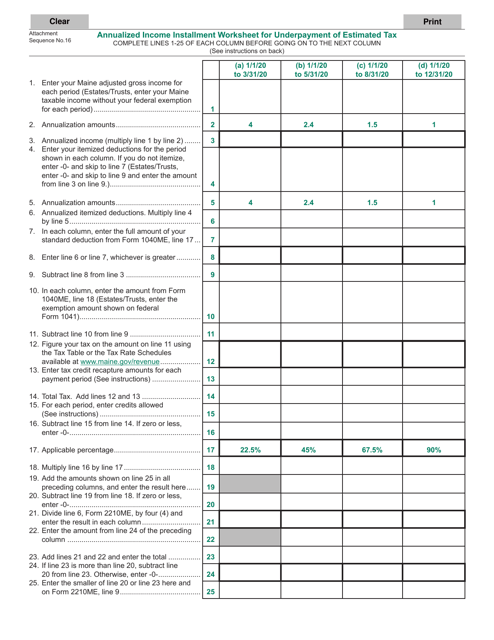

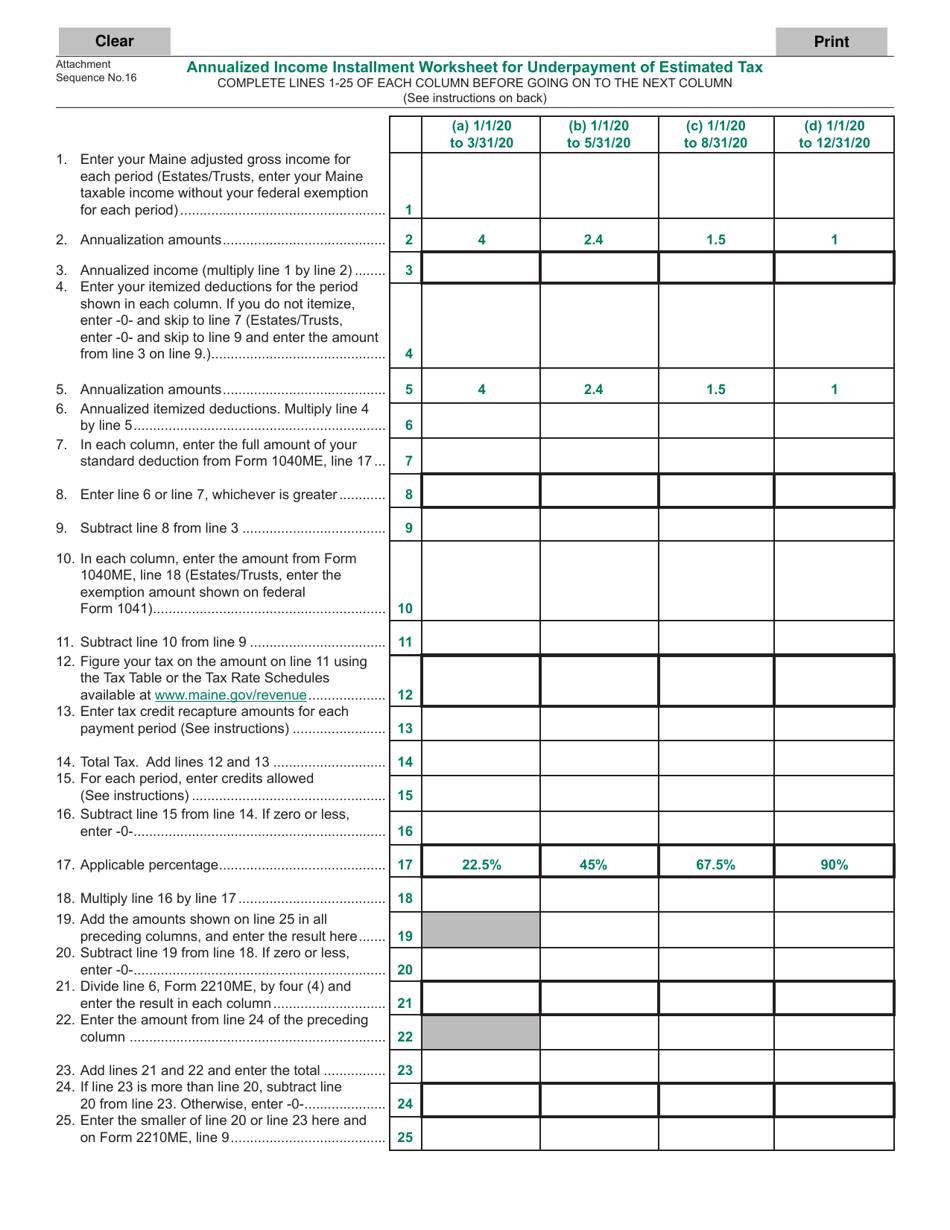

Annualized Income Installment Worksheet for Underpayment of Estimated Tax - Maine

Annualized Income Installment Worksheet for Underpayment of Estimated Tax is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Annualized Income Installment Worksheet for Underpayment of Estimated Tax?

