This version of the form is not currently in use and is provided for reference only. Download this version of

Form 3363A

for the current year.

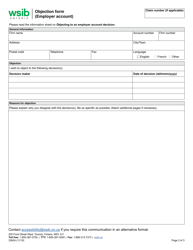

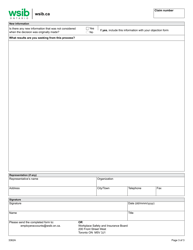

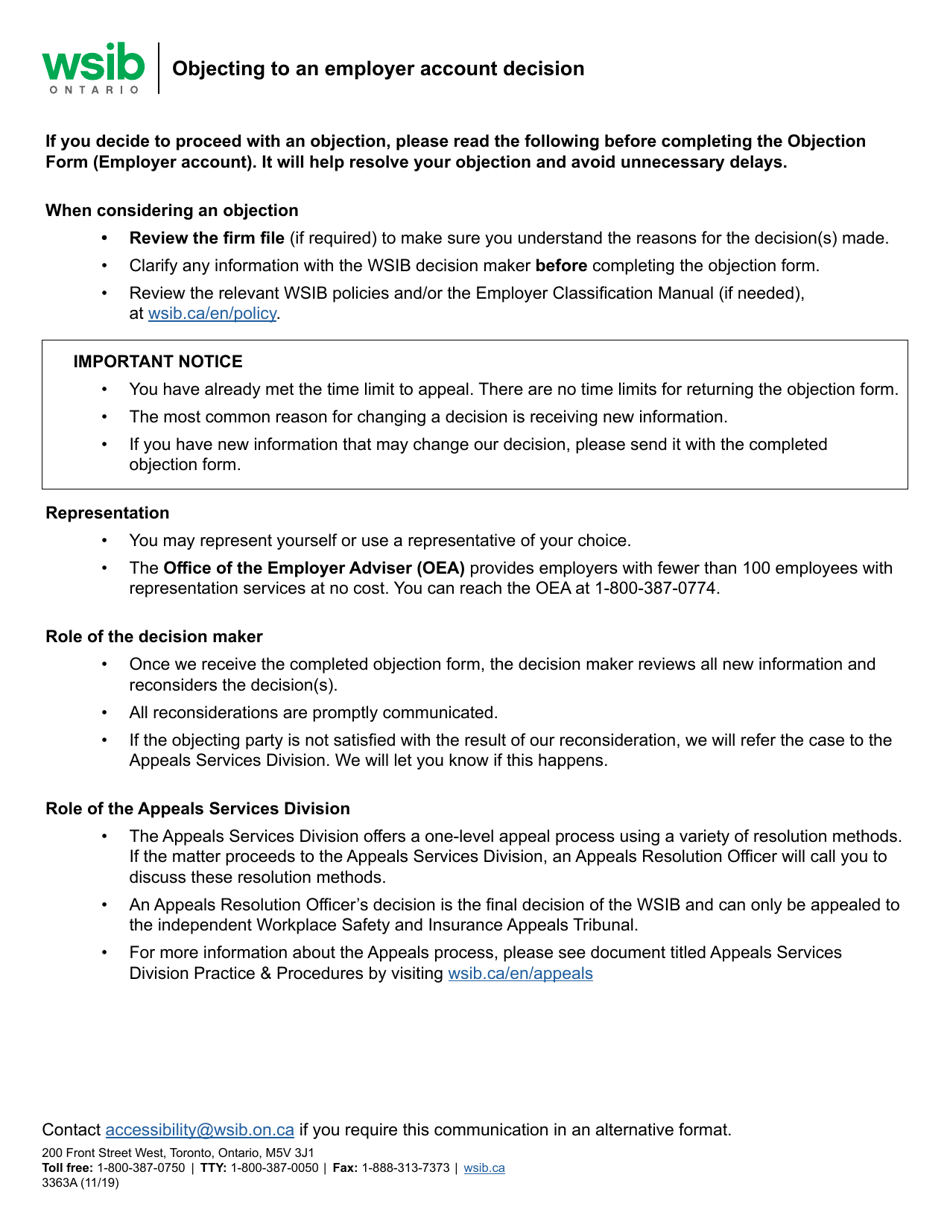

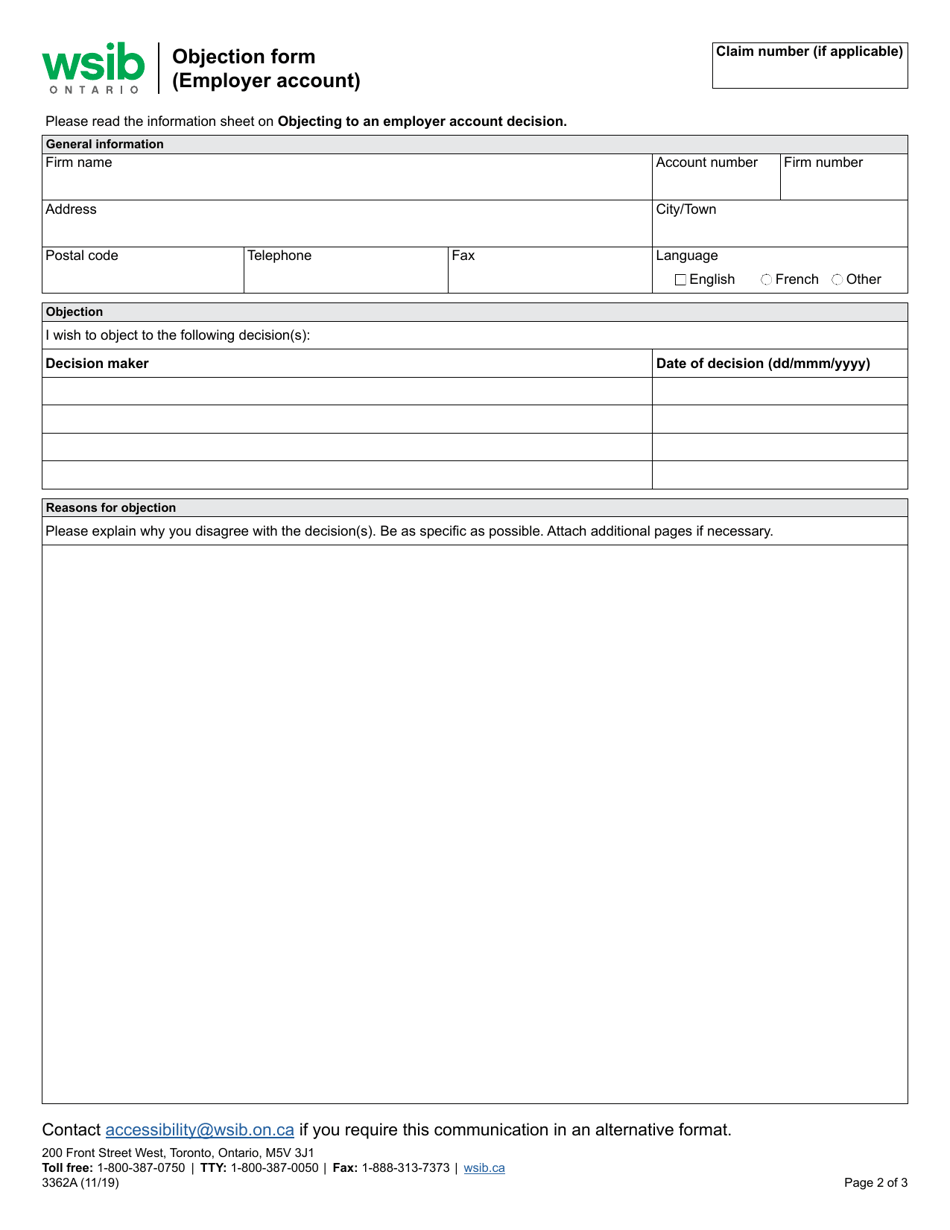

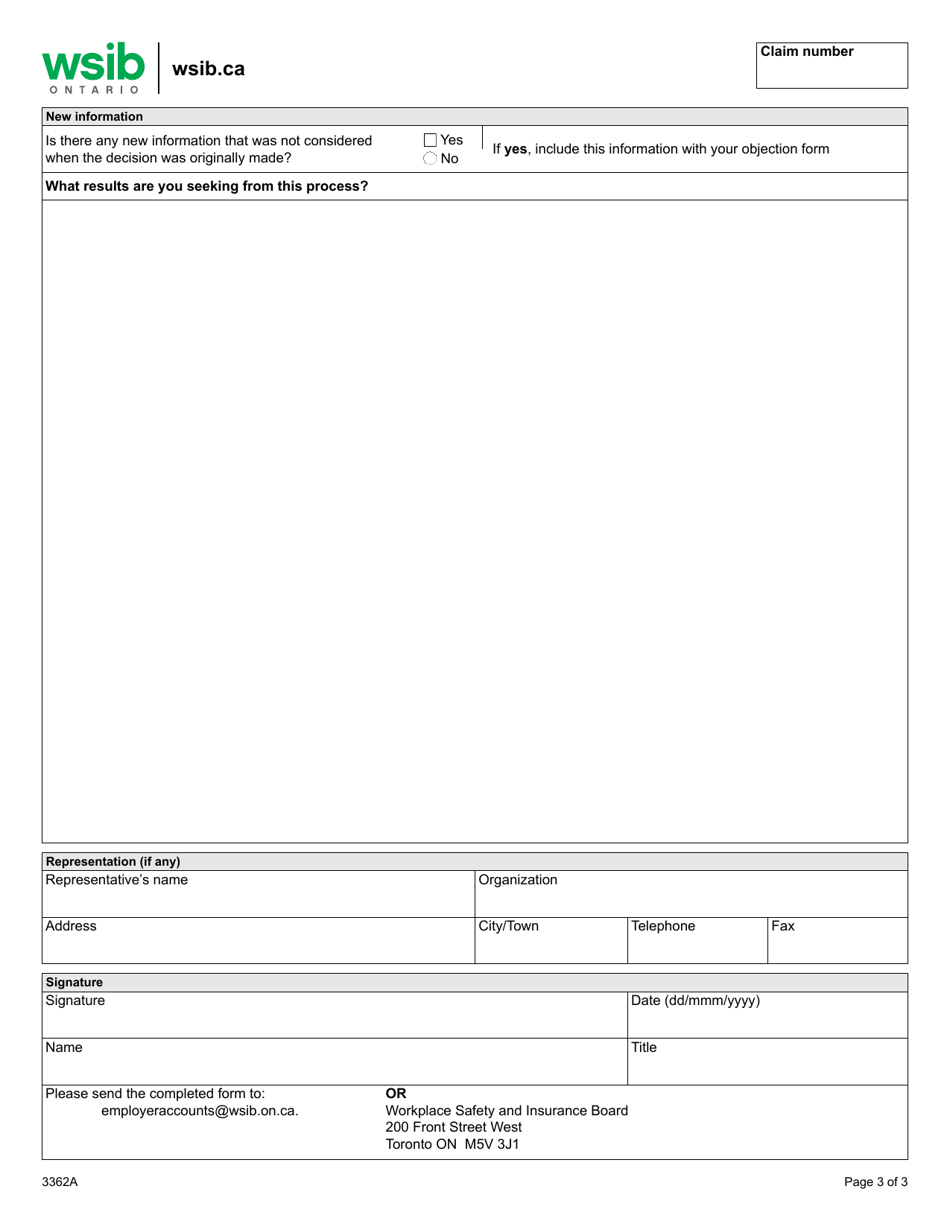

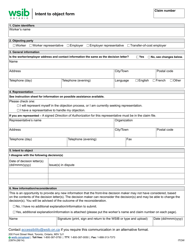

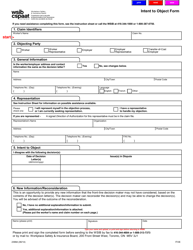

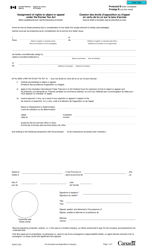

Form 3363A Objecting Form (Employer Account) - Ontario, Canada

The Form 3363A Objecting Form (Employer Account) in Ontario, Canada is typically filed by the employer.

FAQ

Q: What is Form 3363A Objecting Form (Employer Account)?

A: Form 3363A Objecting Form (Employer Account) is a document used in Ontario, Canada, to object to the payment of employment insurance premiums by an employer.

Q: Why would an employer use Form 3363A Objecting Form?

A: An employer would use Form 3363A Objecting Form to object to paying employment insurance premiums for their employees.

Q: Are all employers required to fill out Form 3363A Objecting Form?

A: No, not all employers are required to fill out Form 3363A Objecting Form. It is only for employers who have specific objections to paying employment insurance premiums.

Q: What happens after an employer submits Form 3363A Objecting Form?

A: After an employer submits Form 3363A Objecting Form, the Canada Revenue Agency will review the objection and make a decision on whether the objection is valid or not.

Q: Can an employer change their mind after submitting Form 3363A Objecting Form?

A: Yes, an employer can change their mind after submitting Form 3363A Objecting Form. They would need to notify the Canada Revenue Agency of their change in objection.

Q: Are there any consequences for an employer who successfully objects to paying employment insurance premiums?

A: If an employer successfully objects to paying employment insurance premiums, they may be exempt from paying those premiums for a certain period of time. However, they will not be eligible to claim employment insurance benefits for their employees during that time.