This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1139

for the current year.

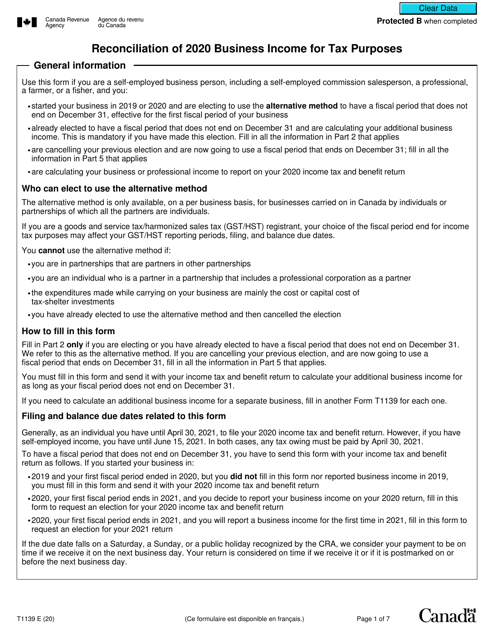

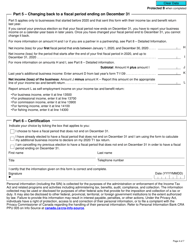

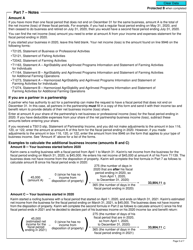

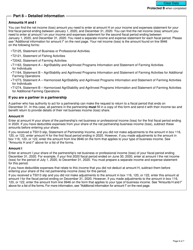

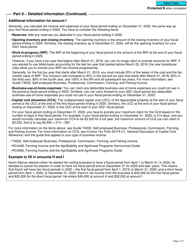

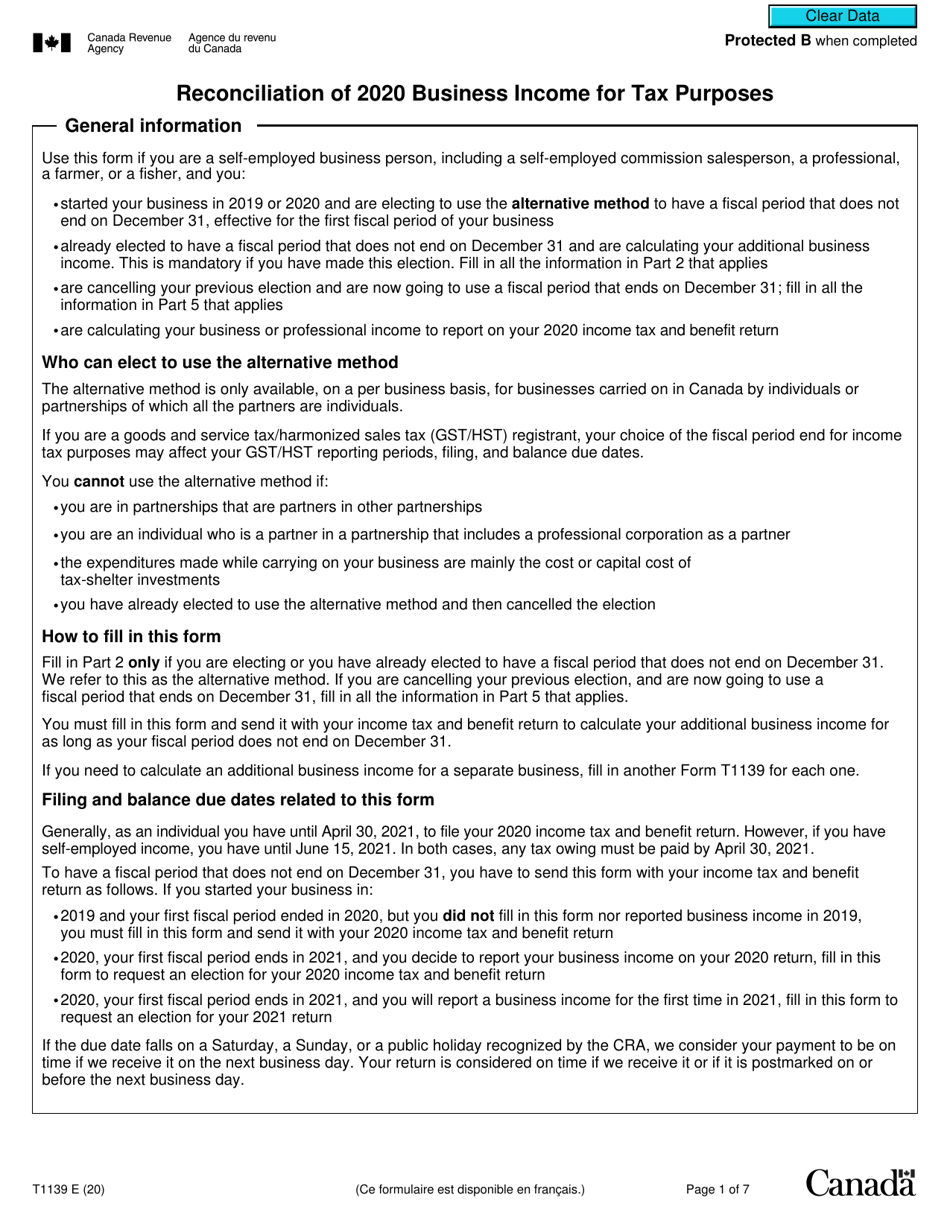

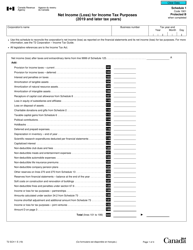

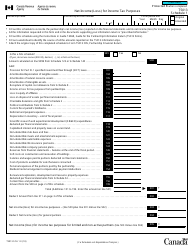

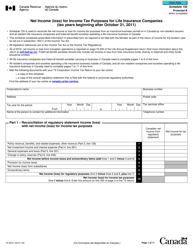

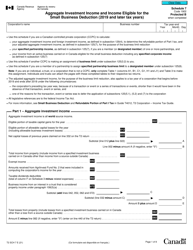

Form T1139 Reconciliation of 2020 Business Income for Tax Purposes - Canada

