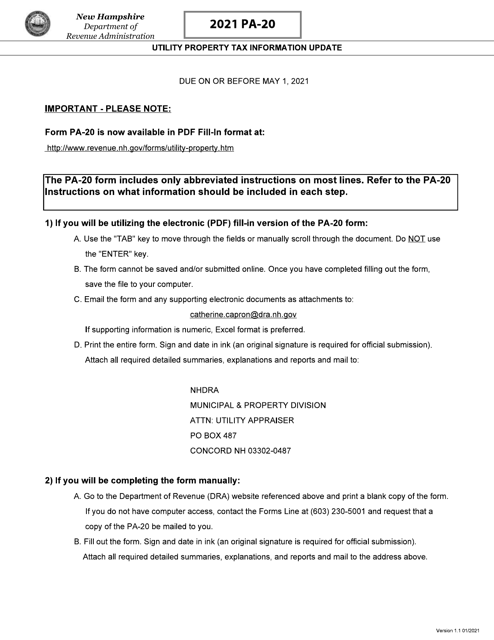

This version of the form is not currently in use and is provided for reference only. Download this version of

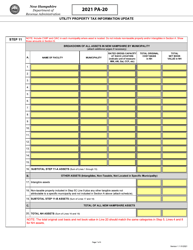

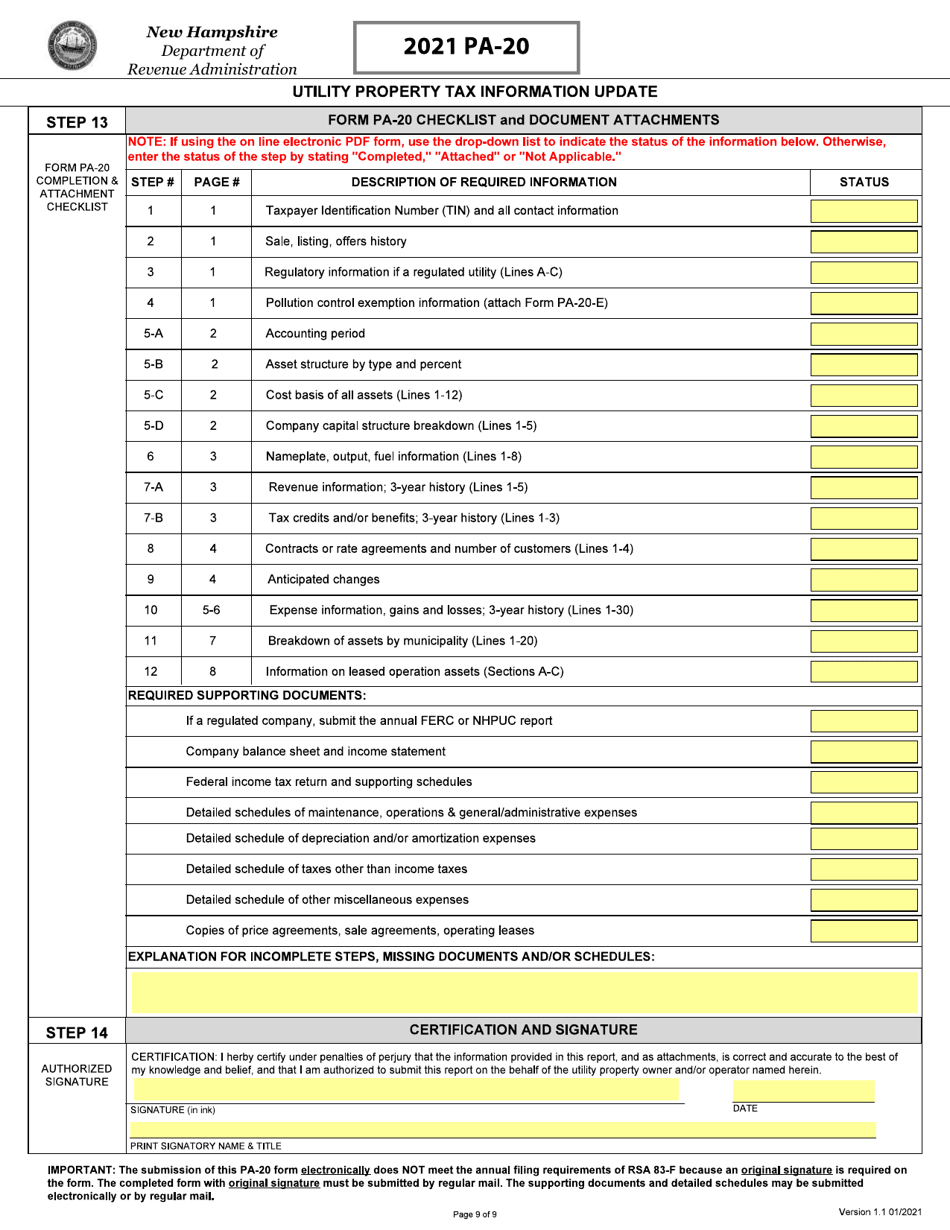

Form PA-20

for the current year.

