This version of the form is not currently in use and is provided for reference only. Download this version of

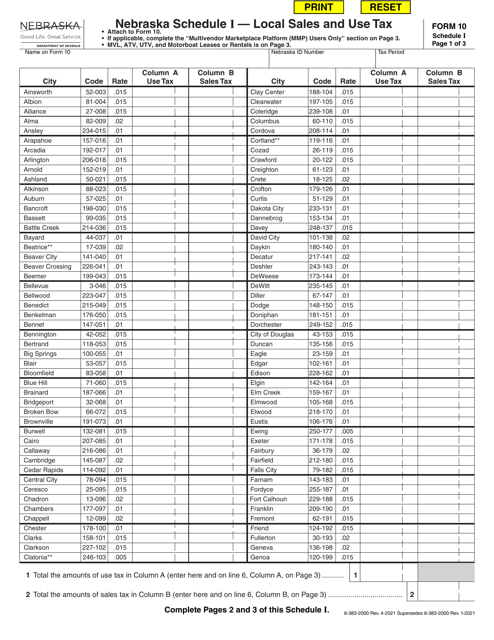

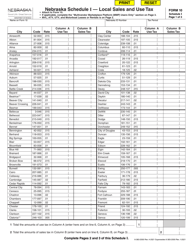

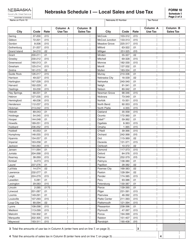

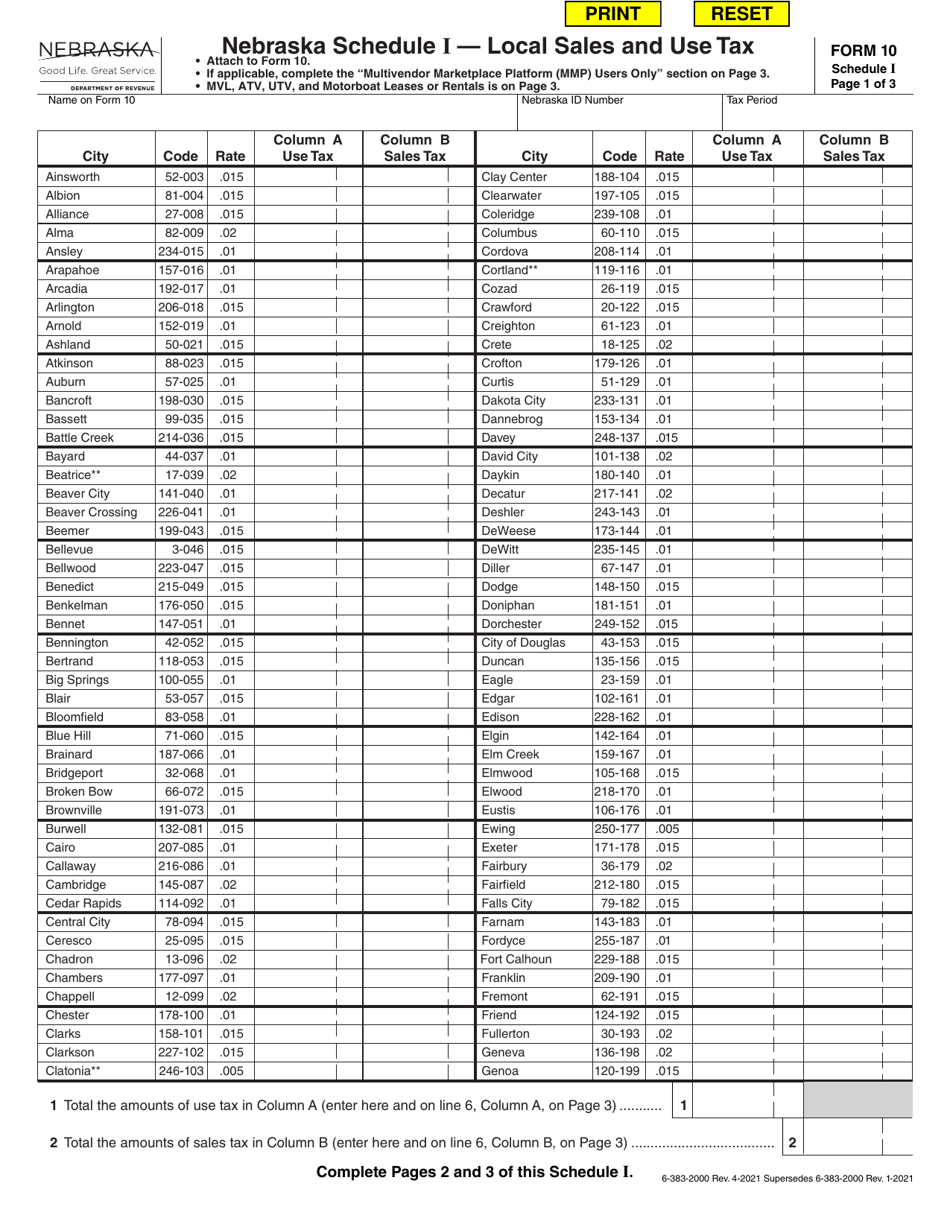

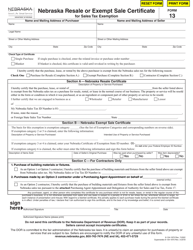

Form 10 Schedule I

for the current year.

