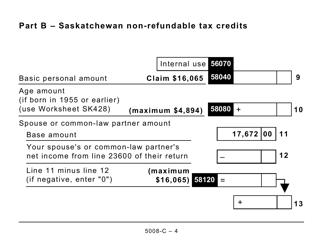

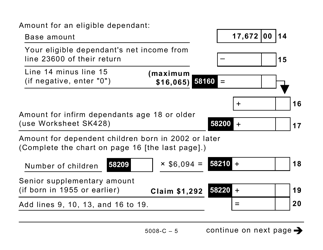

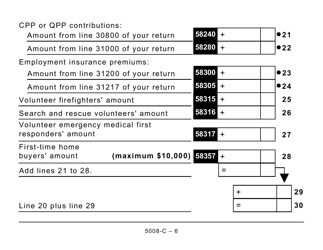

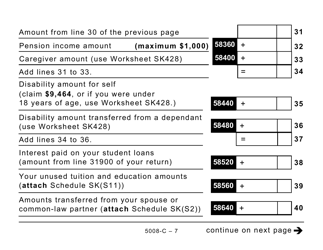

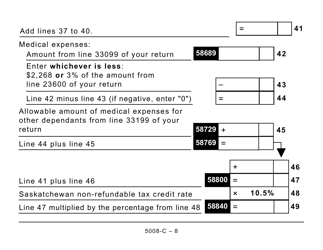

