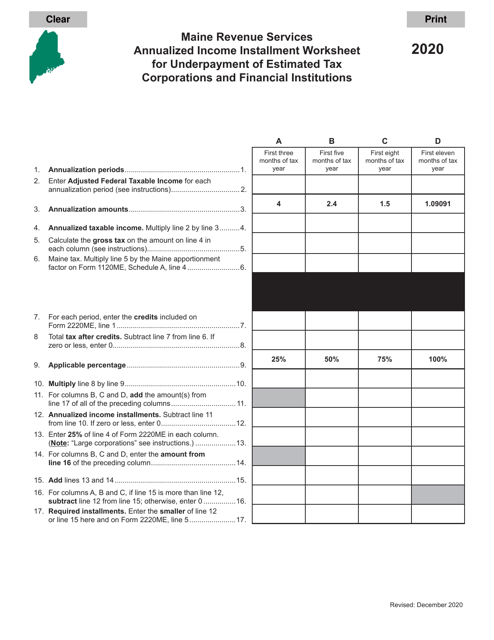

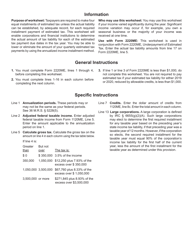

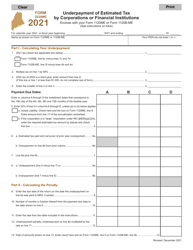

Annualized Income Installment Worksheet for Underpayment of Estimated Tax Corporations and Financial Institutions - Maine

Annualized Income Installment Worksheet for Underpayment of Estimated Tax Corporations and Financial Institutions is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

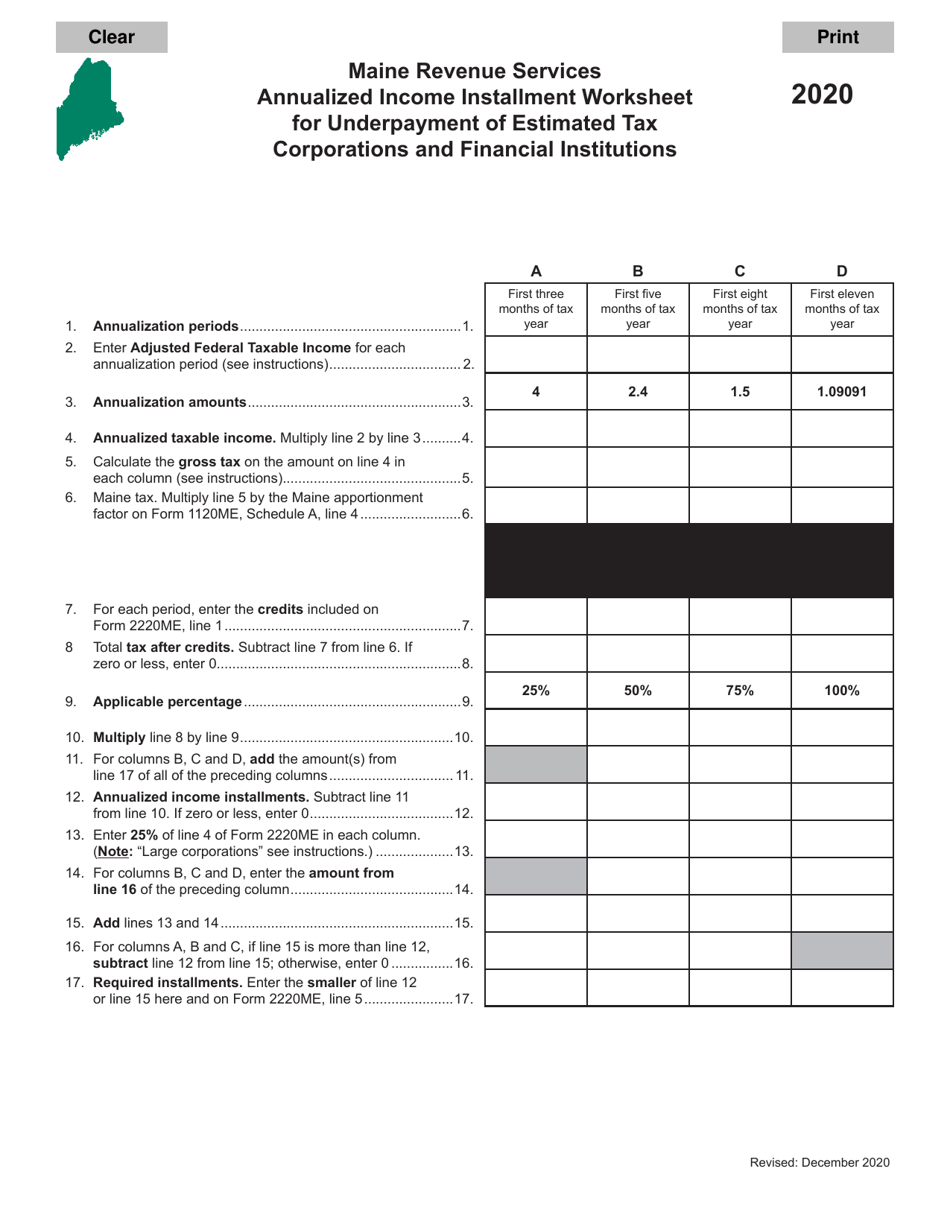

Q: What is the Annualized Income Installment Worksheet?

A: The Annualized Income Installment Worksheet is a tool used by corporations and financial institutions in Maine to calculate their underpayment of estimated tax.

Q: Who needs to use the Annualized Income Installment Worksheet?

A: Corporations and financial institutions in Maine who have underpaid their estimated tax need to use the Annualized Income Installment Worksheet.

Q: What is underpayment of estimated tax?

A: Underpayment of estimated tax occurs when a corporation or financial institution in Maine does not pay enough estimated tax throughout the year.

Q: Why would a corporation or financial institution need to calculate underpayment of estimated tax?

A: Calculating underpayment of estimated tax is necessary to determine if any penalties or interest need to be paid for not paying enough estimated tax throughout the year.

Q: How does the Annualized Income Installment Worksheet help in calculating underpayment of estimated tax?

A: The Annualized Income Installment Worksheet helps calculate underpayment of estimated tax by taking into account the income earned at different times throughout the year, and comparing it to the estimated tax payments made during those periods.

Form Details:

- Released on December 1, 2020;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.