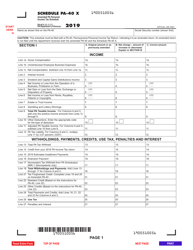

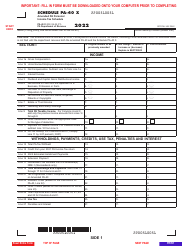

This version of the form is not currently in use and is provided for reference only. Download this version of

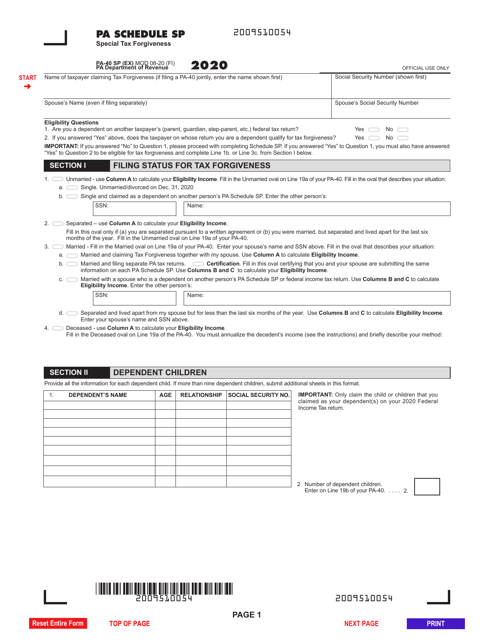

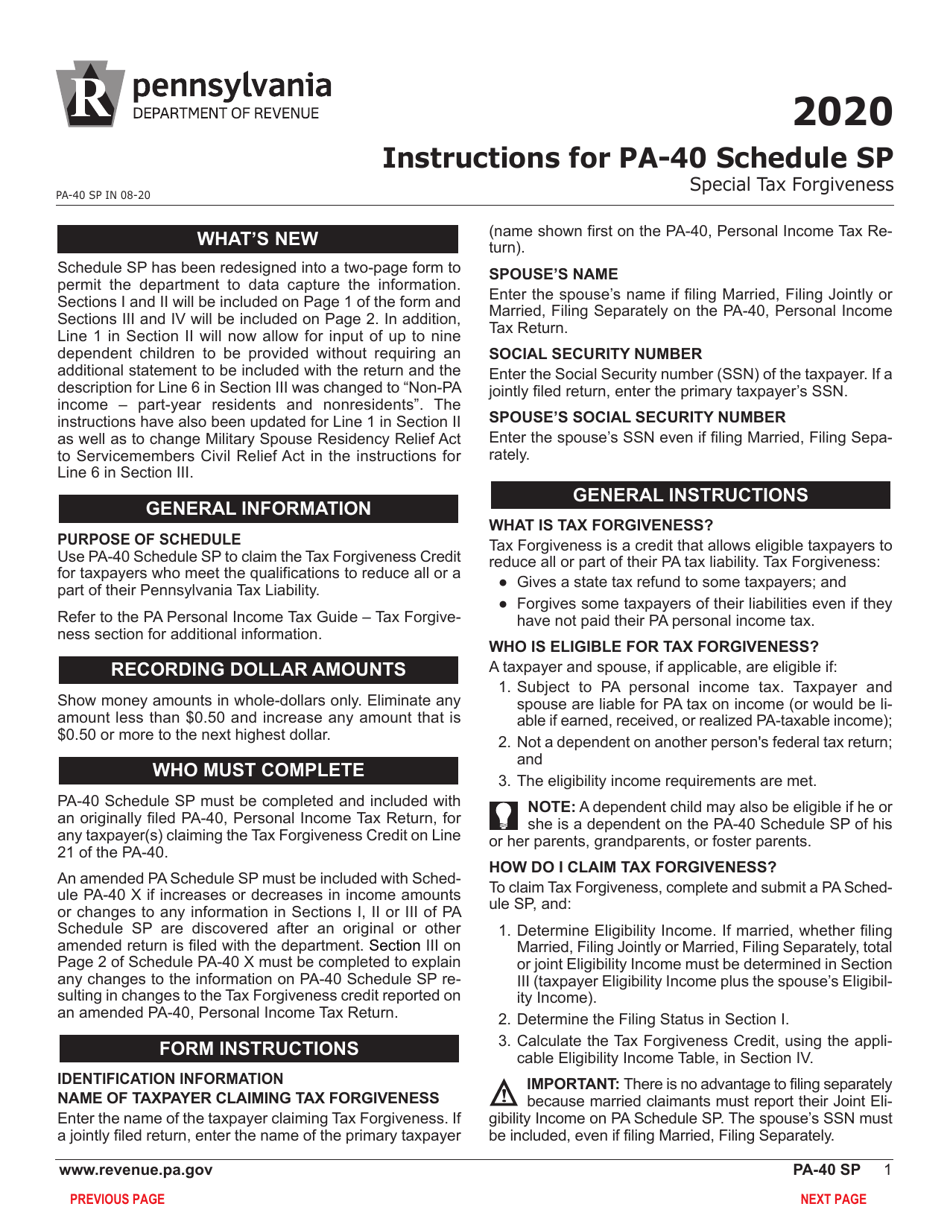

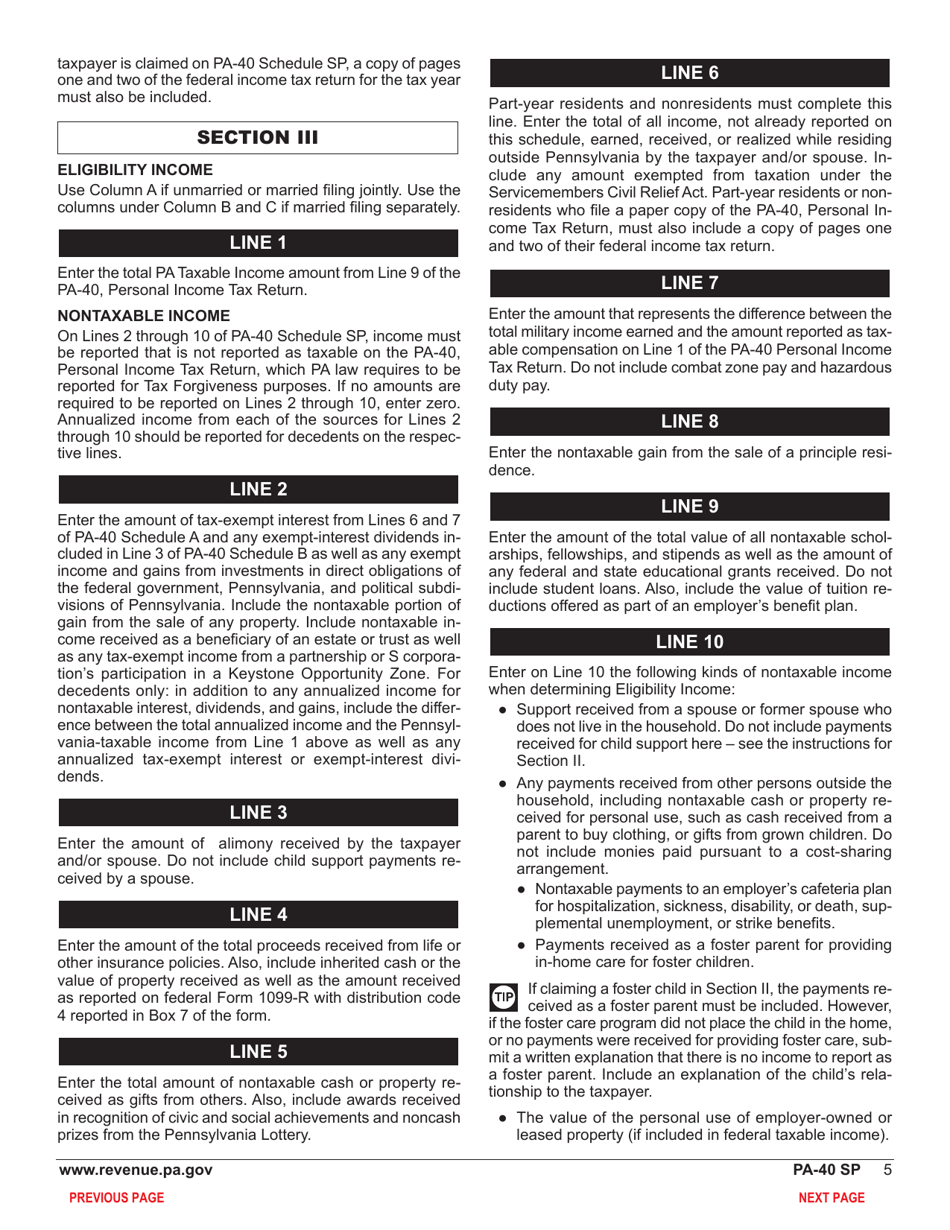