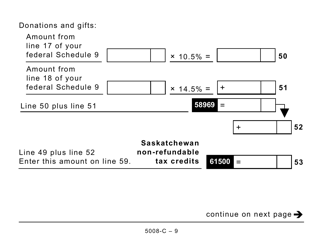

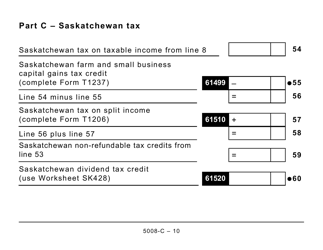

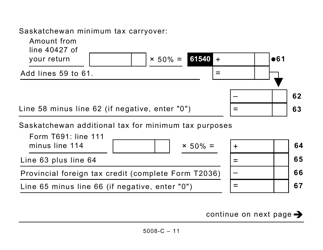

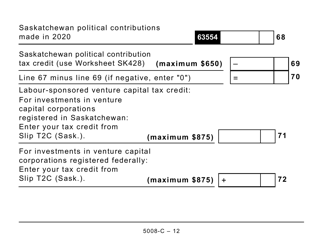

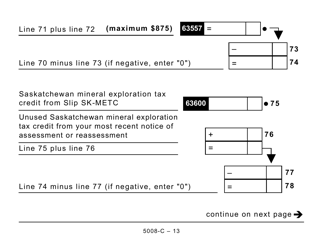

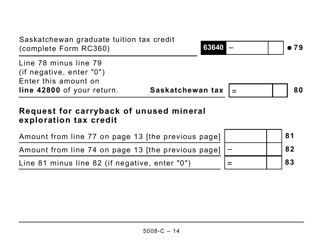

