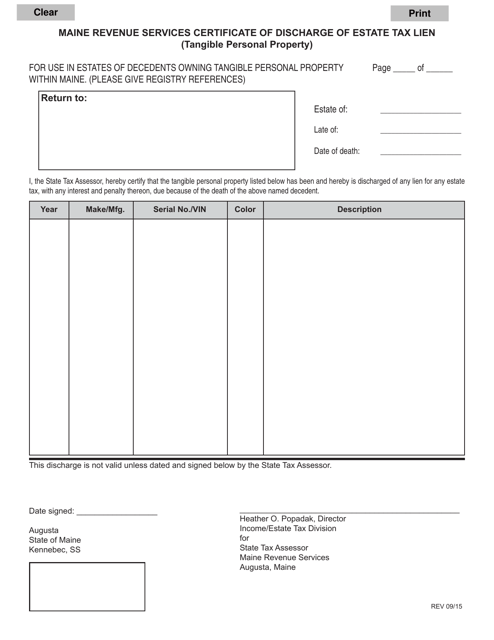

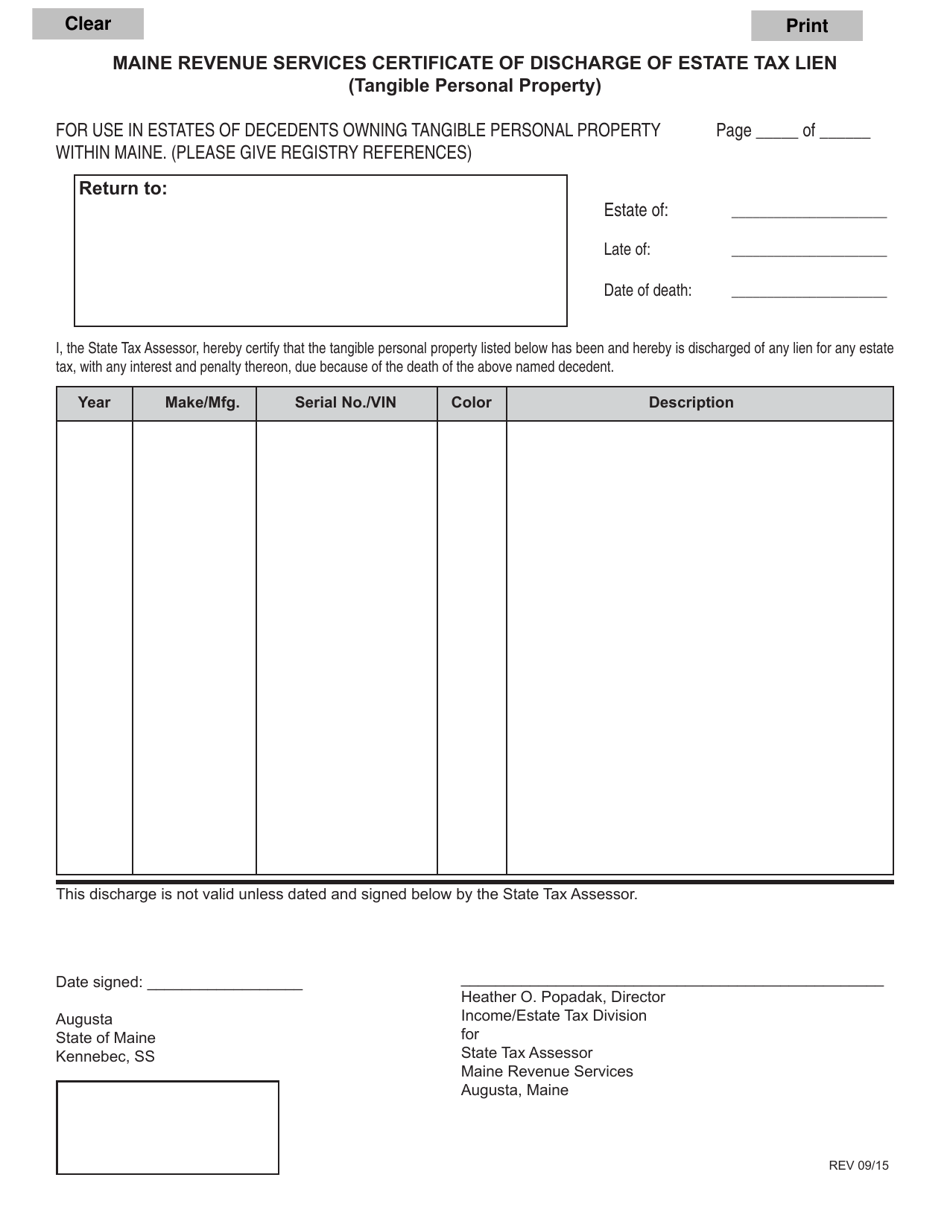

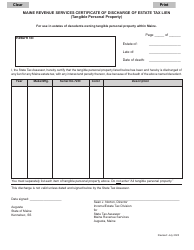

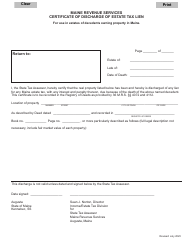

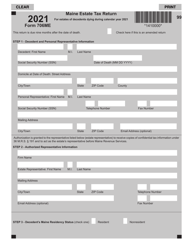

Maine Revenue Services Certificate of Discharge of Estate Tax Lien (Tangible Personal Property) - Maine

Maine Revenue Services Certificate of Discharge of Estate Tax Lien (Tangible Personal Property) is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Certificate of Discharge of Estate Tax Lien?

A: The Certificate of Discharge of Estate Tax Lien is a legal document issued by Maine Revenue Services.

Q: What is the purpose of the Certificate of Discharge of Estate Tax Lien?

A: The purpose of the Certificate of Discharge of Estate Tax Lien is to release the lien on tangible personal property for estate tax purposes in Maine.

Q: Who issues the Certificate of Discharge of Estate Tax Lien?

A: The Certificate of Discharge of Estate Tax Lien is issued by Maine Revenue Services, which is the tax authority in Maine.

Q: What is tangible personal property?

A: Tangible personal property refers to physical assets such as furniture, jewelry, vehicles, and other movable possessions.

Q: Why would someone need a Certificate of Discharge of Estate Tax Lien for tangible personal property?

A: A Certificate of Discharge of Estate Tax Lien may be needed to transfer ownership or sell tangible personal property without the encumbrance of a tax lien.

