This version of the form is not currently in use and is provided for reference only. Download this version of

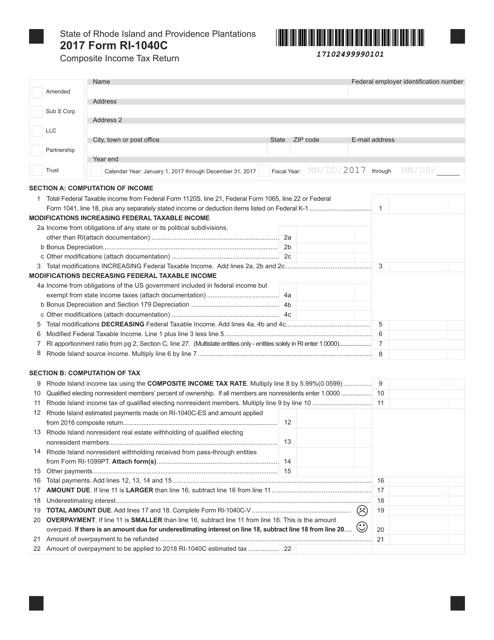

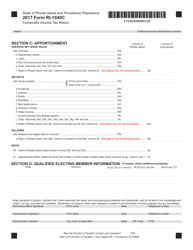

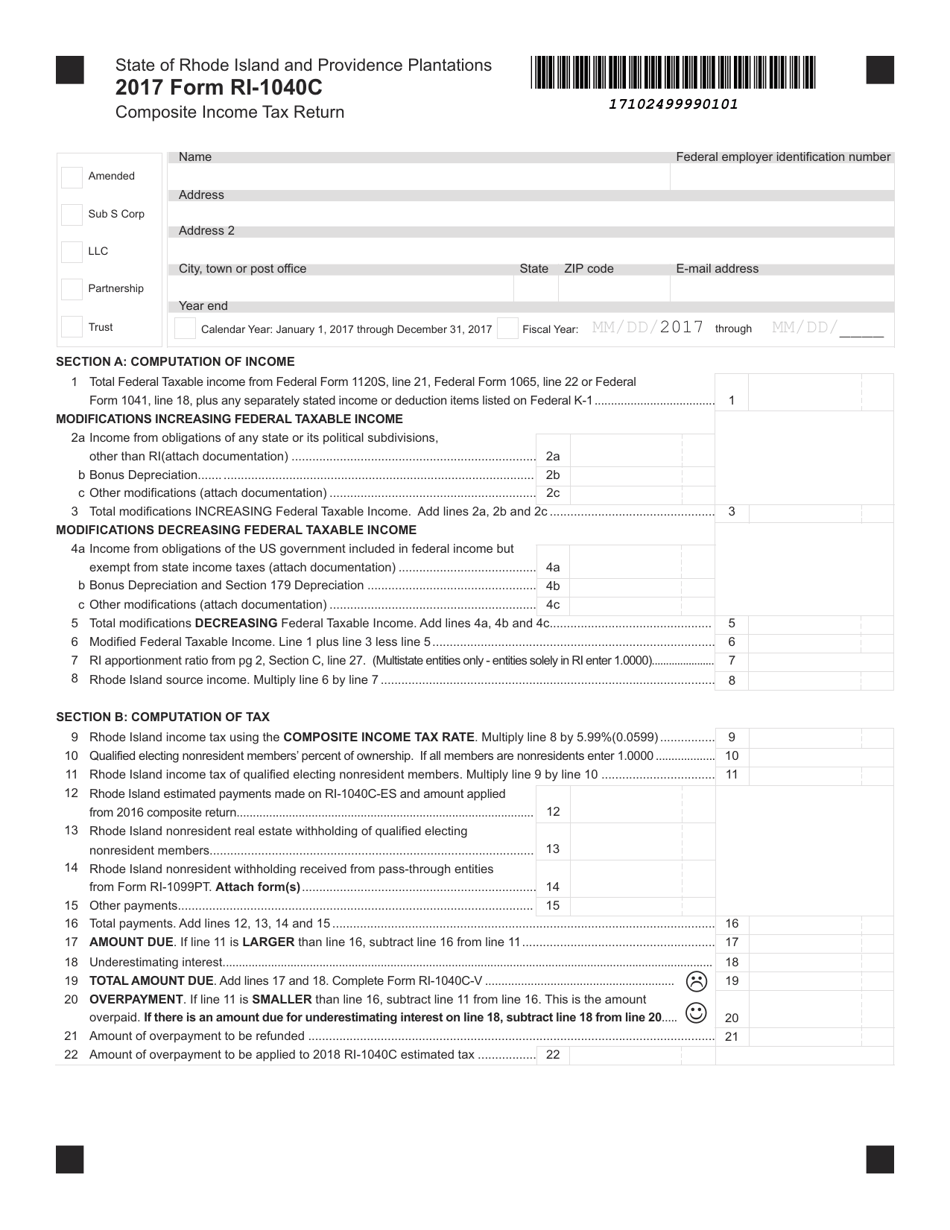

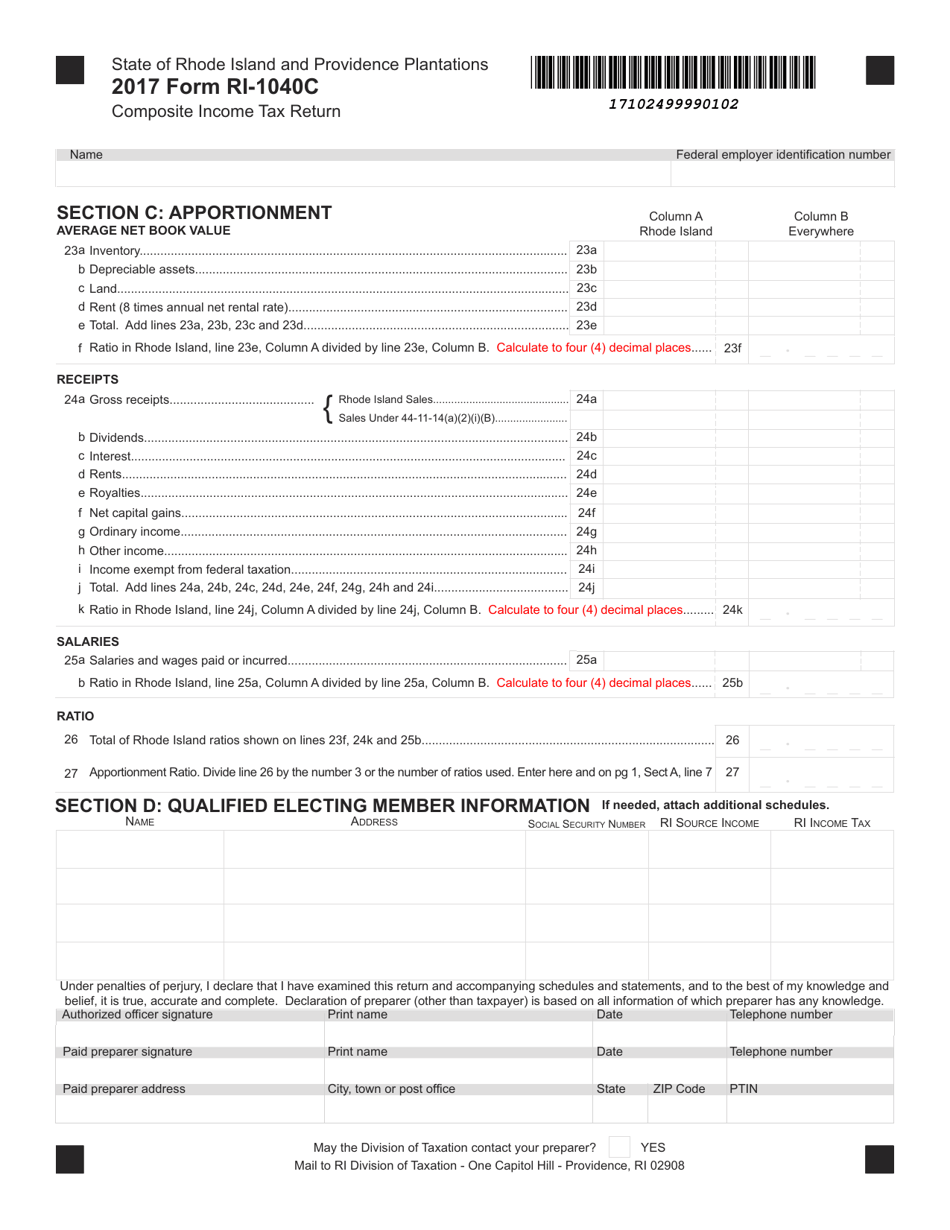

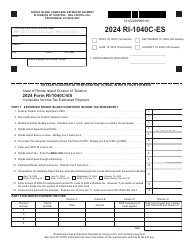

Form RI-1040C

for the current year.

Form RI-1040C Composite Income Tax(return - Rhode Island

What Is Form RI-1040C?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is RI-1040C?

A: RI-1040C is a form used to file a composite income tax return in Rhode Island.

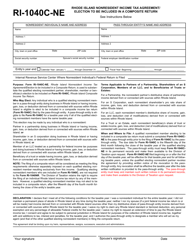

Q: Who needs to file RI-1040C?

A: RI-1040C is filed by pass-through entities, such as partnerships and S corporations, on behalf of nonresident individual members or shareholders.

Q: What is a composite income tax return?

A: A composite income tax return is a single tax return filed by a pass-through entity on behalf of its nonresident individual members or shareholders.

Q: Why would a pass-through entity file a composite income tax return?

A: Pass-through entities file composite income tax returns to pay taxes on behalf of their nonresident individual members or shareholders, allowing them to avoid filing their own individual tax returns in Rhode Island.

Q: What information is required to file RI-1040C?

A: To file RI-1040C, you will need the nonresident individual members' or shareholders' names, addresses, Social Security numbers, and their share of income earned in Rhode Island.

Q: When is the deadline to file RI-1040C?

A: The deadline to file RI-1040C is the same as the regular Rhode Island income tax return deadline, which is typically April 15th.

Q: Are there any penalties for late filing of RI-1040C?

A: Yes, late filing of RI-1040C may result in penalties and interest.

Q: Can I e-file RI-1040C?

A: Yes, you can e-file RI-1040C using approved tax software or through a tax professional.

Q: Are there any additional forms or schedules that need to be filed with RI-1040C?

A: Yes, depending on the specific situation, you may need to file additional forms or schedules, such as Schedule K and Schedule K-1.

Q: What if I have more questions about filing RI-1040C?

A: If you have more questions about filing RI-1040C, you can contact the Rhode Island Division of Taxation or consult a tax professional.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.