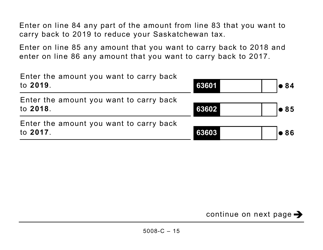

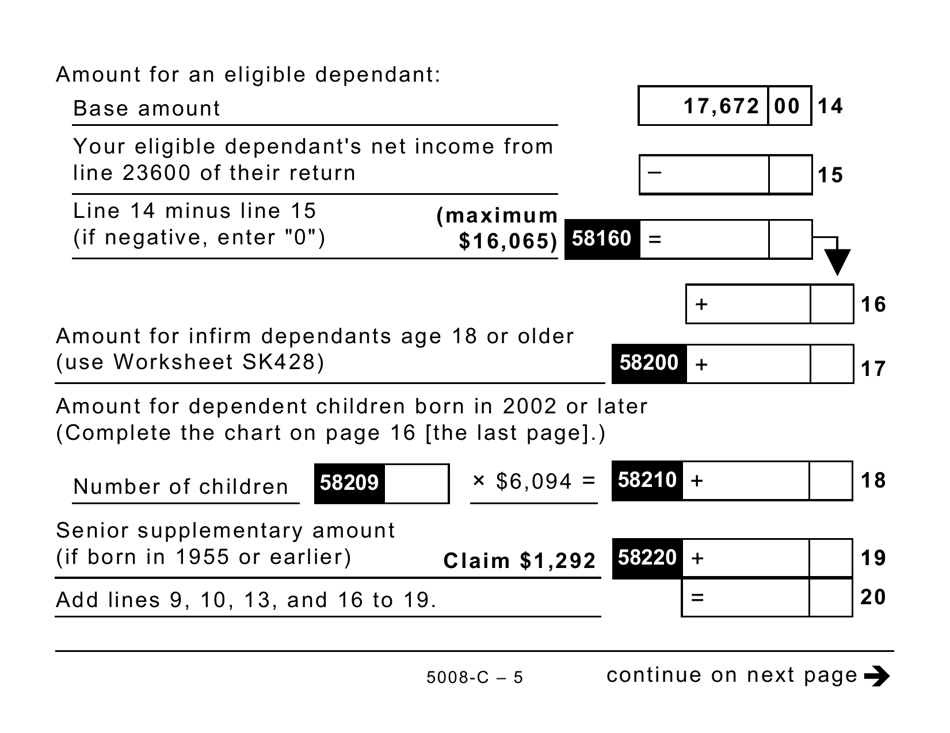

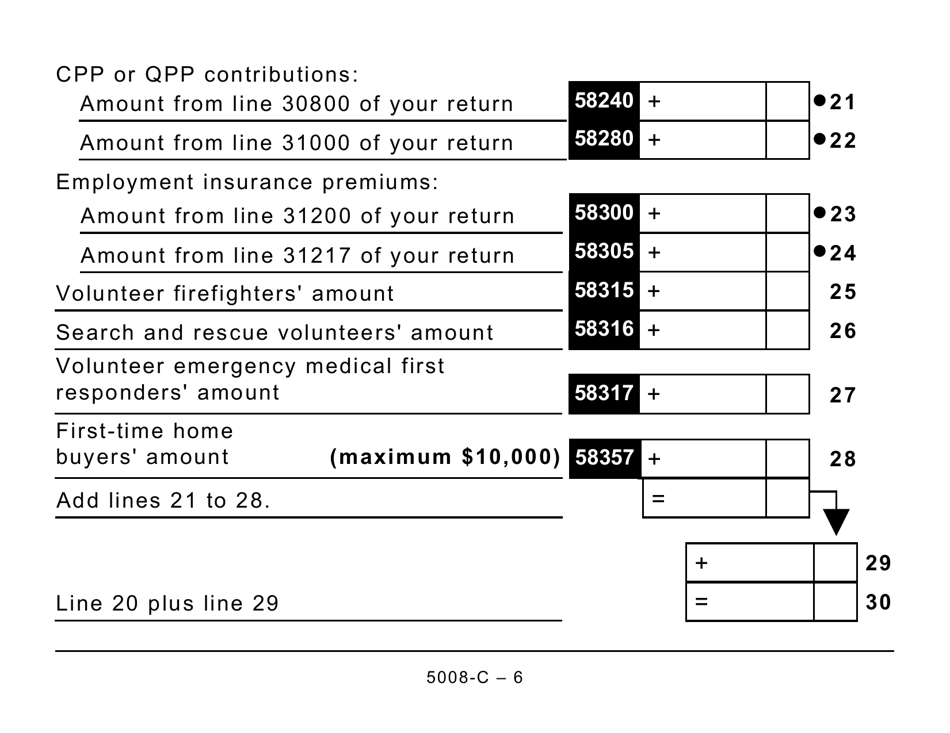

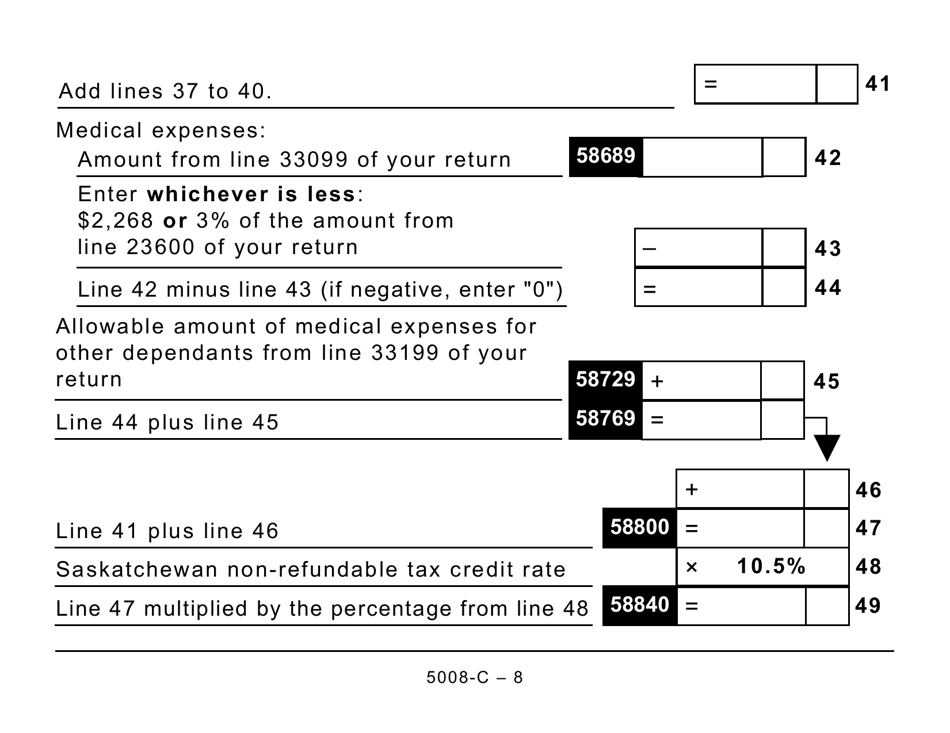

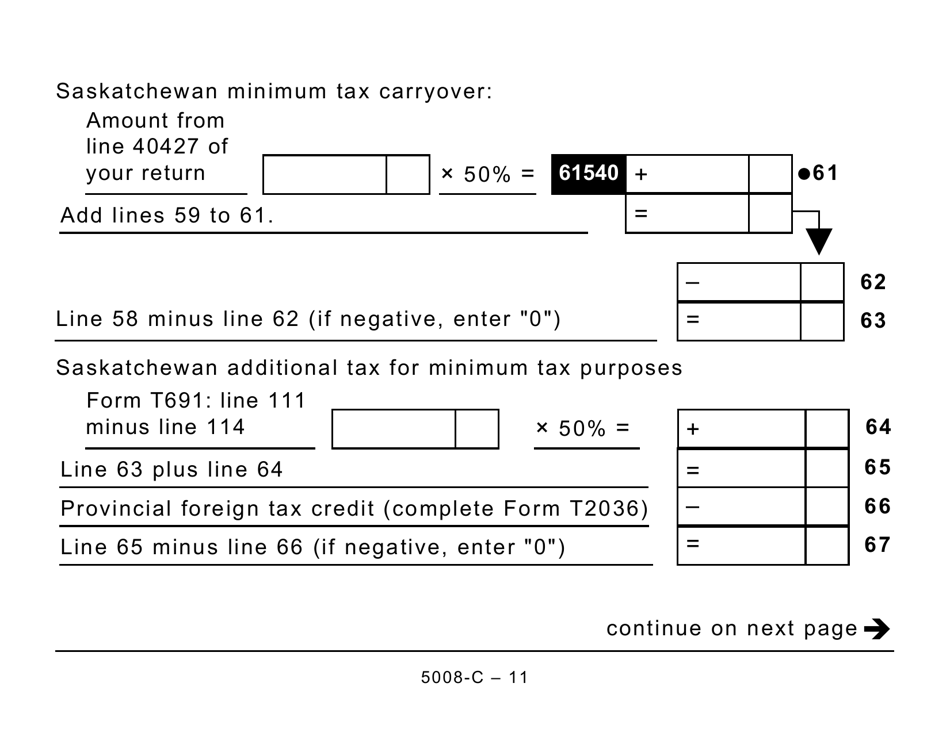

