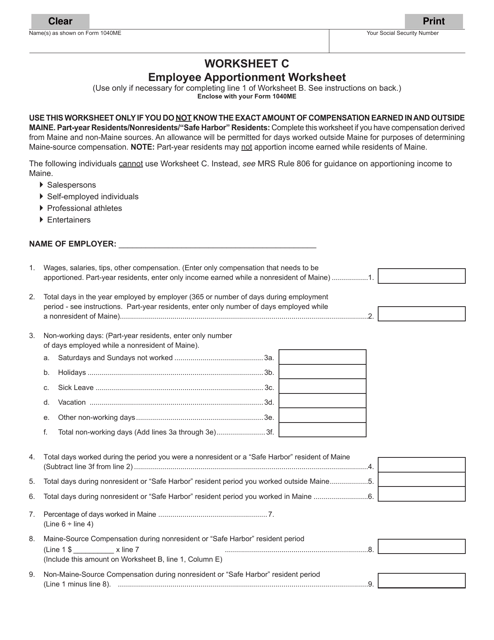

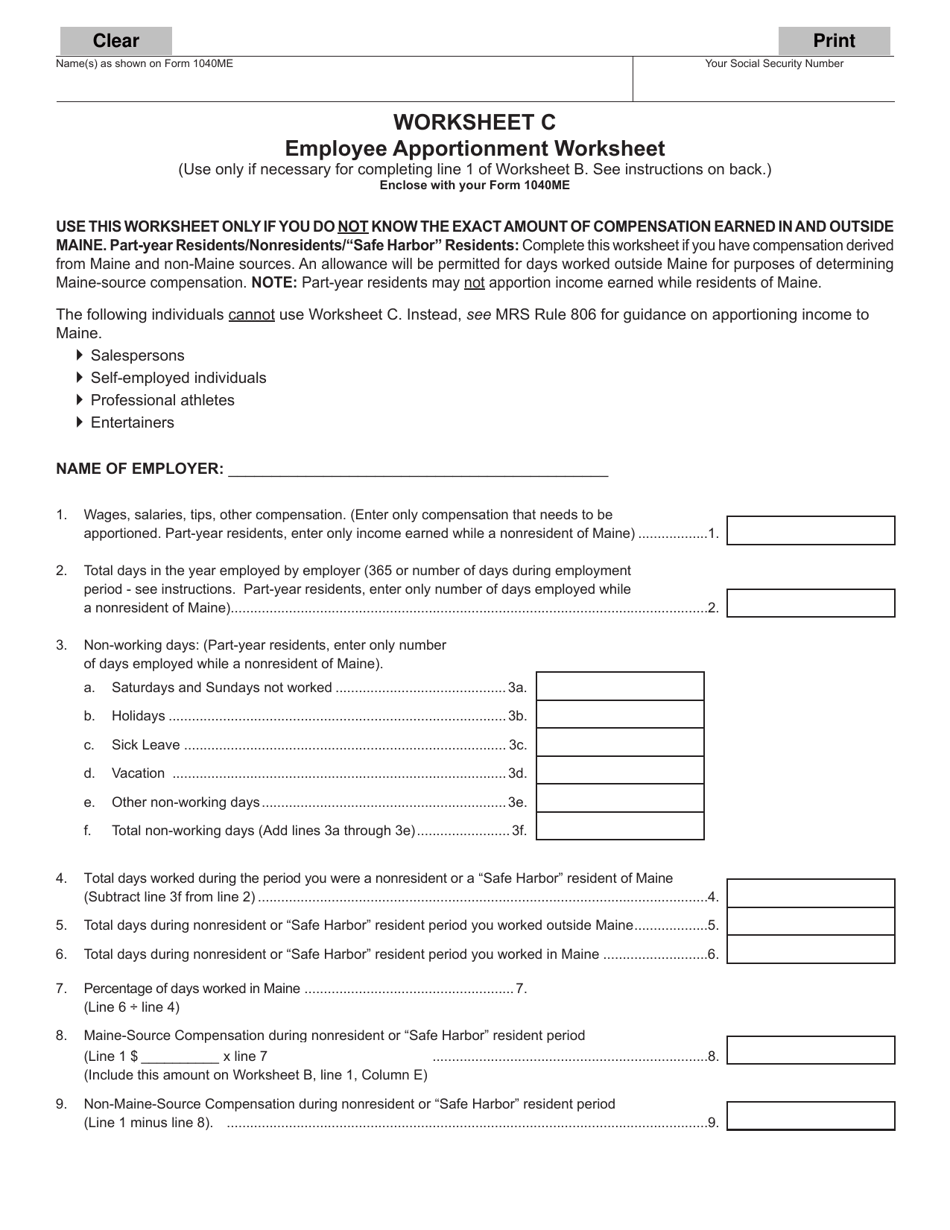

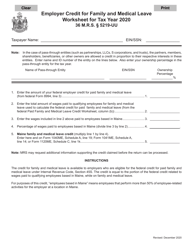

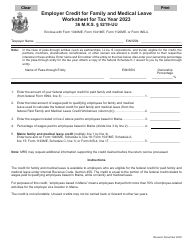

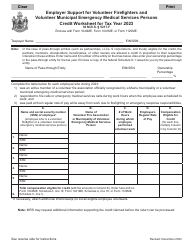

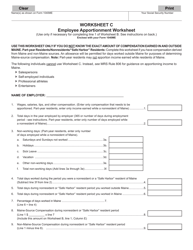

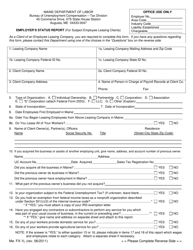

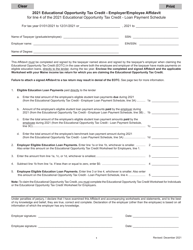

Worksheet C Employee Apportionment Worksheet - Maine

What Is Worksheet C?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Worksheet C?

A: Worksheet C is an Employee Apportionment Worksheet.

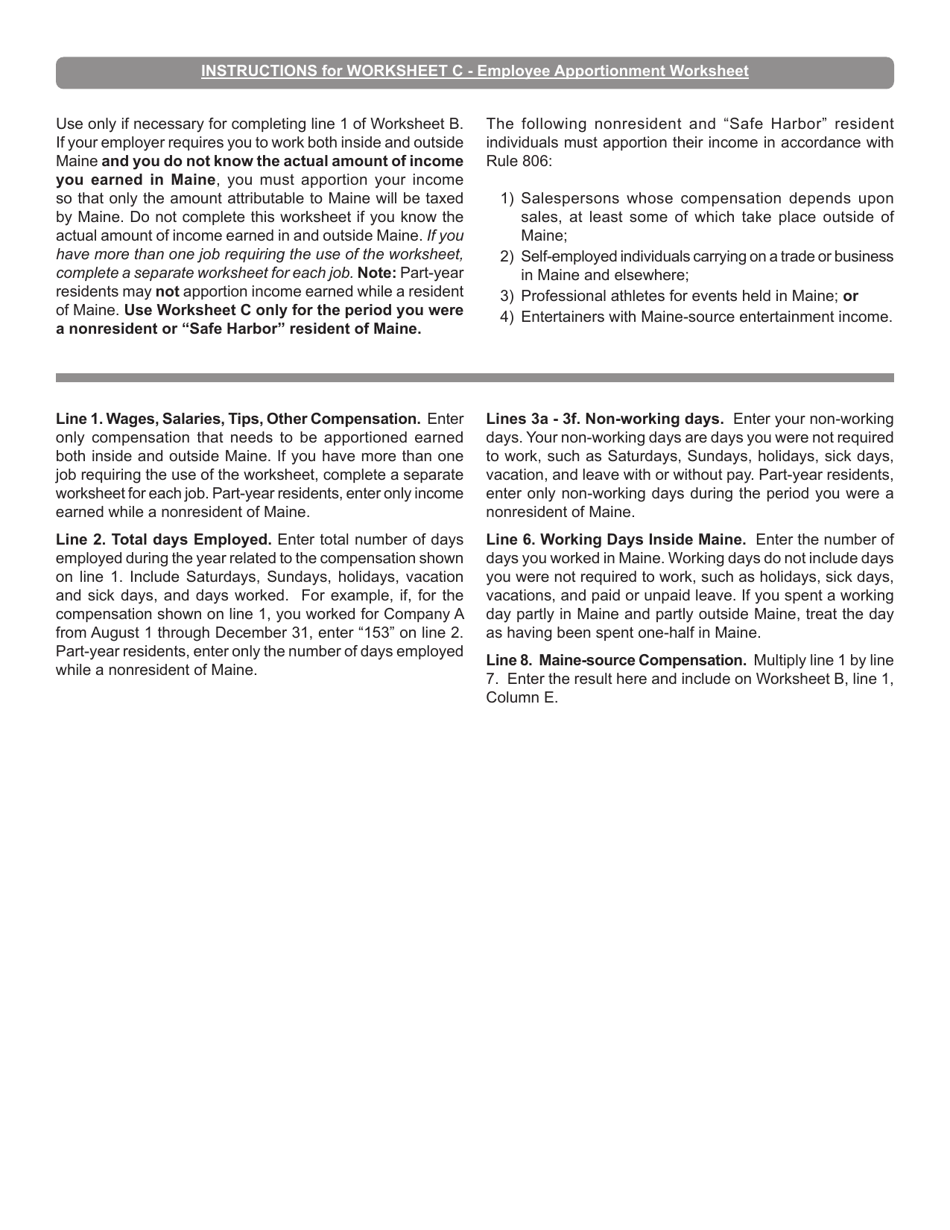

Q: What is the purpose of Worksheet C?

A: The purpose of Worksheet C is to calculate the apportionment of an employee's wages for the state of Maine.

Q: Who should use Worksheet C?

A: Worksheet C should be used by employers with employees who work in Maine.

Q: What information is needed for Worksheet C?

A: You will need information about the total wages paid to an employee and the percentage of time the employee worked in Maine.

Q: How is the apportionment calculated?

A: The apportionment is calculated by multiplying the total wages by the percentage of time worked in Maine.

Q: Why is it important to calculate apportionment?

A: Calculating apportionment ensures that the correct amount of wages is reported and taxed in the state of Maine.

Q: Are there any other requirements for reporting wages in Maine?

A: Yes, in addition to Worksheet C, employers may also need to file quarterly wage reports and withhold state income taxes.

Q: What should I do if I have questions about Worksheet C?

A: If you have questions about Worksheet C, you can contact the Maine Revenue Services for assistance.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet C by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.