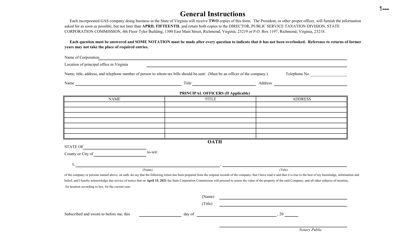

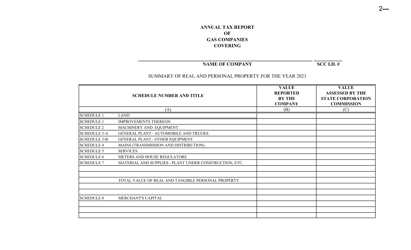

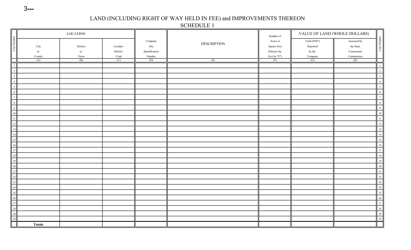

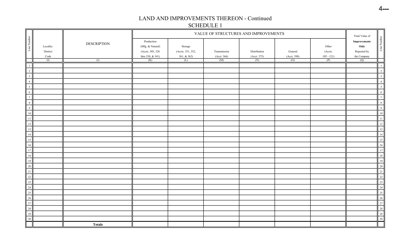

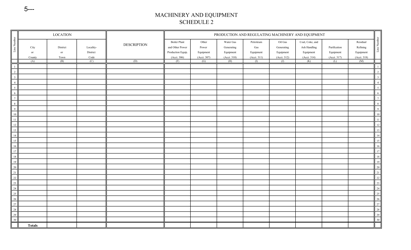

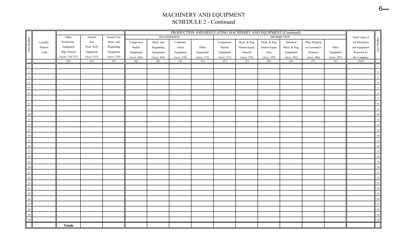

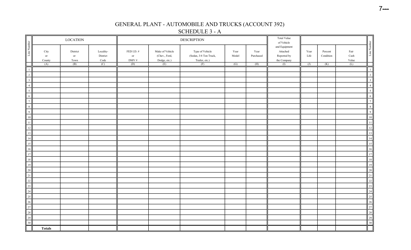

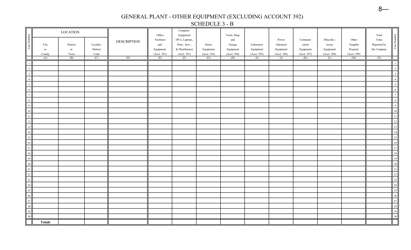

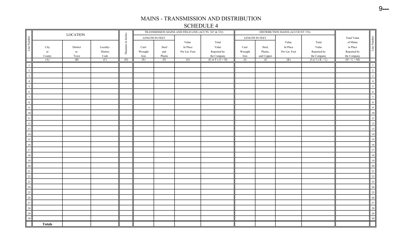