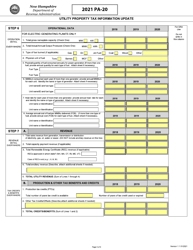

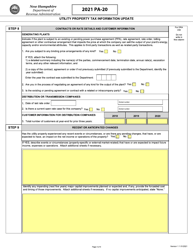

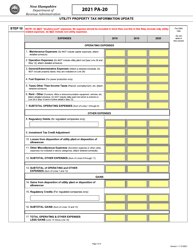

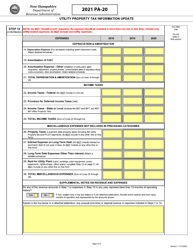

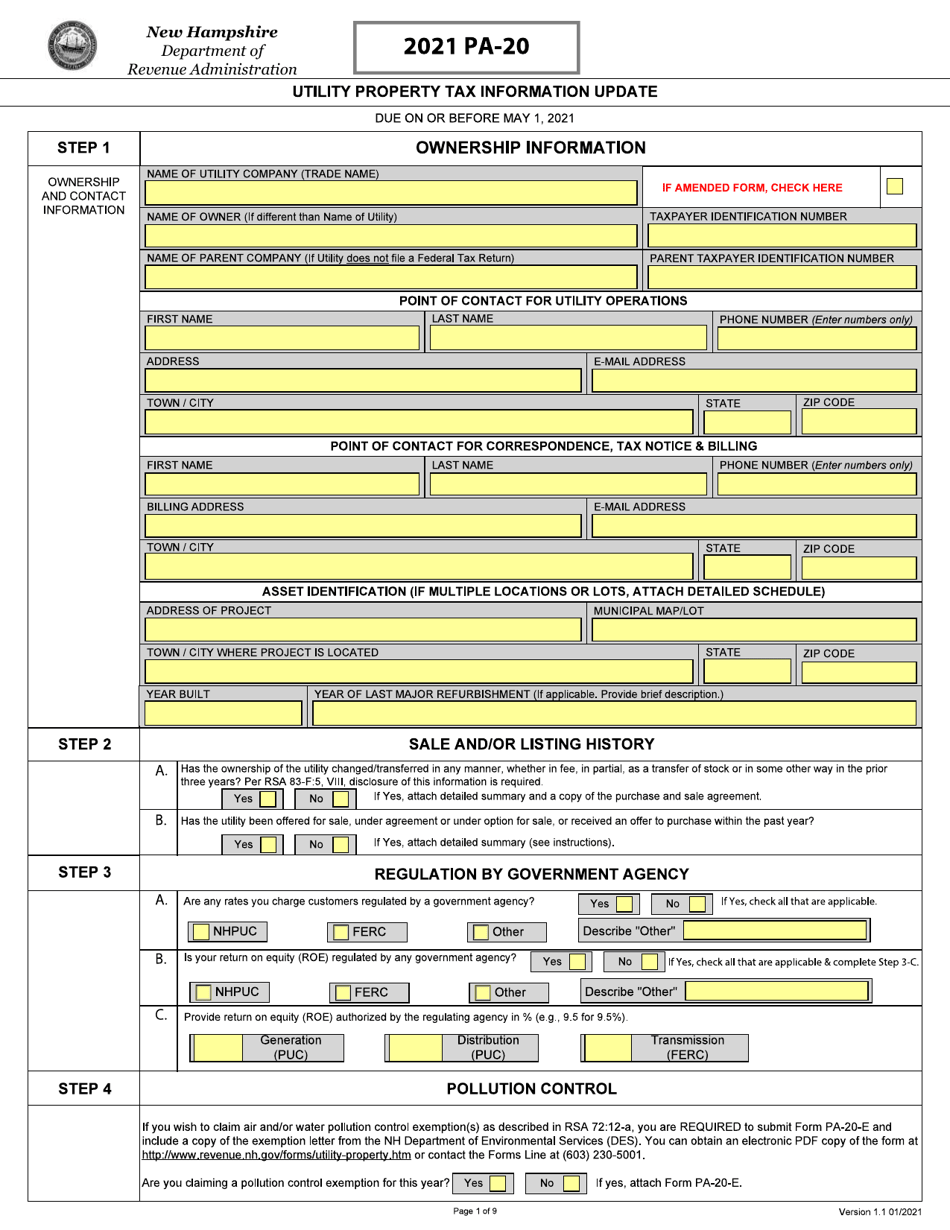

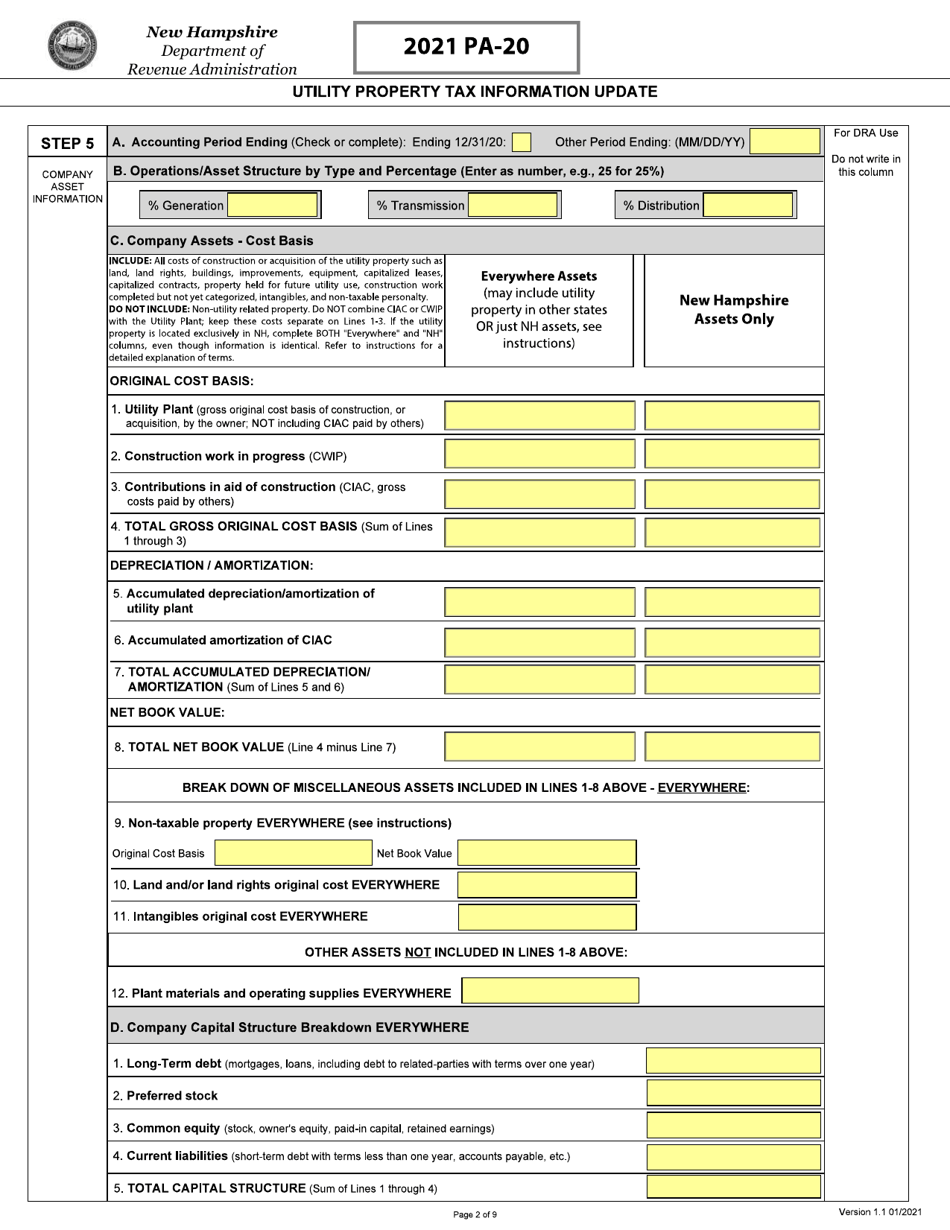

