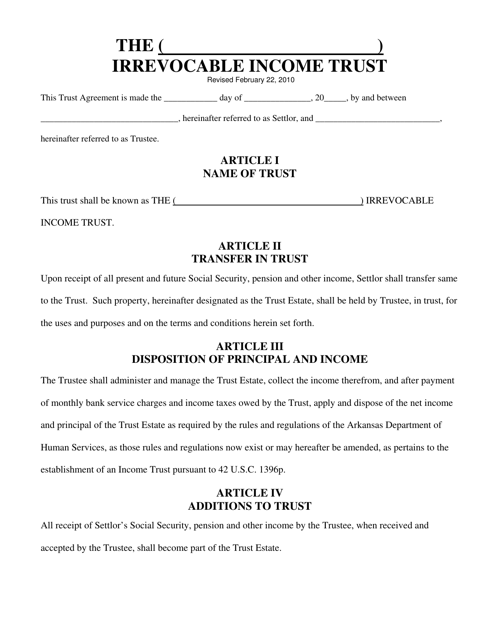

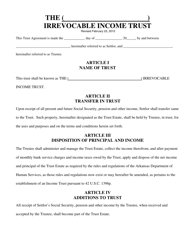

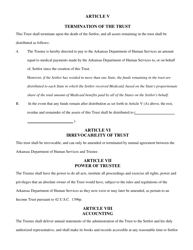

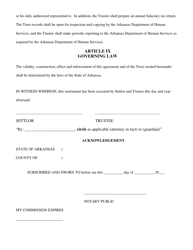

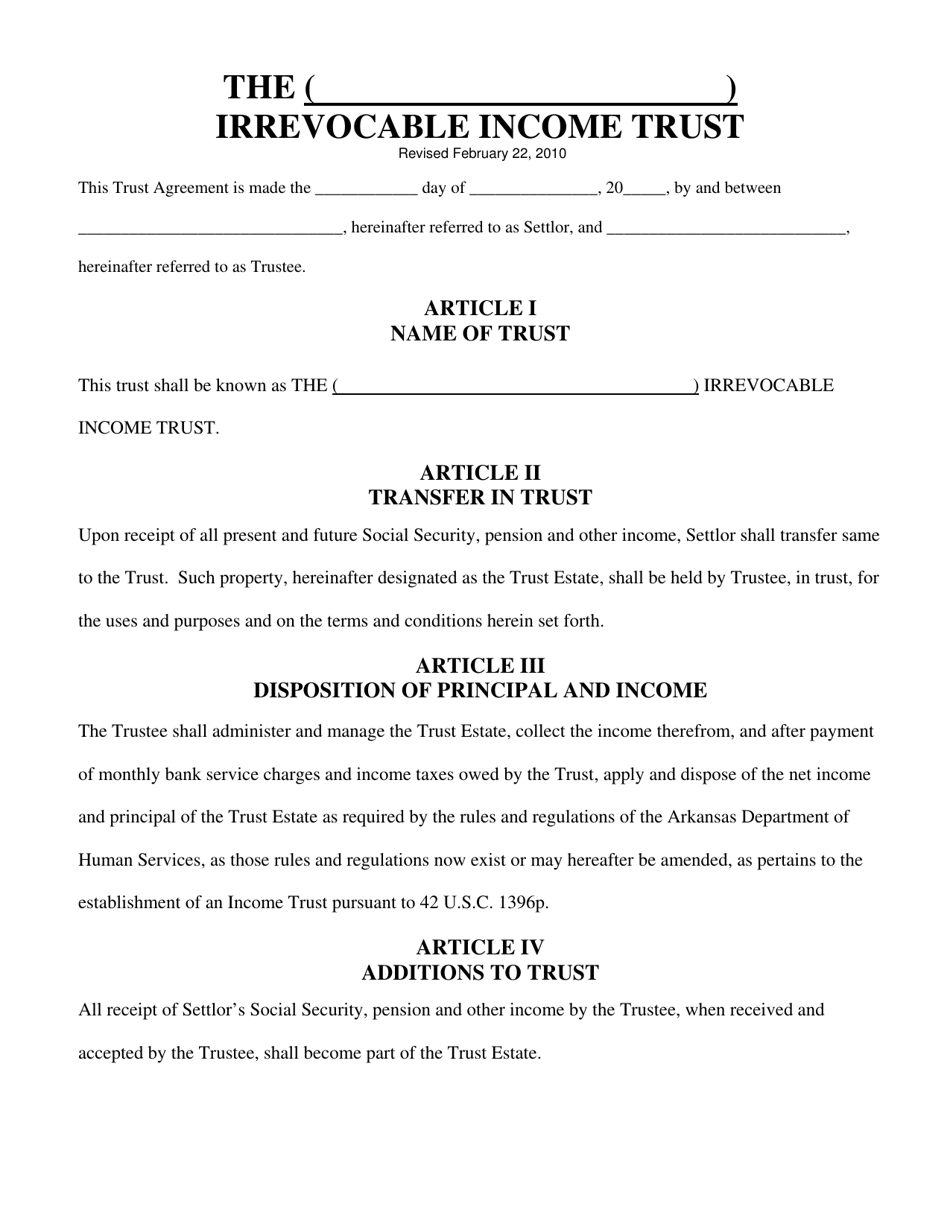

Irrevocable Income Trust - Arkansas

Irrevocable Income Trust is a legal document that was released by the Arkansas Department of Human Services - a government authority operating within Arkansas.

