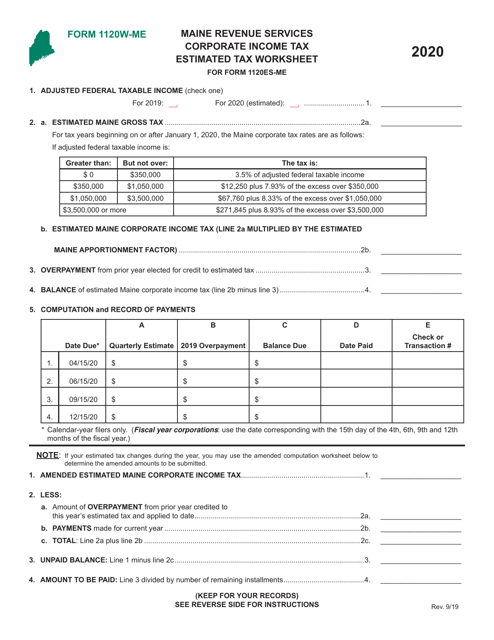

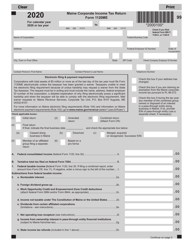

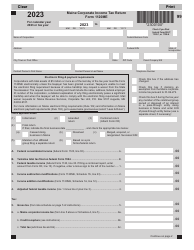

Form 1120W-ME Corporate Income Tax Estimated Tax Worksheet - Maine

What Is Form 1120W-ME?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120W-ME?

A: Form 1120W-ME is a worksheet used for calculating estimated tax for corporate income tax in Maine.

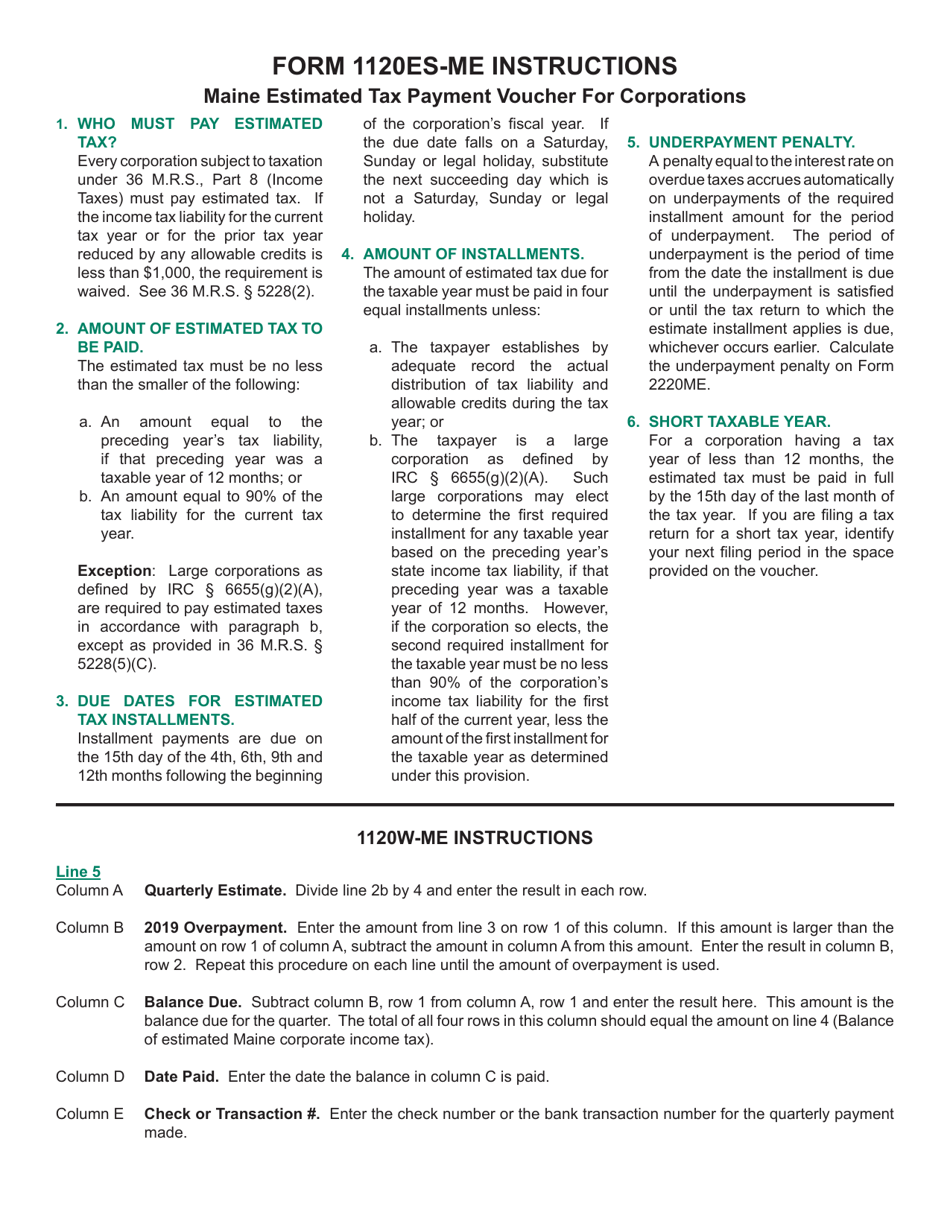

Q: Who needs to file Form 1120W-ME?