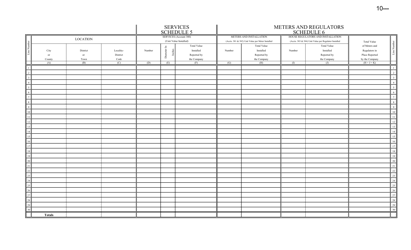

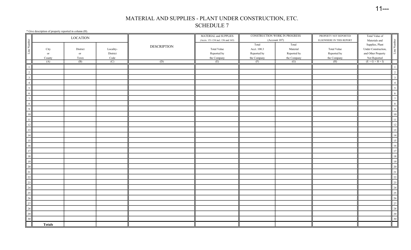

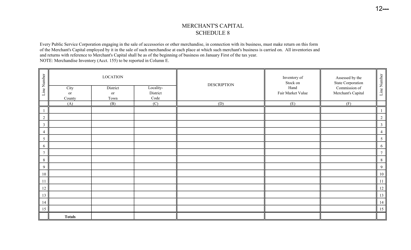

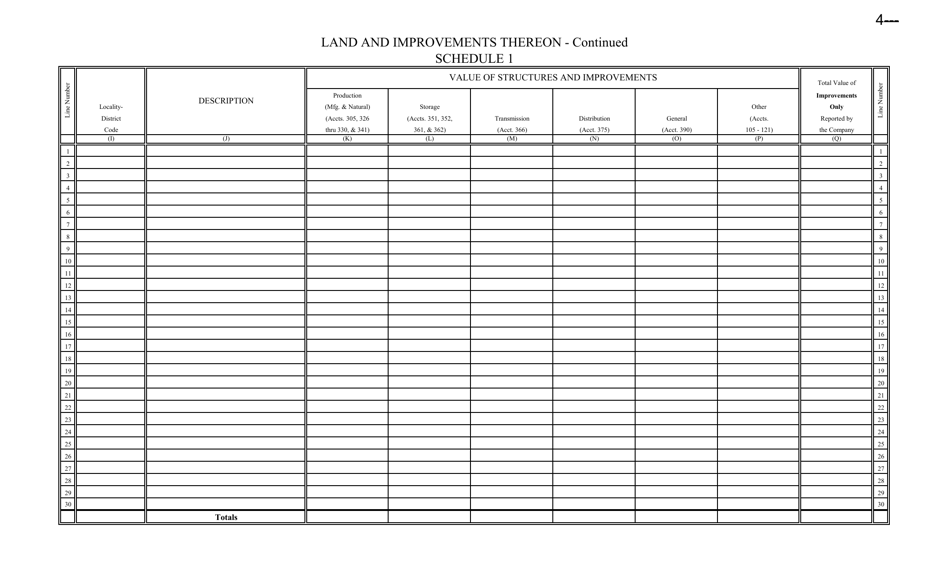

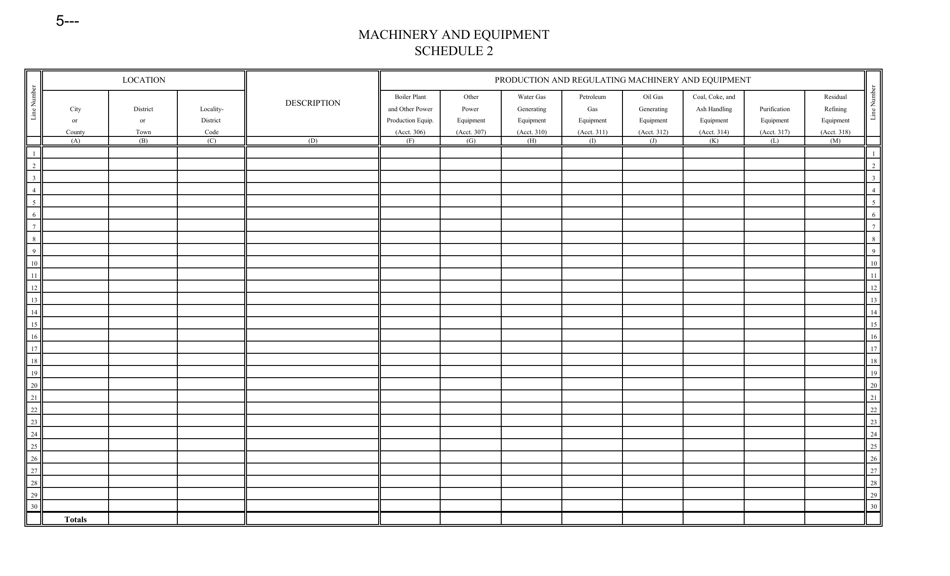

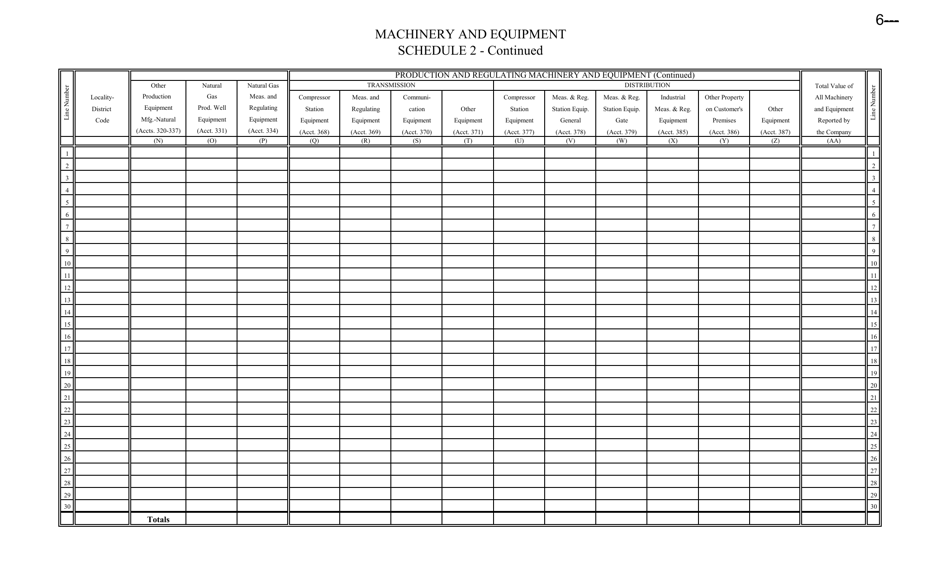

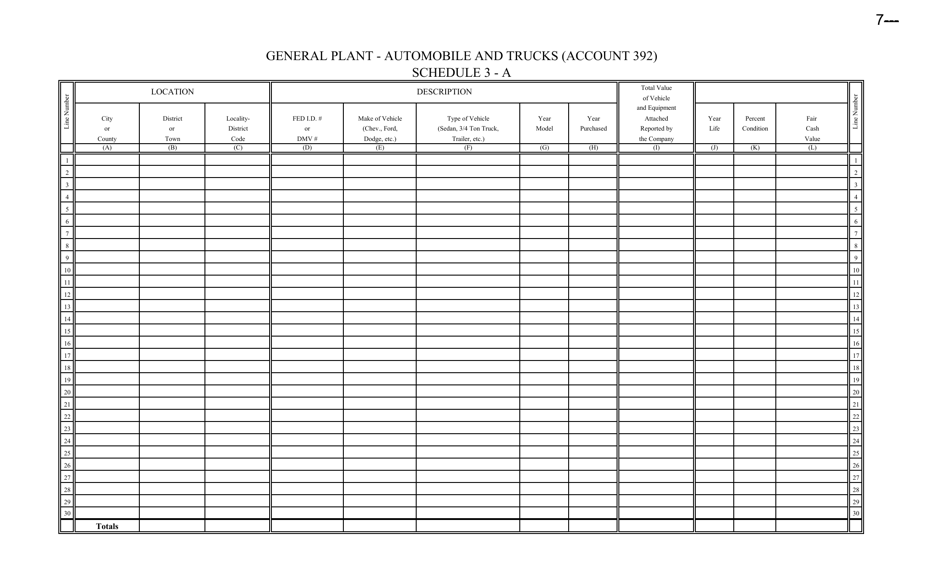

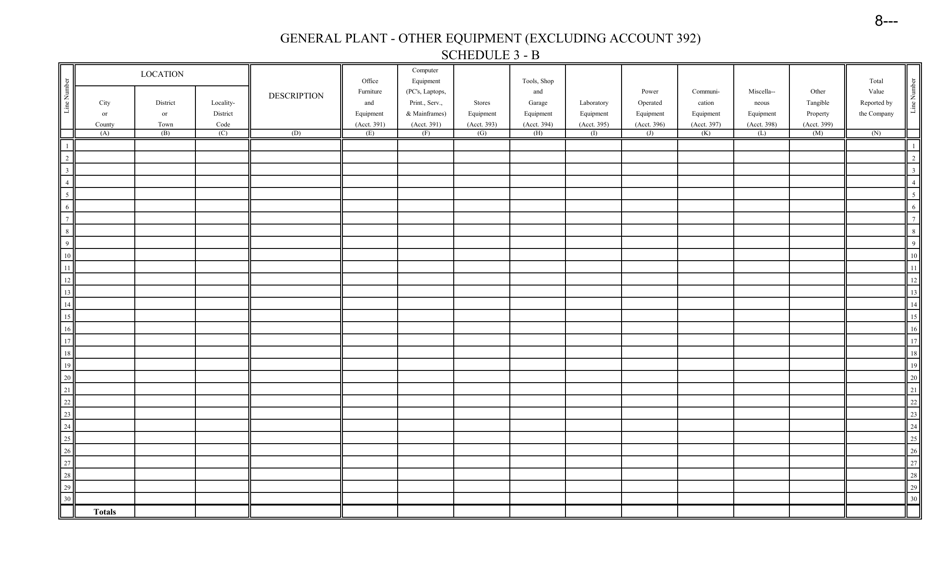

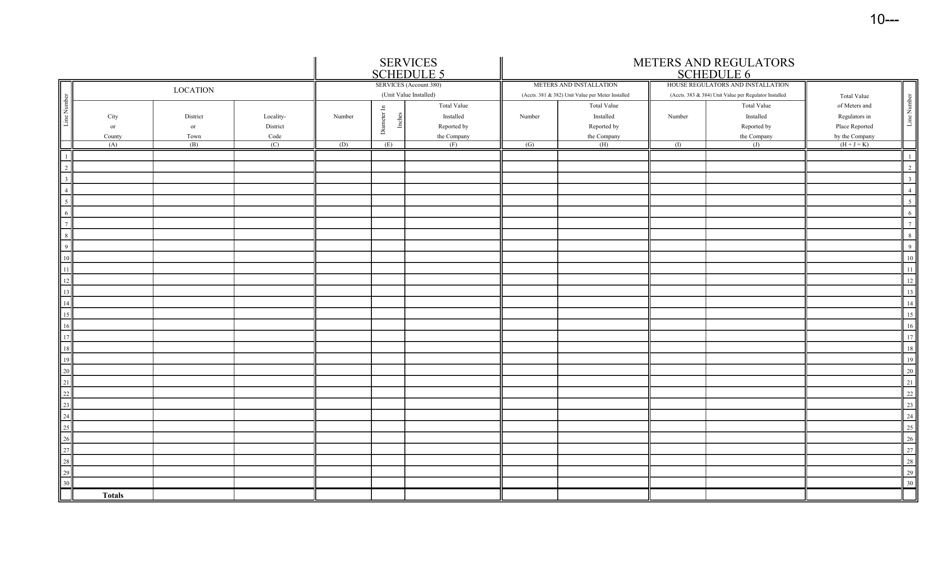