FAQ

Q: What is an Irrevocable Income Trust?

A: An Irrevocable Income Trust is a legal arrangement where an individual transfers assets into a trust to generate income for themselves or their beneficiaries.

Q: How does an Irrevocable Income Trust work?

A: Assets are placed into the trust, generating income that is distributed to the trust beneficiaries. Once assets are in the trust, they cannot be taken back.

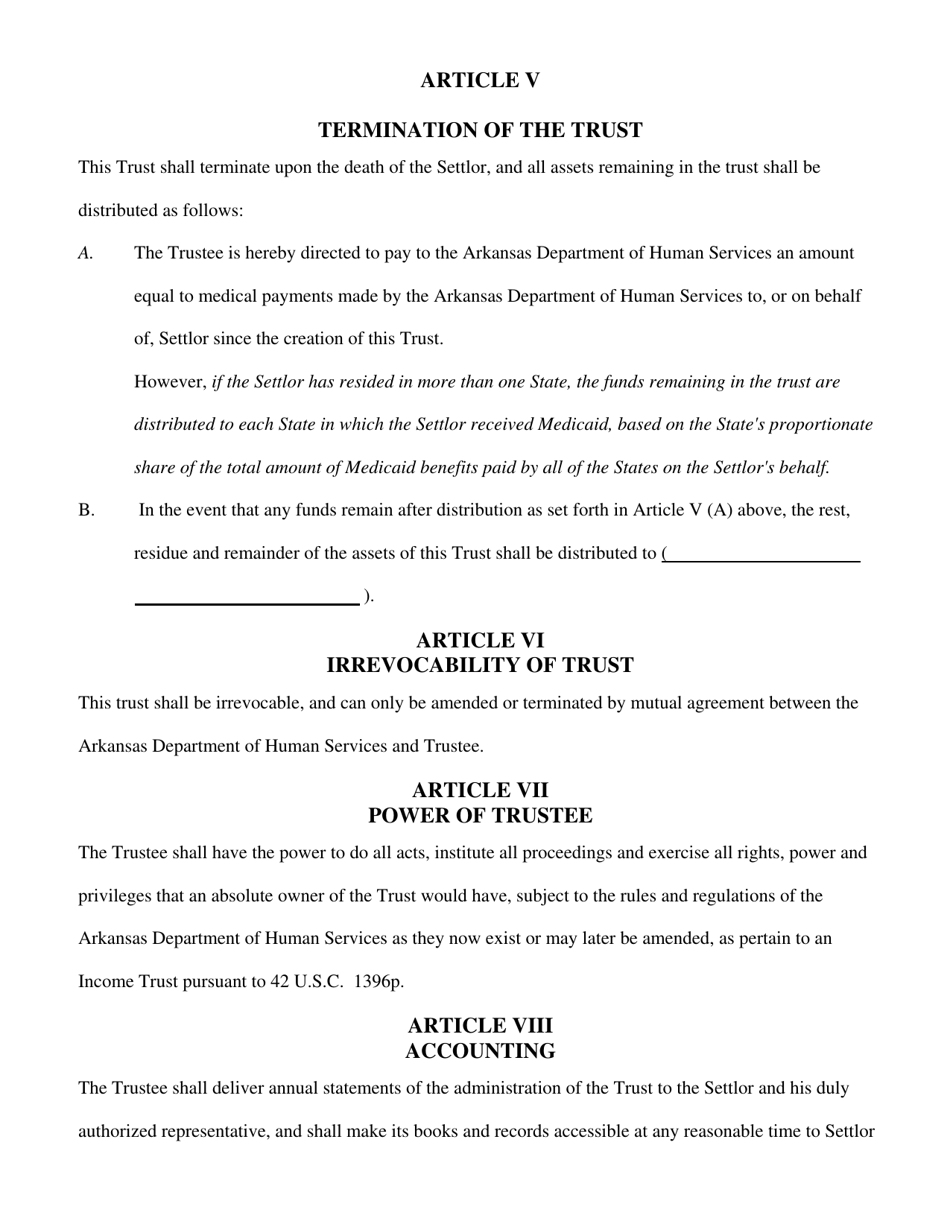

Q: What are the benefits of an Irrevocable Income Trust?

A: An Irrevocable Income Trust can help protect assets from creditors, reduce estate taxes, and provide income for beneficiaries.

Q: Are there any downsides to an Irrevocable Income Trust?

A: Once assets are transferred into the trust, they cannot be accessed or removed by the individual who created the trust.

Q: Can an Irrevocable Income Trust be created in Arkansas?

A: Yes, Irrevocable Income Trusts can be created in Arkansas, subject to the state's specific laws and regulations.

Form Details:

- Released on February 22, 2010;

- The latest edition currently provided by the Arkansas Department of Human Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Human Services.