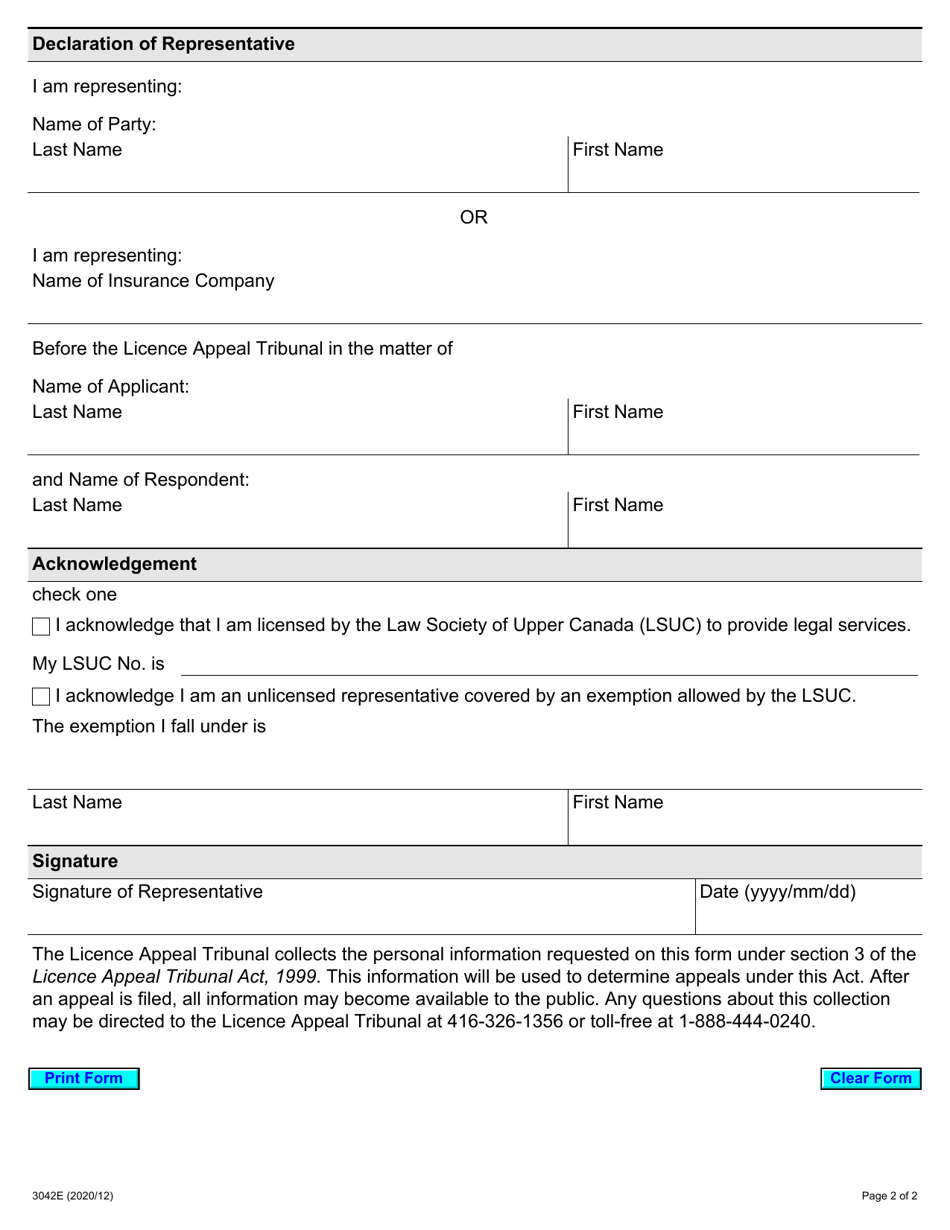

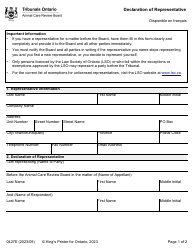

Form 3042 Declaration of Representative - Ontario, Canada

Form 3042 Declaration of Representative in Ontario, Canada is used to designate someone as a representative for a taxpayer. This allows the representative to act on behalf of the taxpayer in dealings with the Canada Revenue Agency (CRA).

FAQ

Q: What is Form 3042 Declaration of Representative?

A: Form 3042 Declaration of Representative is a document used in Ontario, Canada, when appointing a representative to act on behalf of the taxpayer in dealing with the Canada Revenue Agency (CRA).

Q: Who needs to fill out Form 3042 Declaration of Representative?

A: Form 3042 Declaration of Representative should be filled out by a taxpayer who wants to authorize someone else, such as an accountant or tax professional, to communicate with the CRA on their behalf.

