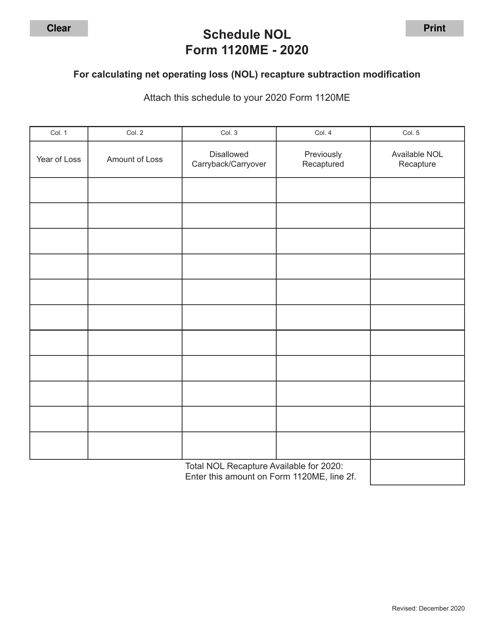

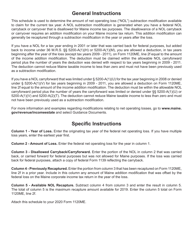

Form 1120ME Schedule NOL Schedule for Calculating Net Operating Loss (Nol) Recapture Subtraction Modification - Maine

What Is Form 1120ME Schedule NOL?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.The document is a supplement to Form 1120ME, Maine Corporate Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1120ME Schedule NOL?

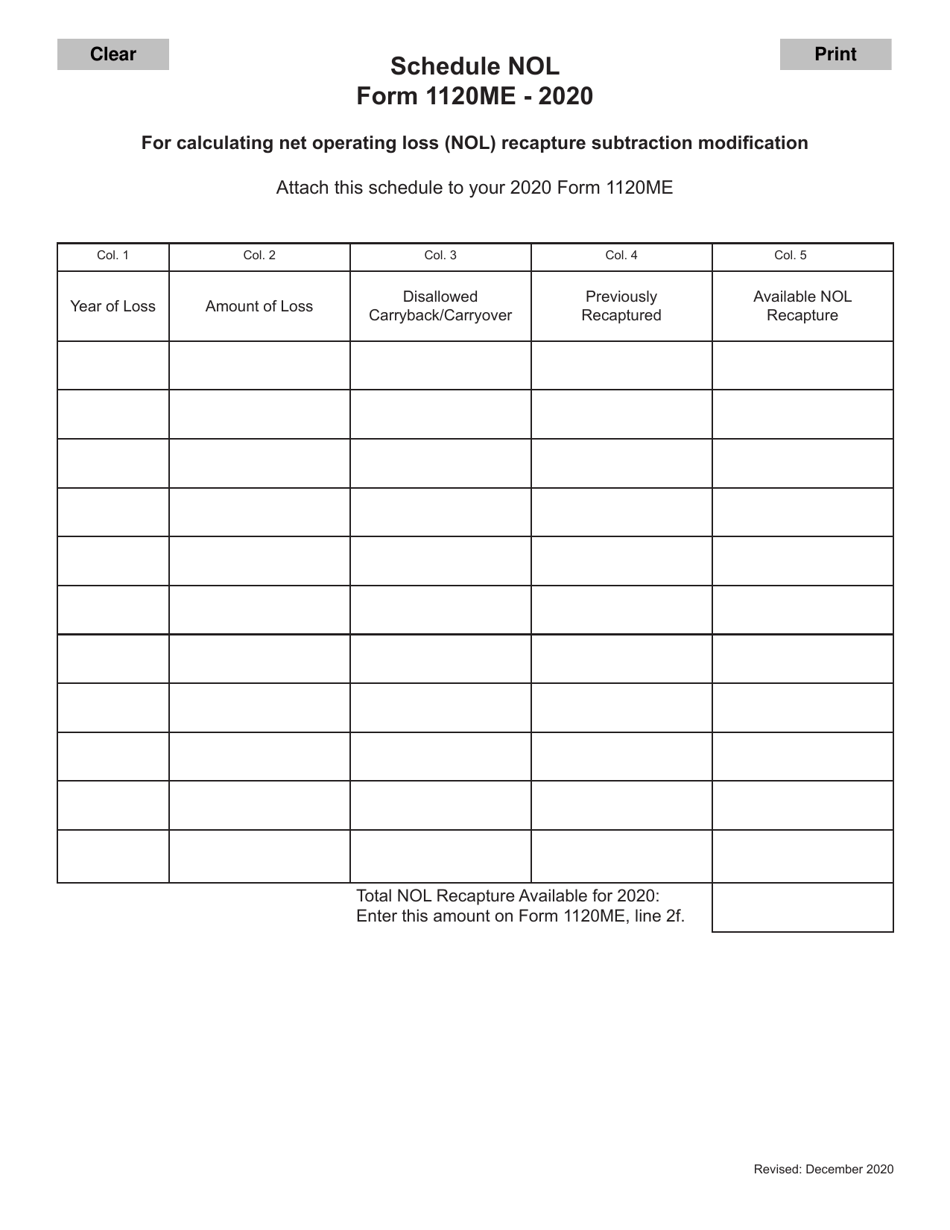

A: Form 1120ME Schedule NOL is a schedule used in Maine for calculating the net operating loss (NOL) recapture subtraction modification.

Q: What is a net operating loss (NOL) recapture subtraction modification?

A: A net operating loss (NOL) recapture subtraction modification is a deduction or adjustment made to account for the recapture of previously claimed net operating losses.

Q: Why would someone need to use Form 1120ME Schedule NOL?

A: Someone would need to use Form 1120ME Schedule NOL if they have previously claimed net operating losses and need to calculate the recapture deduction or adjustment.

Q: What is the purpose of calculating the net operating loss (NOL) recapture subtraction modification?

A: The purpose of calculating the net operating loss (NOL) recapture subtraction modification is to accurately determine the tax liability by adjusting for previously claimed net operating losses that are now subject to recapture.

Q: Who is required to use Form 1120ME Schedule NOL?

A: Taxpayers in Maine who have previously claimed net operating losses and need to calculate the recapture deduction or adjustment are required to use Form 1120ME Schedule NOL.

Q: What happens if someone does not properly calculate the net operating loss (NOL) recapture subtraction modification?

A: If someone does not properly calculate the net operating loss (NOL) recapture subtraction modification, it could result in an inaccurate tax liability calculation and potential penalties or underpayment of taxes.

Q: Are there any other requirements or forms related to Form 1120ME Schedule NOL?

A: Yes, taxpayers may need to file other forms or schedules, depending on their specific tax situation. It is important to review the instructions and requirements provided by the Maine Revenue Services.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1120ME Schedule NOL by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.