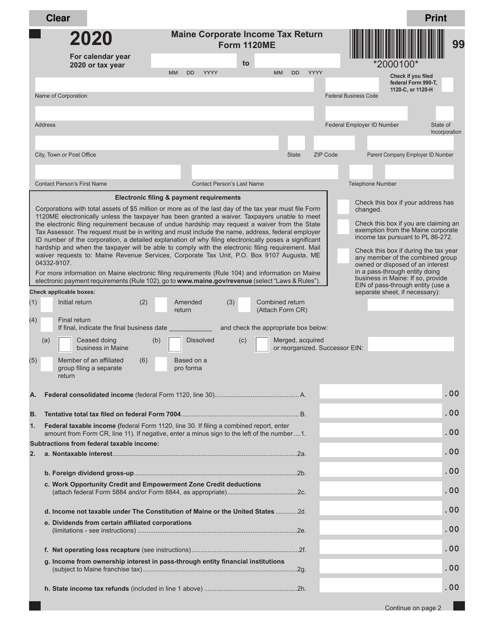

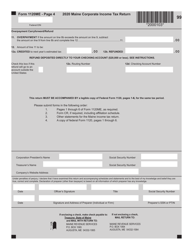

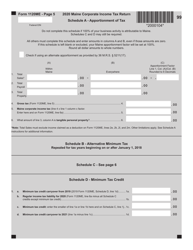