Q: How can I obtain a Certificate of Discharge of Estate Tax Lien?

A: You can obtain a Certificate of Discharge of Estate Tax Lien by contacting Maine Revenue Services and following their application process.

Q: Are there any fees associated with getting a Certificate of Discharge of Estate Tax Lien?

A: Yes, there may be fees associated with obtaining a Certificate of Discharge of Estate Tax Lien. You should contact Maine Revenue Services for more information.

Q: Is the Certificate of Discharge of Estate Tax Lien specific to Maine?

A: Yes, the Certificate of Discharge of Estate Tax Lien is specific to Maine and its estate tax laws.

Q: Is the Certificate of Discharge of Estate Tax Lien applicable to real estate?

A: No, the Certificate of Discharge of Estate Tax Lien is specifically for tangible personal property and does not apply to real estate.

Q: Can the Certificate of Discharge of Estate Tax Lien be used for estate tax liens in other states?

A: No, the Certificate of Discharge of Estate Tax Lien is only applicable to estate tax liens in Maine. Other states may have their own procedures and requirements.

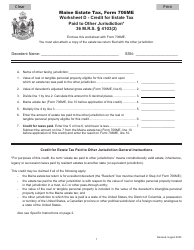

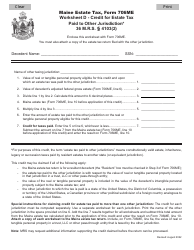

Form Details:

- Released on September 1, 2015;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.