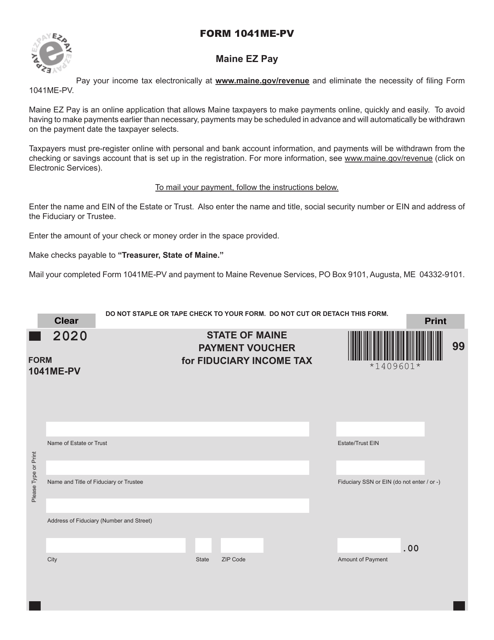

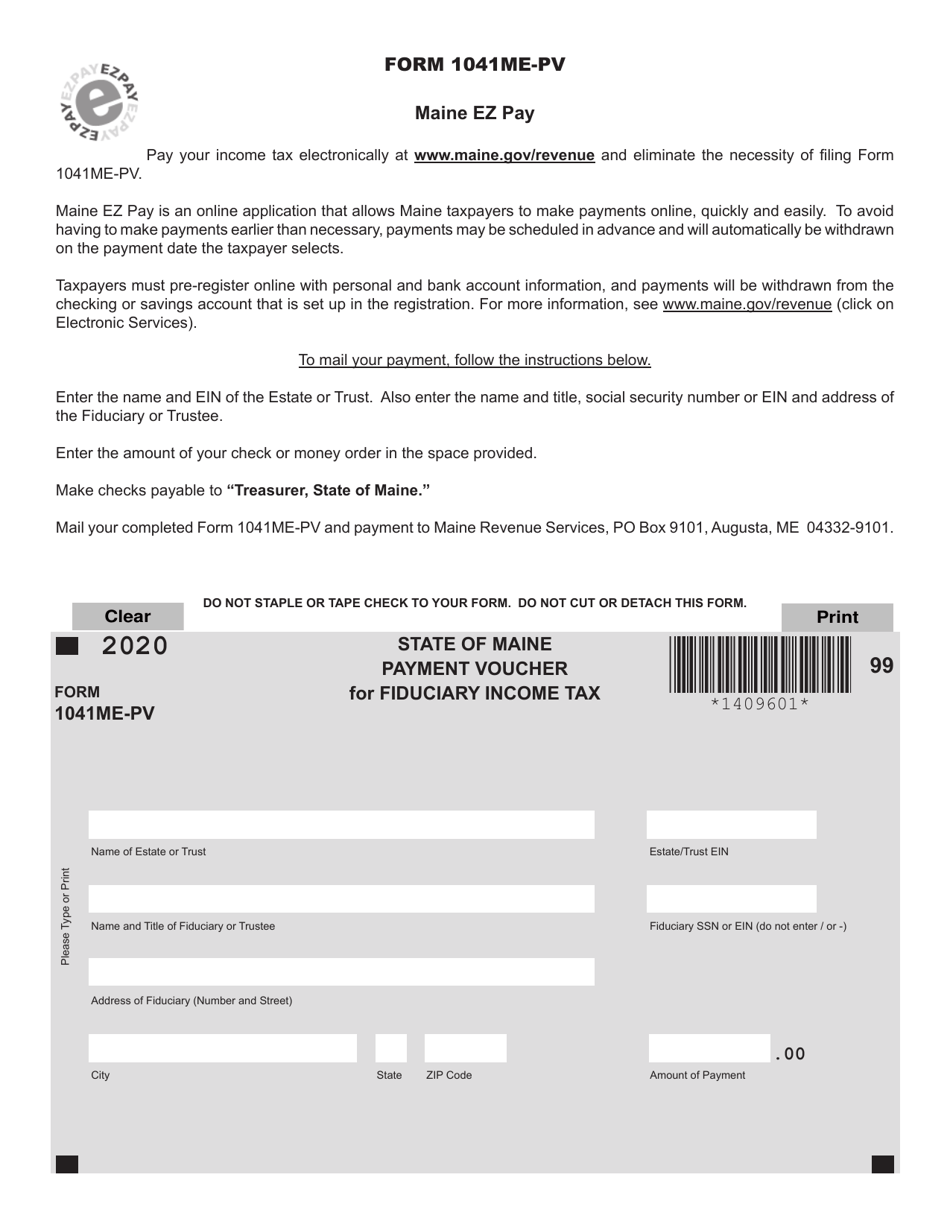

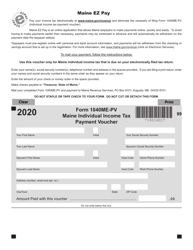

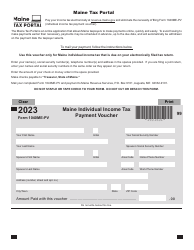

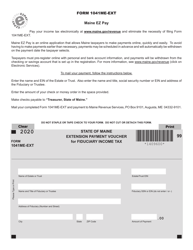

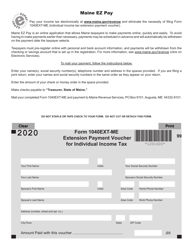

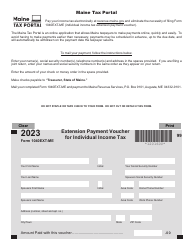

Form 1041ME-PV Payment Voucher for Fiduciary Income Tax - Maine

What Is Form 1041ME-PV?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041ME-PV?

A: Form 1041ME-PV is a payment voucher for fiduciary income tax in Maine.

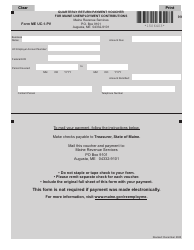

Q: Who needs to use Form 1041ME-PV?

A: Individuals or entities acting as fiduciaries and owe income tax in Maine need to use Form 1041ME-PV.

Q: What is the purpose of Form 1041ME-PV?

A: The purpose of Form 1041ME-PV is to provide a voucher for making payment of fiduciary income tax in Maine.

Q: When is the due date for Form 1041ME-PV?

A: The due date for Form 1041ME-PV is the same as the due date for filing the corresponding tax return.

Q: Can I file Form 1041ME-PV electronically?

A: Yes, you can file Form 1041ME-PV electronically if you are using approved e-filing methods.

Q: What information do I need to fill out Form 1041ME-PV?

A: You will need to provide your name, address, Social Security number or employer identification number, and the amount of tax due.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041ME-PV by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.