A: Any corporation that is required to pay corporate income tax in Maine needs to file Form 1120W-ME.

Q: What is the purpose of Form 1120W-ME?

A: The purpose of Form 1120W-ME is to help corporations estimate their tax liability and pay estimated taxes throughout the year.

Q: What information is required on Form 1120W-ME?

A: Form 1120W-ME requires corporations to provide information about their income, deductions, and tax credits.

Q: When should Form 1120W-ME be filed?

A: Form 1120W-ME should be filed by the 15th day of the 4th month following the end of the corporation's tax year.

Q: Are there any penalties for not filing Form 1120W-ME?

A: Yes, there are penalties for failing to file Form 1120W-ME or paying estimated taxes on time. It is important to meet the filing and payment deadlines to avoid these penalties.

Q: Can Form 1120W-ME be e-filed?

A: Yes, Form 1120W-ME can be e-filed through approved e-file providers.

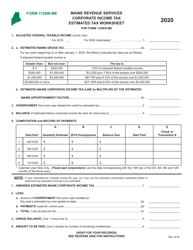

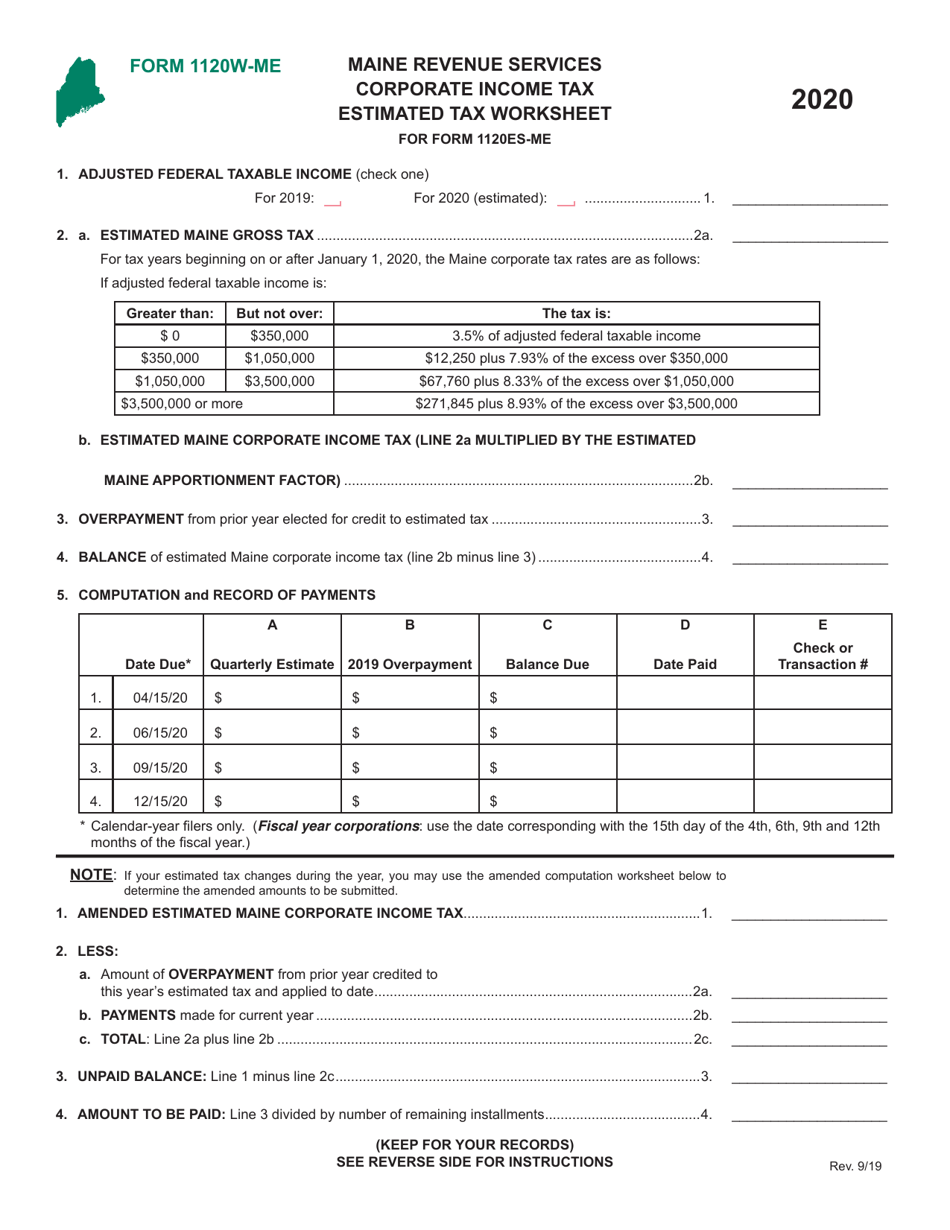

Q: Can I make changes to my estimated tax payments if needed?

A: Yes, if your estimated tax payments need to be adjusted due to changes in income or deductions, you can make changes throughout the year by filing an amended Form 1120W-ME.

Q: Do I need to include my estimated tax payments with Form 1120W-ME?

A: No, estimated tax payments should not be included with Form 1120W-ME. They should be made separately using the appropriate payment methods.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1120W-ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.