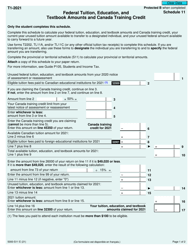

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5000-S11 Schedule 11

for the current year.

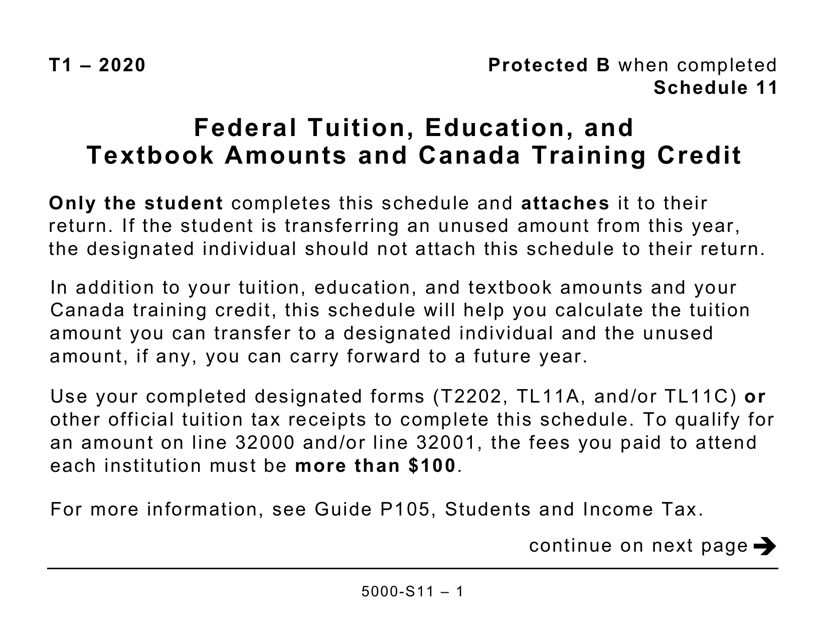

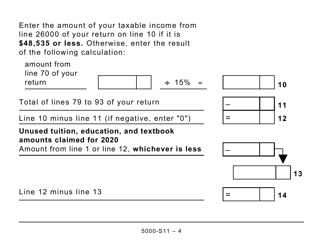

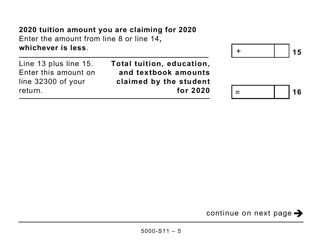

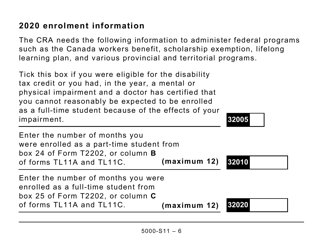

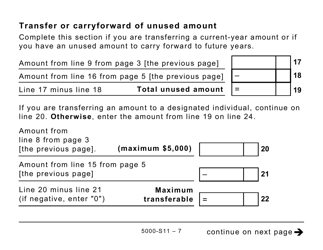

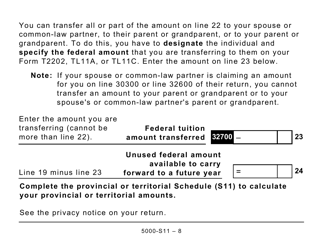

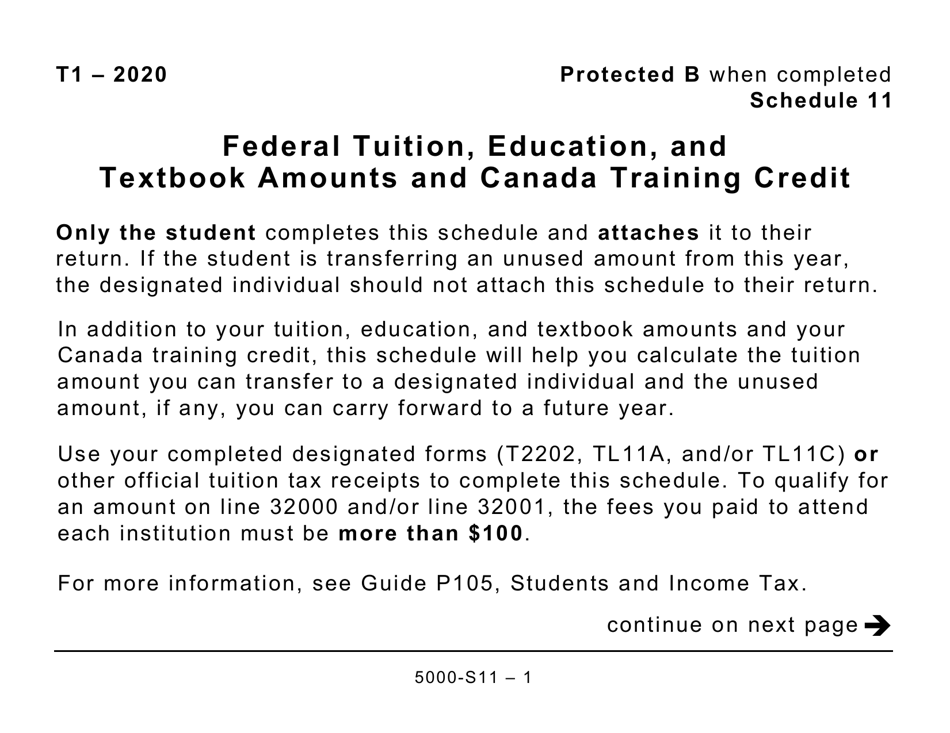

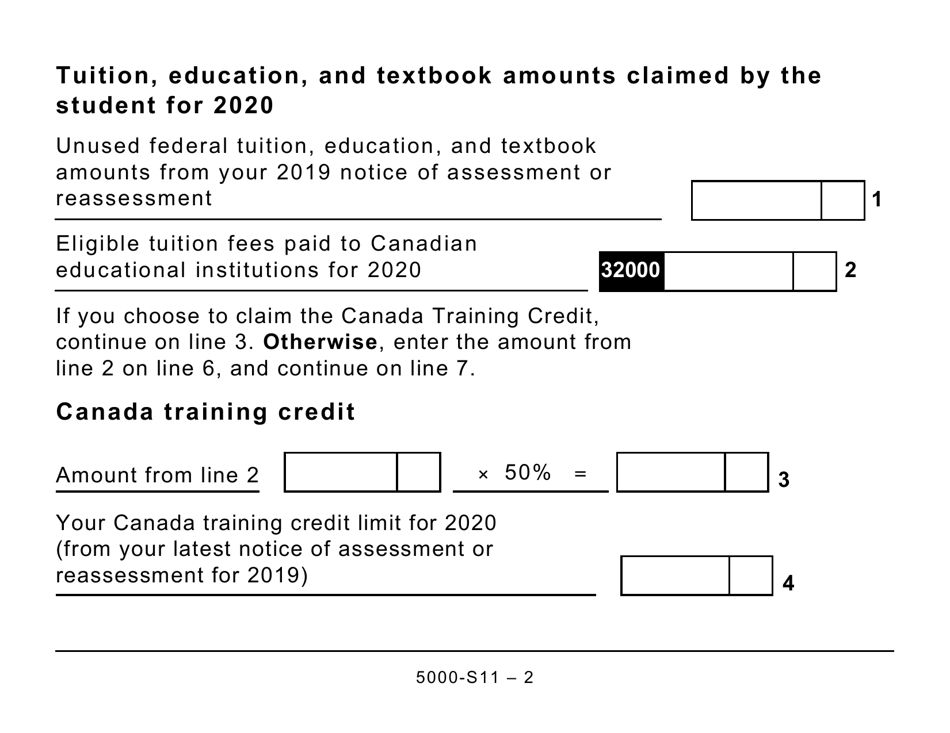

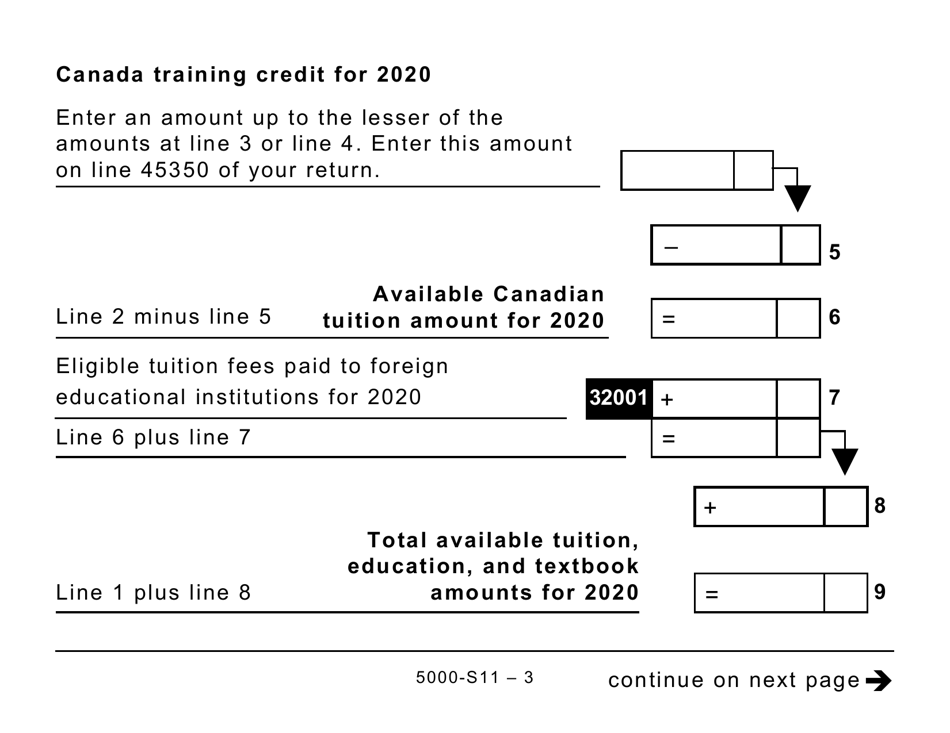

