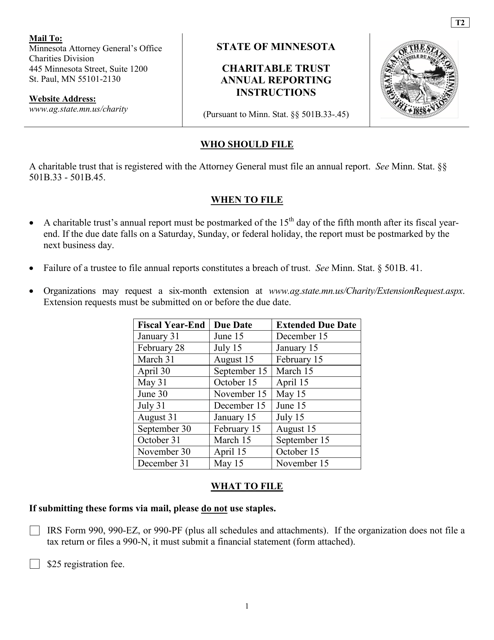

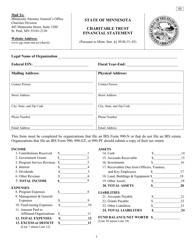

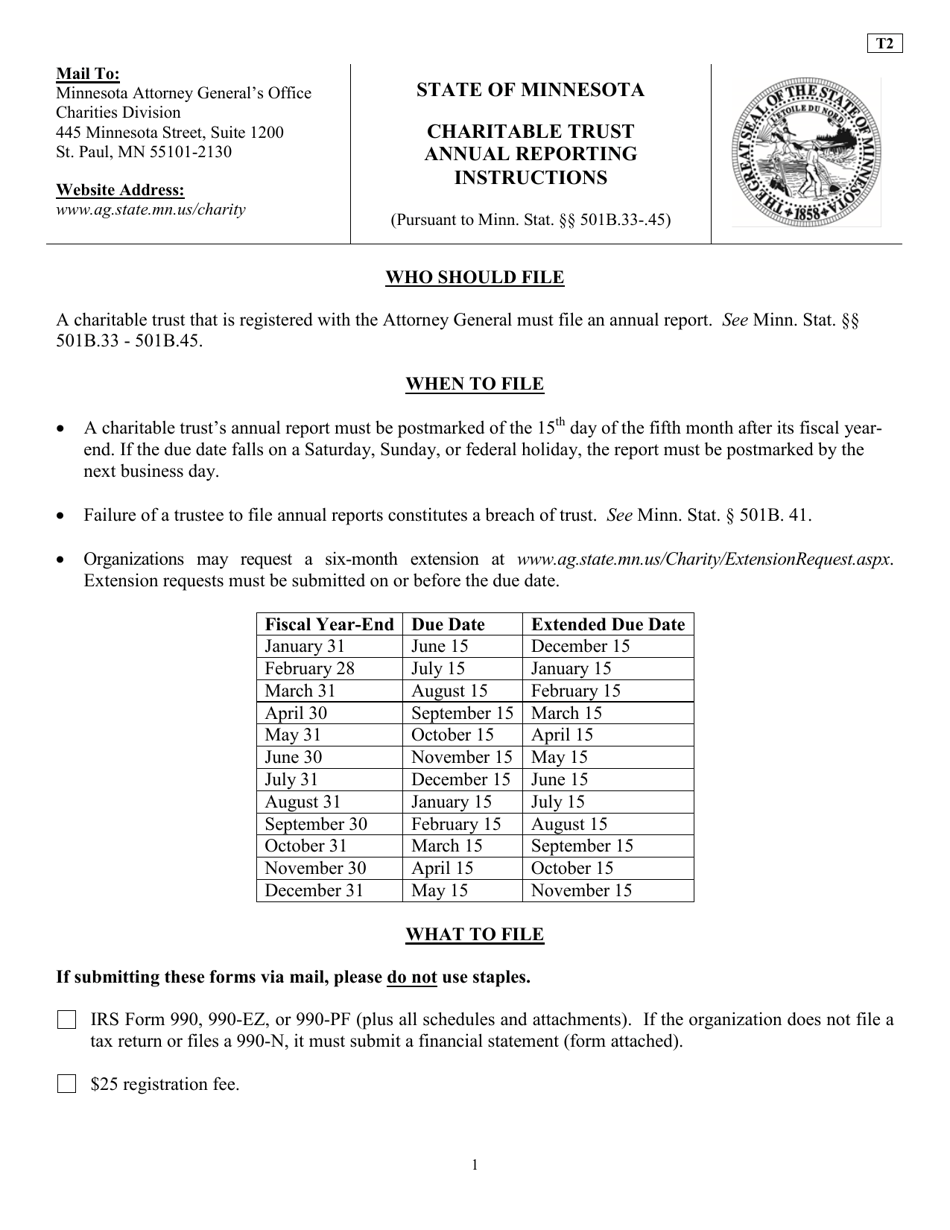

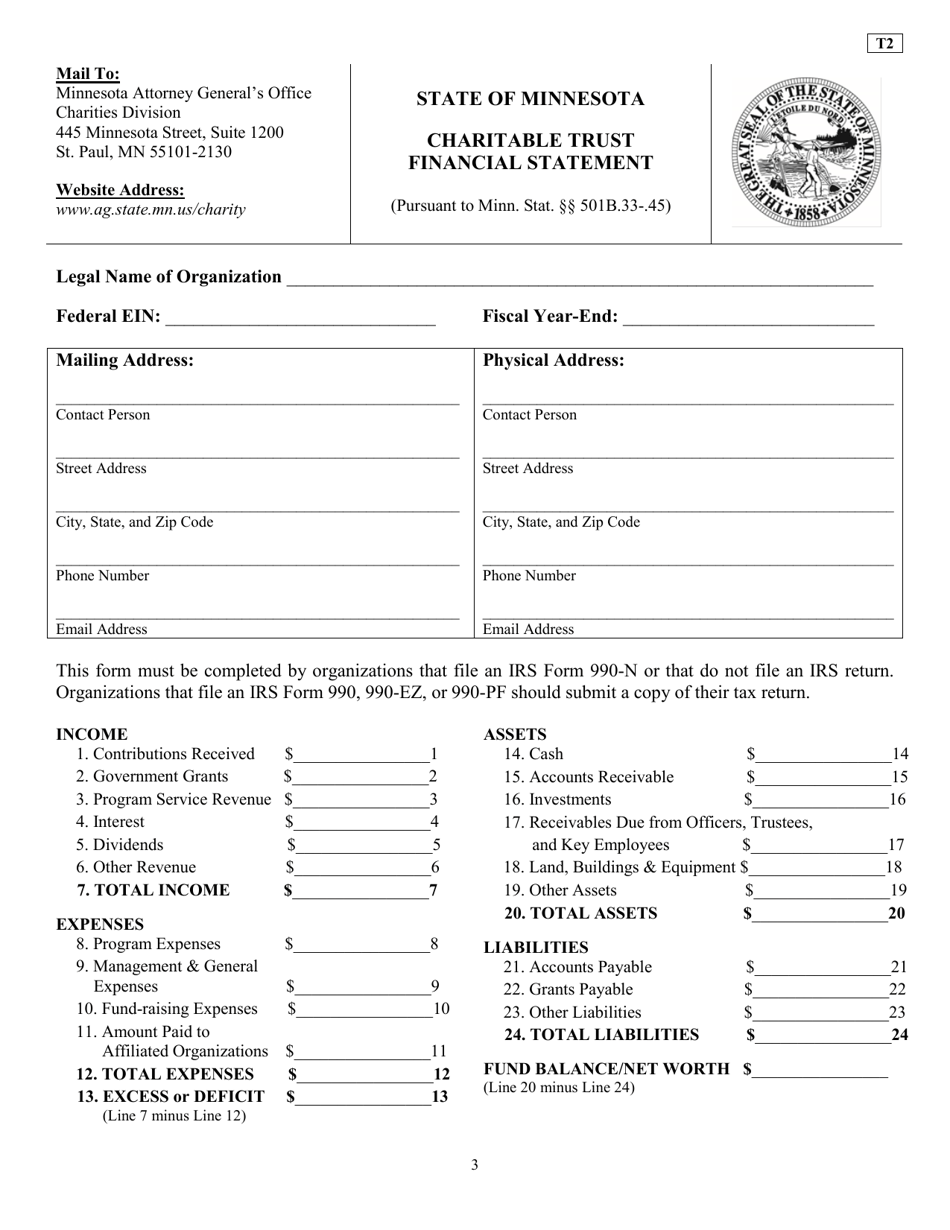

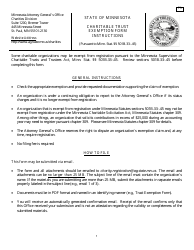

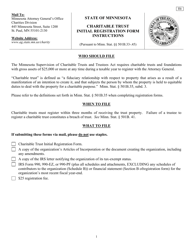

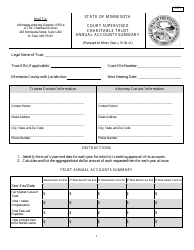

Charitable Trust Financial Statement - Minnesota

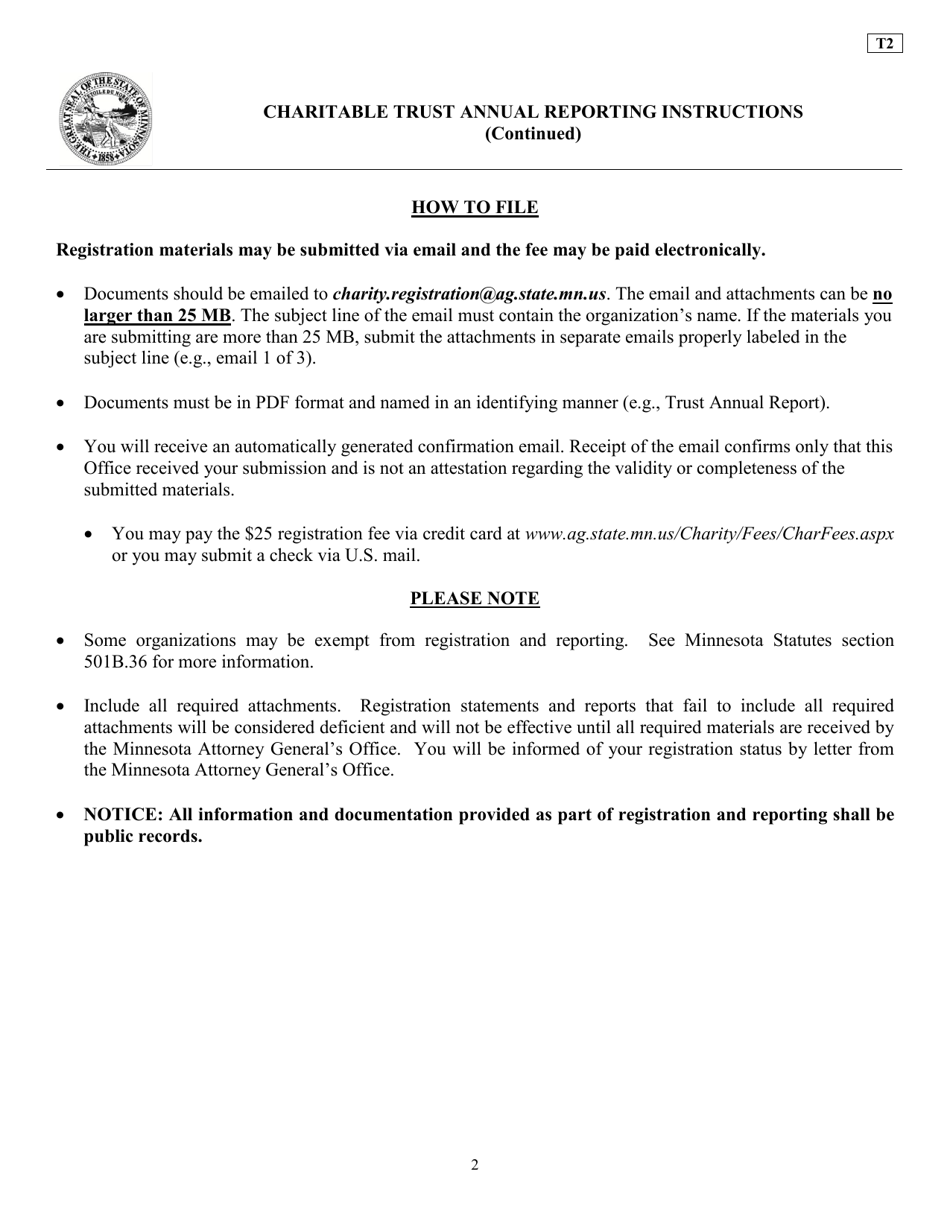

Charitable Trust Financial Statement is a legal document that was released by the Office of the Minnesota Attorney General - a government authority operating within Minnesota.

FAQ

Q: What is a charitable trust?

A: A charitable trust is a legal entity that donates funds and assets to charitable organizations.

Q: What is a financial statement?

A: A financial statement is a document that summarizes the financial activities and position of an organization or individual.

Q: Why would a charitable trust have a financial statement?

A: A charitable trust needs a financial statement to provide transparency and accountability to its stakeholders, such as donors and beneficiaries.

Q: What information is included in a financial statement?

A: A financial statement typically includes information about the trust's income, expenses, assets, liabilities, and net worth.

Q: Why would someone want to see a charitable trust's financial statement?

A: Individuals may want to see a charitable trust's financial statement to assess the trust's financial health and how it utilizes its funds for charitable purposes.

Q: Are financial statements of charitable trusts public?

A: In many cases, financial statements of charitable trusts are public documents and can be accessed by the general public.

Form Details:

- The latest edition currently provided by the Office of the Minnesota Attorney General;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Minnesota Attorney General.