This version of the form is not currently in use and is provided for reference only. Download this version of

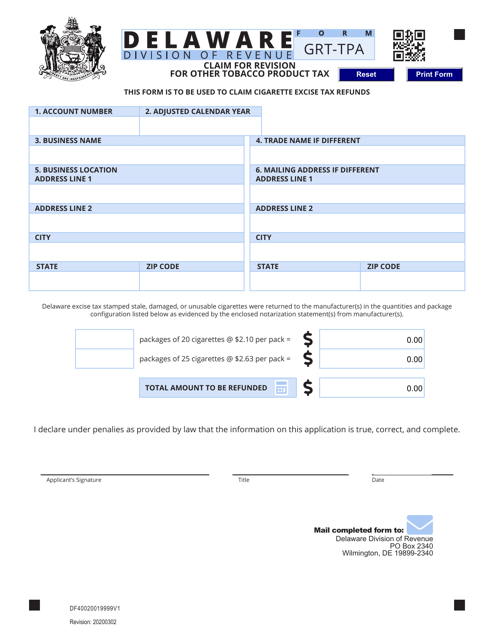

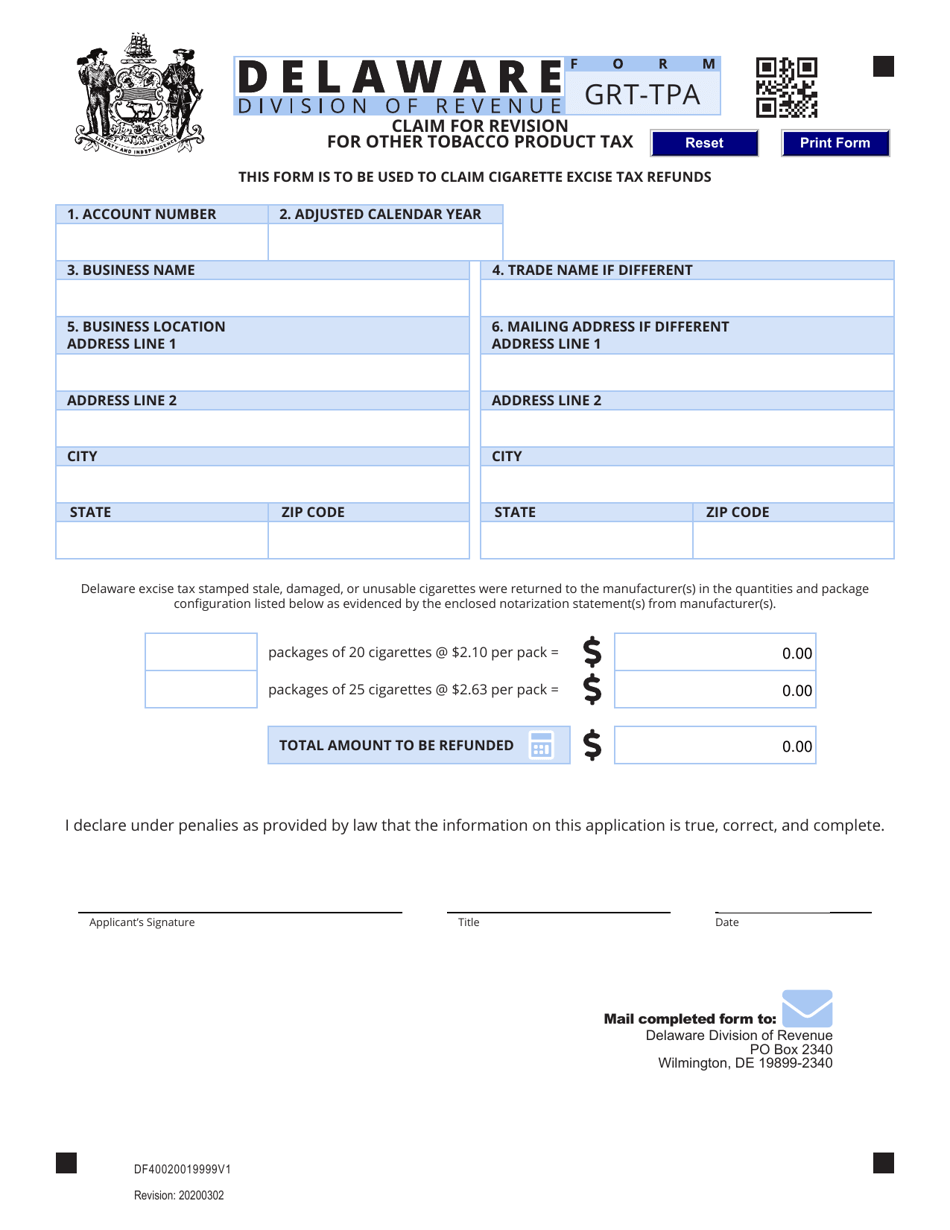

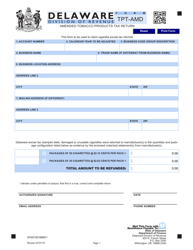

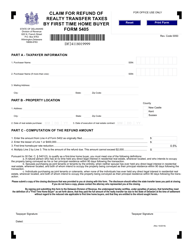

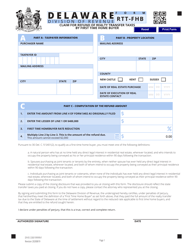

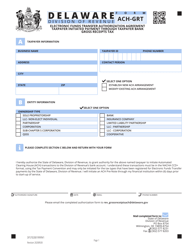

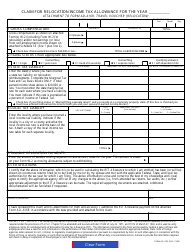

Form GRT-TPA

for the current year.

Form GRT-TPA Claim for Revision for Other Tobacco Product Tax - Delaware

What Is Form GRT-TPA?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GRT-TPA Claim for Revision?

A: The GRT-TPA Claim for Revision is a form used to request a revision to the Other Tobacco Product Tax in Delaware.

Q: What is Other Tobacco Product Tax?

A: Other Tobacco Product Tax is a tax imposed on tobacco productsother than cigarettes, such as cigars and smokeless tobacco.

Q: Who should use the GRT-TPA Claim for Revision?

A: Anyone who needs to request a revision to the Other Tobacco Product Tax in Delaware should use this form.

Q: How do I fill out the GRT-TPA Claim for Revision?

A: You need to provide your contact information, the reason for the revision, and any supporting documents along with the form.

Q: Is there a deadline for submitting the GRT-TPA Claim for Revision?

A: Yes, the form must be submitted within 90 days from the date of the original tax assessment.

Q: What happens after I submit the GRT-TPA Claim for Revision?

A: The Delaware Division of Revenue will review your claim and notify you of their decision.

Q: Can I appeal if my GRT-TPA Claim for Revision is denied?

A: Yes, you have the right to appeal the decision to the Delaware Tax Appeals Board.

Q: Are there any fees for filing the GRT-TPA Claim for Revision?

A: No, there are no fees associated with filing this form.

Form Details:

- Released on March 2, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GRT-TPA by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.