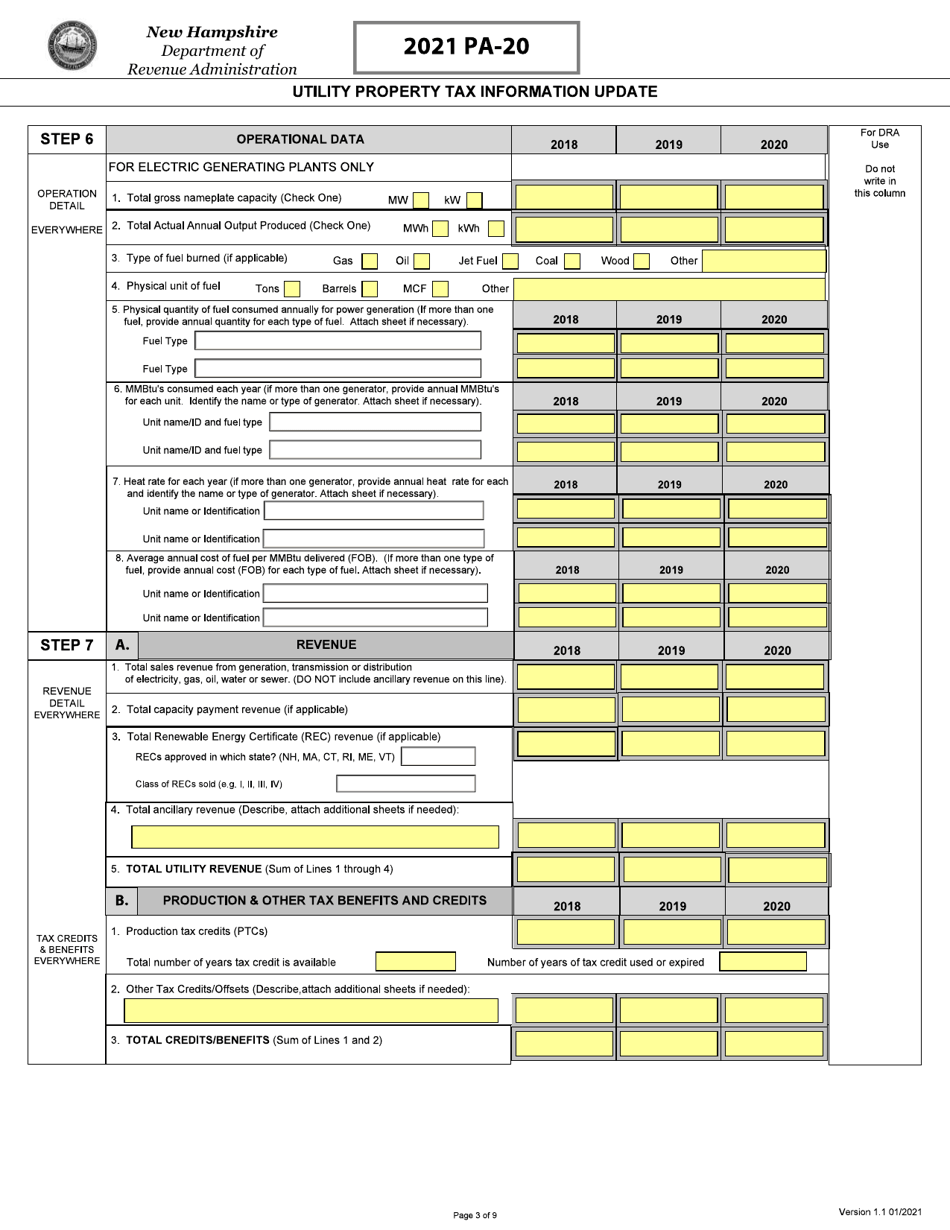

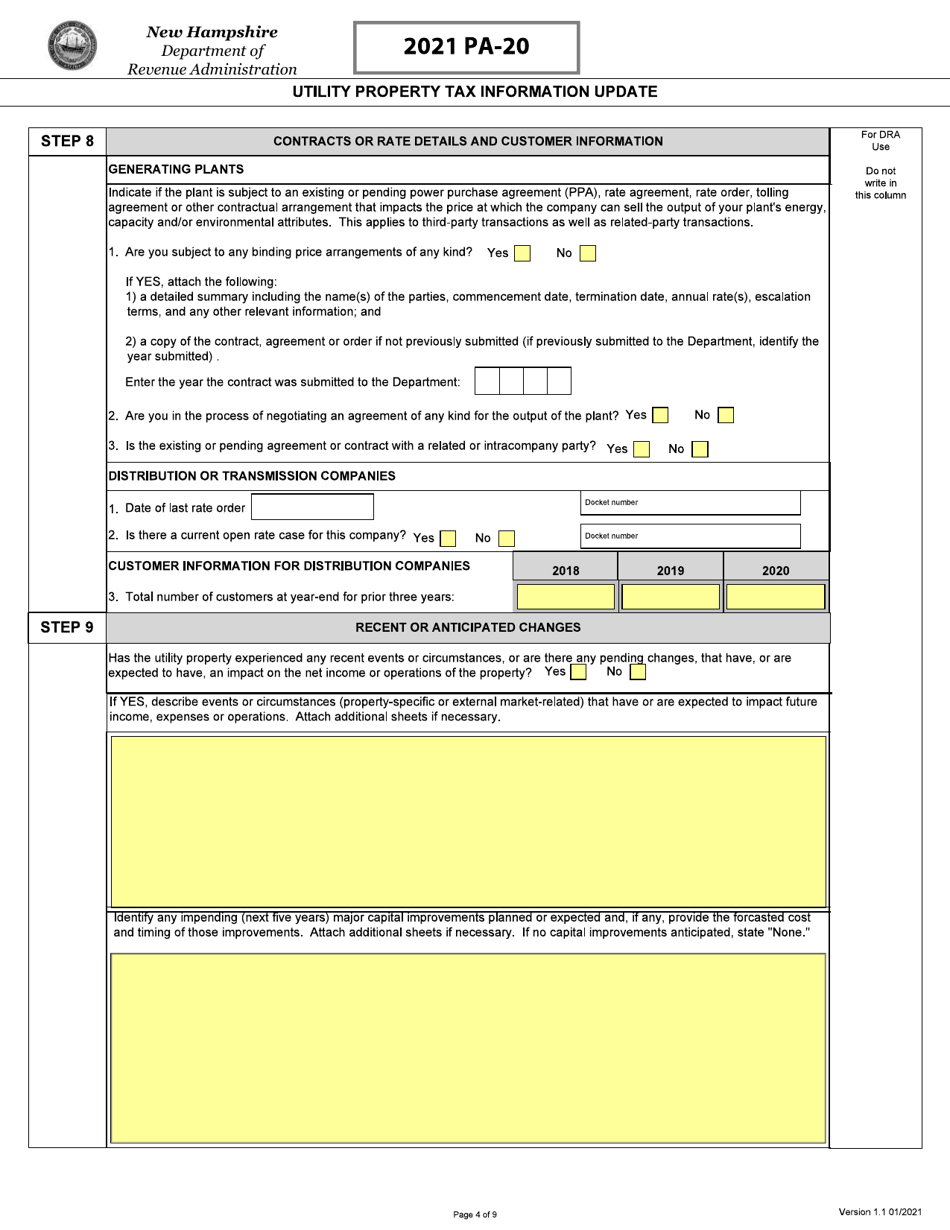

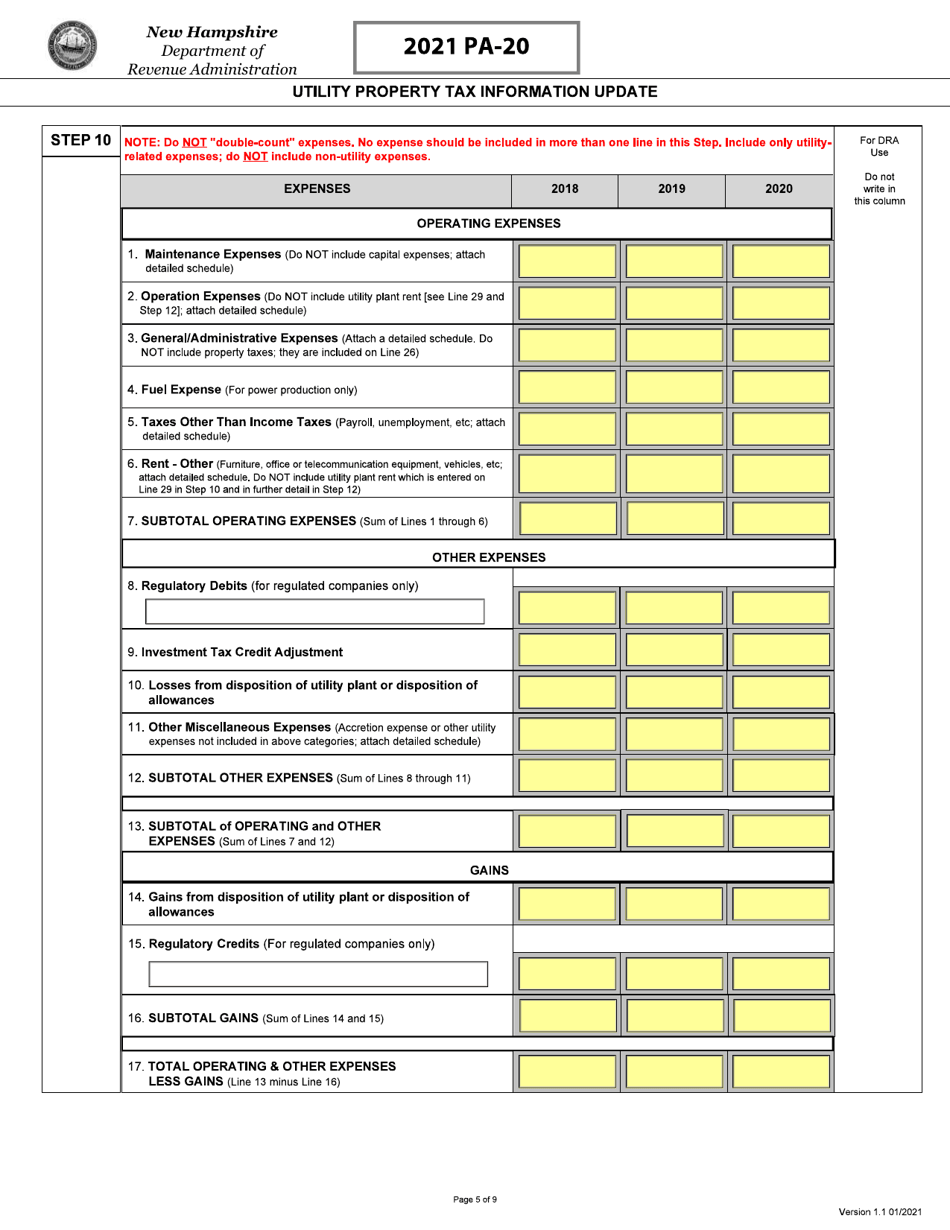

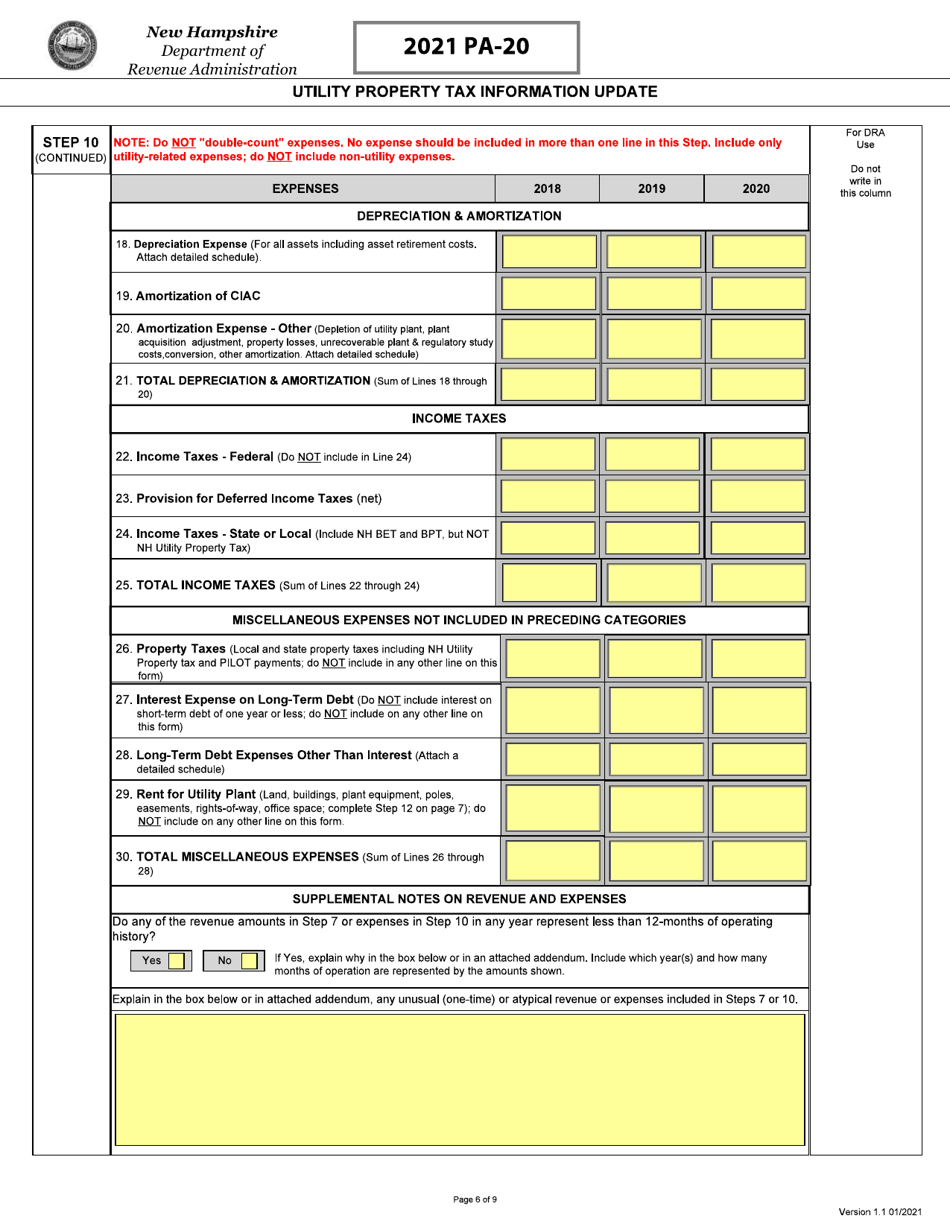

