This version of the form is not currently in use and is provided for reference only. Download this version of

Form CPT1

for the current year.

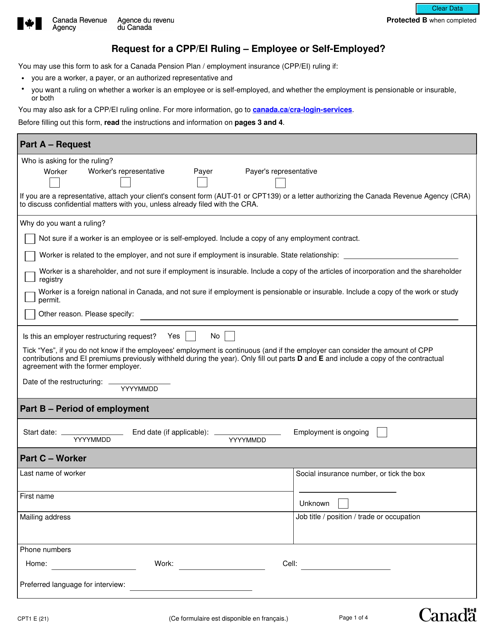

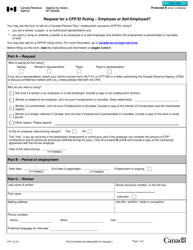

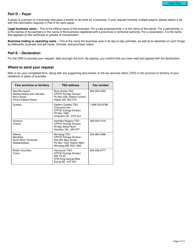

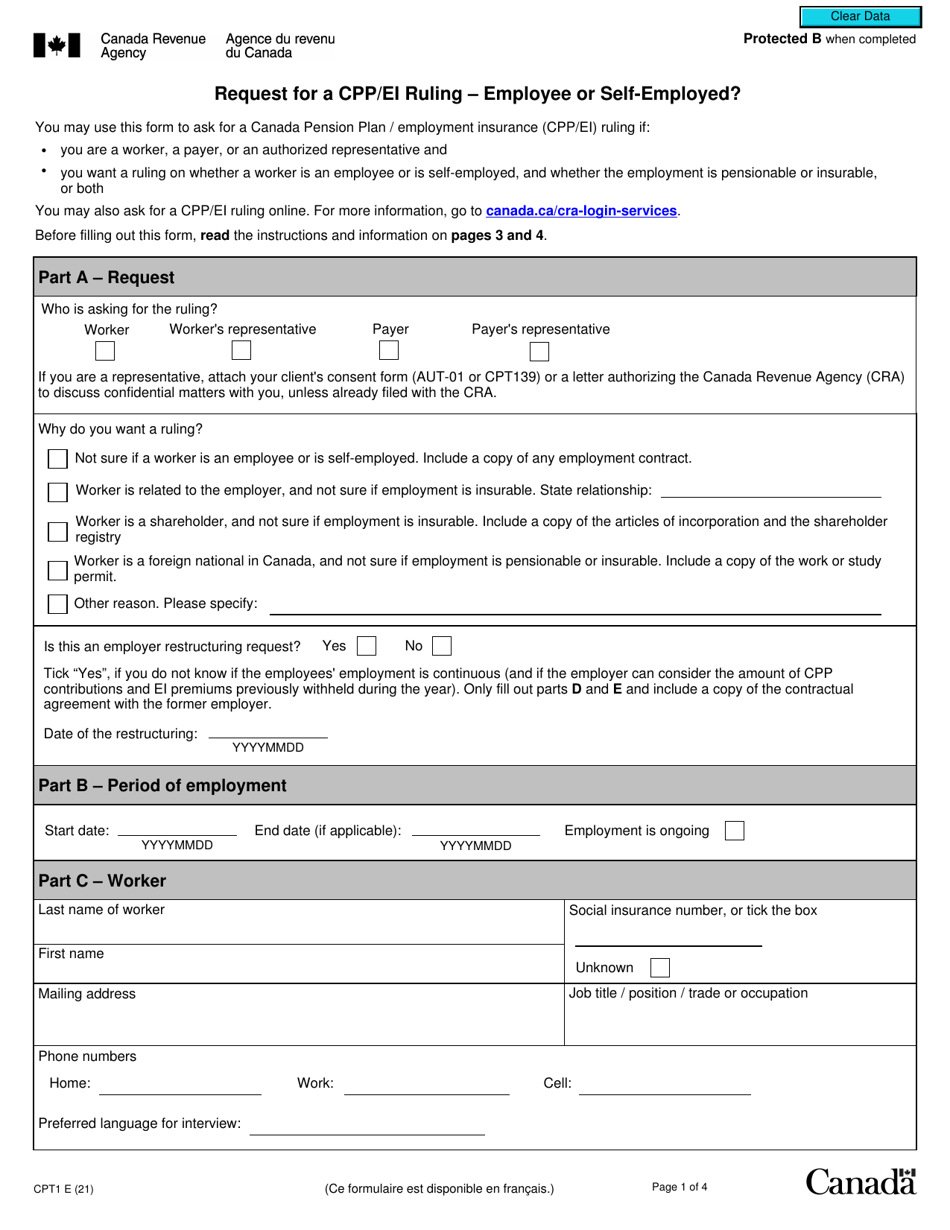

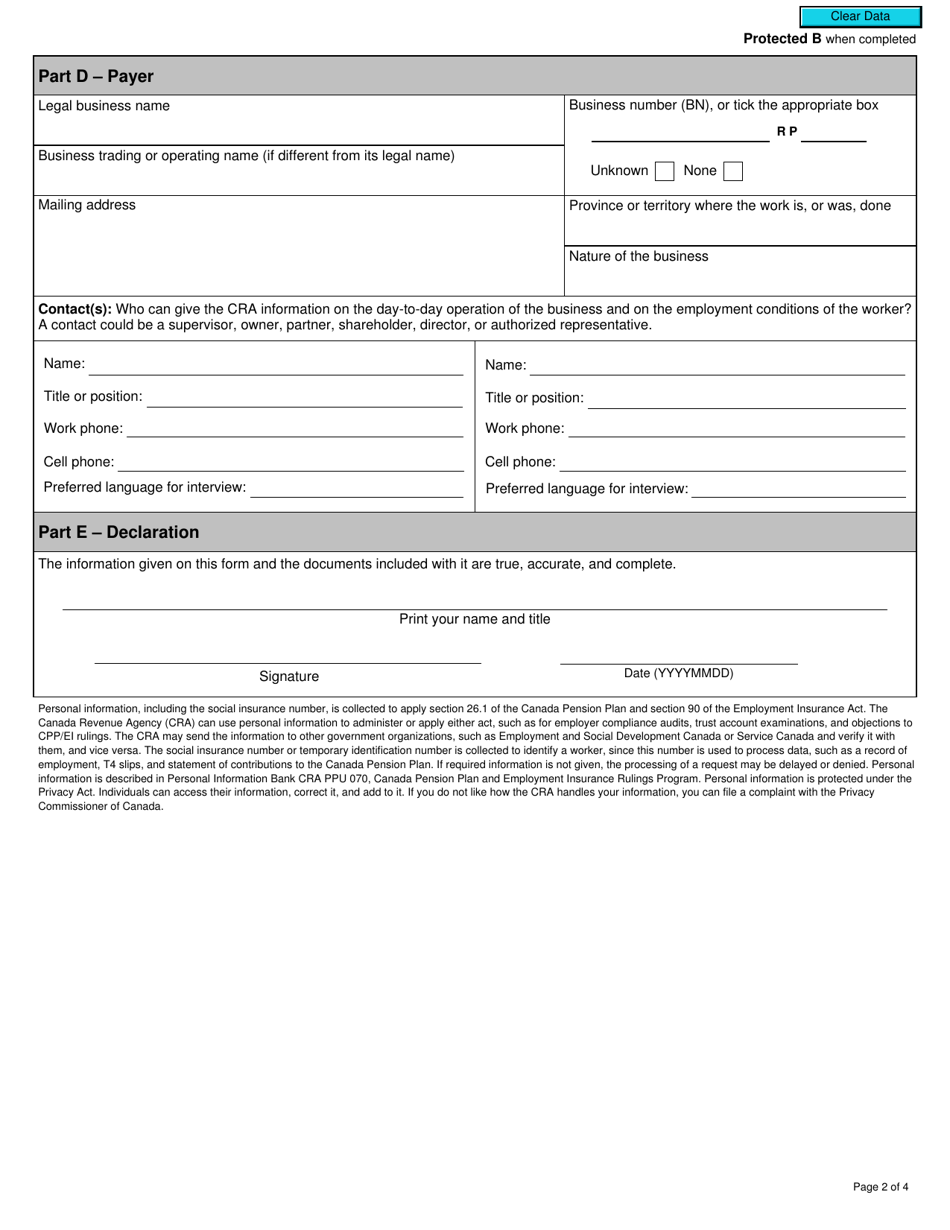

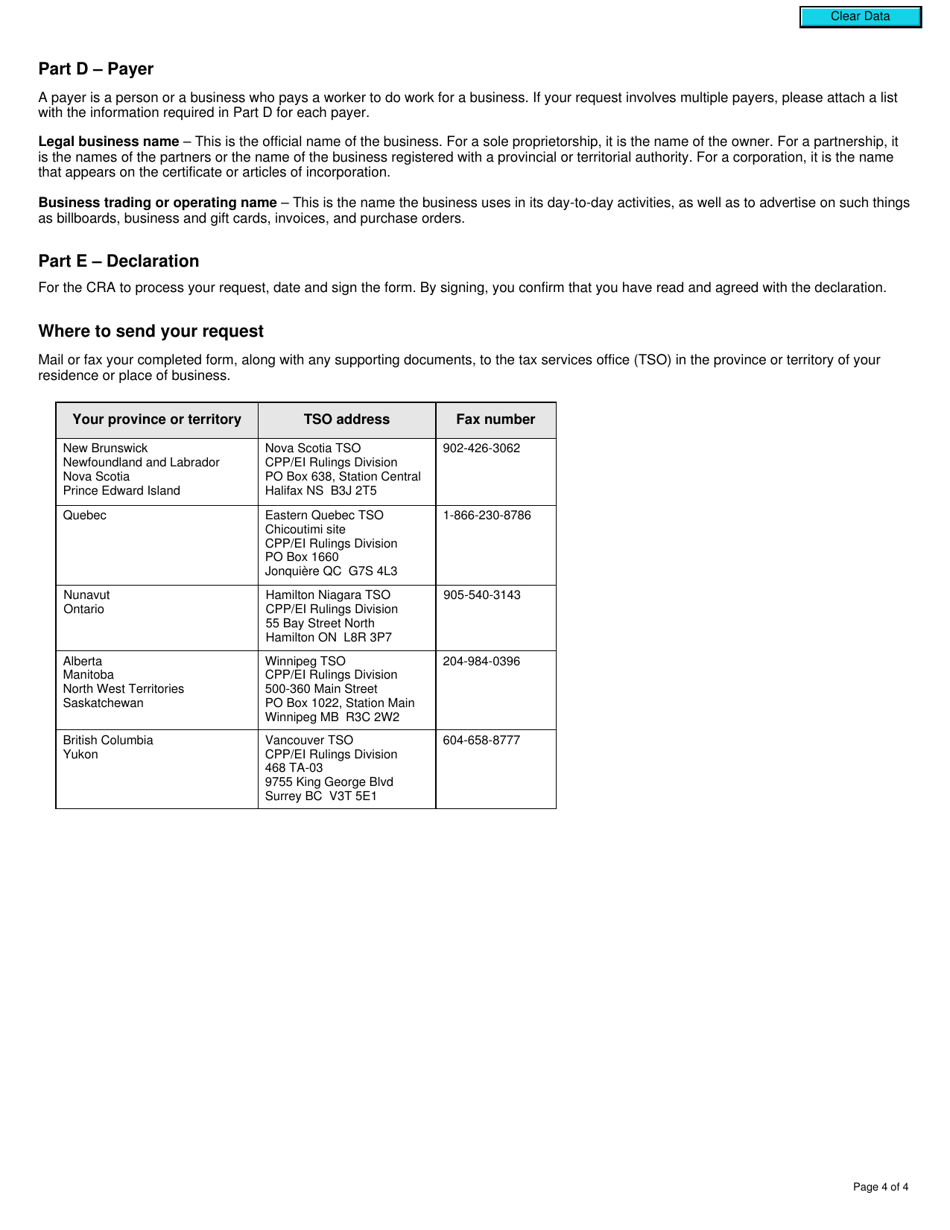

Form CPT1 Request for a Cpp / Ei Ruling - Employee or Self-employed - Canada

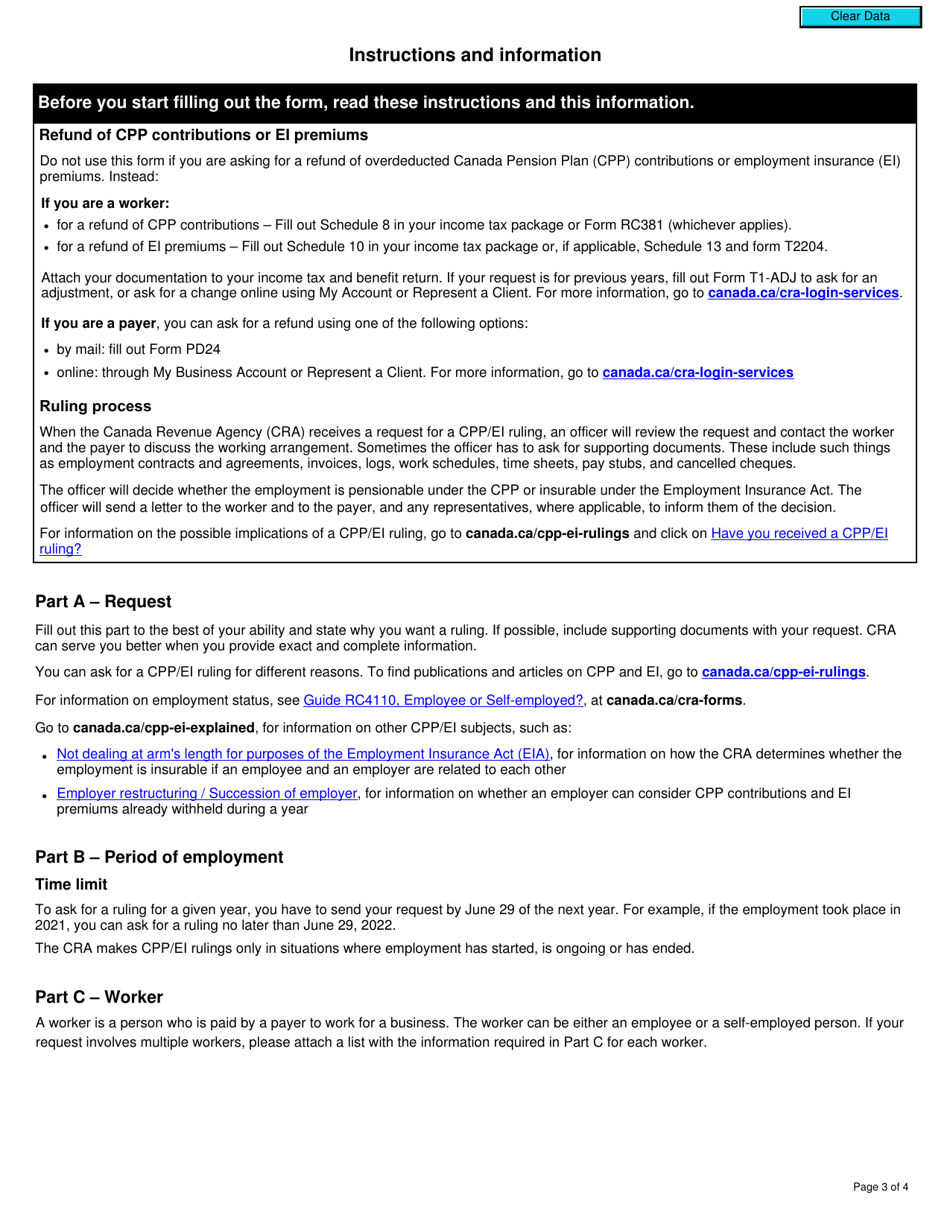

Form CPT1, Request for a CPP/EI Ruling - Employee or Self-employed, is used in Canada to determine if a worker should be classified as an employee or self-employed for the purposes of