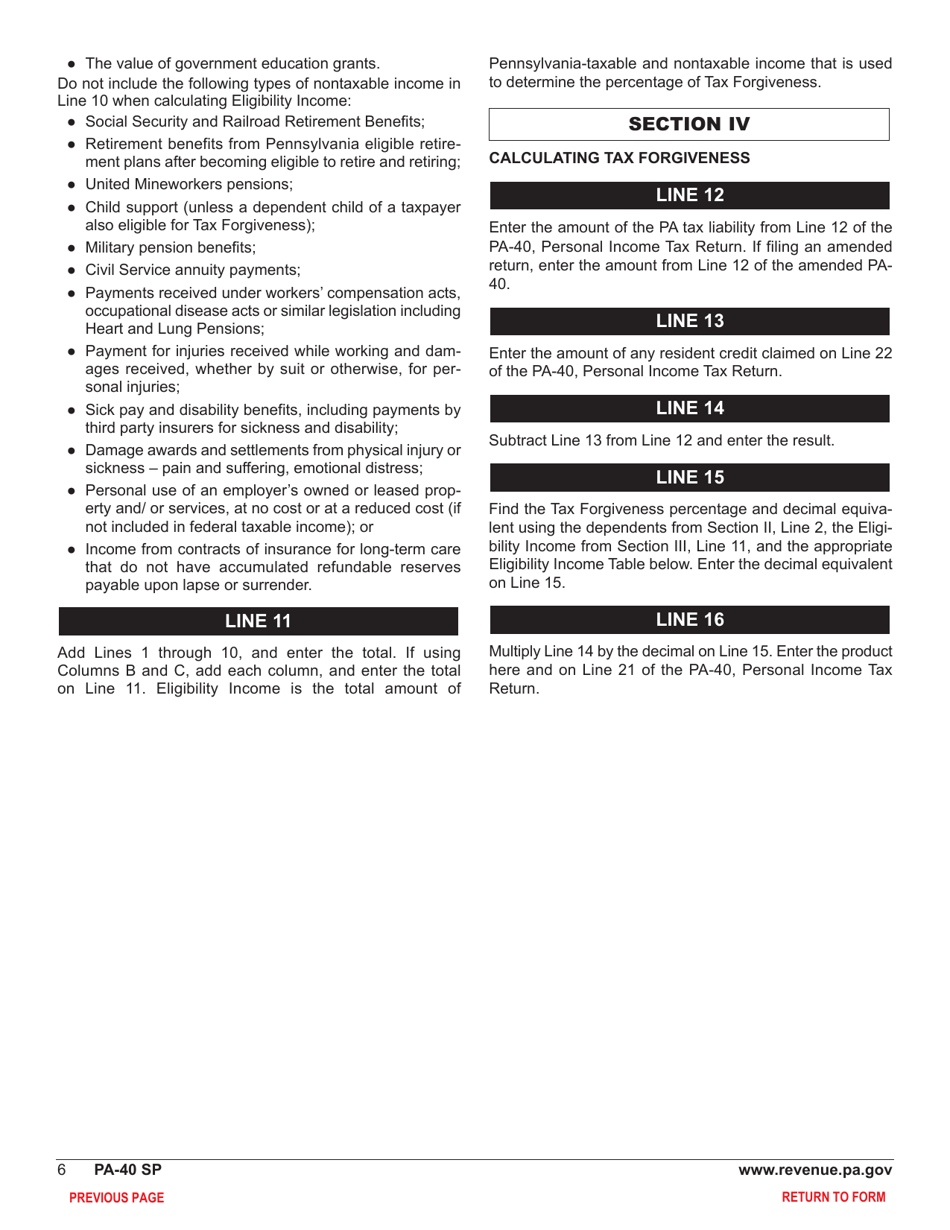

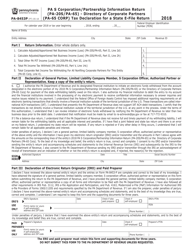

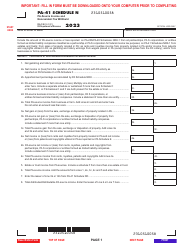

Form PA-40 Schedule SP

for the current year.