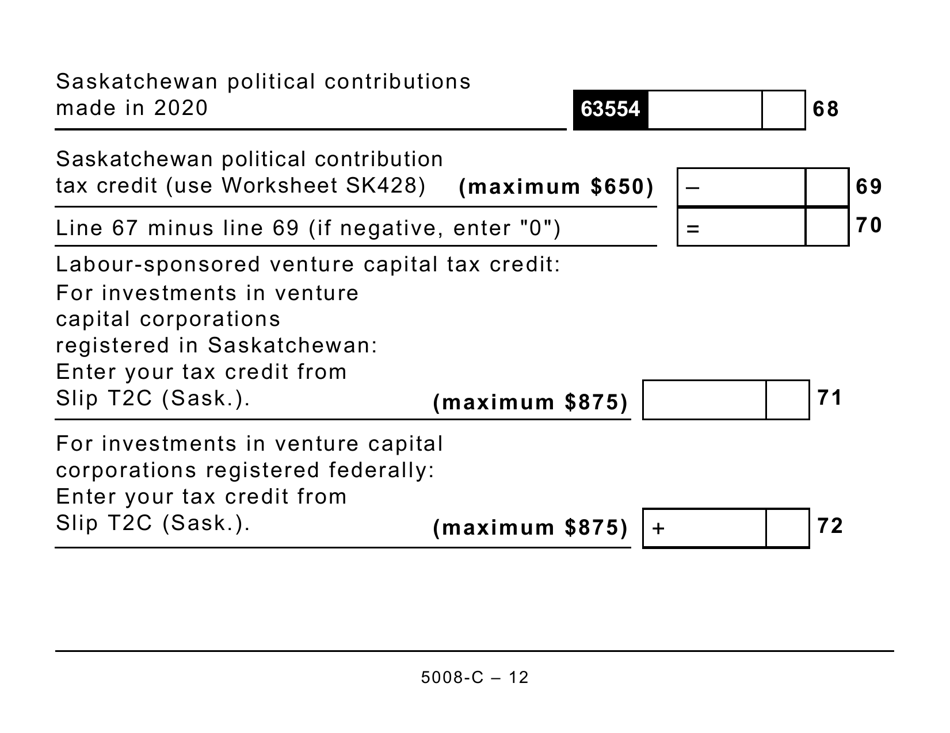

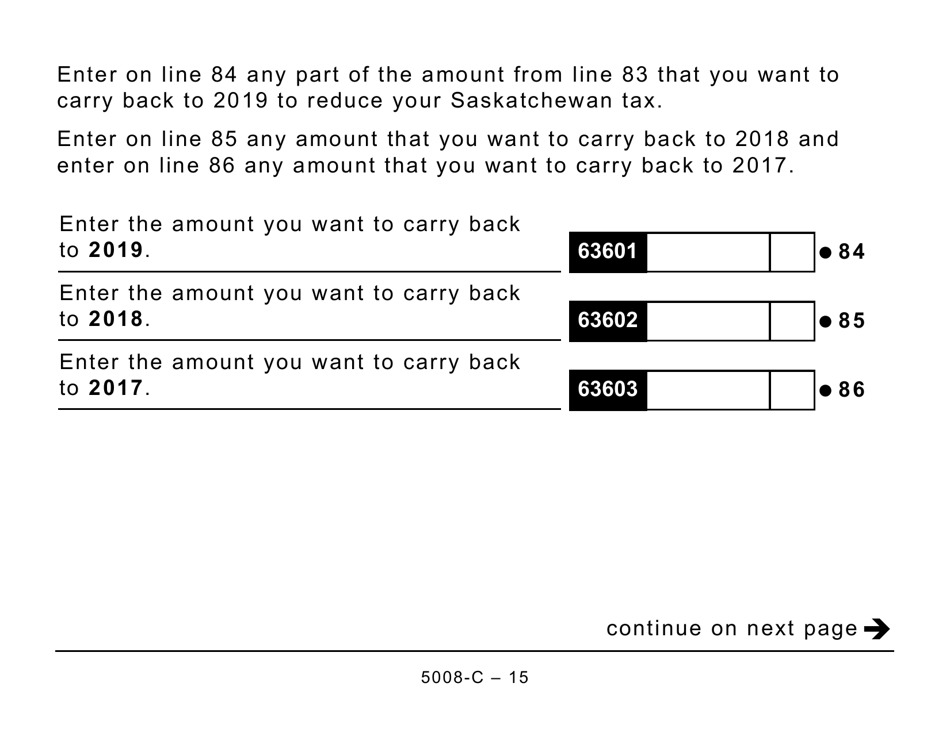

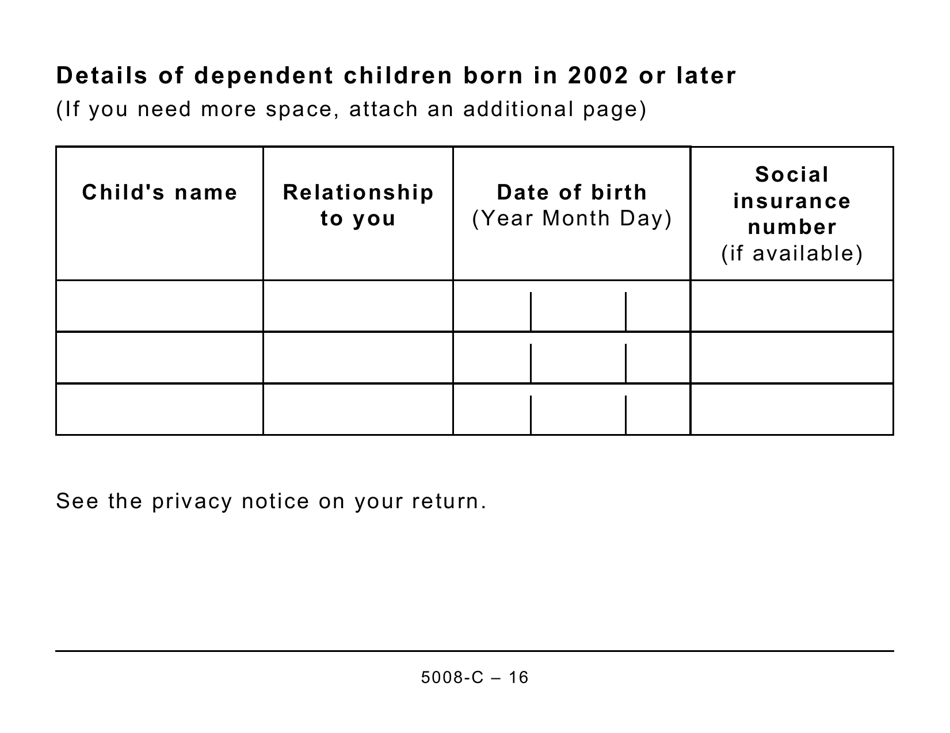

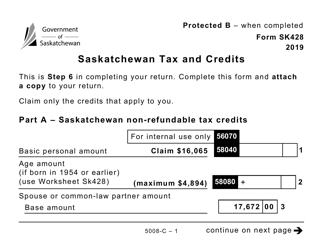

Form 5008-C (SK428) Saskatchewan Tax and Credits - Large Print - Canada

The Form 5008-C (SK428) Saskatchewan Tax and Credits - Large Print in Canada is usually filed by individuals who are residents of Saskatchewan and need to report their income, deductions, and claim tax credits for the province.