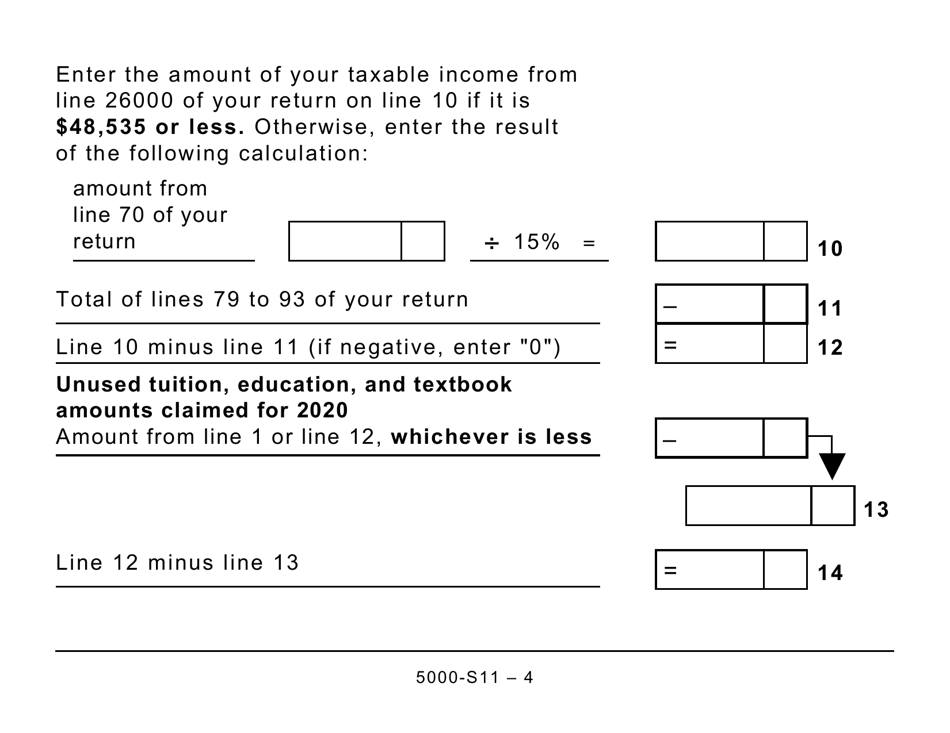

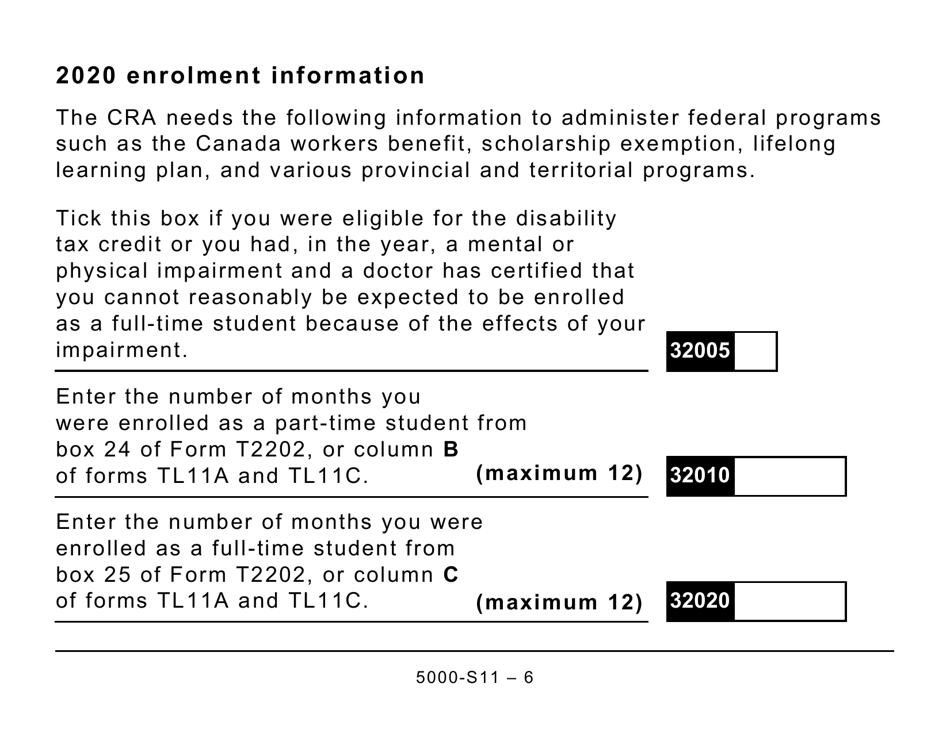

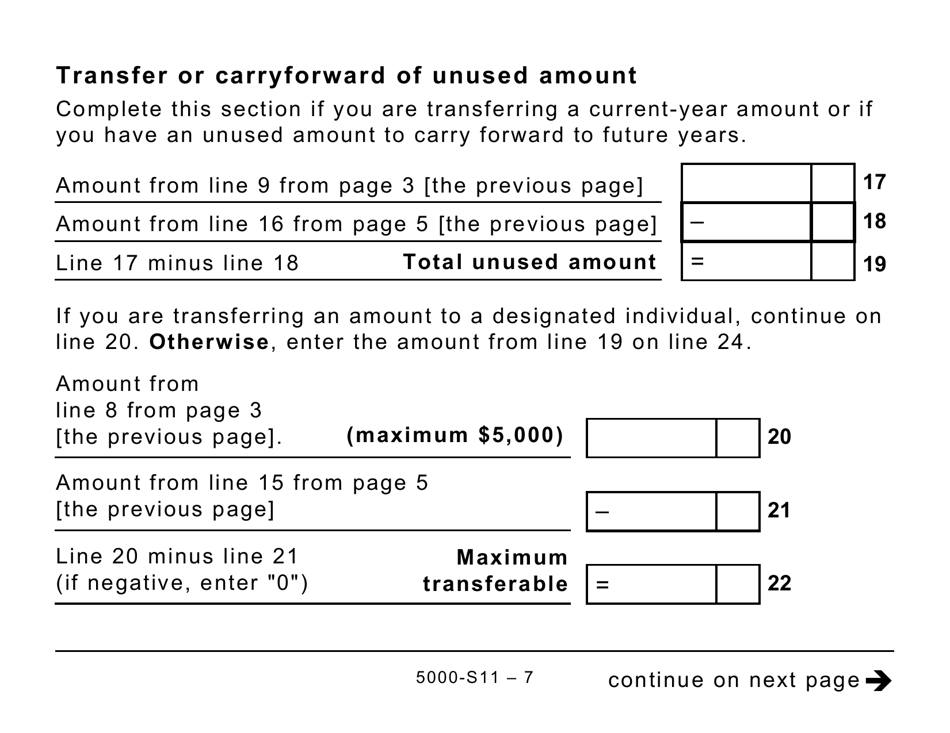

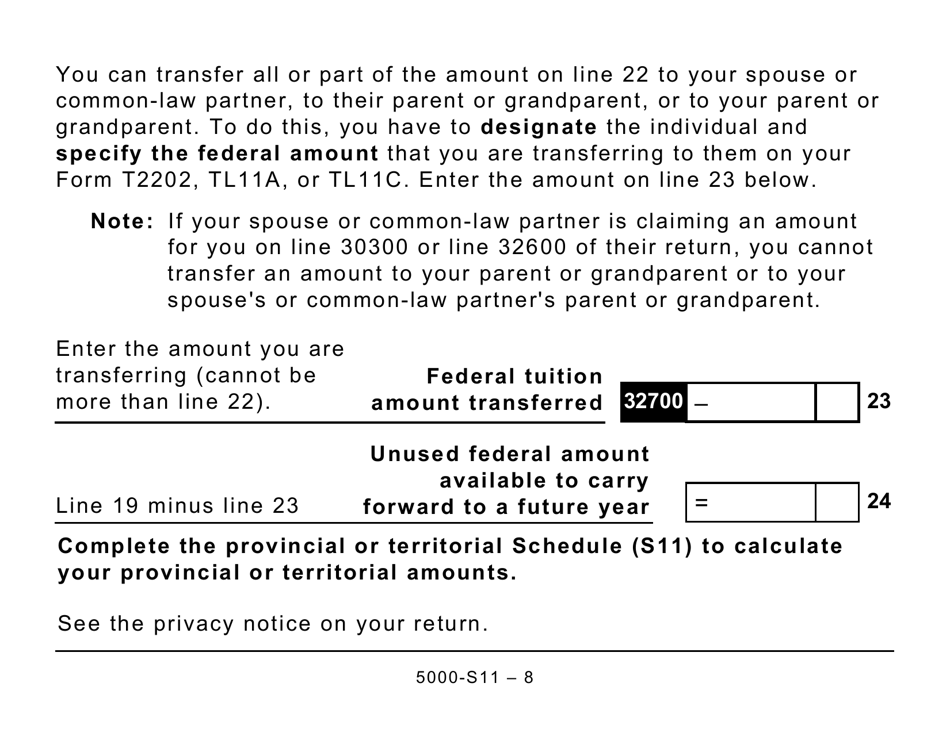

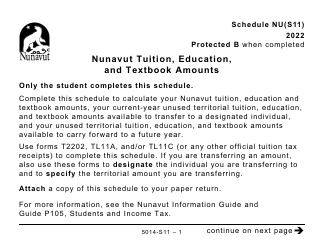

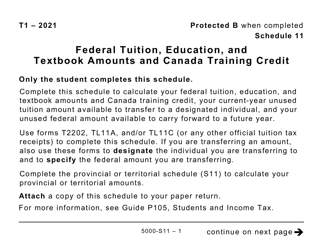

Form 5000-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit - Large Print - Canada

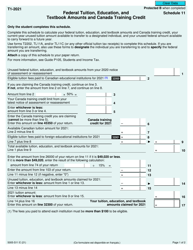

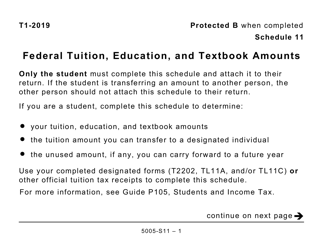

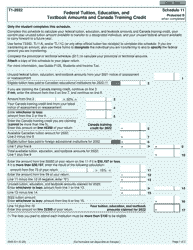