Form PA-40 Schedule SP Special Tax Forgiveness - Pennsylvania

What Is Form PA-40 Schedule SP?

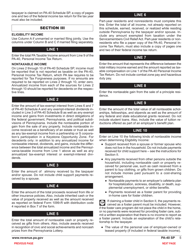

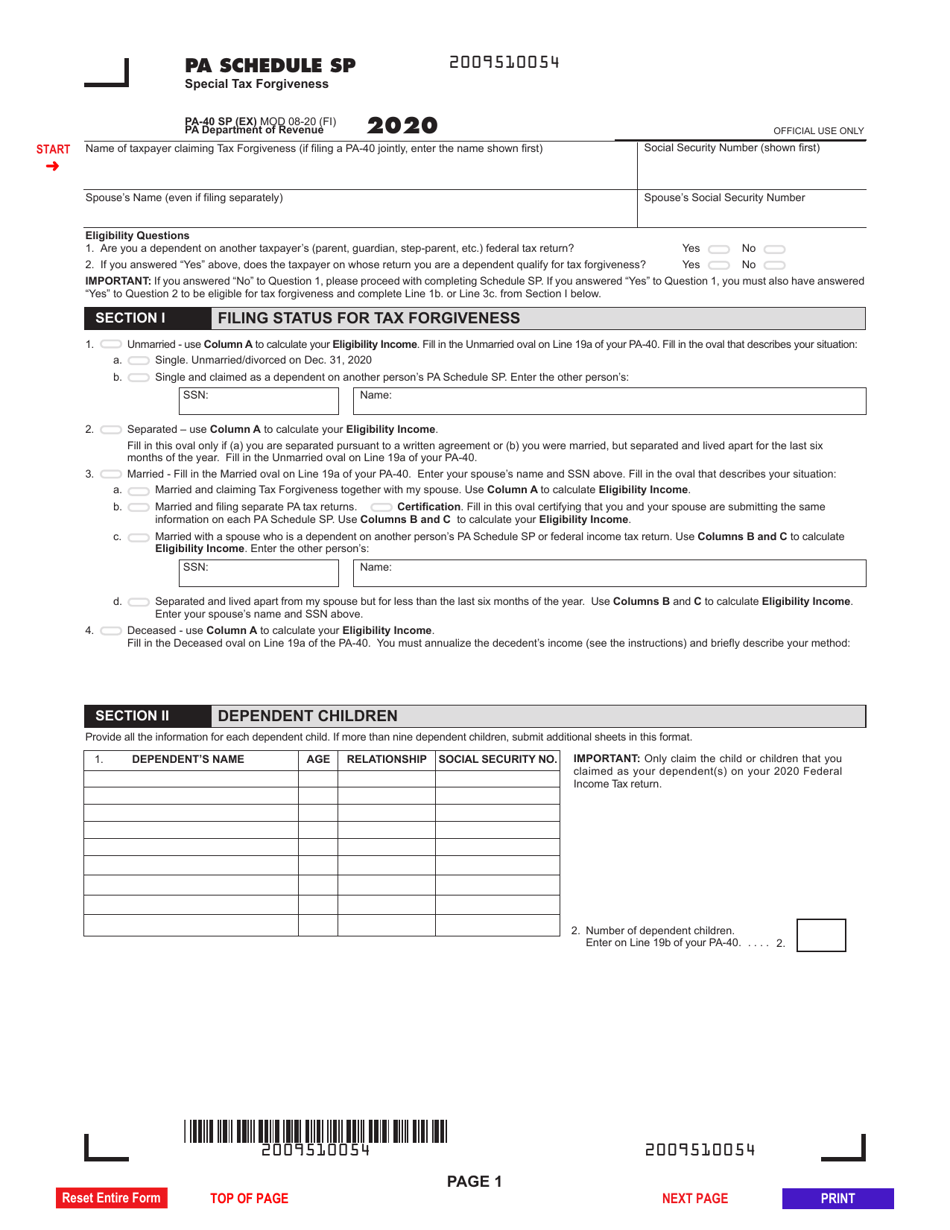

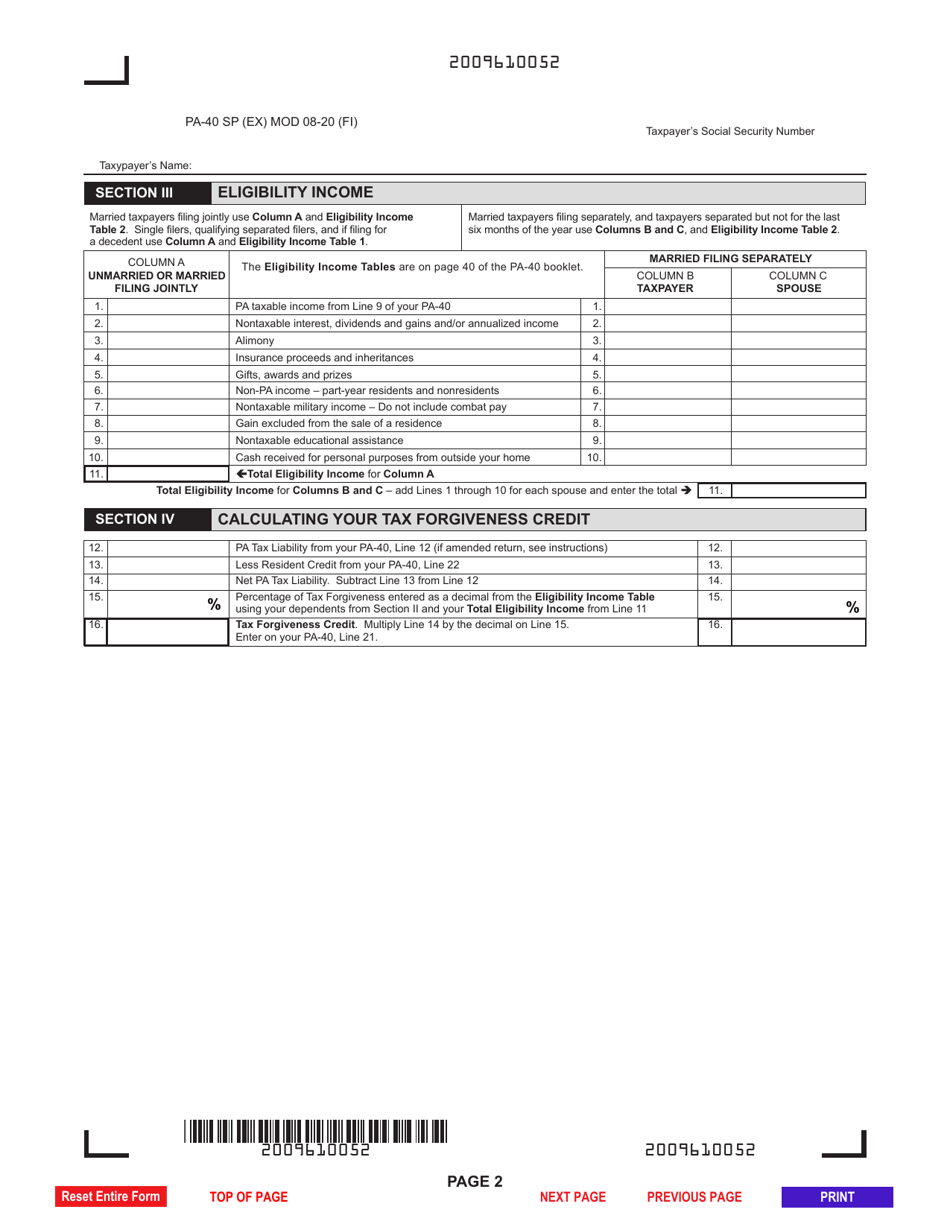

