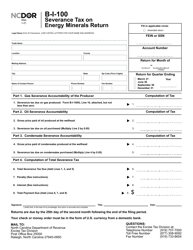

This version of the form is not currently in use and is provided for reference only. Download this version of

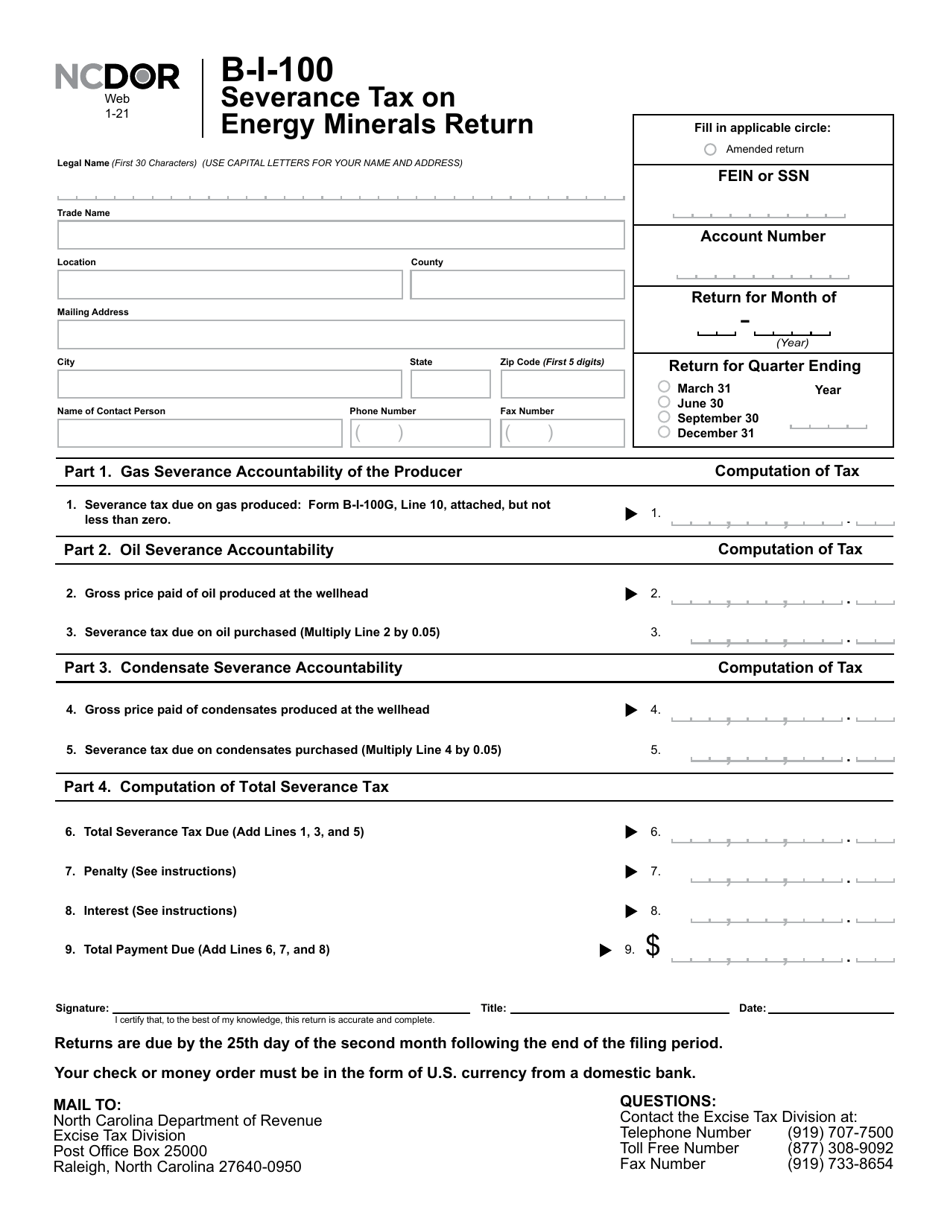

Form B-I-100

for the current year.

Form B-I-100 Severance Tax on Energy Minerals Return - North Carolina

What Is Form B-I-100?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

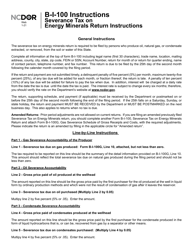

Q: What is Form B-I-100 Severance Tax on Energy Minerals Return?

A: Form B-I-100 is a tax return form specifically for reporting and remitting severance taxes on energy minerals in North Carolina.

Q: Who needs to file Form B-I-100 Severance Tax on Energy Minerals Return?

A: Any person or entity engaged in the extraction, production, or severance of energy minerals in North Carolina is required to file Form B-I-100.

Q: What are energy minerals?

A: Energy minerals include coal, natural gas, oil, oil shale, or any other mineral substance containing hydrocarbons.

Q: When is Form B-I-100 Severance Tax on Energy Minerals Return due?

A: Form B-I-100 is due annually on or before the last day of the fourth month following the close of the taxpayer's fiscal year.

Q: Are there any penalties for not filing Form B-I-100 Severance Tax on Energy Minerals Return?

A: Yes, failure to file Form B-I-100 or pay the severance tax in a timely manner can result in penalties and interest being assessed.

Q: Can I file Form B-I-100 Severance Tax on Energy Minerals Return electronically?

A: As of now, electronic filing for Form B-I-100 is not available. It must be filed by mail.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form B-I-100 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.