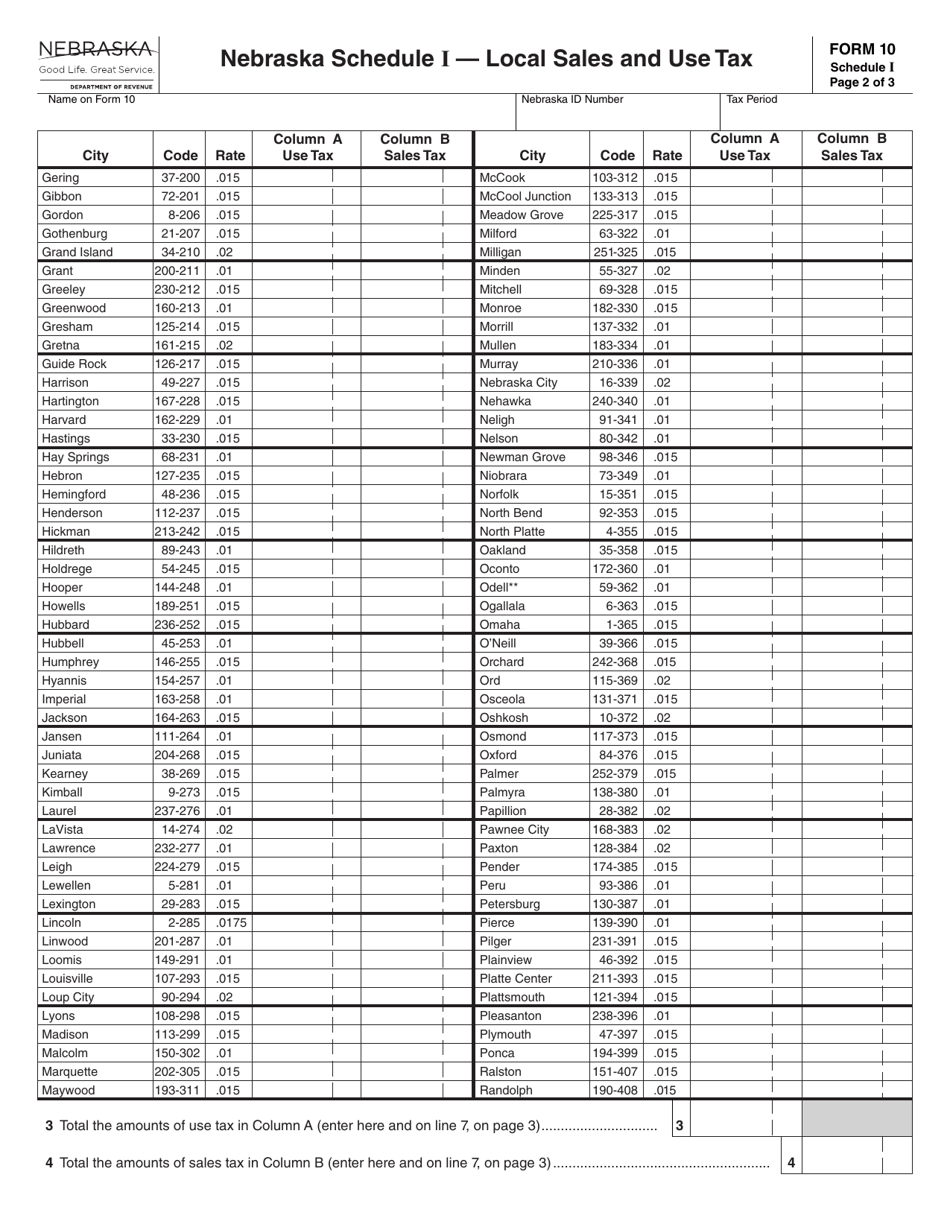

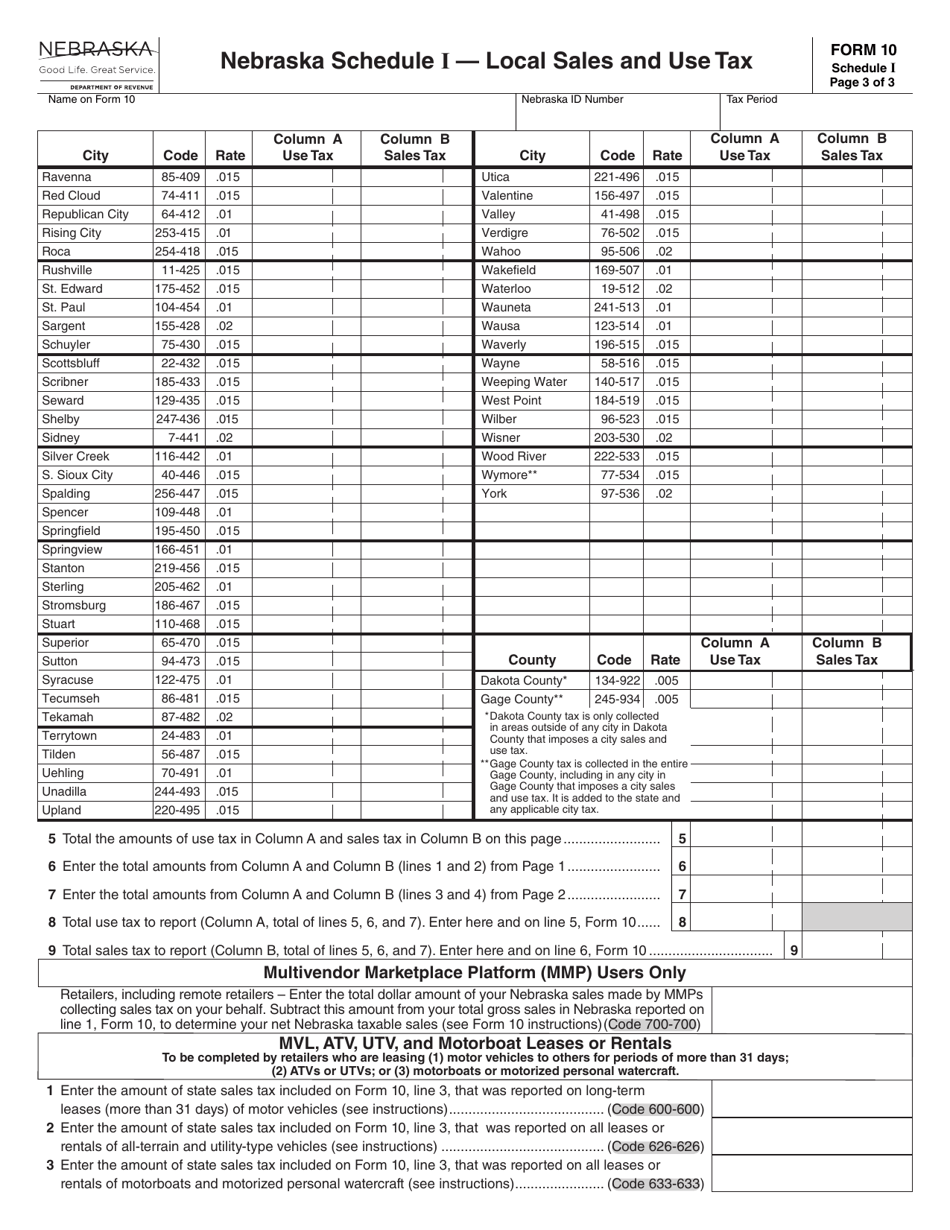

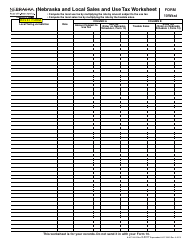

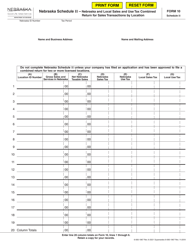

Form 10 Schedule I Local Sales and Use Tax - Nebraska

What Is Form 10 Schedule I?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.The document is a supplement to Form 10, Nebraska Combined Collection Fee Calculation Worksheet. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10 Schedule I?

A: Form 10 Schedule I is a tax form used in Nebraska for reporting local sales and use tax.

Q: What is the purpose of Form 10 Schedule I?

A: The purpose of Form 10 Schedule I is to report and remit local sales and use tax collected by retailers in Nebraska.

Q: Who should file Form 10 Schedule I?

A: Retailers in Nebraska who are required to collect and remit local sales and use tax should file Form 10 Schedule I.

Q: When is Form 10 Schedule I due?

A: Form 10 Schedule I is due on or before the 20th day of the month following the end of the reporting period.

Q: What information do I need to complete Form 10 Schedule I?

A: To complete Form 10 Schedule I, you will need information about your sales and use tax collections for each local jurisdiction in Nebraska.

Q: Are there any penalties for late filing of Form 10 Schedule I?

A: Yes, there may be penalties for late filing of Form 10 Schedule I, including interest charges and possible criminal penalties for intentional non-compliance.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10 Schedule I by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.