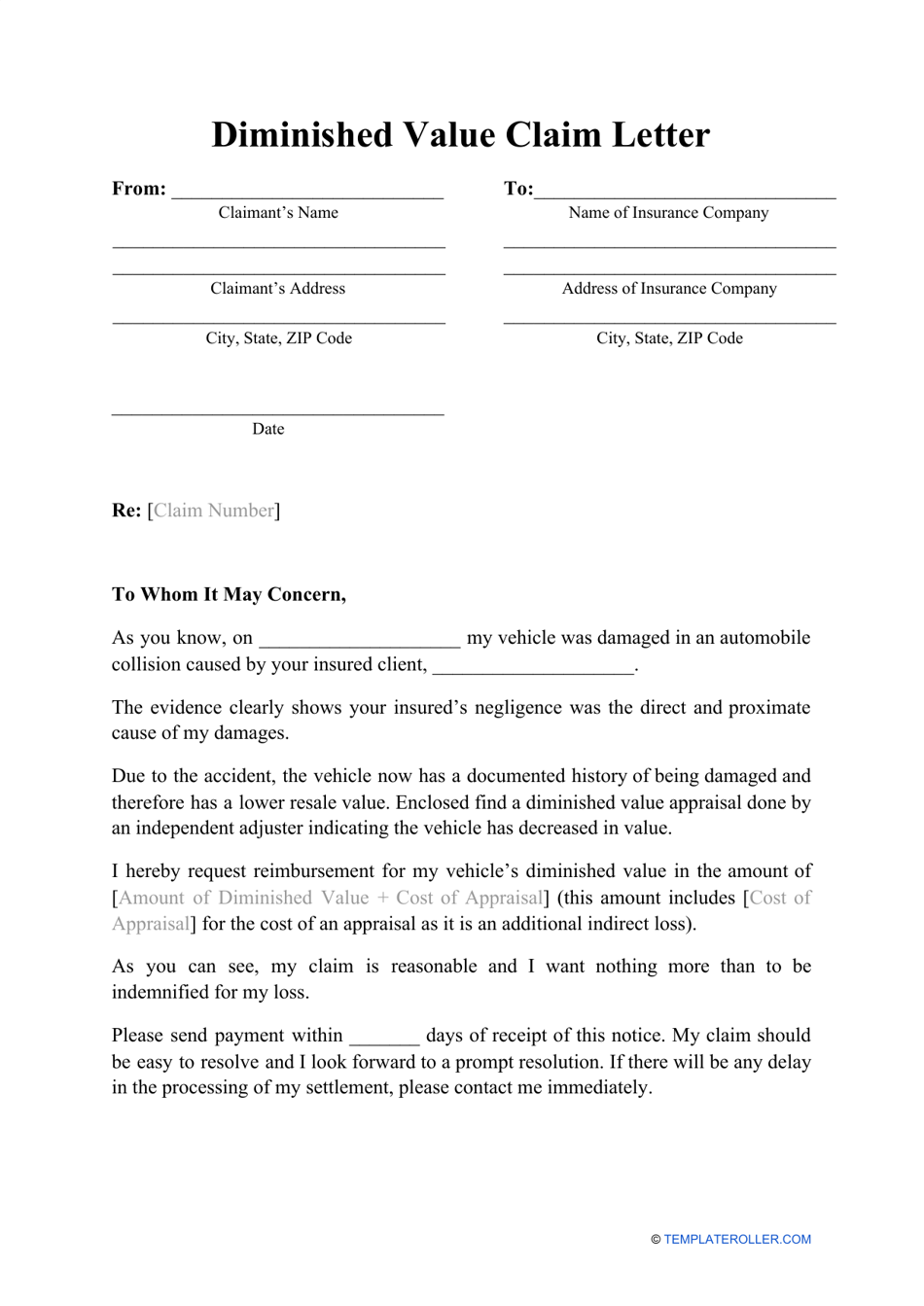

Diminished Value Claim Letter Template

What Is a Diminished Value Claim Letter?

A Diminished Value Claim Letter is a formal document prepared by an insured person or company and sent to their insurance provider with the intention to reimburse the policyholder for the difference in the insured item's value. You can complete this letter if the item's value diminished after the event that triggered the insurance coverage, even though it was repaired.

A printable Claim Denial Letter template can be downloaded through the link below.

Often used in the car insurance industry, this letter allows insurance policyholders to hold the insurance company responsible for the diminished value of their automobile - obviously, any car loses its value after an accident, even if you have made every effort to restore it. The coverage depends on the state you live in and the nature of the accident, but in most cases, you are entitled to a certain compensation if you were not at fault for the event that caused damage. Even if later you choose to sue the person or entity that was responsible for your material losses, before that you can ask the insurance provider to calculate the diminished value and pay for it.

How to Write a Diminished Value Claim Letter?

Certainly, you may present any claim to your insurance provider in person or by calling them. However, it is recommended to draft a formal letter to create evidence in case you have to pursue legal action in the future.

Here is how you compose a letter requesting a diminished value claim:

- Greet the insurance provider and introduce yourself. Enter the details of your insurance policy.

- Indicate the reason for writing and make a reference to a clause in your agreement with the insurer that allows you to file a claim on this issue.

- Describe the accident or event that happened and your attempts to repair the item in question.

- List documentation that proves your statements and attach it to the letter.

- Record the sum of money you want to receive from the insurer or ask them to tell you the diminished value of your item.

- Sign the document, add your contact details, and offer the recipient of the letter to get in touch with you if they need more details or are prepared to send you compensation right away.

Check out these related letter templates: