This version of the form is not currently in use and is provided for reference only. Download this version of

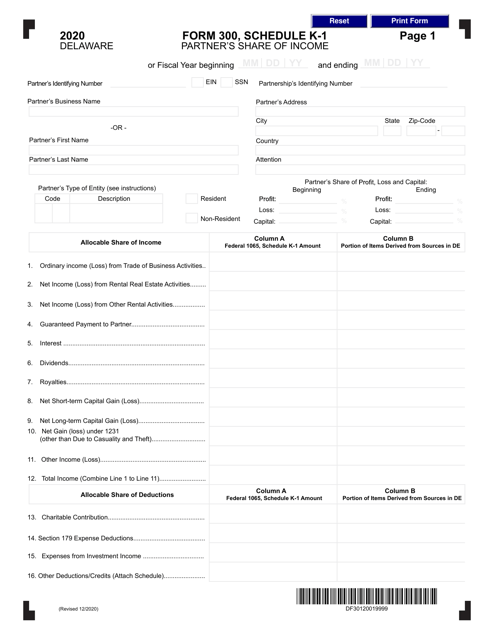

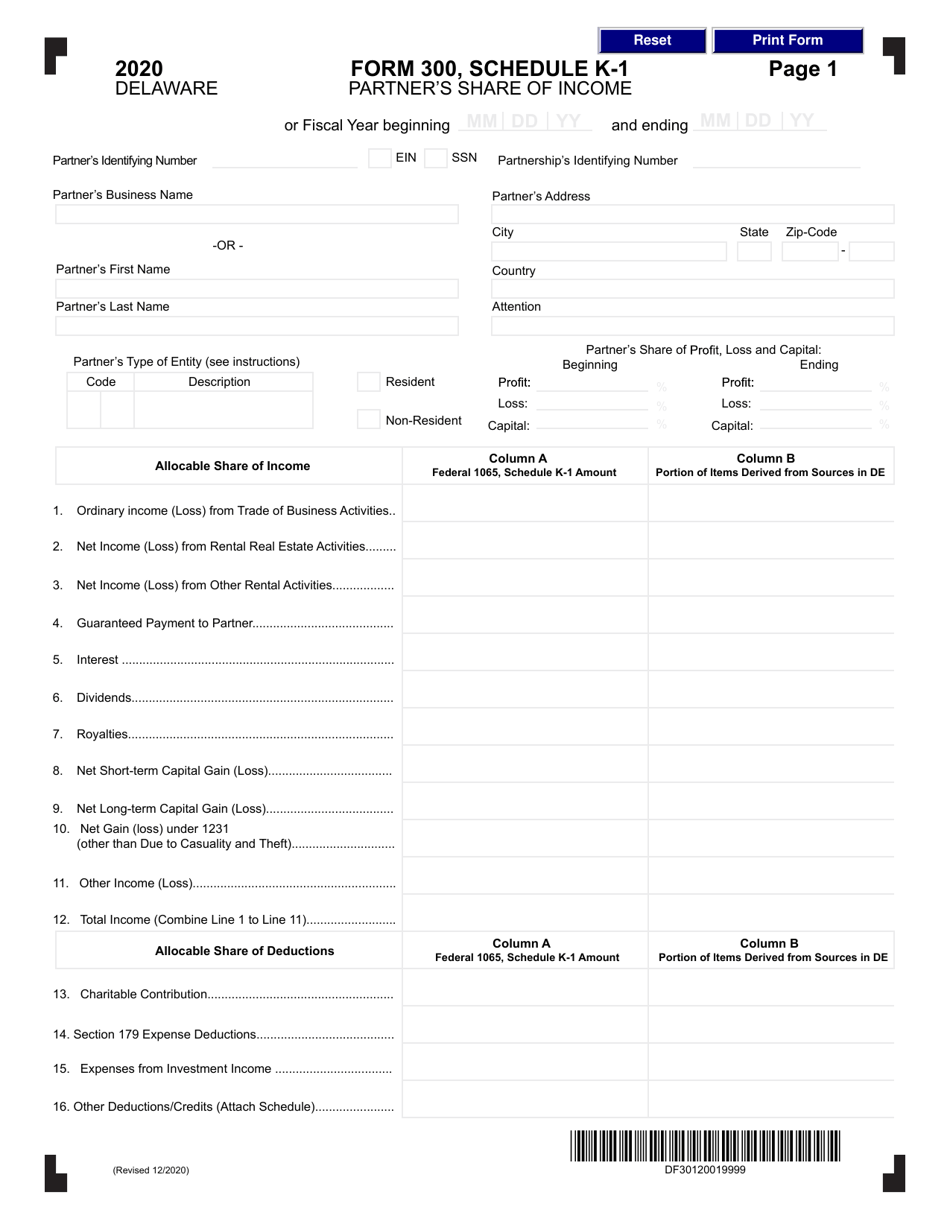

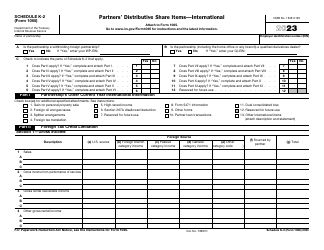

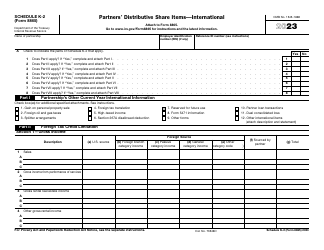

Form 300 Schedule K-1

for the current year.

Form 300 Schedule K-1 Partner's Share of Income - Delaware

What Is Form 300 Schedule K-1?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware.The document is a supplement to Form 300, Partnership Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 300 Schedule K-1?

A: Form 300 Schedule K-1 is a tax form that reports a partner's share of income, deductions, and credits from a partnership or LLC.

Q: Who needs to file Form 300 Schedule K-1?

A: Partners or members of a partnership or LLC need to file Form 300 Schedule K-1.

Q: What is the purpose of Form 300 Schedule K-1?

A: The purpose of Form 300 Schedule K-1 is to report each partner's share of the partnership's income, deductions, and credits.

Q: Is Form 300 Schedule K-1 specific to Delaware?

A: No, Form 300 Schedule K-1 is not specific to any state. It is used nationwide.

Q: When is the deadline to file Form 300 Schedule K-1?

A: The deadline to file Form 300 Schedule K-1 is usually April 15th, but it may vary depending on the tax year.

Q: What should I do if I have more questions about Form 300 Schedule K-1?

A: If you have more questions about Form 300 Schedule K-1, you should consult a tax professional or the IRS for assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 300 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.