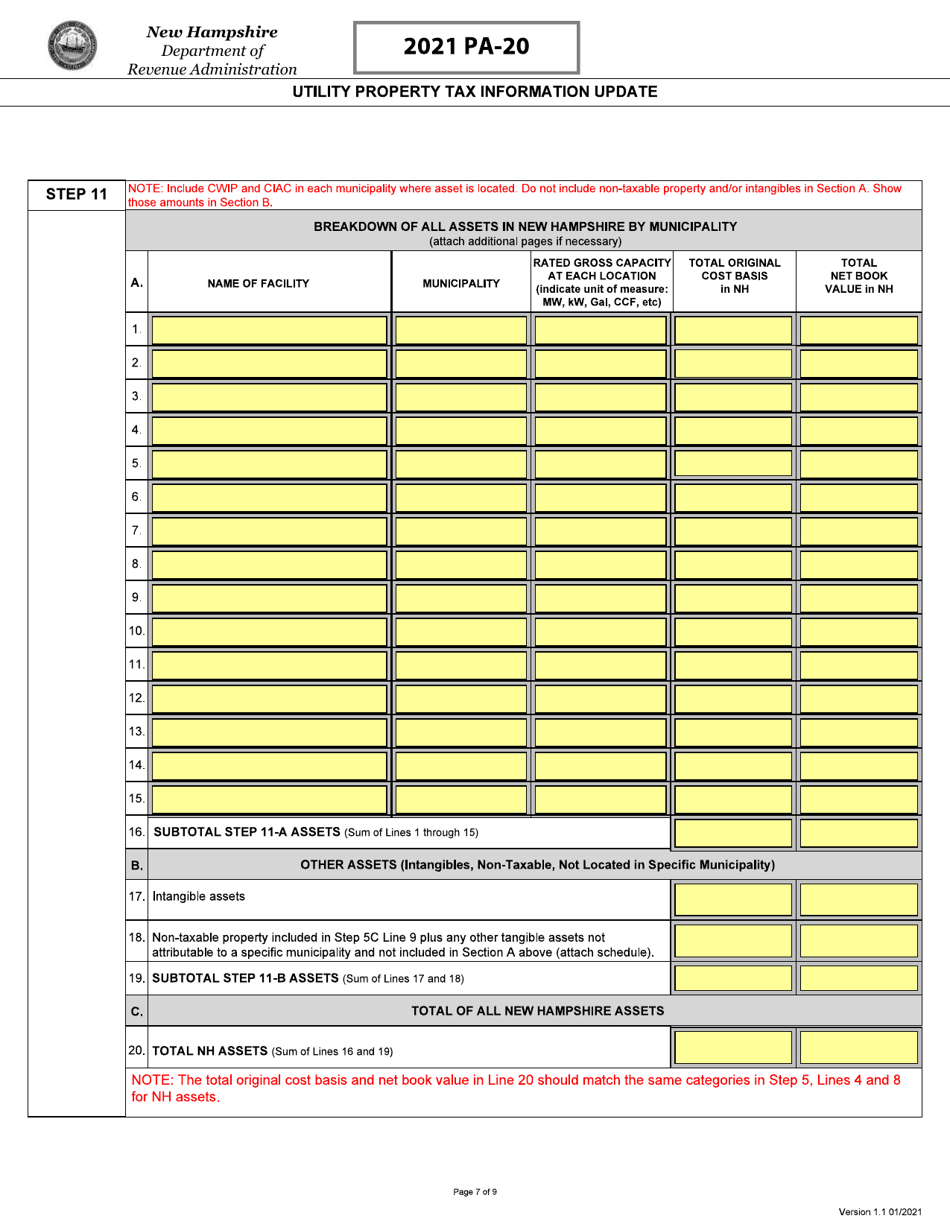

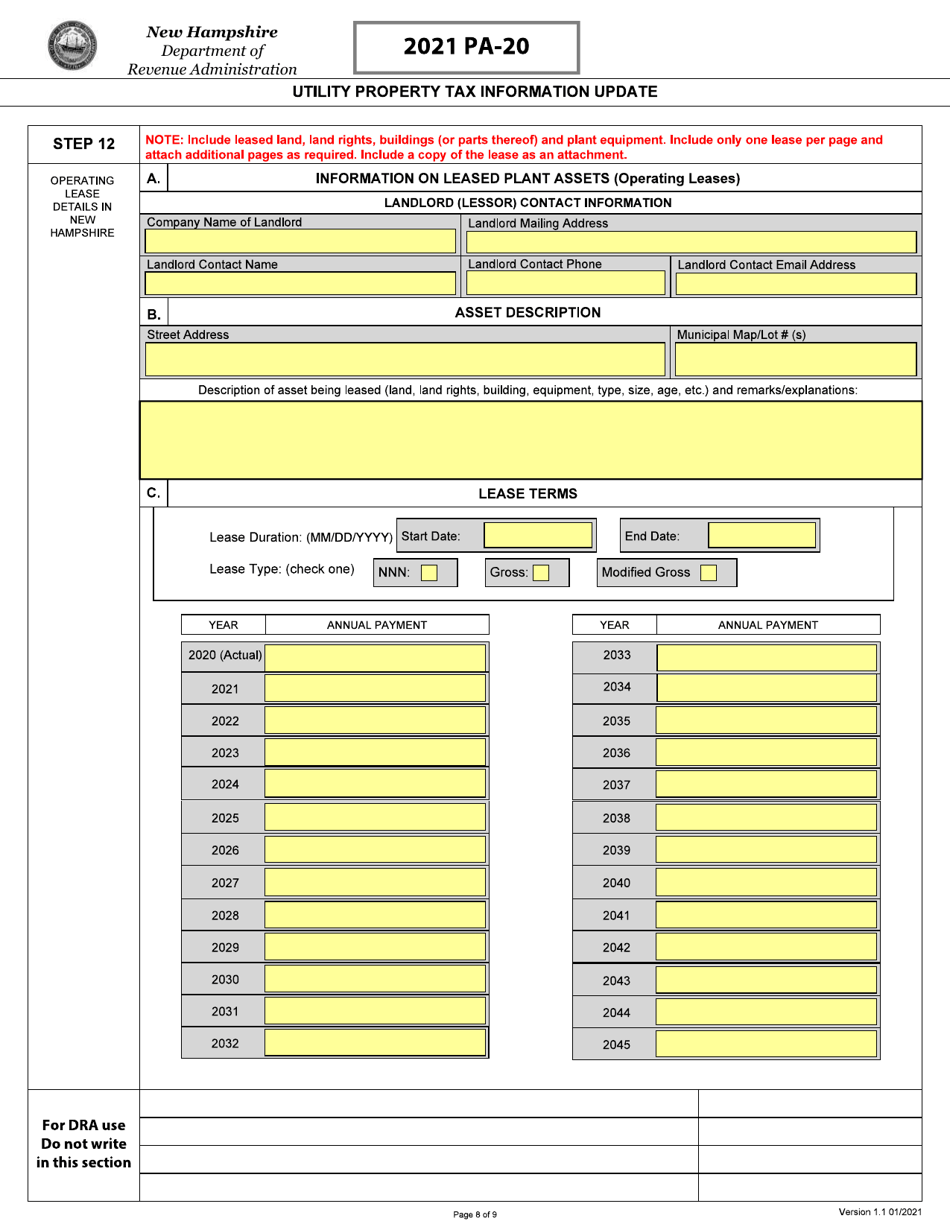

Form PA-20 Utility Property Tax Information Update - New Hampshire

What Is Form PA-20?

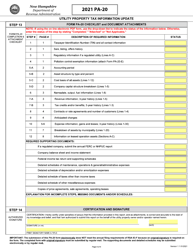

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20?

A: Form PA-20 is a utility property tax information update form in New Hampshire.

Q: Who needs to file Form PA-20?