Form 5000-S11 Schedule 11 is a document used in Canada to claim federal tax credits for tuition, education, and textbook costs, as well as the Canada Training Credit. The "Large Print" version provides a format that is easier to read for those with visual impairments.

The form 5000-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit - Large Print in Canada is filed by individual taxpayers who want to claim the federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

FAQ

Q: What is Form 5000-S11?

A: Form 5000-S11 is a tax form used in Canada to report federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

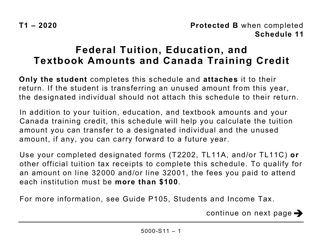

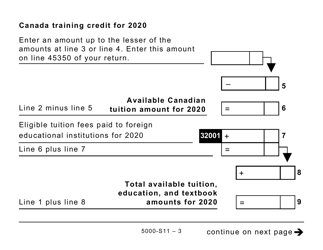

Q: What are federal tuition, education, and textbook amounts?

A: Federal tuition, education, and textbook amounts are tax credits that can be claimed by students or their supporting individuals to reduce their taxable income.

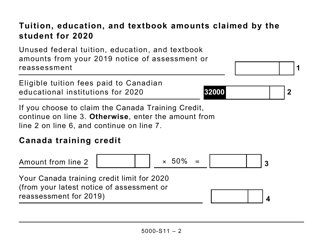

Q: What is the Canada Training Credit?

A: The Canada Training Credit is a new refundable tax credit introduced in Canada to help with the cost of eligible training expenses.

Q: Who can claim the federal tuition, education, and textbook amounts?

A: The federal tuition, education, and textbook amounts can be claimed by students or their supporting individuals, such as parents or partners, who have incurred eligible tuition fees.

Q: Who is eligible to claim the Canada Training Credit?

A: To be eligible for the Canada Training Credit, you must be between the ages of 26 and 65, have a minimum income of $10,000, and have paid tuition fees for eligible training.