This version of the form is not currently in use and is provided for reference only. Download this version of

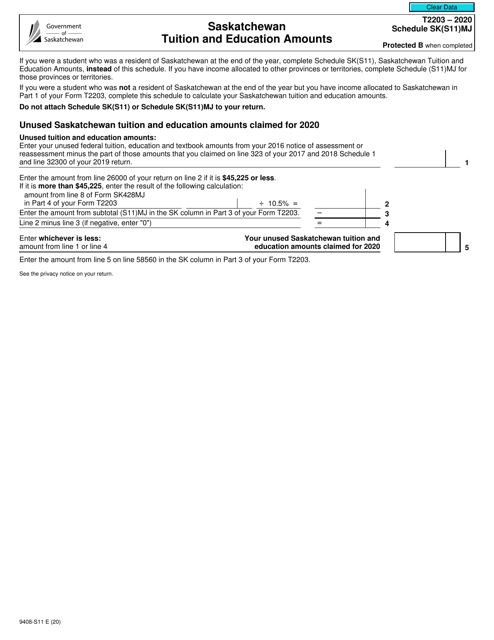

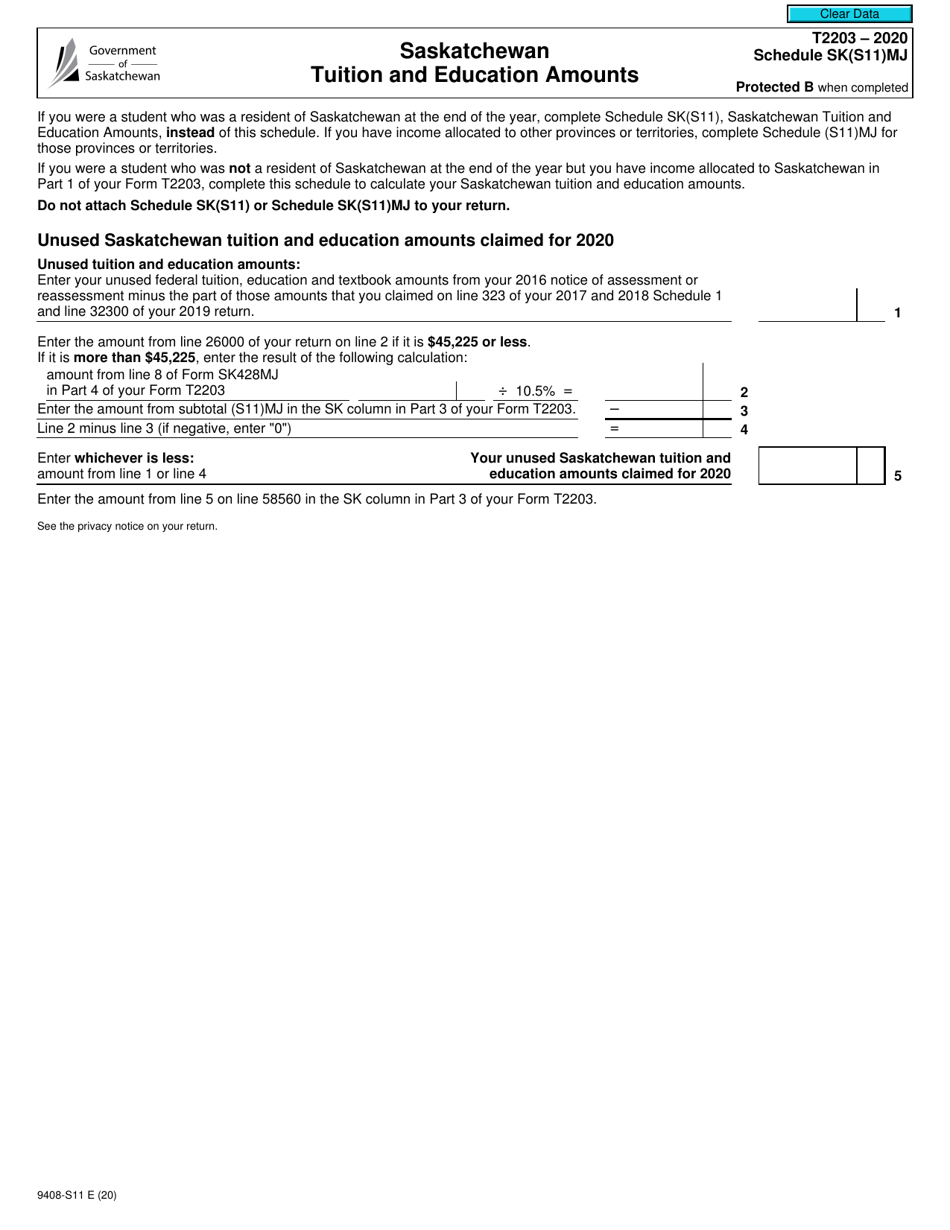

Form T2203 (9408-S11) Schedule SK(S11)MJ

for the current year.

Form T2203 (9408-S11) Schedule SK(S11)MJ Saskatchewan Tuition and Education Amounts - Canada

Form T2203 (9408-S11) Schedule SK(S11)MJ Saskatchewan Tuition and Education Amounts in Canada is used to claim tuition and education amounts specific to the province of Saskatchewan. This form is used to calculate the maximum amount of tuition and education credits that a taxpayer can claim in Saskatchewan.

The Form T2203 (9408-S11) Schedule SK(S11)MJ Saskatchewan Tuition and Education Amounts in Canada must be filed by the individual who is claiming the Saskatchewan Tuition and Education Amounts.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to claim tuition and education amounts in the province of Saskatchewan.

Q: What is the purpose of Form T2203?

A: The purpose of Form T2203 is to calculate and claim the tuition and education amounts in Saskatchewan for tax purposes.

Q: Who needs to file Form T2203?

A: Residents of Saskatchewan who have eligible tuition and education expenses to claim on their Canadian income tax return need to file Form T2203.

Q: What are tuition and education amounts?

A: Tuition and education amounts are deductions or credits that can be claimed for eligible educational expenses, such as tuition fees and textbooks.

Q: What is Schedule SK(S11)MJ?

A: Schedule SK(S11)MJ is a specific schedule within Form T2203 that is used to calculate the tuition and education amounts for residents of Saskatchewan.

Q: Can I claim tuition and education amounts if I am not a resident of Saskatchewan?

A: No, Form T2203 and Schedule SK(S11)MJ are specifically for residents of Saskatchewan. Other provinces and territories have their own forms for claiming these amounts.