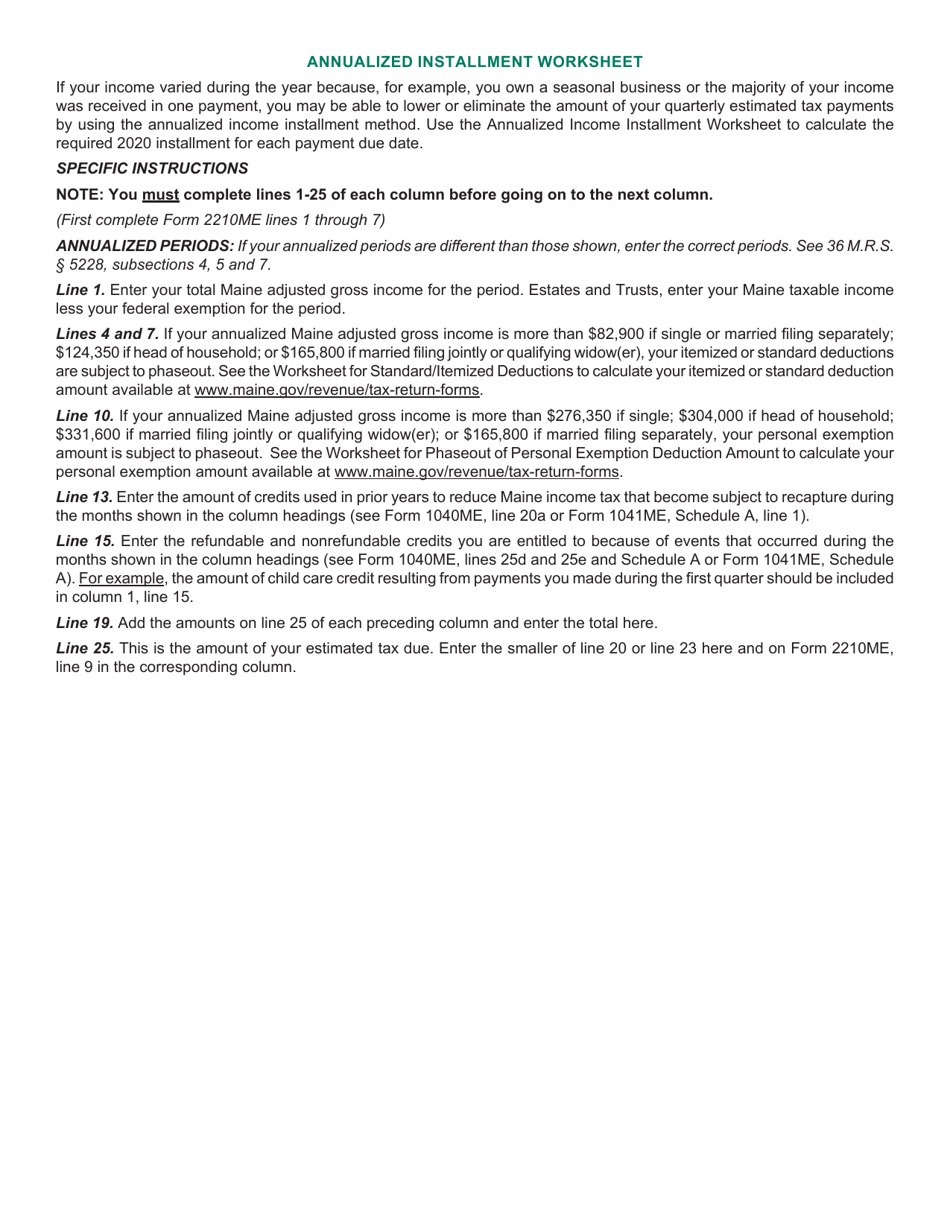

A: The Annualized Income Installment Worksheet for Underpayment of Estimated Tax is a form used in the state of Maine to calculate and adjust the amount of estimated tax payments for individuals who have fluctuating income throughout the year.

Q: Who needs to use the Annualized Income Installment Worksheet?

A: Individuals in Maine who have fluctuating income throughout the year may need to use the Annualized Income Installment Worksheet to adjust their estimated tax payments.

Q: How does the Annualized Income Installment Worksheet work?

A: The worksheet helps individuals calculate their estimated tax payments based on their income earned in each installment period. It takes into account the fluctuating income and adjusts the payment amounts accordingly.

Q: Why would someone use the Annualized Income Installment Worksheet?

A: Someone would use the Annualized Income Installment Worksheet if their income varies throughout the year and they want to avoid penalties for underpayment of estimated tax.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.