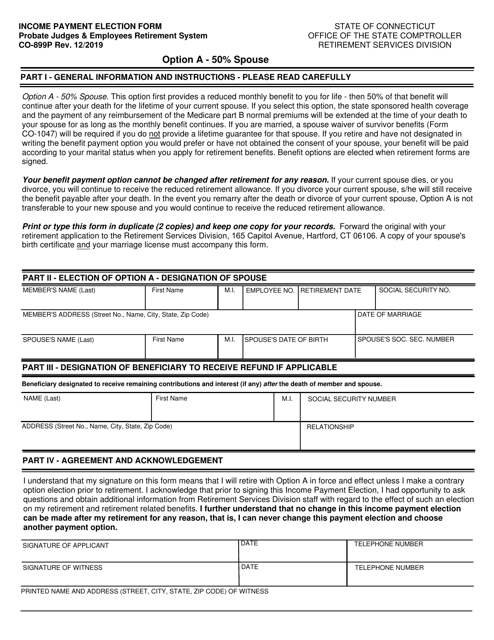

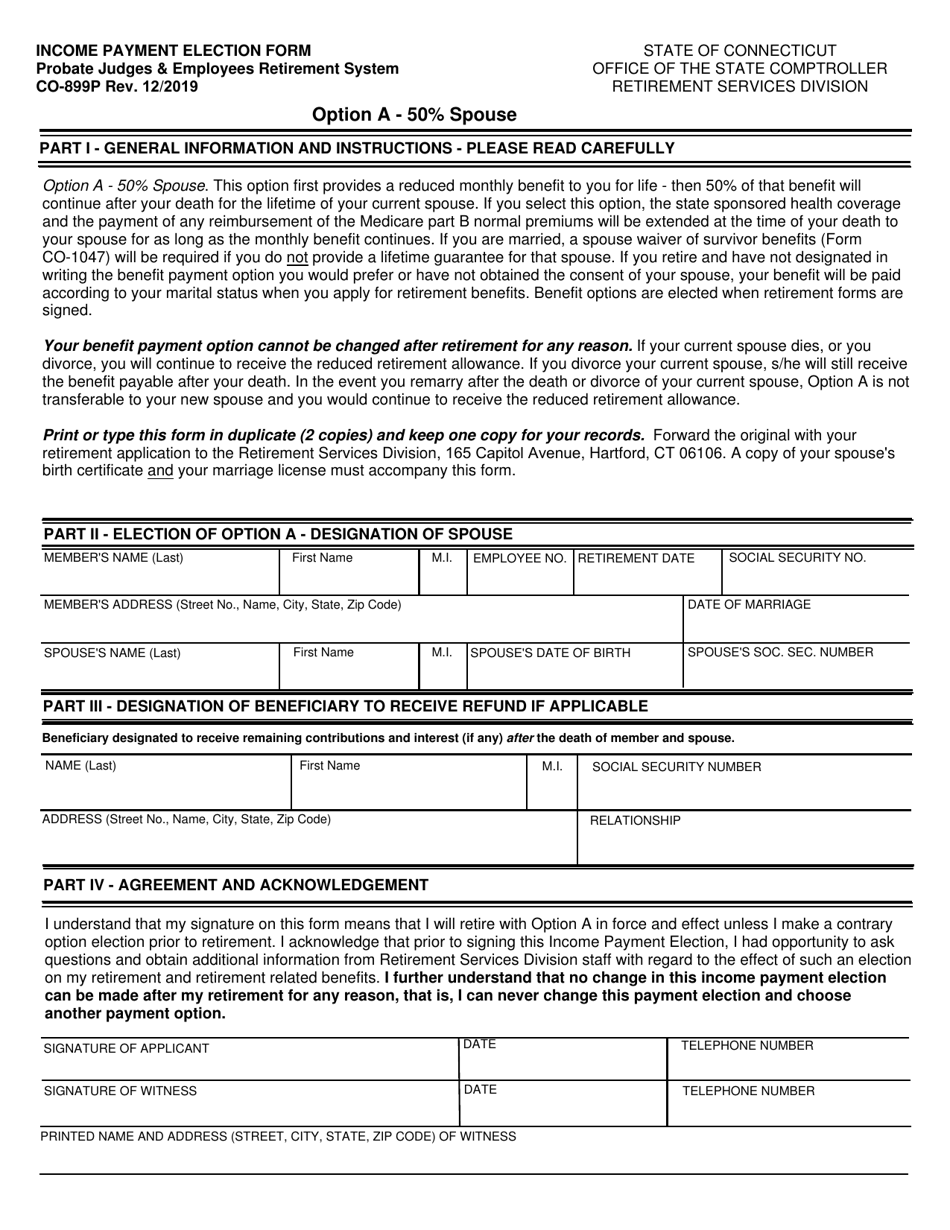

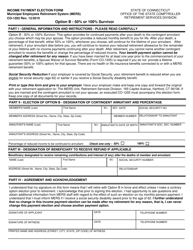

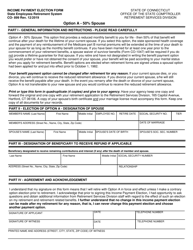

Form CO-899P Income Payment Election Form - Option a - 50% Spouse - Connecticut

What Is Form CO-899P?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-899P?

A: Form CO-899P is the Income Payment Election Form.

Q: What is Option a on Form CO-899P?

A: Option a allows you to designate 50% of the income payment to your spouse.

Q: What does the form cover?

A: The form covers income payments.

Q: Is Form CO-899P specific to a state?

A: Yes, the form is specific to Connecticut.

Q: What is the purpose of Form CO-899P?

A: The purpose of the form is to make an income payment election, specifically for Option a - 50% Spouse.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-899P by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.