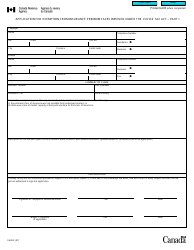

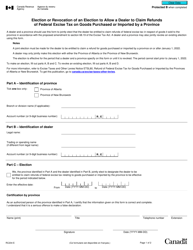

This version of the form is not currently in use and is provided for reference only. Download this version of

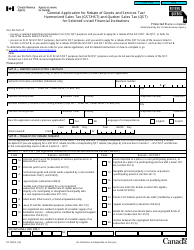

Form GST303

for the current year.

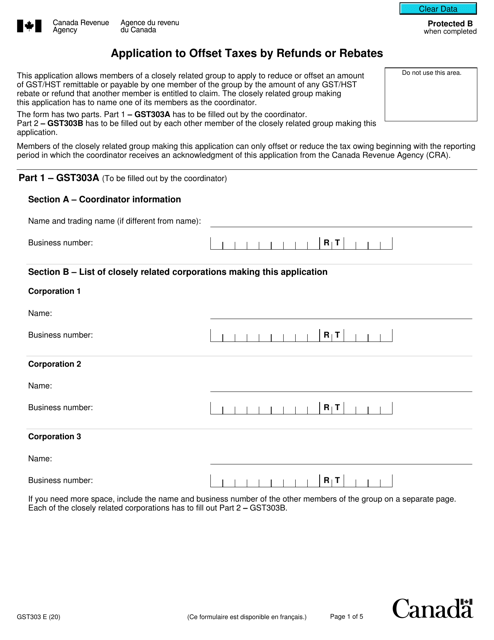

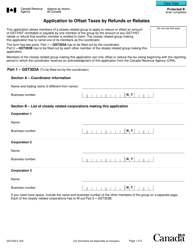

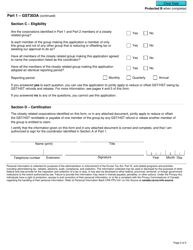

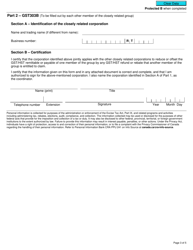

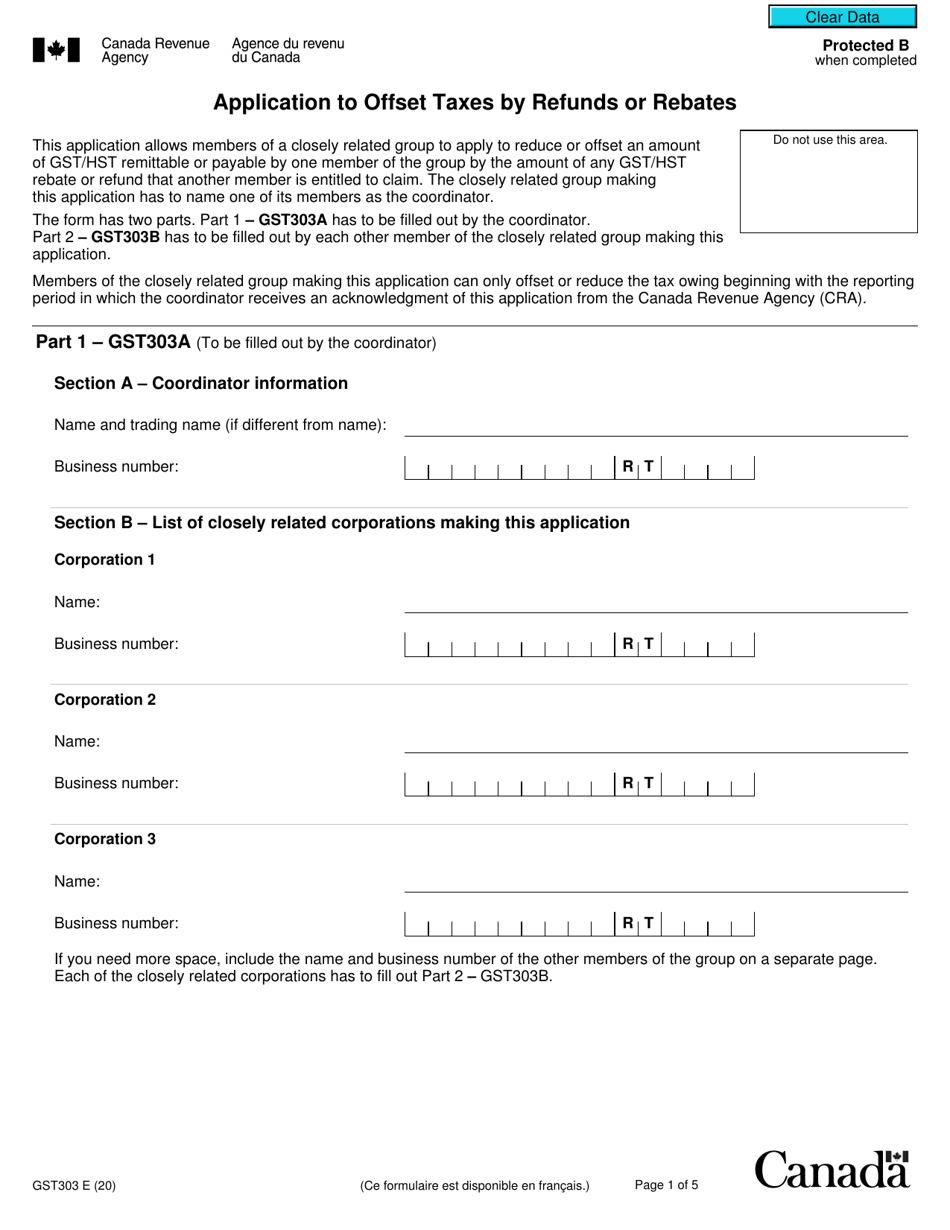

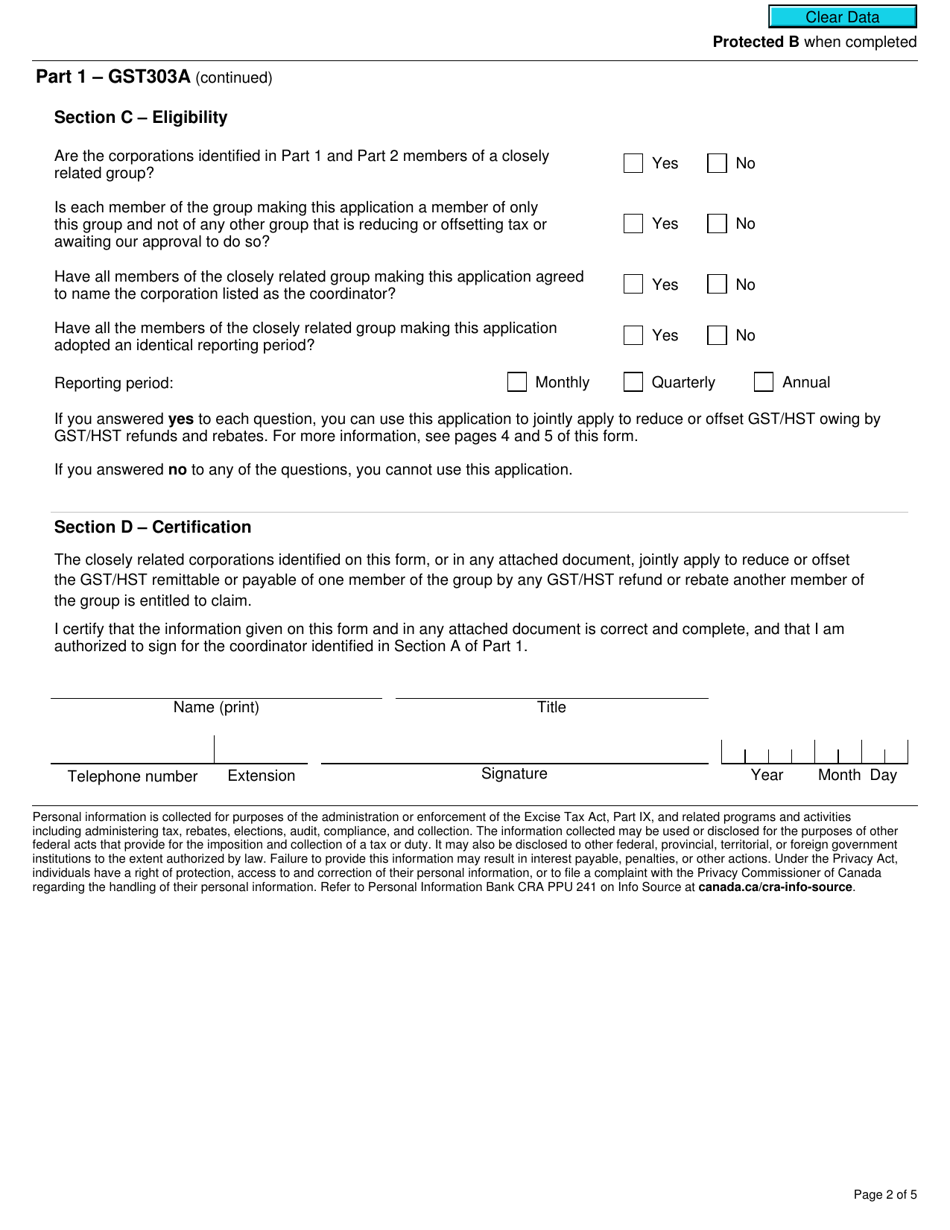

