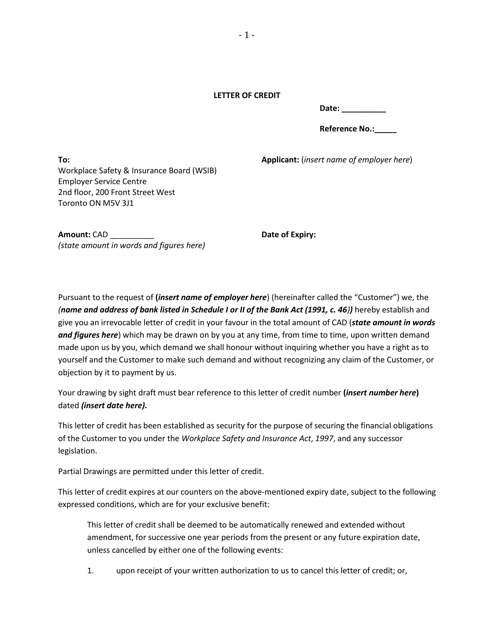

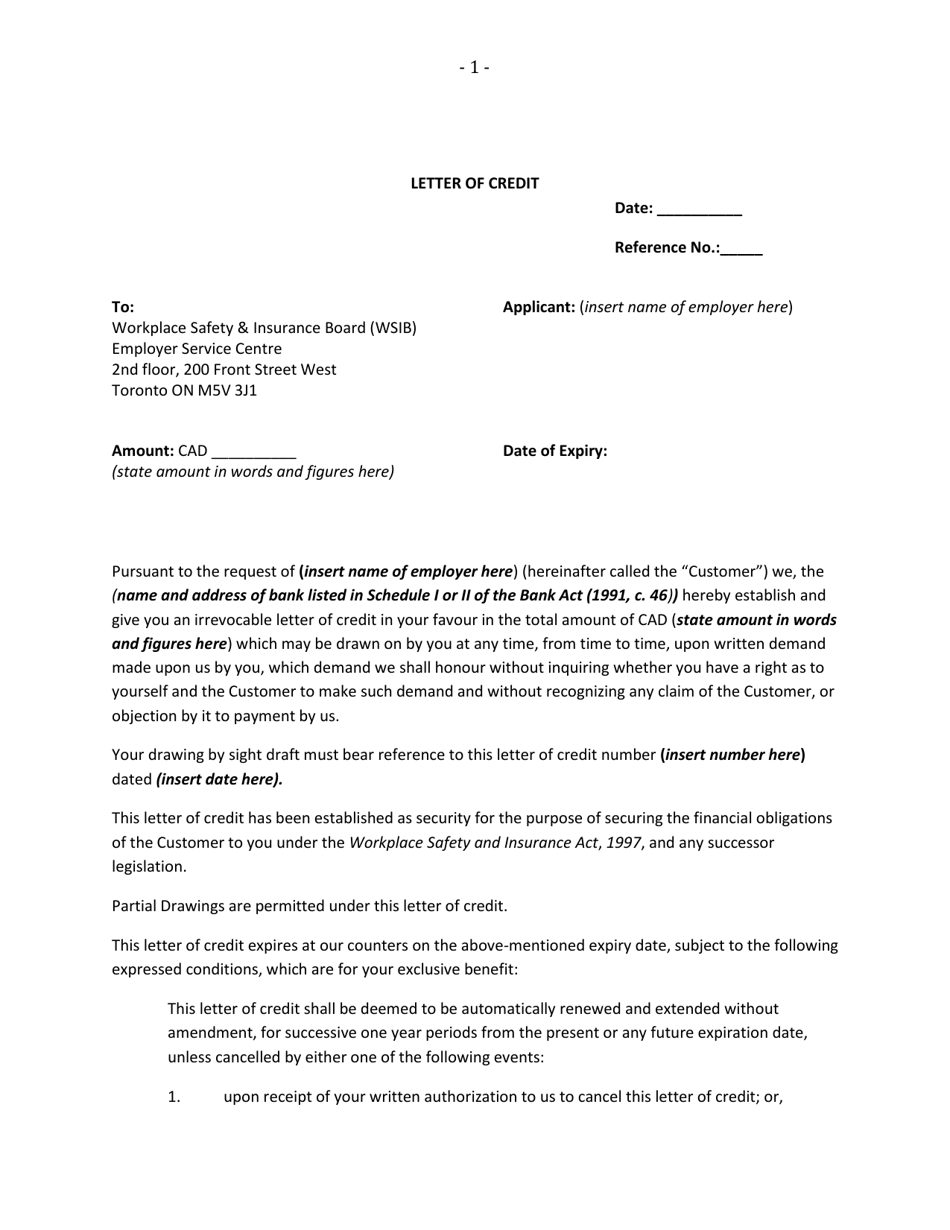

Schedule 1 Letter of Credit - Ontario, Canada

Schedule 1 Letter of Credit in Ontario, Canada is used to secure payment for certain types of construction projects. It provides financial protection to the party requesting the letter of credit in case the contractor fails to fulfill their obligations.

The Schedule 1 letter of credit in Ontario, Canada is typically filed by the borrower.

FAQ

Q: What is a Schedule 1 Letter of Credit?

A: A Schedule 1 Letter of Credit is a type of financial guarantee that ensures payment between parties involved in a commercial transaction.

Q: What is the purpose of a Schedule 1 Letter of Credit?

A: The purpose of a Schedule 1 Letter of Credit is to provide confidence to both the buyer and seller that funds will be available for payment once the terms of the agreement are fulfilled.

Q: How does a Schedule 1 Letter of Credit work?

A: A Schedule 1 Letter of Credit works by a bank (the issuer) issuing a guarantee to pay the seller when certain conditions specified in the letter of credit are met.