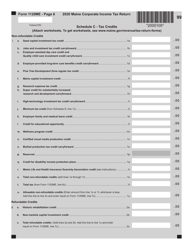

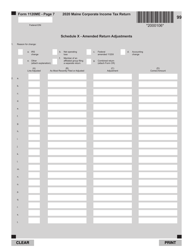

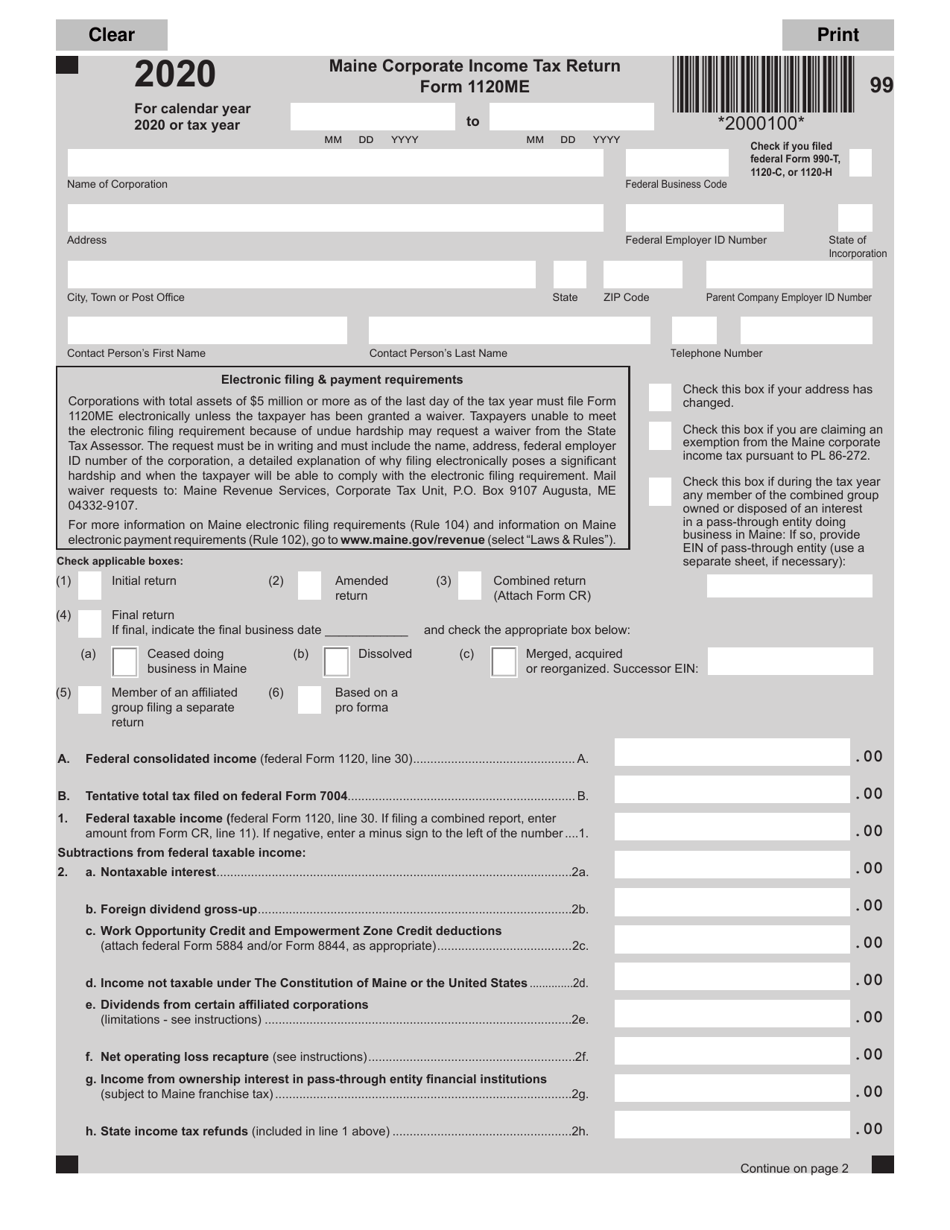