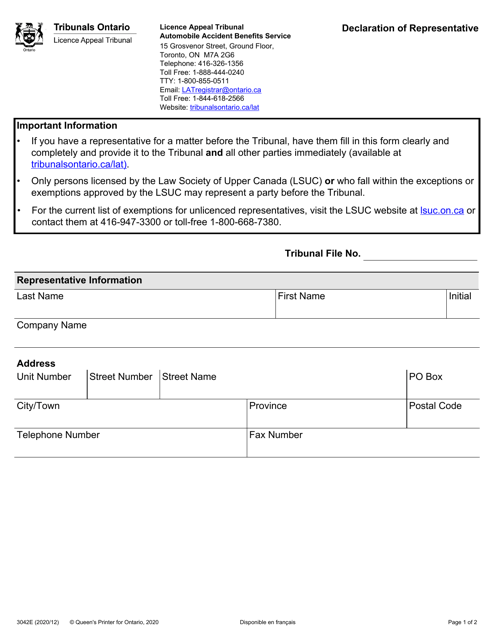

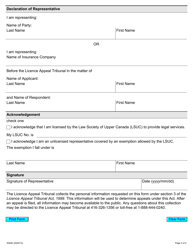

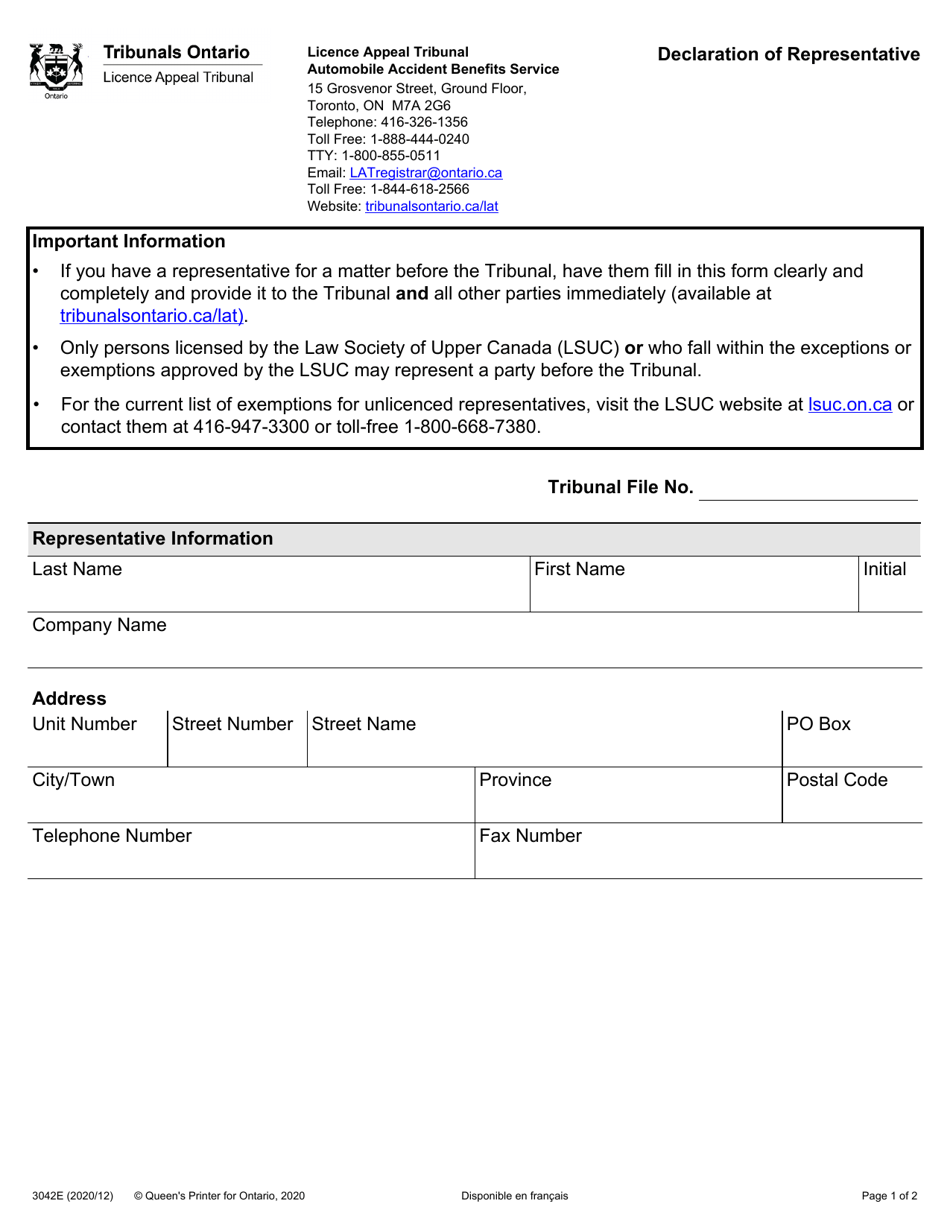

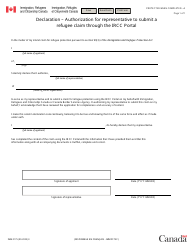

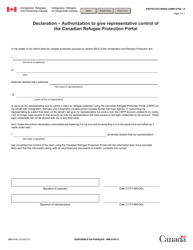

Q: What information is required in Form 3042 Declaration of Representative?

A: The form requires the taxpayer's information, including their name, address, social insurance number, as well as the representative's information, including their name and contact details. The form also requires the taxpayer's signature and the representative's declaration.

Q: Is there a deadline for submitting Form 3042 Declaration of Representative?

A: There is no specific deadline for submitting Form 3042 Declaration of Representative. However, it is recommended to submit the form before the representative needs to communicate with the CRA on behalf of the taxpayer.