the Canada Pension Plan (CPP) and Employment Insurance (EI) programs. By completing this form, individuals or businesses can seek a ruling from the Canada Revenue Agency (CRA) to clarify the employment status of a worker, which can affect their entitlement to CPP and EI benefits.

The Form CPT1 request for a CPP/EI ruling in Canada is filed by the self-employed individual.

FAQ

Q: What is Form CPT1?

A: Form CPT1 is a request for a Cpp/Ei ruling in Canada to determine if an individual is considered an employee or self-employed.

Q: Why would someone need to fill out Form CPT1?

A: Form CPT1 is used when someone wants to get a ruling from the Canada Revenue Agency (CRA) to determine their employment status for the purposes of the Canada Pension Plan (CPP) and/or Employment Insurance (EI).

Q: What is the purpose of determining whether someone is an employee or self-employed?

A: Determining employment status is important for tax and benefits purposes, as the rights and responsibilities differ for employees and self-employed individuals.

Q: What information is required on Form CPT1?

A: Form CPT1 requires details about the individual's work arrangement, including the type of work, control over work, tools/equipment used, financial risk, and other factors relevant to determining employment status.

Q: How long does it take to receive a ruling after submitting Form CPT1?

A: The timeline for receiving a ruling may vary, but it is typically within 60 days of submitting the form.

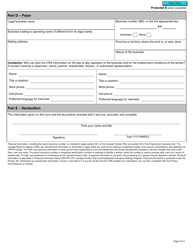

Q: What happens after receiving a ruling on employment status?

A: Once a ruling is received, the individual and the payer (employer or client) must follow the CRA's decision and comply with the appropriate tax and benefit obligations.

Q: Can the ruling be appealed if someone disagrees with it?

A: Yes, if someone disagrees with the ruling, they have the right to appeal within 90 days of receiving the decision.

Q: Are there any fees associated with submitting Form CPT1?

A: There is no fee to submit Form CPT1 to request a Cpp/Ei ruling in Canada.