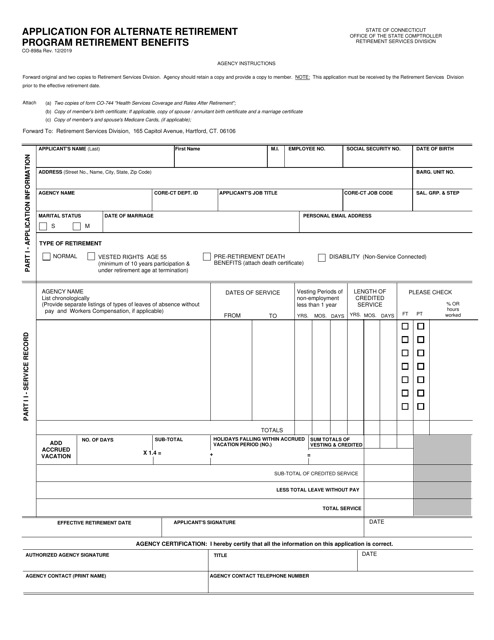

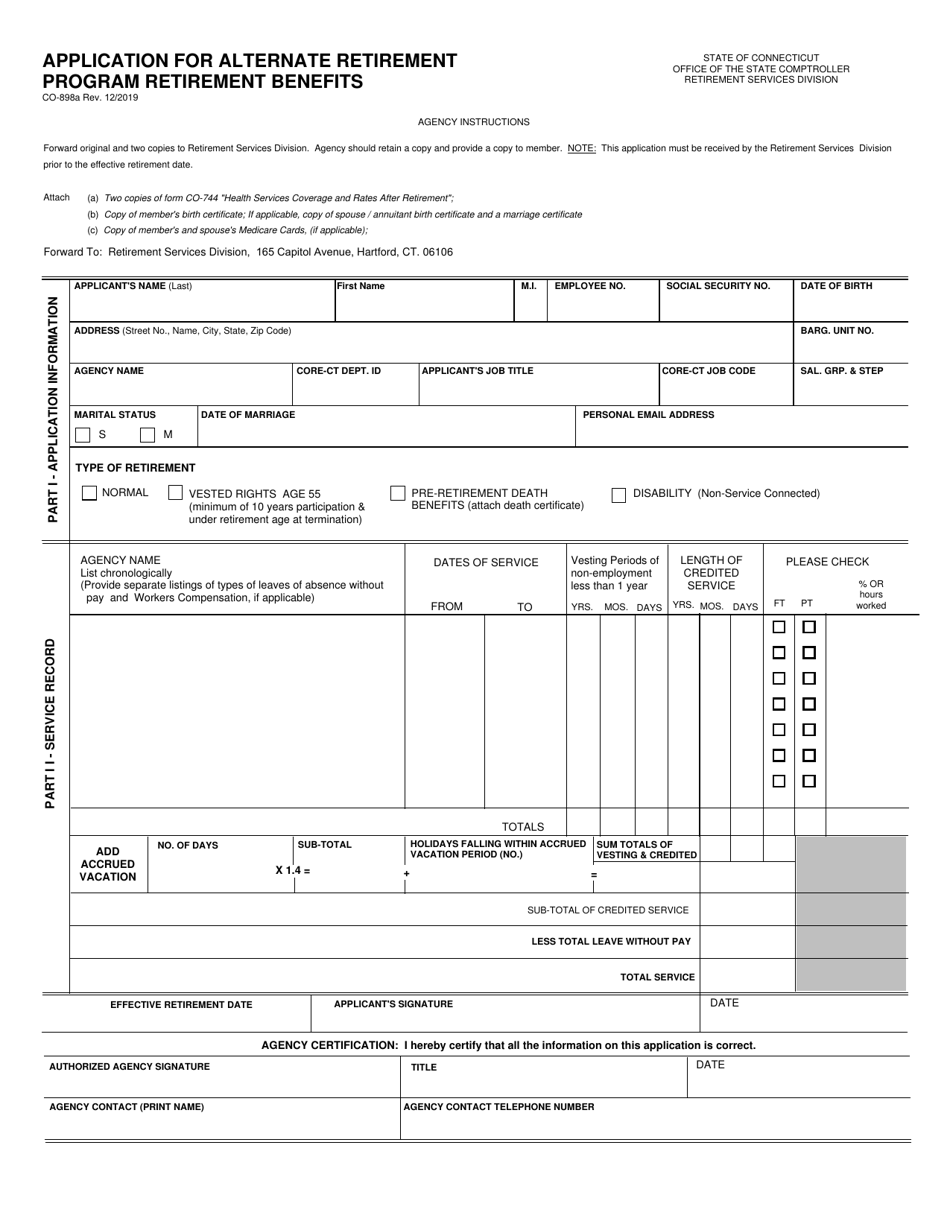

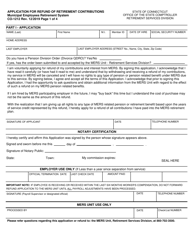

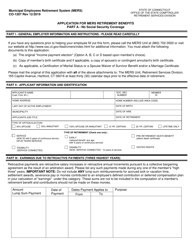

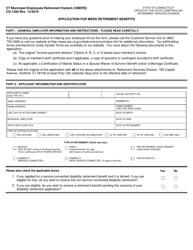

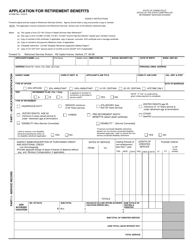

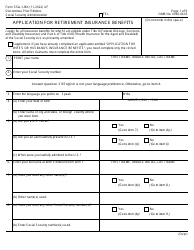

Form CO-898A Application for Alternate Retirement Program Retirement Benefits - Connecticut

What Is Form CO-898A?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-898A?

A: Form CO-898A is an application for Alternate Retirement Programretirement benefits in Connecticut.

Q: Who can apply for Alternate Retirement Program retirement benefits?

A: Employees who are eligible for retirement under the Alternate Retirement Program in Connecticut can apply.

Q: What is the Alternate Retirement Program?

A: The Alternate Retirement Program is a retirement plan for certain state employees in Connecticut.

Q: How do I apply for retirement benefits using Form CO-898A?

A: You can apply for retirement benefits by completing and submitting Form CO-898A to the appropriate retirement system in Connecticut.

Q: Are there any eligibility requirements for the Alternate Retirement Program?

A: Yes, to be eligible for the Alternate Retirement Program, you must meet certain service requirements and be a member of a participating retirement system.

Q: Is there a deadline for submitting Form CO-898A?

A: The deadline for submitting Form CO-898A may vary, so it's important to check with the retirement system for the specific deadline.

Q: What documentation do I need to submit with Form CO-898A?

A: You may be required to submit various documents, such as birth certificates, marriage certificates, and proof of employment, with Form CO-898A.

Q: Who should I contact for more information about Form CO-898A and the Alternate Retirement Program?

A: You should contact the appropriate retirement system in Connecticut for more information about Form CO-898A and the Alternate Retirement Program.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-898A by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.