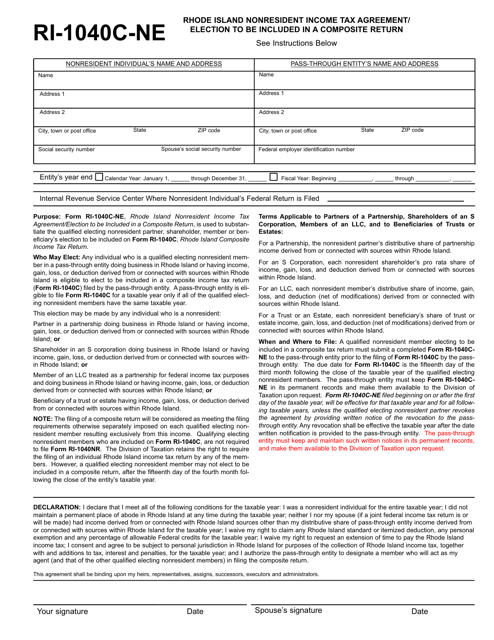

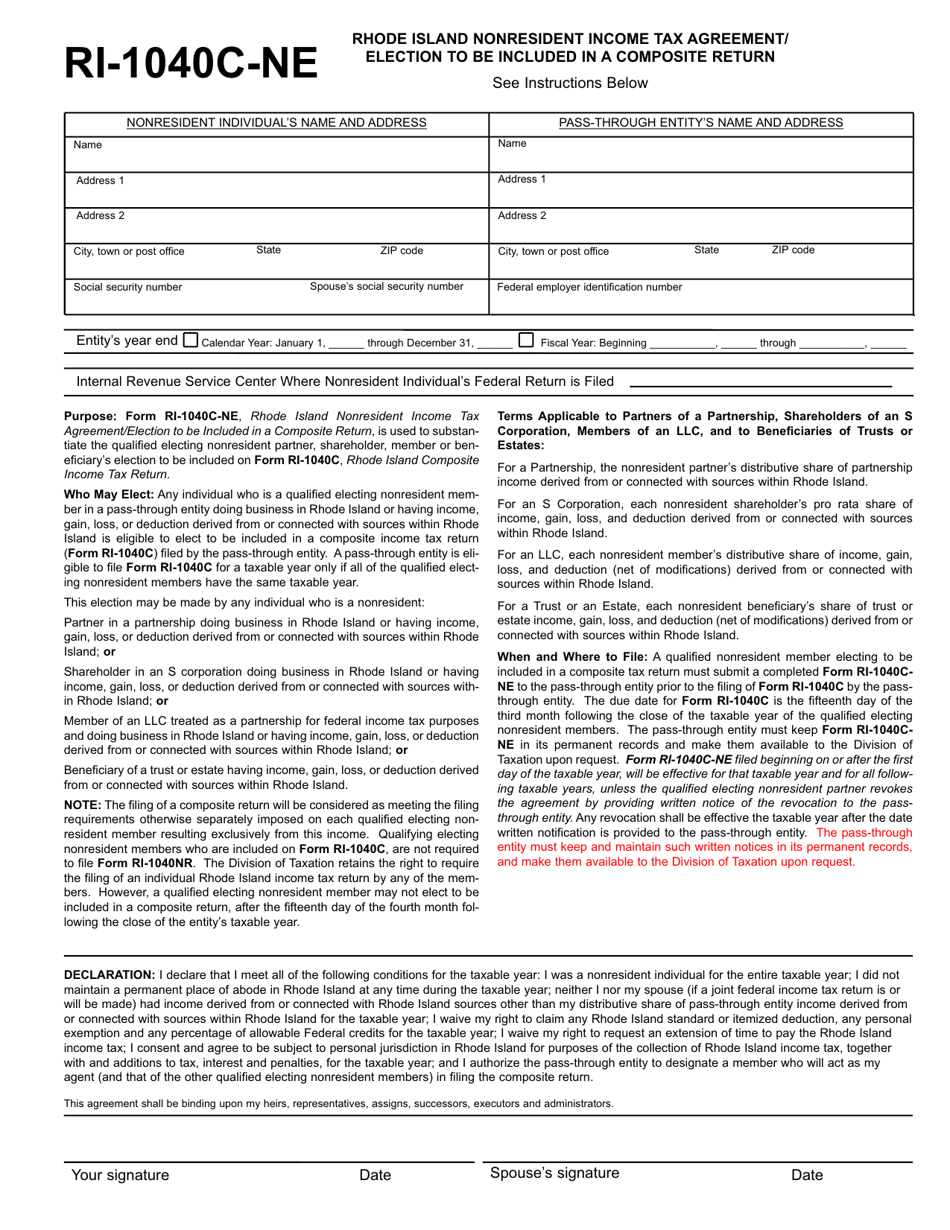

Form RI-1040C-NE Rhode Island Nonresident Income Tax Agreement / Election to Be Included in a Composite Return - Rhode Island

What Is Form RI-1040C-NE?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1040C-NE?

A: Form RI-1040C-NE is the Rhode Island Nonresident Income Tax Agreement/Election to Be Included in a Composite Return form.

Q: Who should use Form RI-1040C-NE?

A: Form RI-1040C-NE should be used by nonresidents of Rhode Island who want to be included in a composite return.

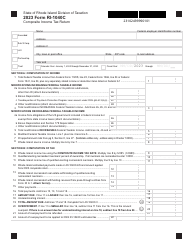

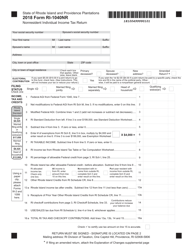

Q: What is a composite return?

A: A composite return is a single income tax return filed on behalf of multiple nonresident individuals.

Q: Why would someone file a composite return?

A: Someone would file a composite return to simplify the income tax filing process by combining the income and tax liability of multiple nonresident individuals.

Q: What information is required on Form RI-1040C-NE?

A: Form RI-1040C-NE requires information about each nonresident individual, including their name, address, and Social Security number.

Q: Is there a deadline for filing Form RI-1040C-NE?

A: Yes, Form RI-1040C-NE must be filed by the due date of the composite return, which is generally April 15th.

Q: Are there any fees associated with filing Form RI-1040C-NE?

A: No, there are no fees associated with filing Form RI-1040C-NE.

Q: Can Form RI-1040C-NE be e-filed?

A: Yes, Form RI-1040C-NE can be e-filed if using an approved tax software.

Q: Can I amend my Form RI-1040C-NE?

A: Yes, you can file an amended Form RI-1040C-NE if necessary.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040C-NE by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.