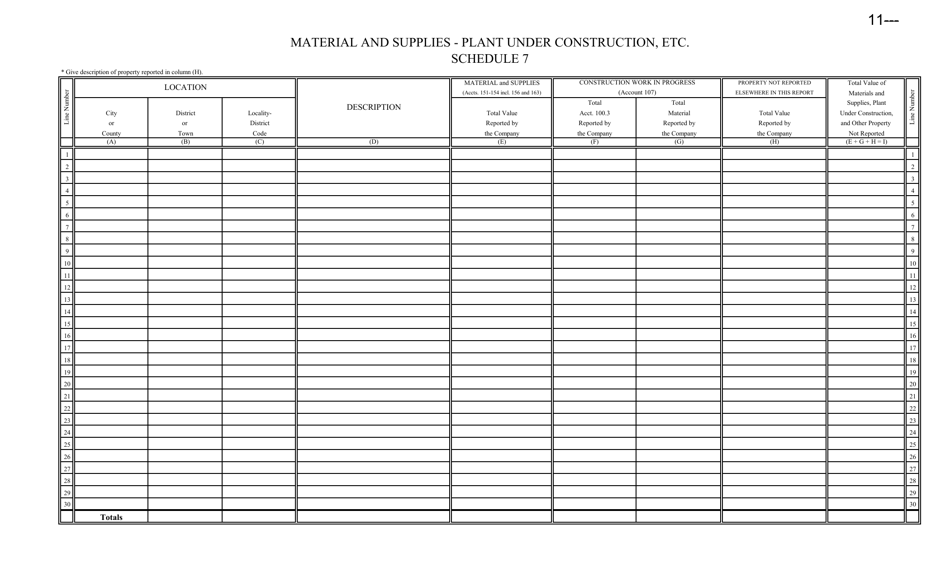

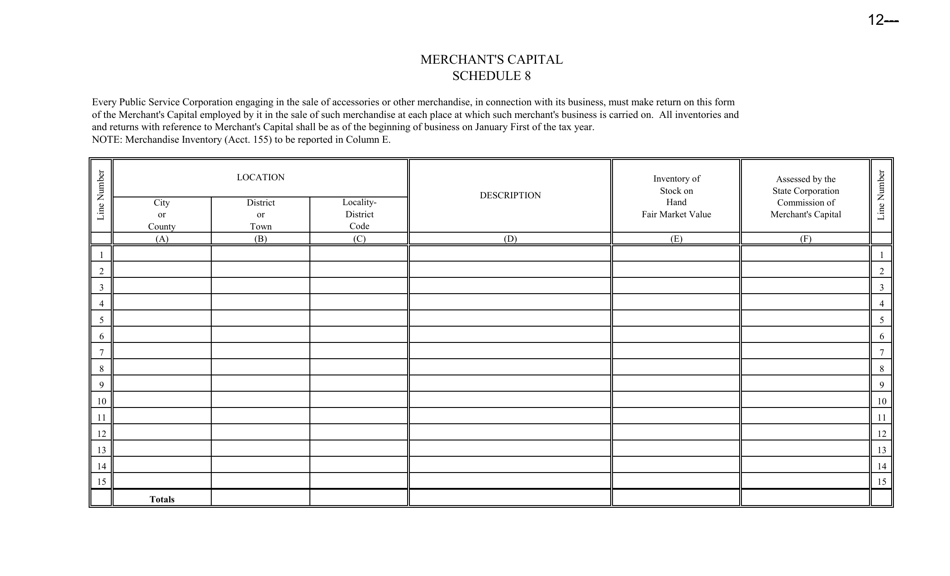

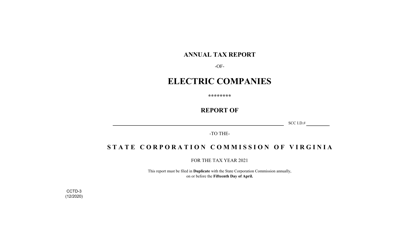

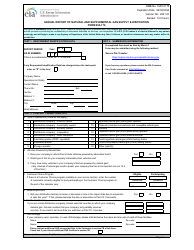

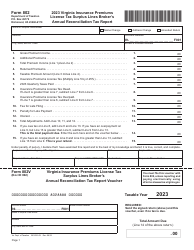

Form C.C.T.D.7 Annual Tax Report of Gas Companies - Virginia

What Is Form C.C.T.D.7?

This is a legal form that was released by the Virginia State Corporation Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form C.C.T.D.7?

A: Form C.C.T.D.7 is the Annual Tax Report of Gas Companies in Virginia.

Q: Who needs to file the Form C.C.T.D.7?

A: Gas companies in Virginia need to file the Form C.C.T.D.7.

Q: What is the purpose of the Form C.C.T.D.7?

A: The Form C.C.T.D.7 is used to report annual tax information for gas companies in Virginia.