Q: Who is involved in a Schedule 1 Letter of Credit?

A: The parties involved in a Schedule 1 Letter of Credit are the buyer (applicant), the seller (beneficiary), and the bank (issuer).

Q: Is a Schedule 1 Letter of Credit mandatory in Ontario, Canada?

A: No, a Schedule 1 Letter of Credit is not mandatory in Ontario, Canada. However, it is commonly used in commercial transactions to provide security for both parties.

Q: What are the benefits of using a Schedule 1 Letter of Credit?

A: The benefits of using a Schedule 1 Letter of Credit include providing assurance of payment to the seller, mitigating the risk of non-payment for the buyer, and facilitating trade and commerce.

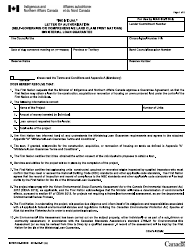

Q: Are there any laws or regulations governing Schedule 1 Letters of Credit in Ontario, Canada?

A: Yes, Schedule 1 Letters of Credit in Ontario, Canada are governed by the Ontario Business Corporations Act and various regulations related to commercial transactions.

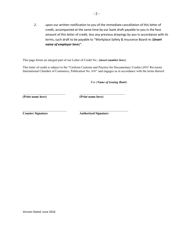

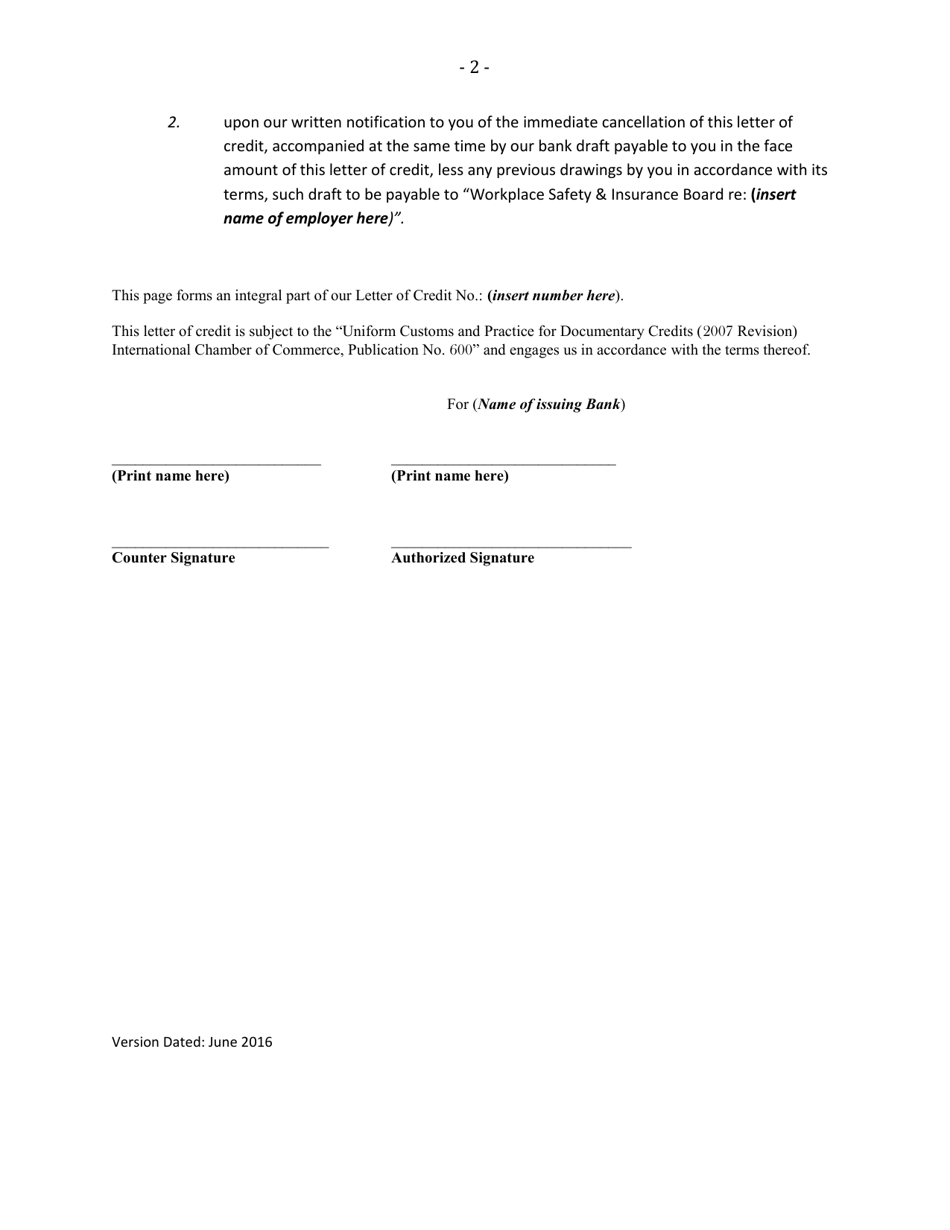

Q: Can a Schedule 1 Letter of Credit be modified or cancelled?

A: A Schedule 1 Letter of Credit can only be modified or cancelled with the agreement of all parties involved, including the bank that issued the letter of credit.

Q: Is a Schedule 1 Letter of Credit the same as a regular letter of credit?

A: A Schedule 1 Letter of Credit is a specific type of letter of credit that is recognized under the Ontario Business Corporations Act. It may have additional requirements compared to a regular letter of credit.

Q: How can one obtain a Schedule 1 Letter of Credit?

A: To obtain a Schedule 1 Letter of Credit, one must contact a bank or financial institution that offers this service and provide the necessary documentation and information as specified by the issuer.