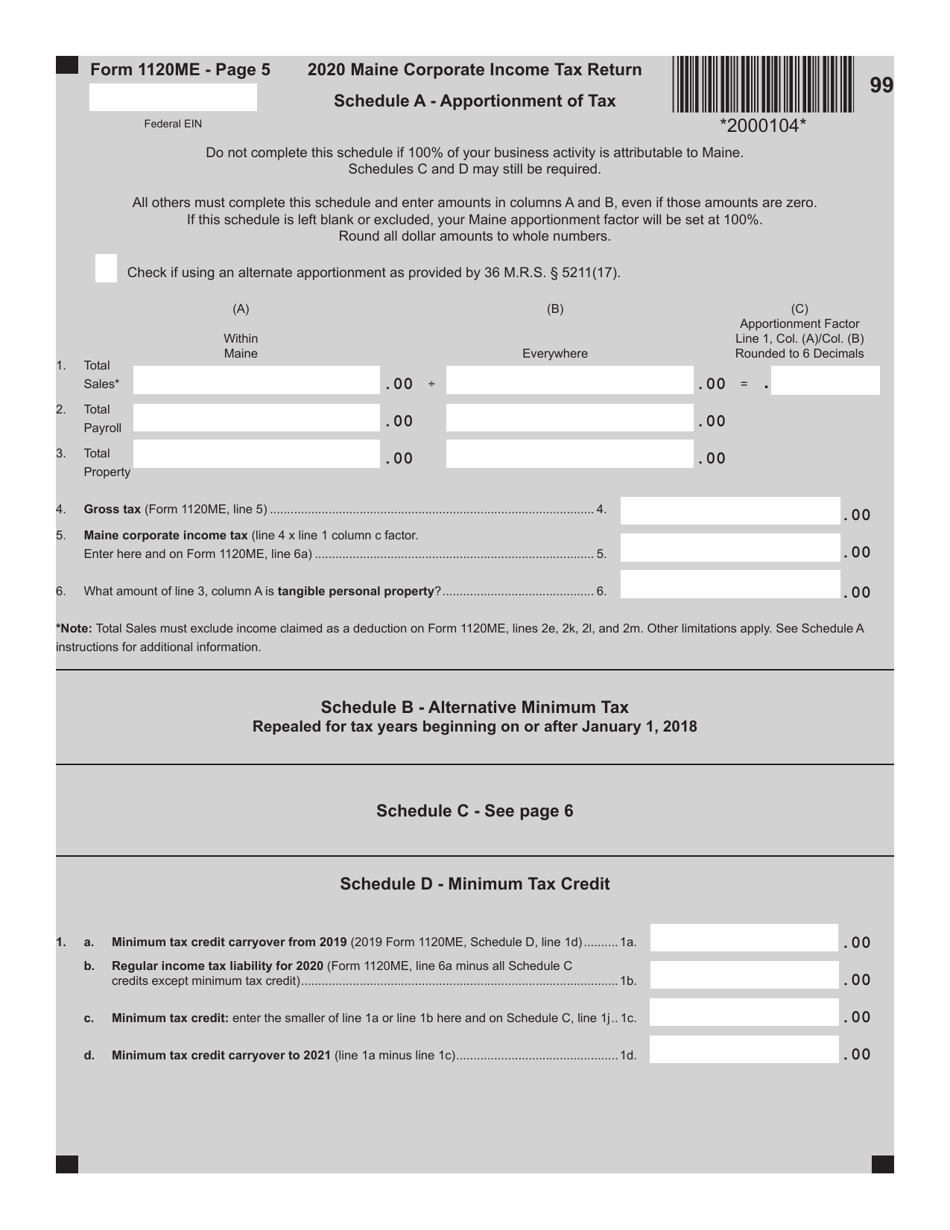

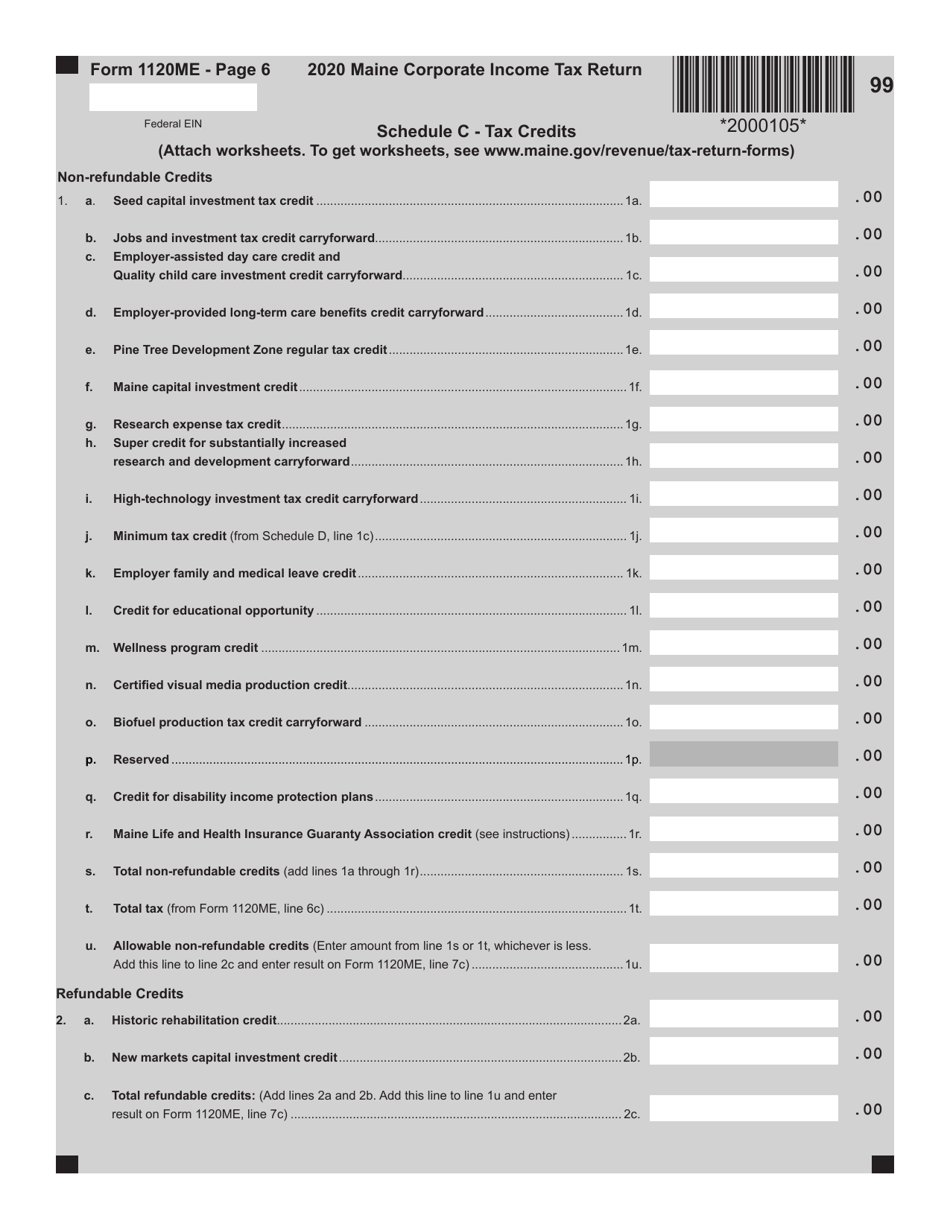

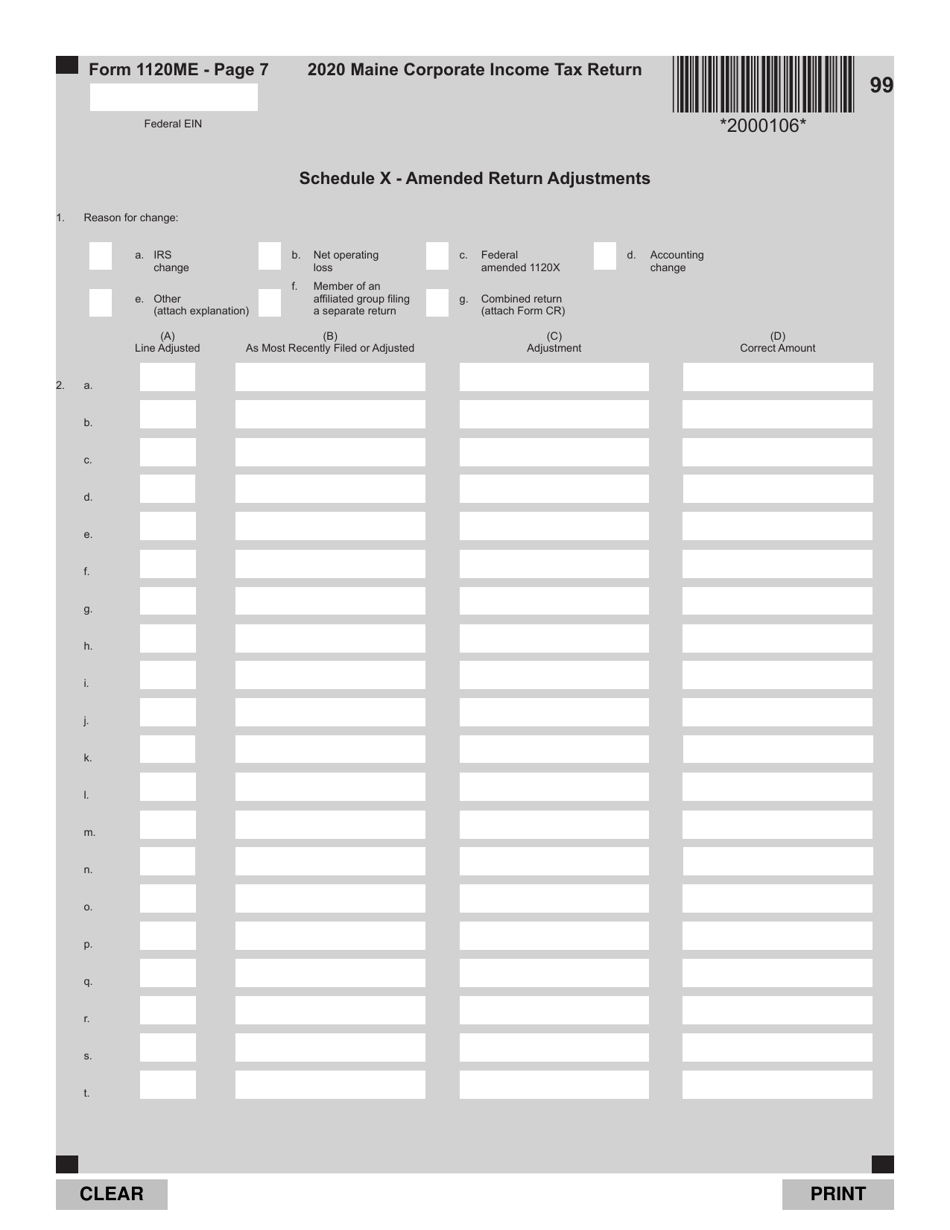

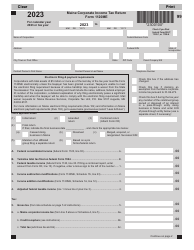

Form 1120ME Maine Corporate Income Tax Return - Maine

What Is Form 1120ME?