A: Owners or operators of utility property in New Hampshire need to file Form PA-20.

Q: What is the purpose of Form PA-20?

A: The purpose of Form PA-20 is to update the tax information for utility property in New Hampshire.

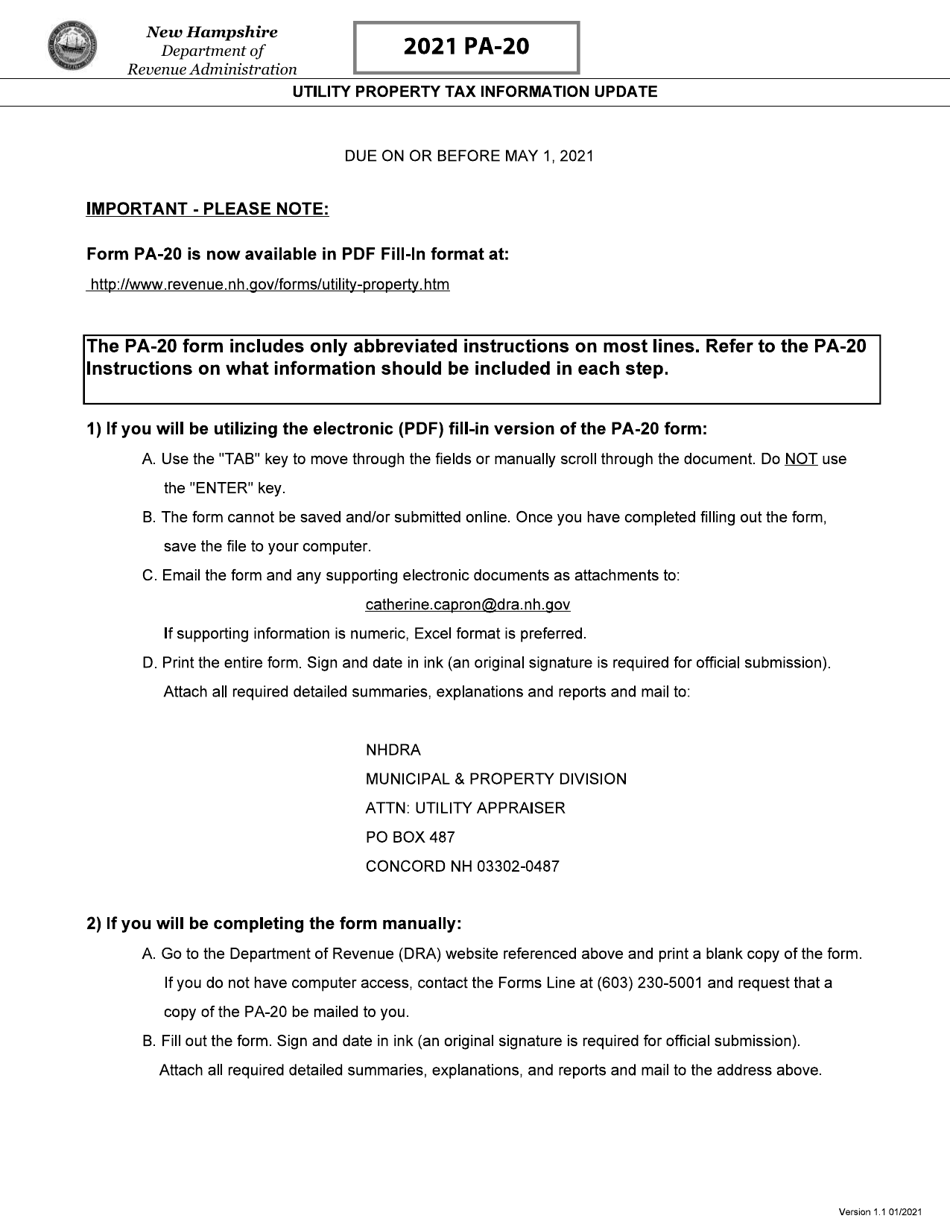

Q: When is Form PA-20 due?

A: Form PA-20 is due annually by April 15th.

Q: Do I need to include payment with Form PA-20?

A: No, payment is not required with Form PA-20. However, taxes owed must be paid separately.

Q: Are there any penalties for late filing of Form PA-20?

A: Yes, there are penalties for late filing of Form PA-20. The penalty is 10% of the tax due with a minimum penalty of $10.

Q: What should I do if I need an extension to file Form PA-20?

A: You can request an extension to file Form PA-20 by contacting the New Hampshire Department of Revenue Administration.

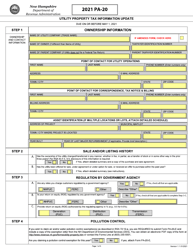

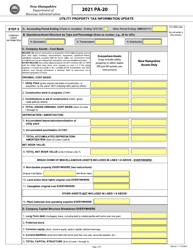

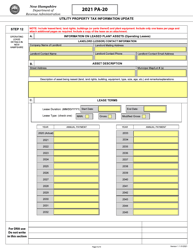

Q: What information do I need to provide on Form PA-20?

A: You need to provide detailed information about your utility property, including its value, location, and other relevant details.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.