Form GST303 Application to Offset Taxes by Refunds or Rebates - Canada

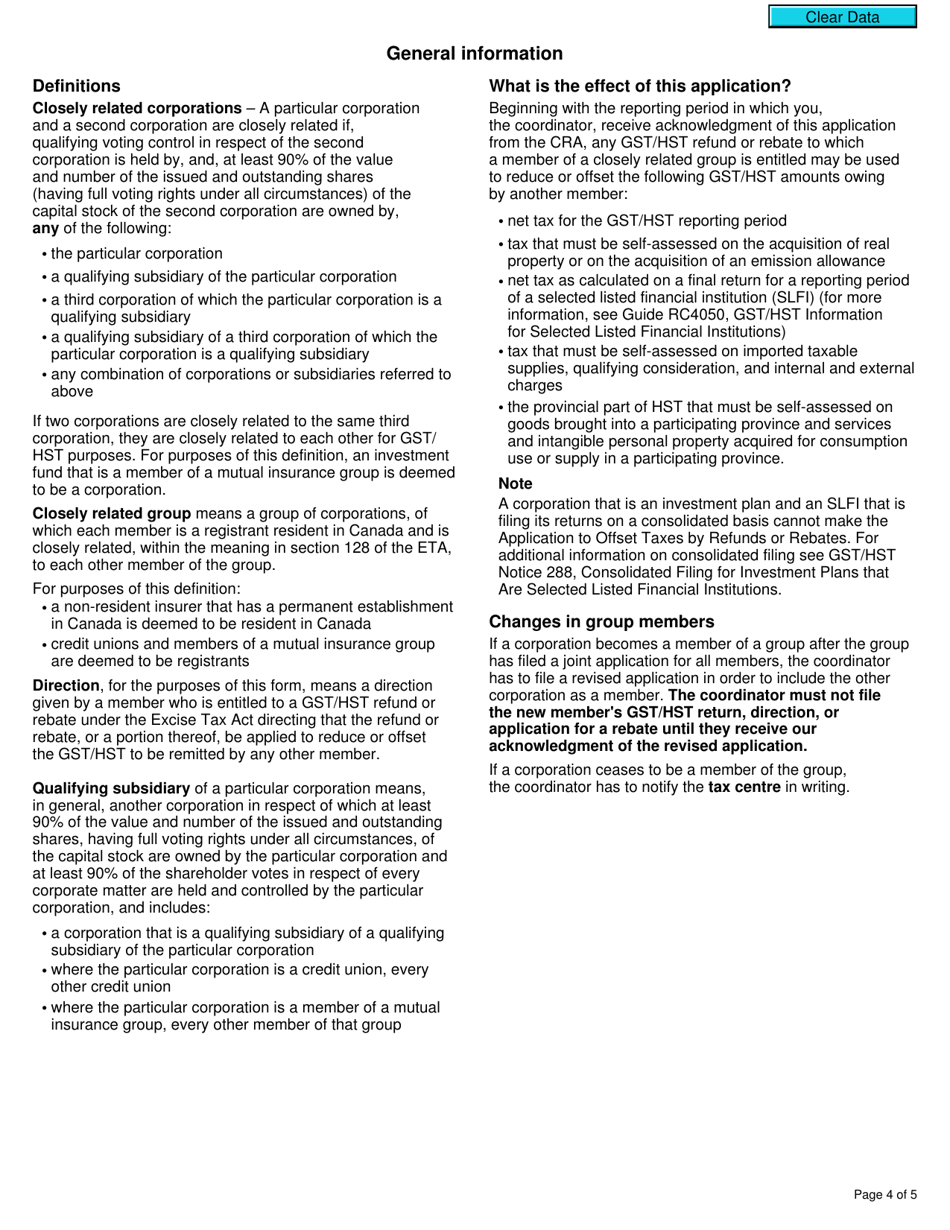

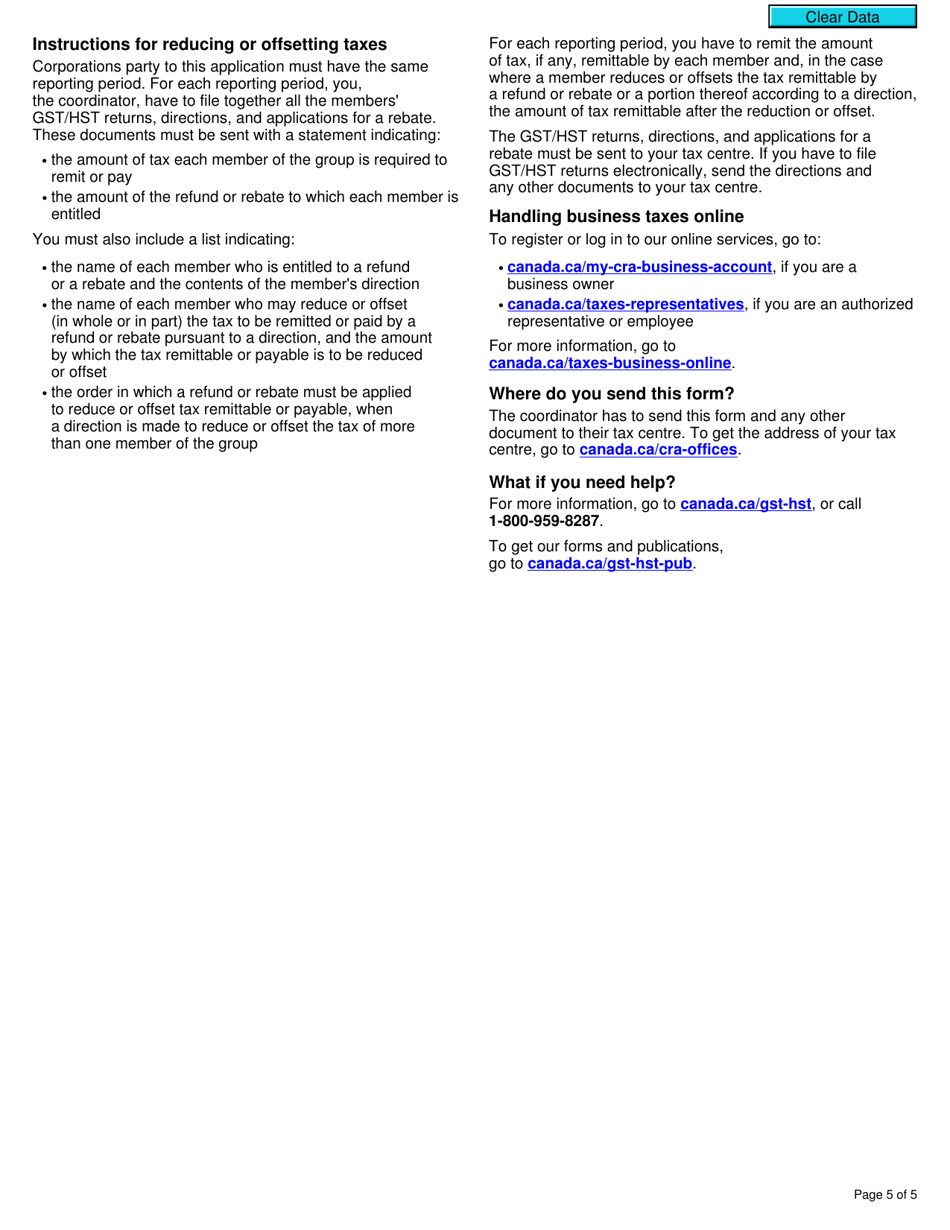

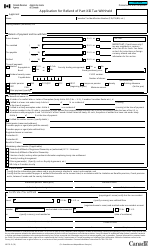

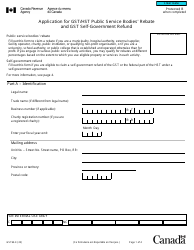

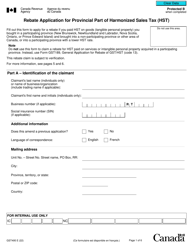

Form GST303, Application to Offset Taxes by Refunds or Rebates, is used by businesses in Canada to apply for a refund or rebate of Goods and Services Tax/Harmonized Sales Tax (GST/HST) they have paid, which can be used to offset any outstanding taxes they owe.

