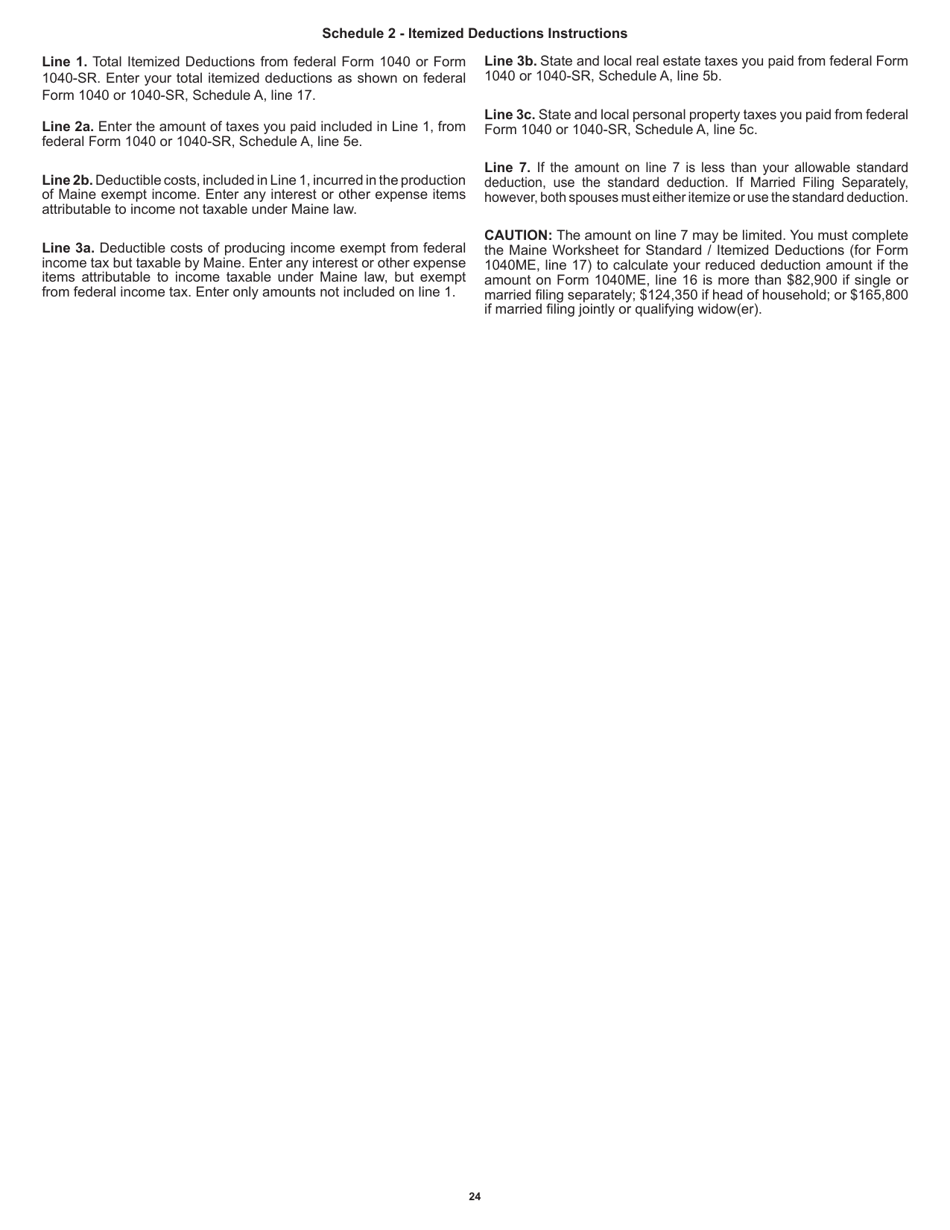

A: Expenses that can be deducted on Form 1040ME Schedule 2 include medical and dental expenses, state and local taxes, mortgage interest, charitable contributions, and certain other miscellaneous deductions.

Q: How do I fill out Form 1040ME Schedule 2?

A: You will need to gather documentation for your itemized deductions and fill out the appropriate sections of the form, including providing details of each deductible expense.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule 2 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.