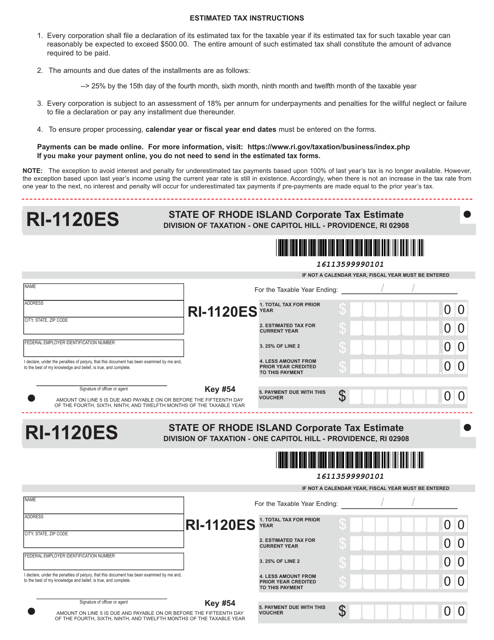

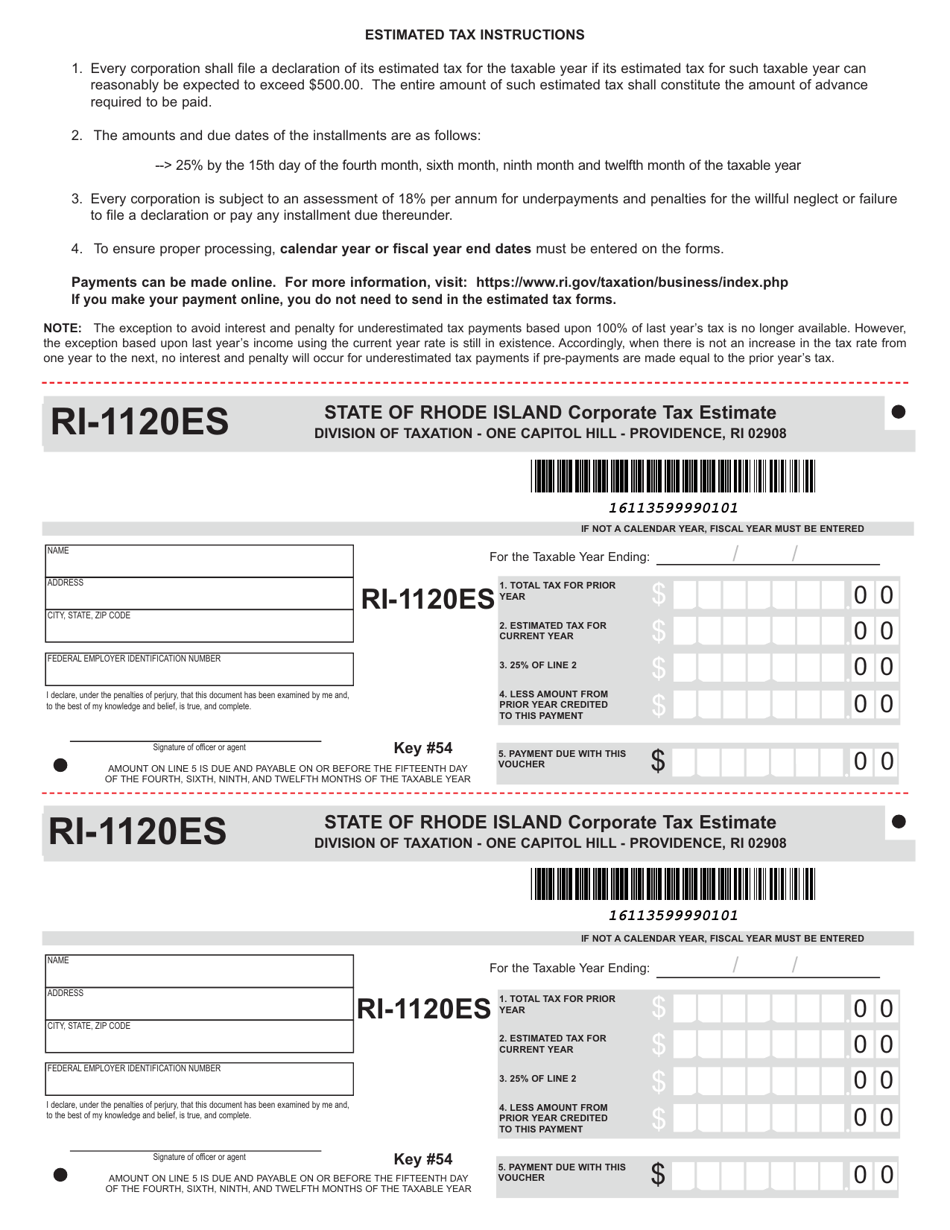

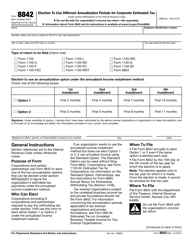

Form RI-1120ES Corporate Tax Estimate - Rhode Island

What Is Form RI-1120ES?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1120ES?

A: Form RI-1120ES is a form used by corporations in Rhode Island to estimate their income tax liability for the year.

Q: Who needs to file Form RI-1120ES?

A: Corporations in Rhode Island that expect to owe more than $400 in tax for the year must file Form RI-1120ES.

Q: When is Form RI-1120ES due?

A: Form RI-1120ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's fiscal year.

Q: How do I calculate my estimated tax payment?

A: To calculate your estimated tax payment, you will need to estimate your taxable income for the year and apply the appropriate tax rate.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120ES by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.