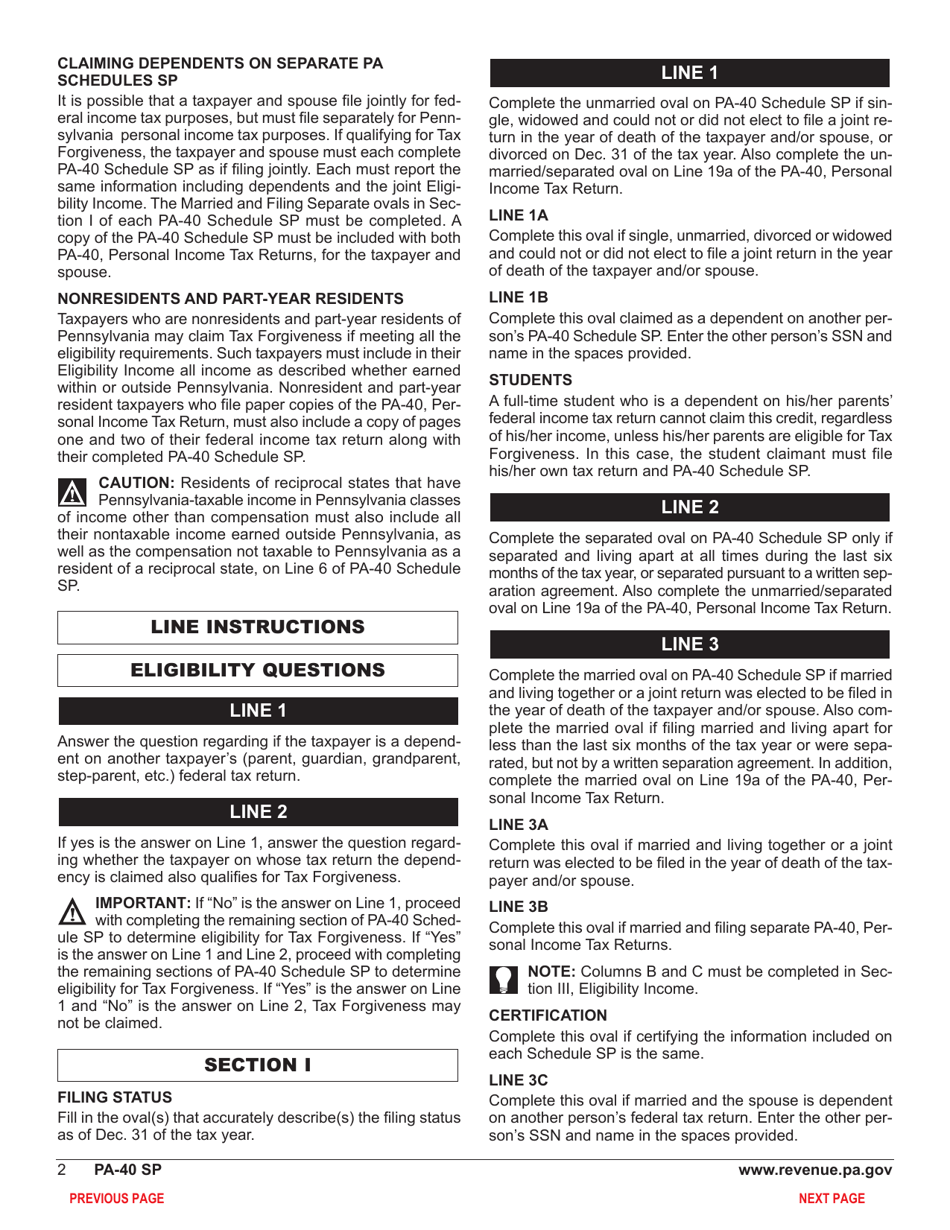

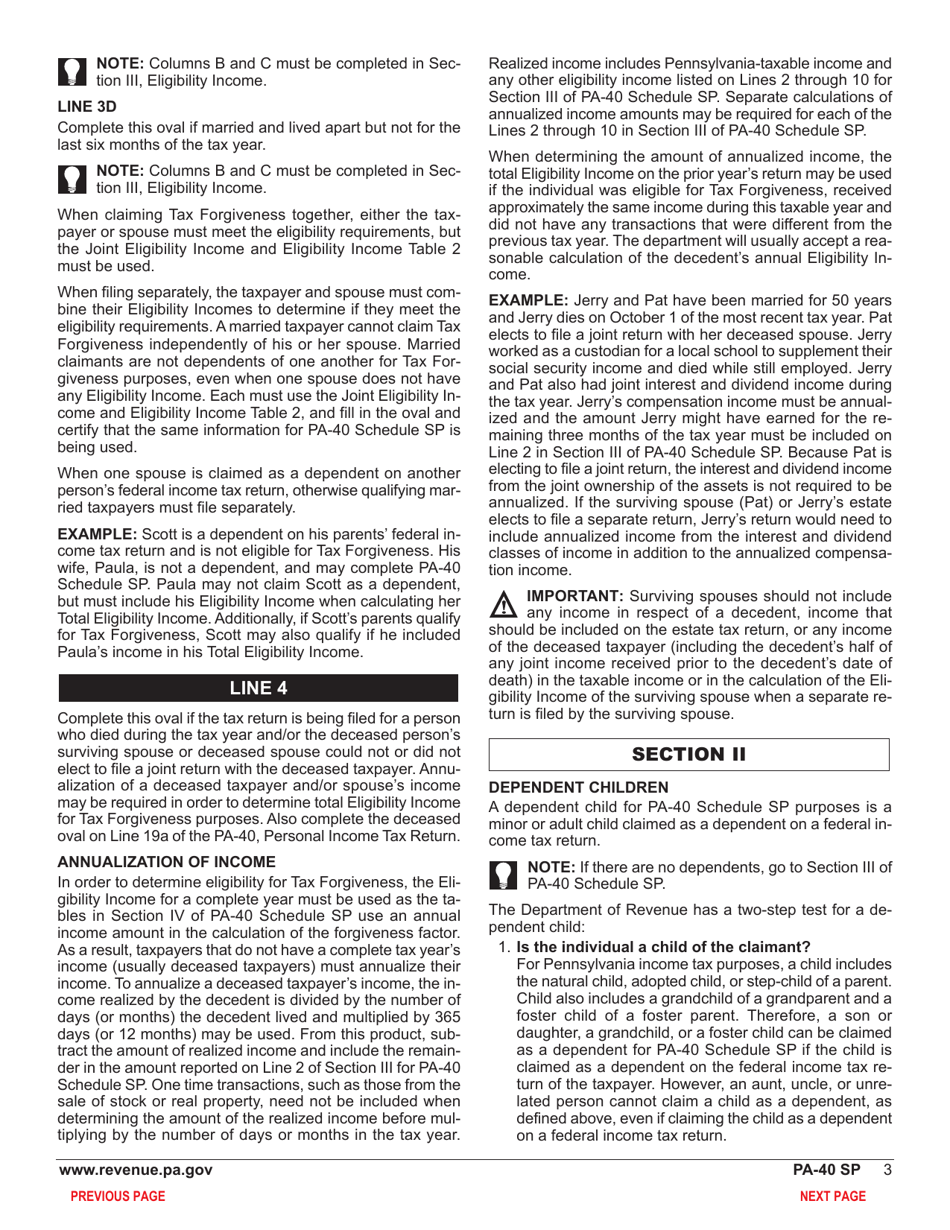

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule SP?

A: Form PA-40 Schedule SP is a special tax forgiveness form in Pennsylvania.

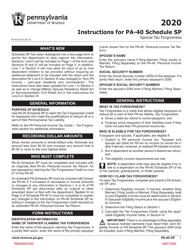

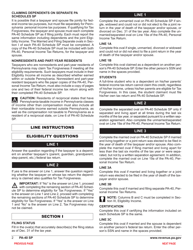

Q: Who is eligible to use Form PA-40 Schedule SP?

A: Individual taxpayers who meet certain criteria are eligible to use Form PA-40 Schedule SP.

Q: What is the purpose of Form PA-40 Schedule SP?

A: The purpose of Form PA-40 Schedule SP is to claim special tax forgiveness for eligible taxpayers.