FAQ

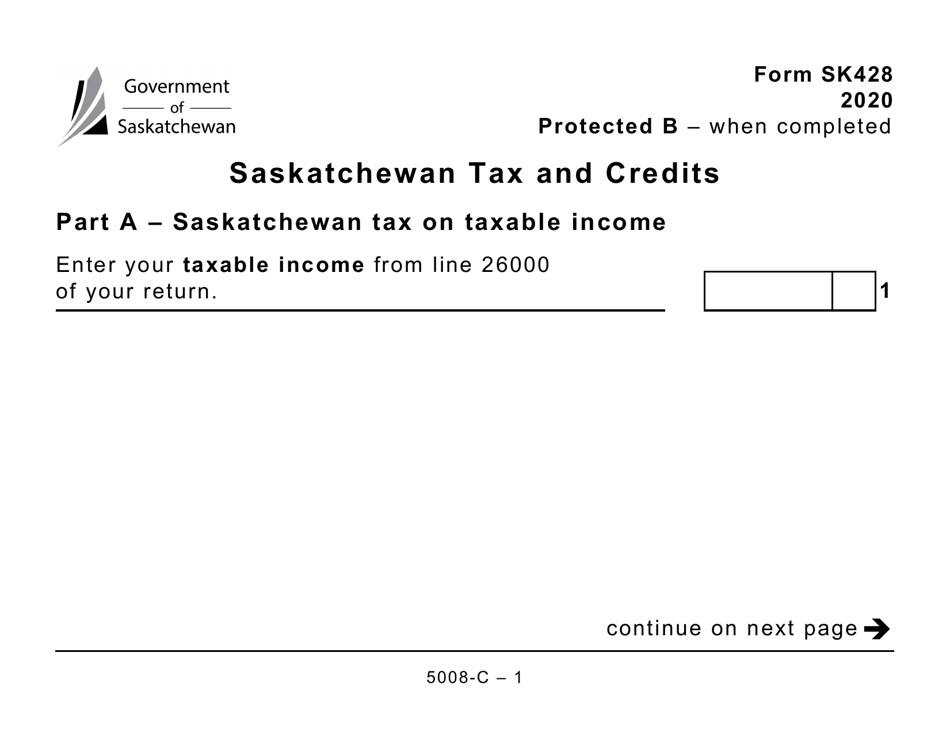

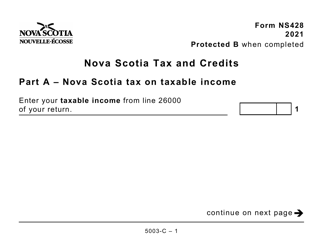

Q: What is Form 5008-C (SK428)?

