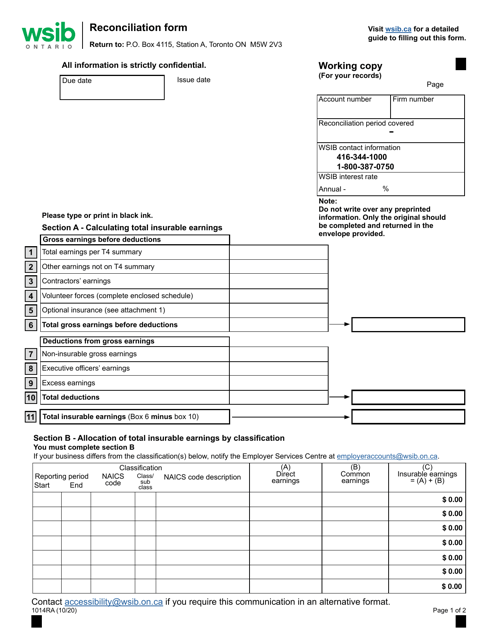

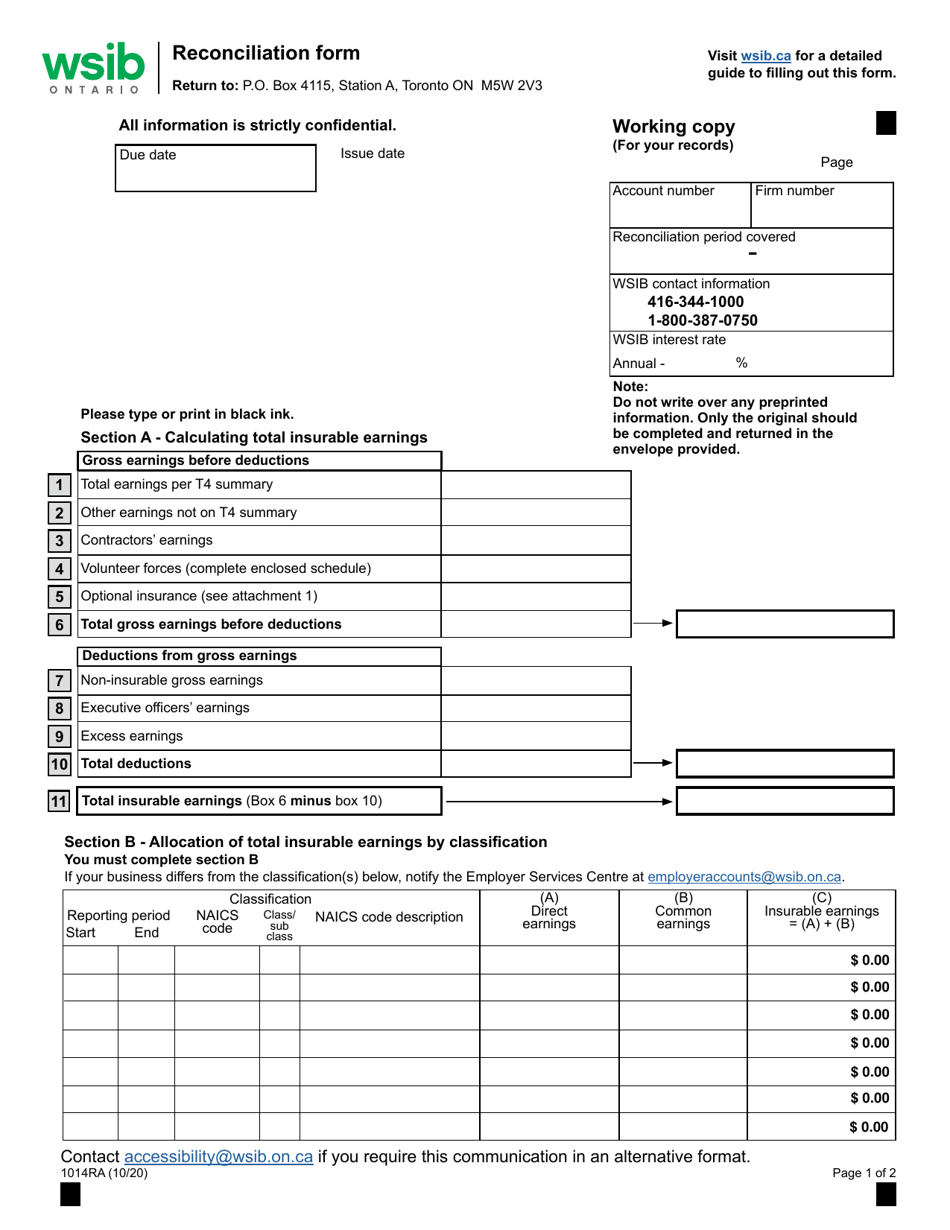

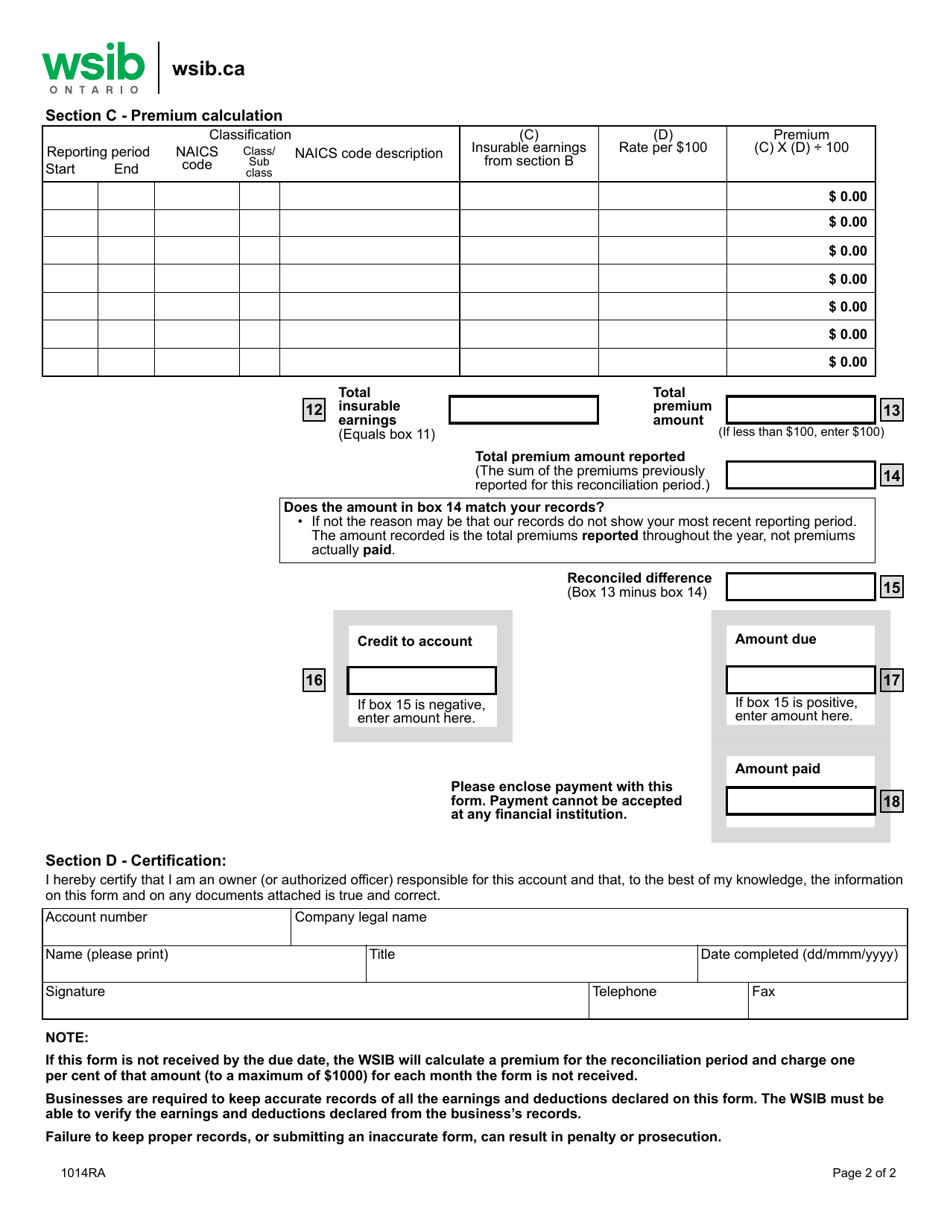

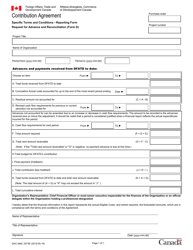

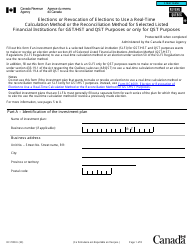

Form 1014RA Reconciliation Form - Ontario, Canada

Form 1014RA Reconciliation Form in Ontario, Canada is used by businesses to report their annual sales accurately for tax purposes. It helps businesses reconcile their sales reported in their sales tax returns with their actual sales for the year.

The Form 1014RA Reconciliation Form in Ontario, Canada is filed by employers.

FAQ

Q: What is Form 1014RA?

A: Form 1014RA is the Reconciliation Form used in Ontario, Canada.

Q: Who needs to file Form 1014RA?

A: Employers in Ontario, Canada need to file Form 1014RA.

Q: What is the purpose of Form 1014RA?

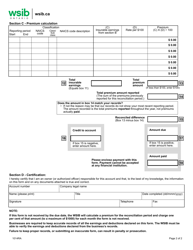

A: Form 1014RA is used to reconcile the amounts reported on an employer's payroll returns with the amounts remitted.

Q: When is Form 1014RA due?

A: Form 1014RA is due by the end of February each year.

Q: How do I file Form 1014RA?

A: Form 1014RA can be filed electronically or by mail.

Q: What information is required on Form 1014RA?

A: Form 1014RA requires information such as employer details, payroll information, and the amounts remitted for each reporting period.

Q: What happens if I don't file Form 1014RA?

A: Failure to file Form 1014RA may result in penalties and interest.

Q: Can I make changes to a filed Form 1014RA?

A: Yes, you can make changes to a filed Form 1014RA by submitting an amended form.

Q: Is there a fee to file Form 1014RA?

A: No, there is no fee to file Form 1014RA.