This version of the form is not currently in use and is provided for reference only. Download this version of

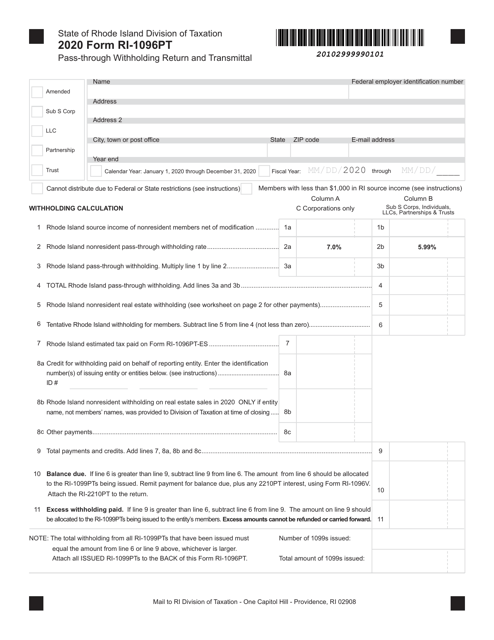

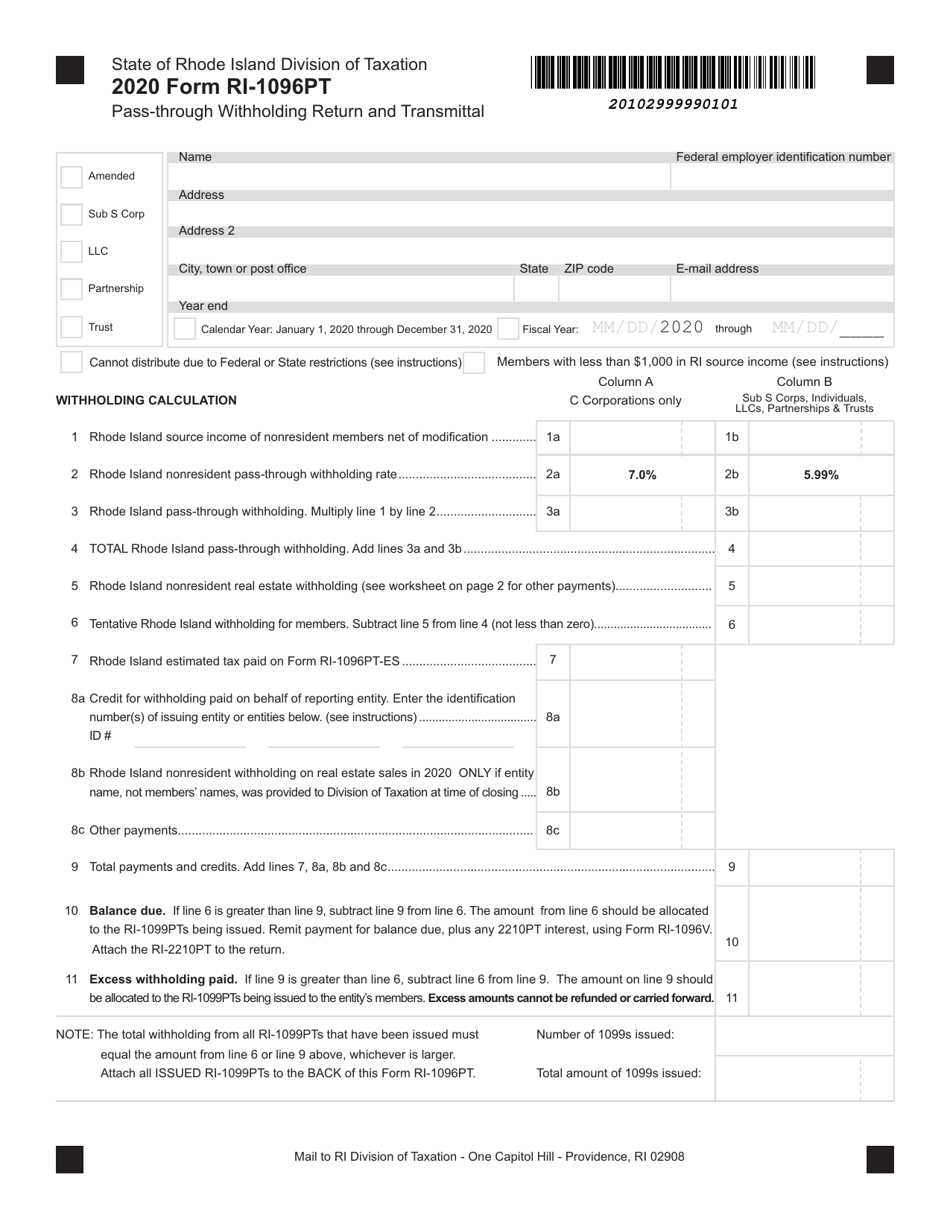

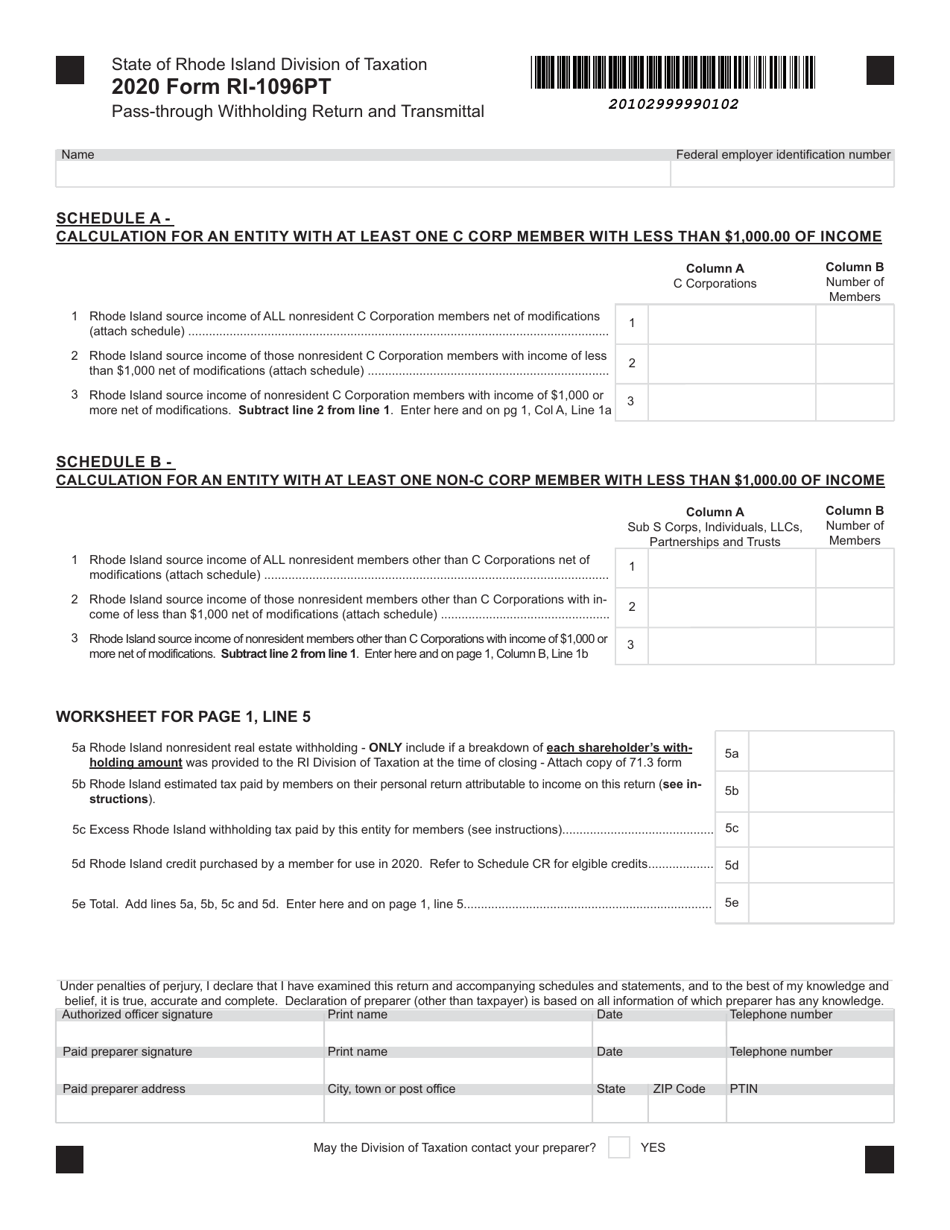

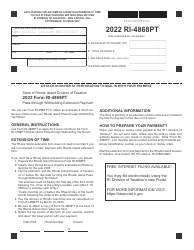

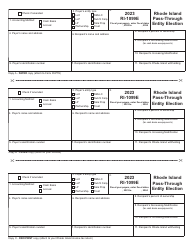

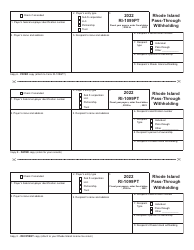

Form RI-1096PT

for the current year.

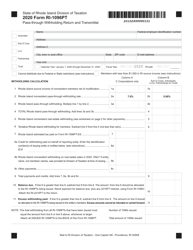

Form RI-1096PT Pass-Through Withholding Return and Transmittal - Rhode Island

What Is Form RI-1096PT?

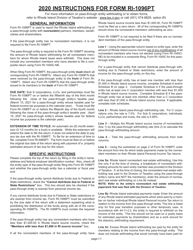

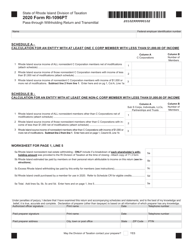

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

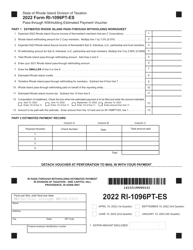

Q: What is Form RI-1096PT?

A: Form RI-1096PT is the Pass-Through Withholding Return and Transmittal for Rhode Island.

Q: Who needs to file Form RI-1096PT?

A: Pass-through entities who have withheld Rhode Island income tax on behalf of their nonresident partners or shareholders need to file Form RI-1096PT.

Q: What is the purpose of Form RI-1096PT?

A: Form RI-1096PT is used to report and transmit the Pass-Through Withholding taxes withheld by the entity.

Q: When is Form RI-1096PT due?

A: Form RI-1096PT is due on or before the 15th day of the 3rd month following the close of the pass-through entity’s tax year.

Q: Are there any penalties for late filing of Form RI-1096PT?

A: Yes, late filing of Form RI-1096PT may result in penalties and interest charges.

Q: Is Form RI-1096PT required for all pass-through entities in Rhode Island?

A: Yes, all pass-through entities that have withheld Rhode Island income tax must file Form RI-1096PT.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1096PT by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.