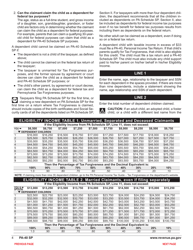

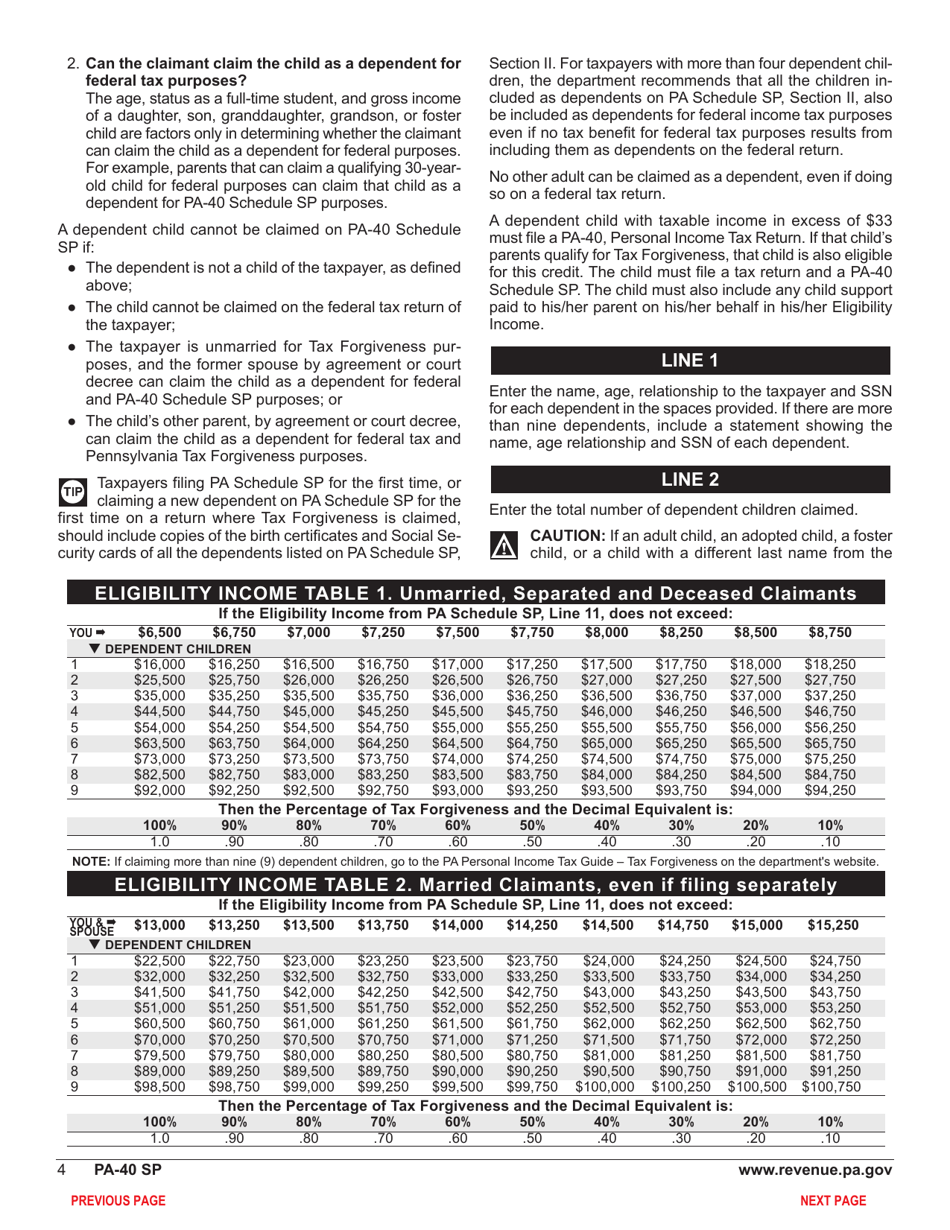

Q: What are the criteria to be eligible for special tax forgiveness in Pennsylvania?

A: To be eligible for special tax forgiveness in Pennsylvania, taxpayers must meet certain income and household size requirements.

Q: When is the deadline to file Form PA-40 Schedule SP?

A: The deadline to file Form PA-40 Schedule SP is typically April 15th, or the same deadline as your Pennsylvania state tax return.

Q: Are there any fees associated with filing Form PA-40 Schedule SP?

A: No, there are no fees associated with filing Form PA-40 Schedule SP.

Q: Can I file Form PA-40 Schedule SP electronically?

A: Yes, you can file Form PA-40 Schedule SP electronically if you e-file your Pennsylvania state tax return.

Q: What should I do if I have questions or need assistance with Form PA-40 Schedule SP?

A: If you have questions or need assistance with Form PA-40 Schedule SP, you should contact the Pennsylvania Department of Revenue or seek guidance from a tax professional.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule SP by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.