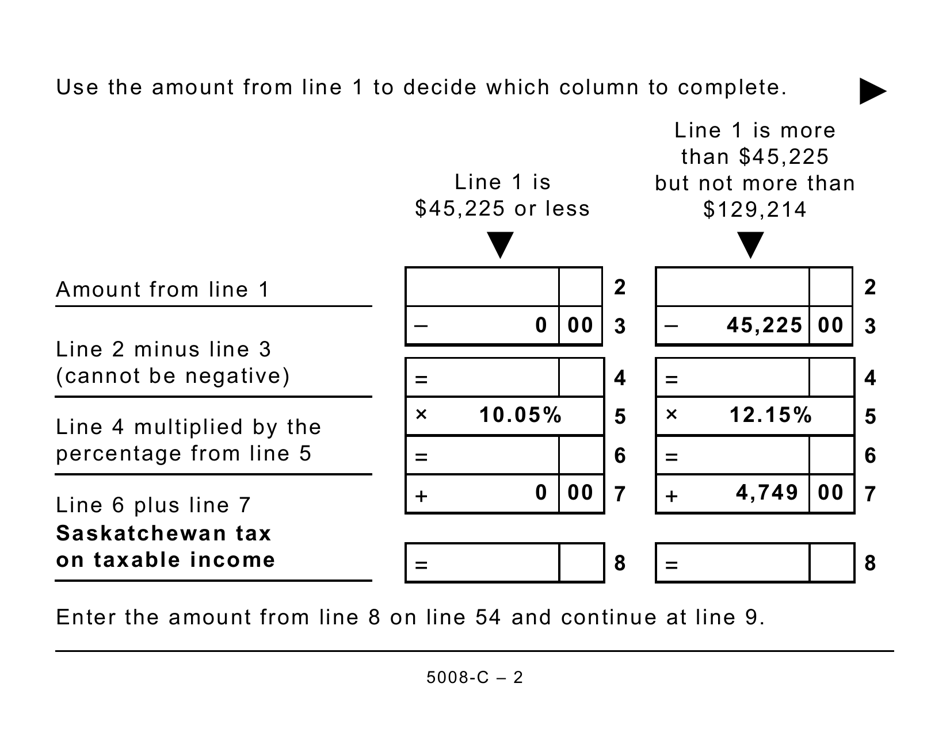

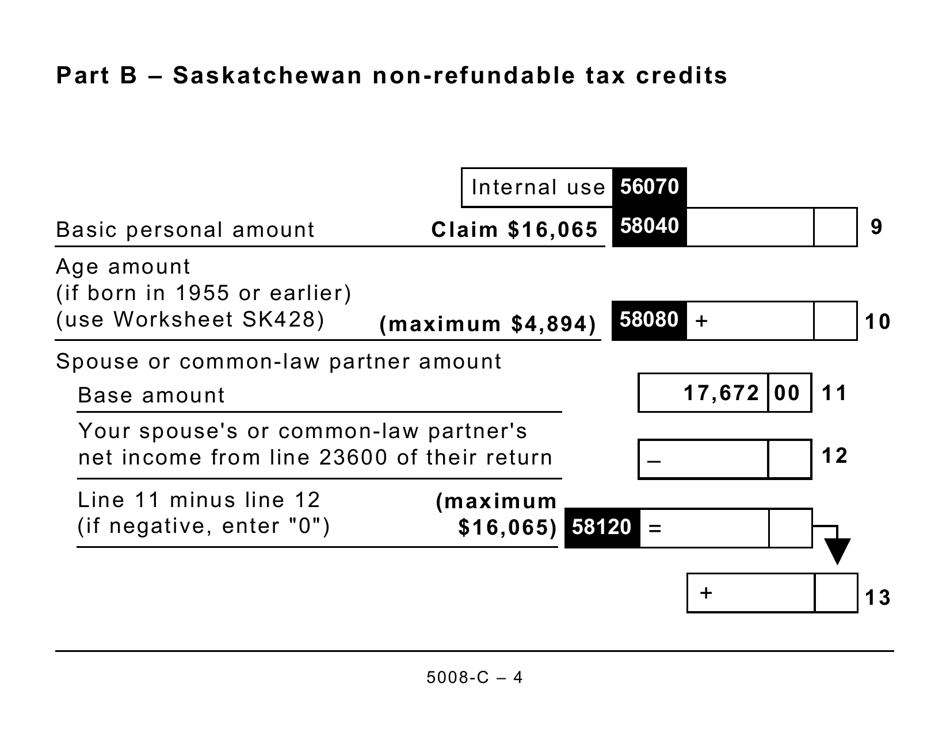

A: Form 5008-C (SK428) is a tax form used in Saskatchewan, Canada to report provincial taxes and claim tax credits.

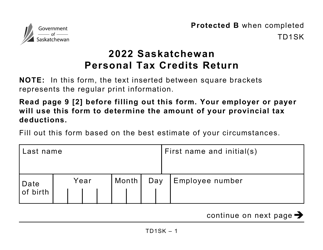

Q: Who needs to file Form 5008-C (SK428)?

A: Anyone who is a resident of Saskatchewan and has income subject to provincial taxation or is eligible to claim provincial tax credits needs to file Form 5008-C (SK428).

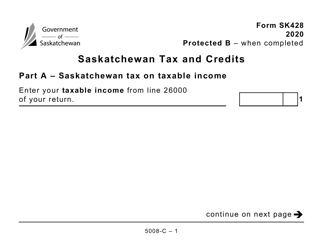

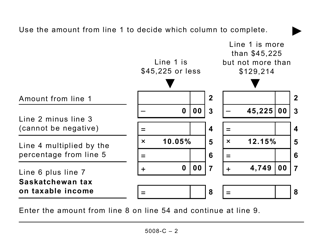

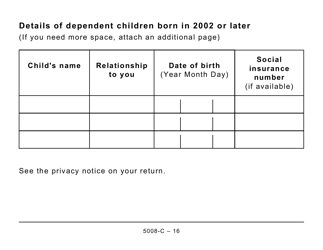

Q: What information do I need to complete Form 5008-C (SK428)?

A: You will need to gather information such as your income, expenses, and any eligible tax credits you wish to claim.

Q: Are there any penalties for late filing of Form 5008-C (SK428)?

A: Yes, if you file your Form 5008-C (SK428) late or fail to file it, you may be subject to penalties and interest charges.

Q: What should I do if I need help completing Form 5008-C (SK428)?

A: If you need assistance with completing Form 5008-C (SK428), you can contact the Canada Revenue Agency or seek the help of a professional tax preparer.

Q: Can I file Form 5008-C (SK428) if I am a non-resident of Saskatchewan?

A: No, Form 5008-C (SK428) is specifically for residents of Saskatchewan. Non-residents should consult with the CRA or a tax professional to determine their filing requirements.