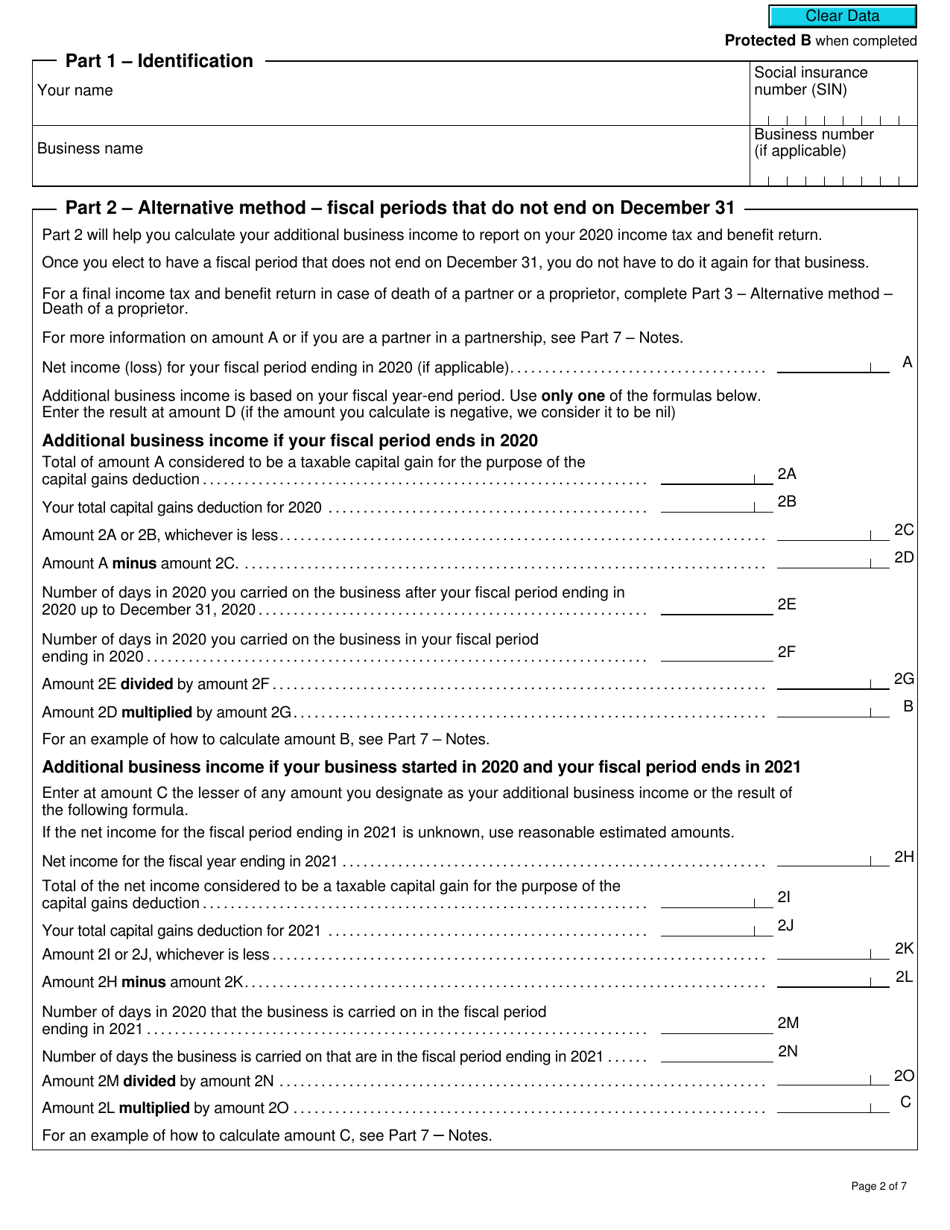

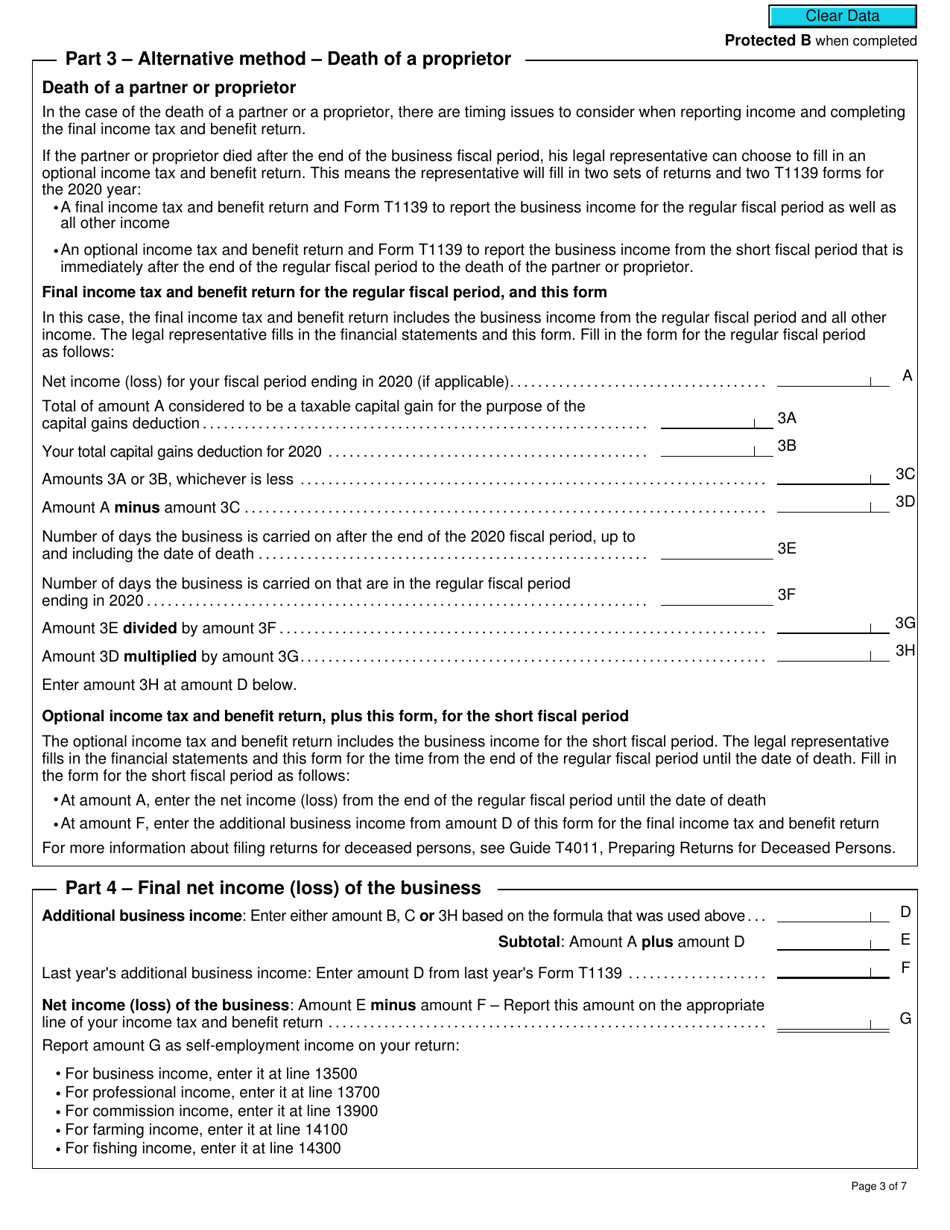

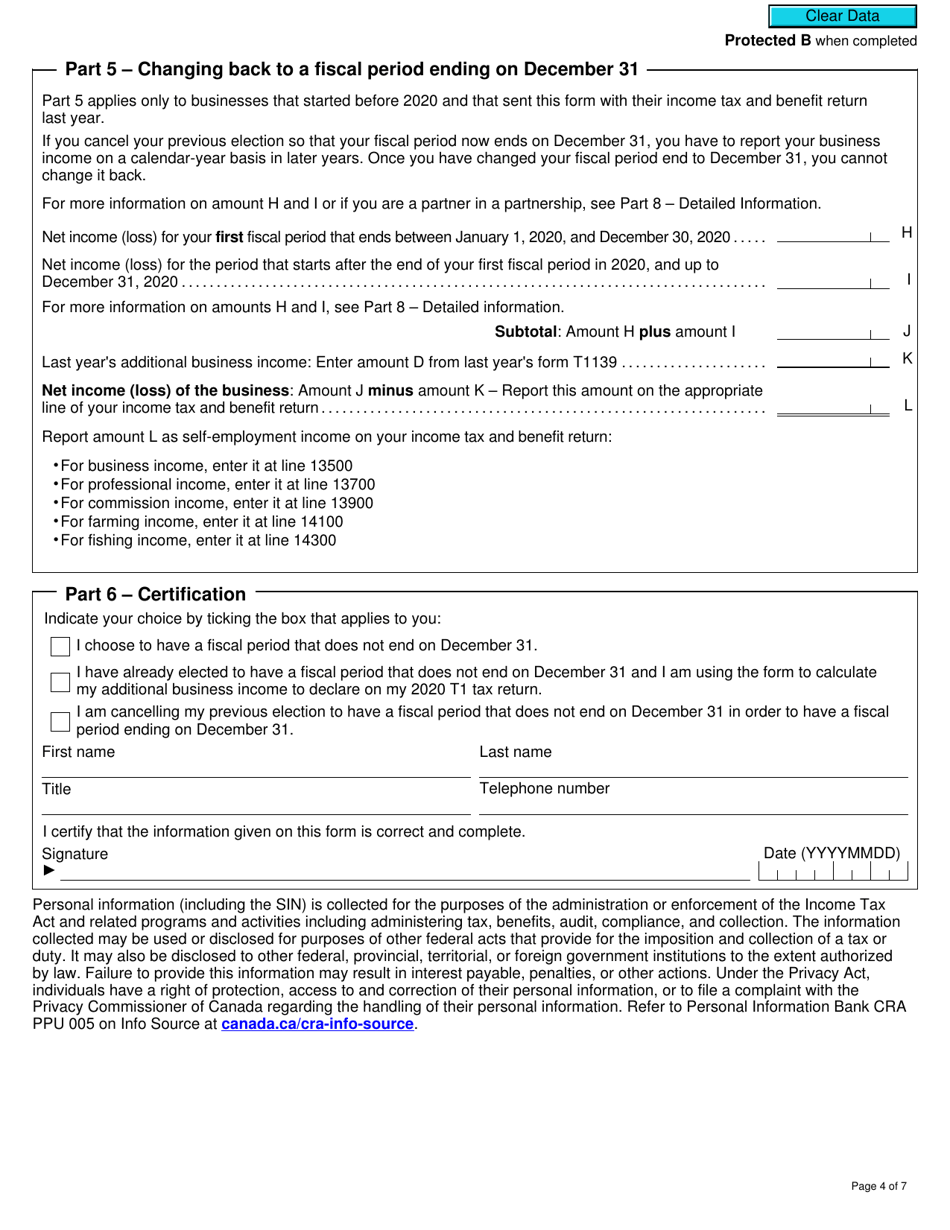

Form T1139 Reconciliation of 2020 Business Income for Tax Purposes in Canada is used to reconcile the reported business income on a taxpayer's tax return with the income reported in their financial statements for tax purposes. It is used to ensure that the business income reported on the tax return is accurate and in compliance with the tax laws in Canada.