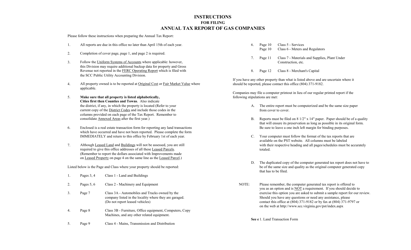

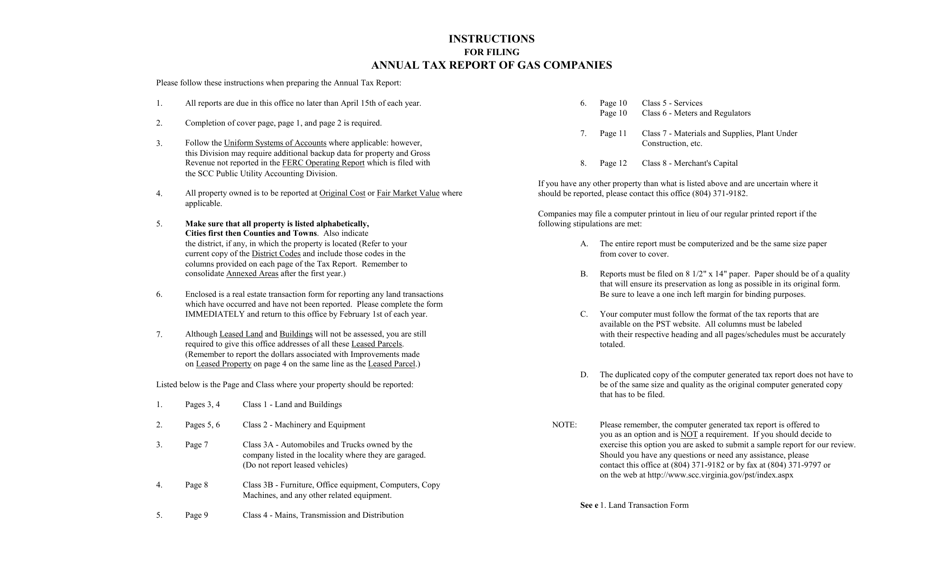

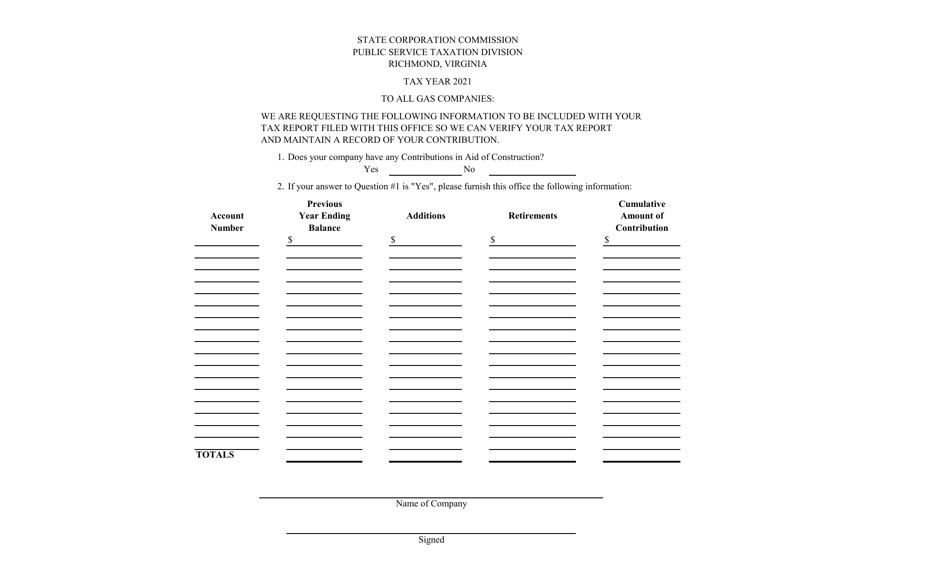

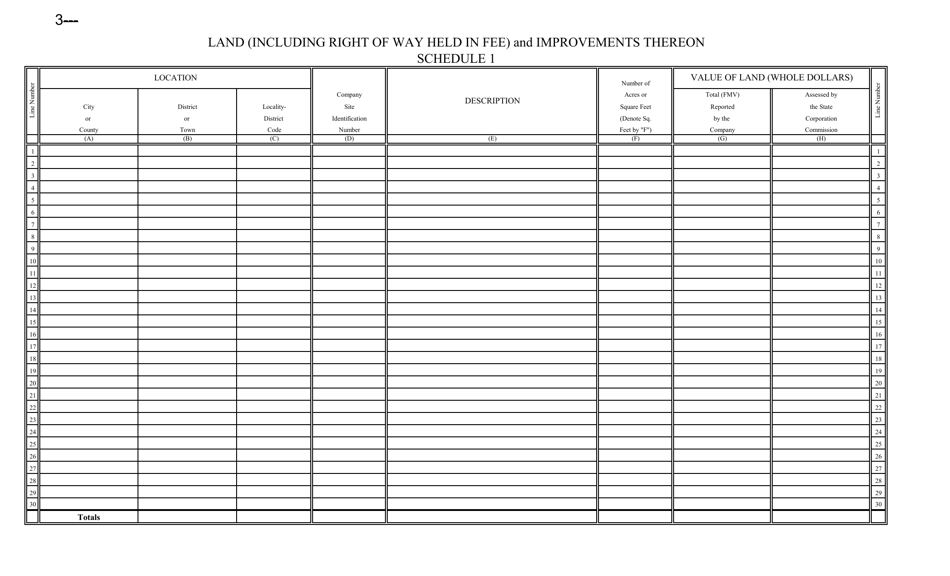

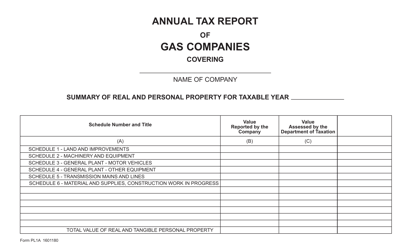

Q: What information is required on the Form C.C.T.D.7?

A: The Form C.C.T.D.7 requires gas companies to provide details about their operations and income.

Q: When is the deadline for filing the Form C.C.T.D.7?

A: The deadline for filing the Form C.C.T.D.7 is typically on or before a specific date each year.

Q: Are there any penalties for not filing the Form C.C.T.D.7?

A: Yes, there may be penalties for not filing the Form C.C.T.D.7 or for filing it late.

Q: Is the Form C.C.T.D.7 only for gas companies in Virginia?

A: Yes, the Form C.C.T.D.7 is specifically for gas companies operating in Virginia.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Virginia State Corporation Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C.C.T.D.7 by clicking the link below or browse more documents and templates provided by the Virginia State Corporation Commission.