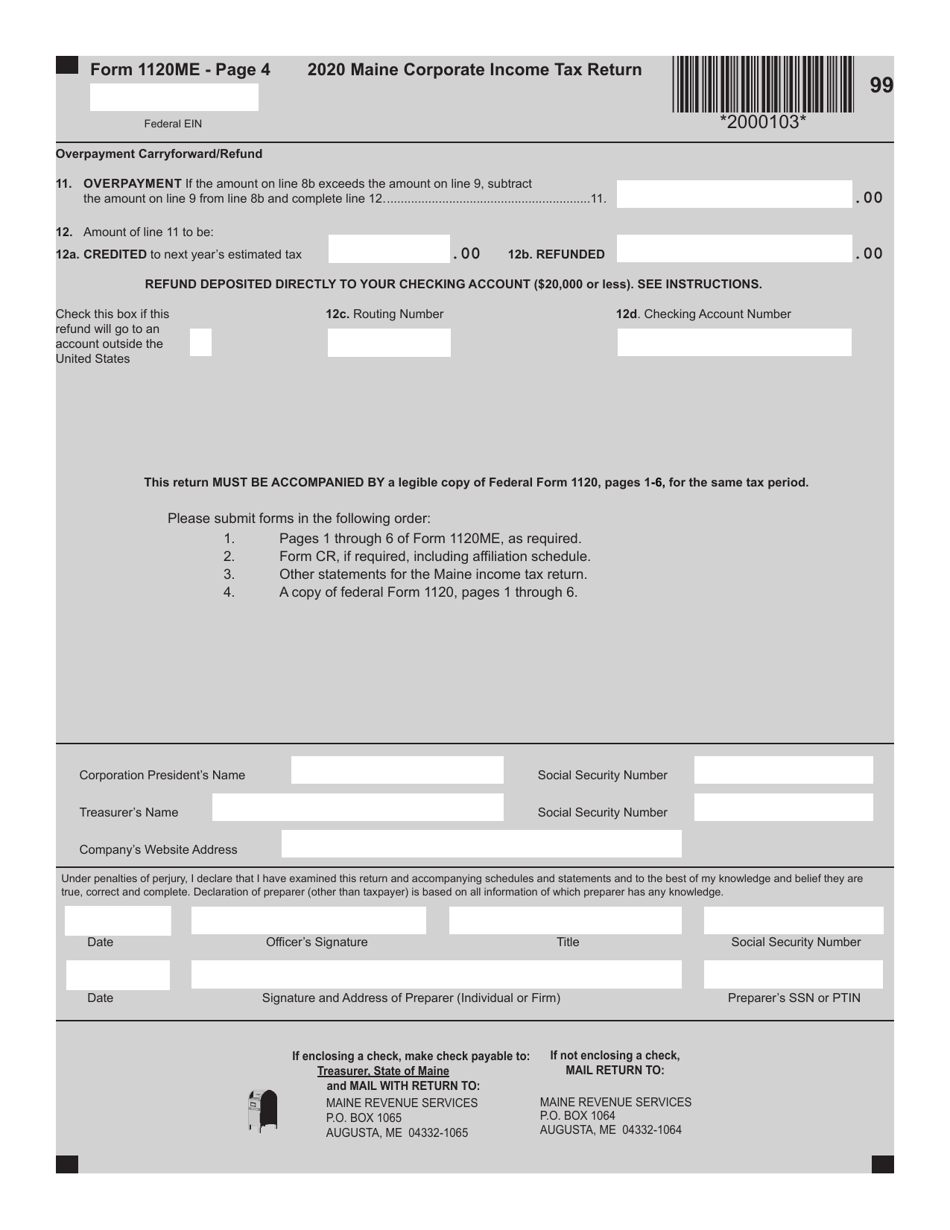

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1120ME?

A: Form 1120ME is the Maine Corporate Income Tax Return for Maine corporations.

Q: Who needs to file Form 1120ME?