The Form T1139 Reconciliation of 2020 Business Income for Tax Purposes in Canada should be filed by self-employed individuals and partnerships.

FAQ

Q: What is Form T1139?

A: Form T1139 is a document used in Canada to reconcile business income for tax purposes.

Q: What is the purpose of Form T1139?

A: The purpose of Form T1139 is to reconcile the business income reported on a taxpayer's tax return with the income reported in their financial statements.

Q: Who needs to file Form T1139?

A: Taxpayers in Canada who have business income and need to reconcile it for tax purposes may need to file Form T1139.

Q: When is Form T1139 due?

A: Form T1139 is typically due at the same time as the taxpayer's tax return, which is generally April 30th for most individuals.

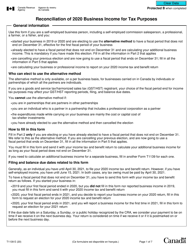

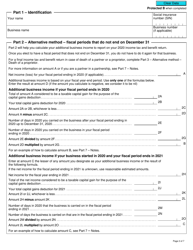

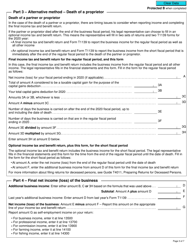

Q: What information is required on Form T1139?

A: Form T1139 requires information such as the taxpayer's business income as reported on their financial statements, adjustments to reconcile that income with their tax return, and supporting documentation.

Q: Are there penalties for not filing Form T1139?

A: Yes, there can be penalties for not filing Form T1139 or for filing it late. It's important to ensure compliance with the CRA's deadlines and requirements.

Q: Can I get help with filling out Form T1139?

A: Yes, if you need help in filling out Form T1139, it is recommended to seek assistance from a tax professional or use the resources provided by the CRA.

Q: Is Form T1139 specific to the tax year 2020?

A: Yes, Form T1139 is specific to the tax year 2020 and is used to reconcile business income for that particular year.