The individual or business who wants to offset their taxes by refunds or rebates in Canada would file the Form GST303 application.

FAQ

Q: What is GST303?

A: GST303 is an application form in Canada used to offset taxes by refunds or rebates.

Q: Who can use GST303?

A: Any business or individual in Canada who is eligible for tax refunds or rebates can use GST303.

Q: How do I use GST303?

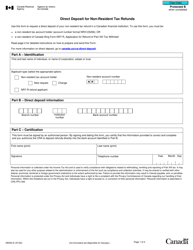

A: To use GST303, fill out the application form with the required information and submit it to the appropriate tax authorities.

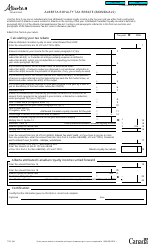

Q: What types of taxes can be offset using GST303?

A: GST303 can be used to offset Goods and Services Tax (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST) refunds or rebates.

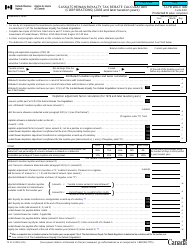

Q: What documents do I need to submit with GST303?

A: The required documents may vary based on your specific situation, but generally, you will need to include supporting documentation such as receipts, invoices, or other proof of tax payments.

Q: How long does it take to process GST303?

A: The processing time for GST303 can vary, but it typically takes several weeks to process the application and receive the refund or rebate.

Q: What should I do if I made a mistake on my GST303 application?

A: If you made a mistake on your GST303 application, you should contact the tax authorities as soon as possible to correct the error.

Q: Are there any fees associated with GST303?

A: There are no fees associated with submitting a GST303 application. However, there may be fees for certain services related to tax refunds or rebates.