A: Maine corporations that have taxable income or are required to file for other reasons must file Form 1120ME.

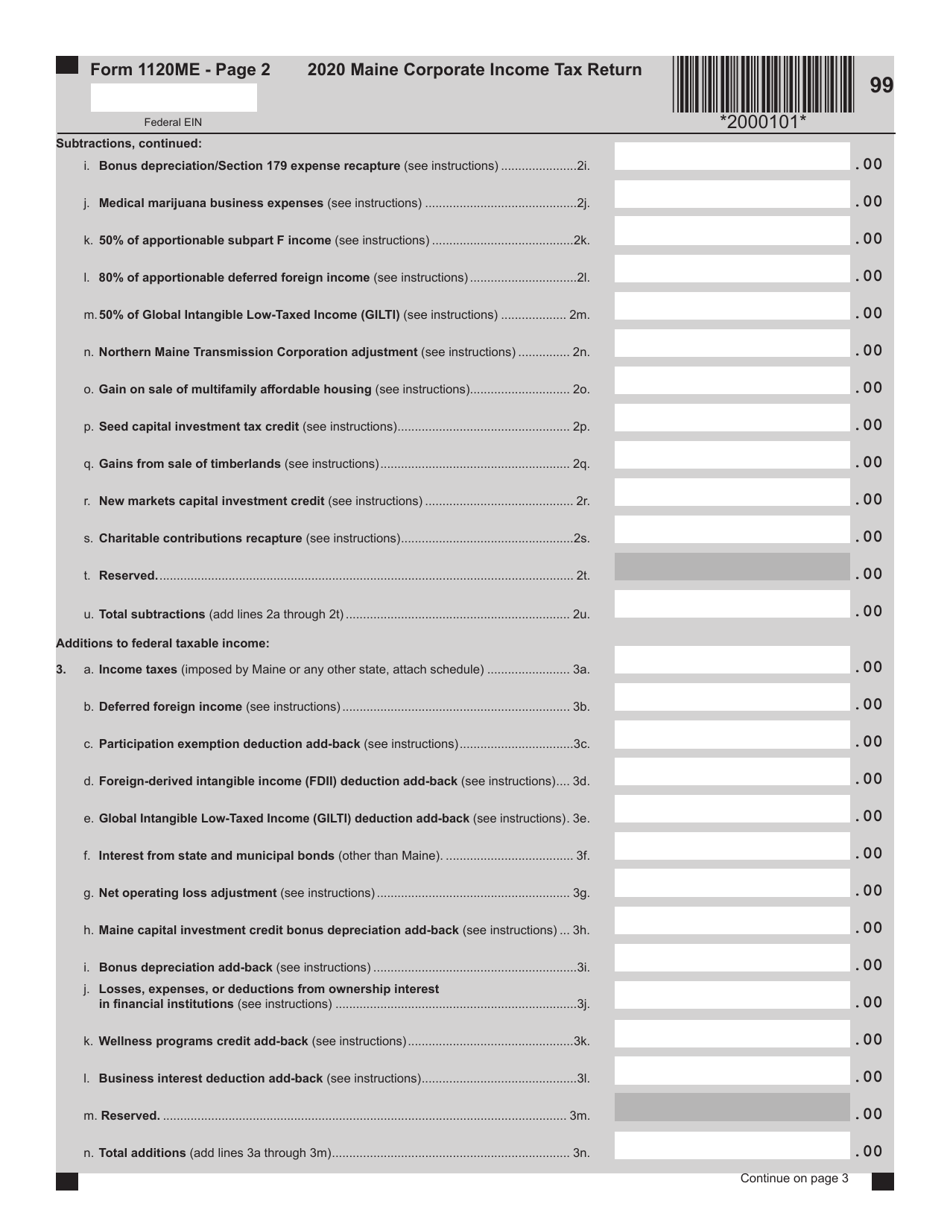

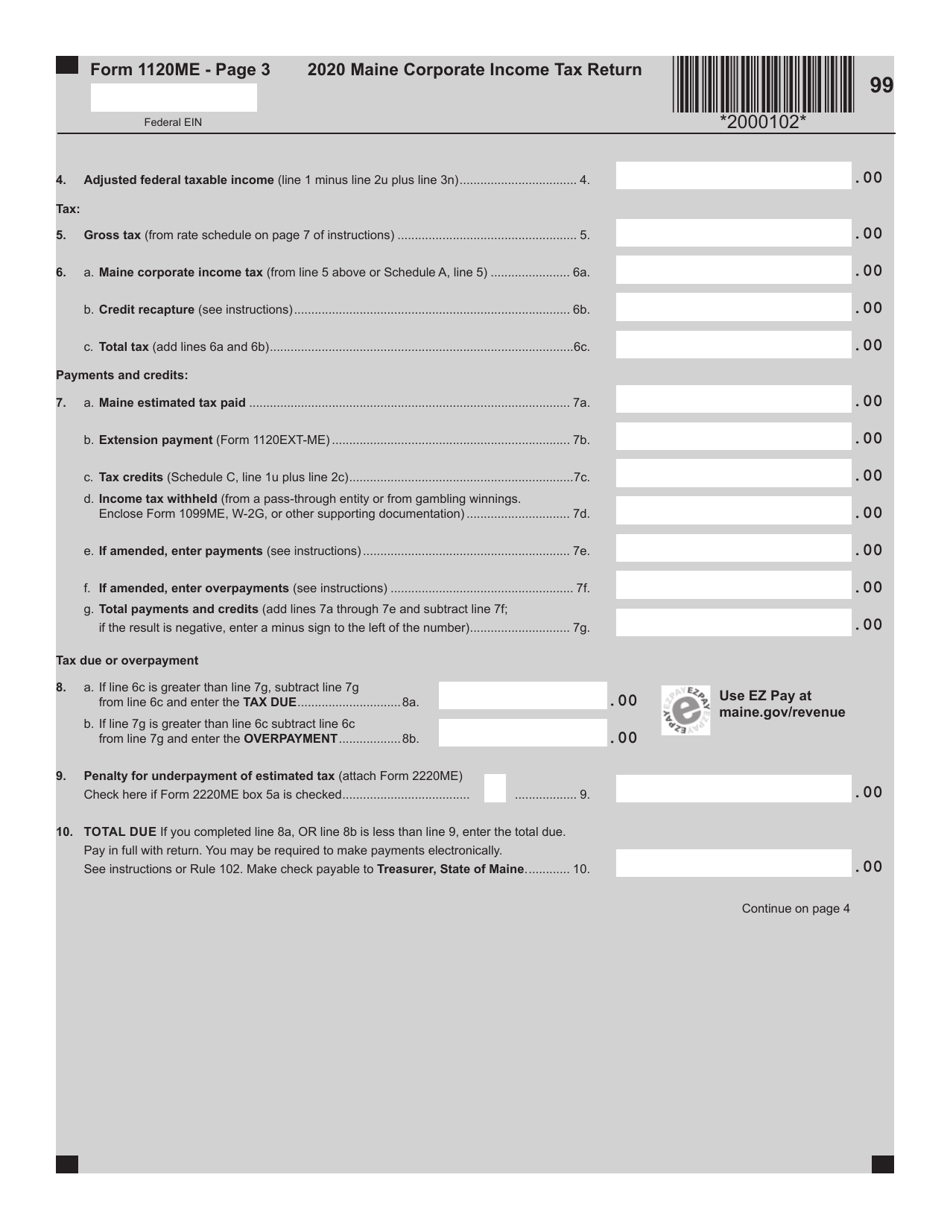

Q: What information is required on Form 1120ME?

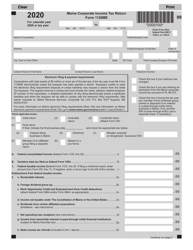

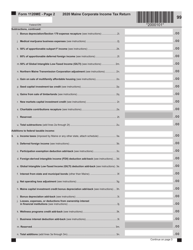

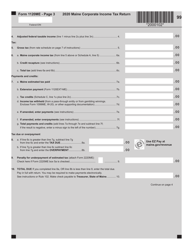

A: Form 1120ME requires information about a corporation's income, deductions, credits, and other relevant details.

Q: When is the due date for Form 1120ME?

A: The due date for Form 1120ME is typically the 15th day of the 4th month following the close of the tax year.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120ME by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.