This version of the form is not currently in use and is provided for reference only. Download this version of

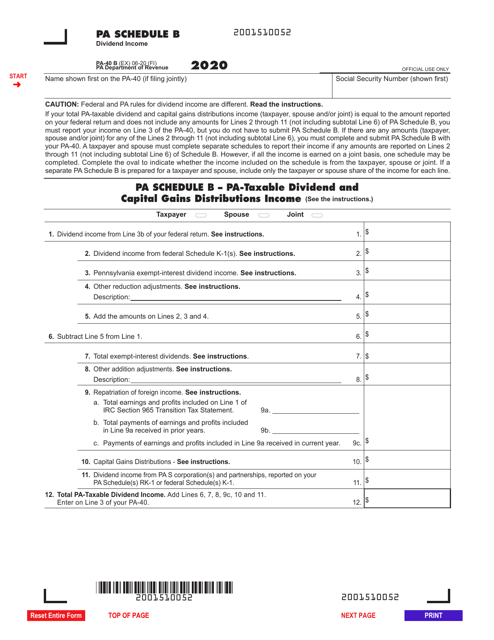

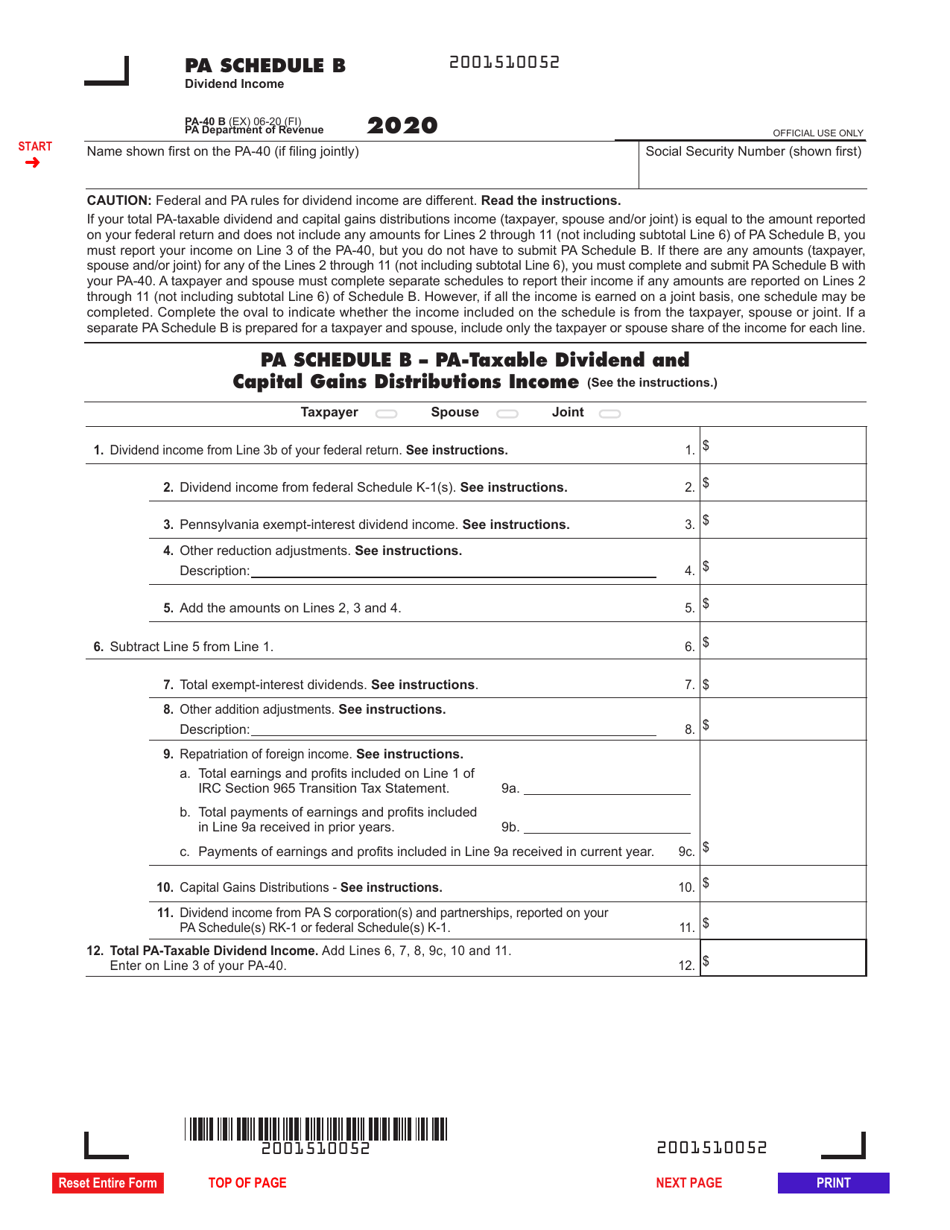

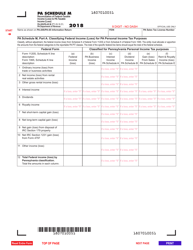

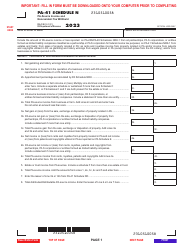

Form PA-40 Schedule B

for the current year.

Form PA-40 Schedule B Dividend Income - Pennsylvania

What Is Form PA-40 Schedule B?

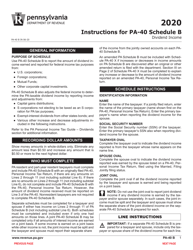

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule B?

A: PA-40 Schedule B is a tax form used in Pennsylvania to report dividend income.

Q: What is dividend income?

A: Dividend income is the money earned from owning shares of stock in a company.

Q: Why do I need to report dividend income on PA-40 Schedule B?

A: You need to report dividend income on PA-40 Schedule B for tax purposes in Pennsylvania.

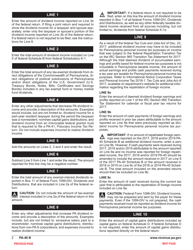

Q: How do I fill out PA-40 Schedule B?

A: To fill out PA-40 Schedule B, you will need to provide information about the dividends you received, such as the amount and the name of the company.

Q: What if I have multiple sources of dividend income?

A: If you have multiple sources of dividend income, you will need to list each one separately on PA-40 Schedule B.

Q: When is the deadline to file PA-40 Schedule B?

A: The deadline to file PA-40 Schedule B is the same as the deadline to file your Pennsylvania state tax return, usually April 15th.

Q: Do I need to pay taxes on dividend income?

A: Yes, dividend income is generally subject to taxes at both the federal and state levels.

Q: Are there any deductions or exemptions for dividend income on PA-40 Schedule B?

A: There may be deductions or exemptions available for dividend income on PA-40 Schedule B, depending on your individual circumstances. It is recommended to consult a tax professional or refer to the instructions for the form.

Q: What happens if I don't report dividend income on PA-40 Schedule B?

A: Failing to report dividend income on PA-40 Schedule B could result in penalties or fines from the Pennsylvania Department of Revenue.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.