This version of the form is not currently in use and is provided for reference only. Download this version of

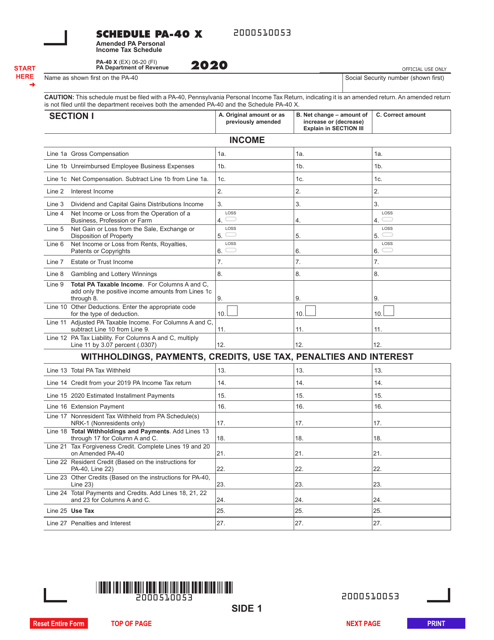

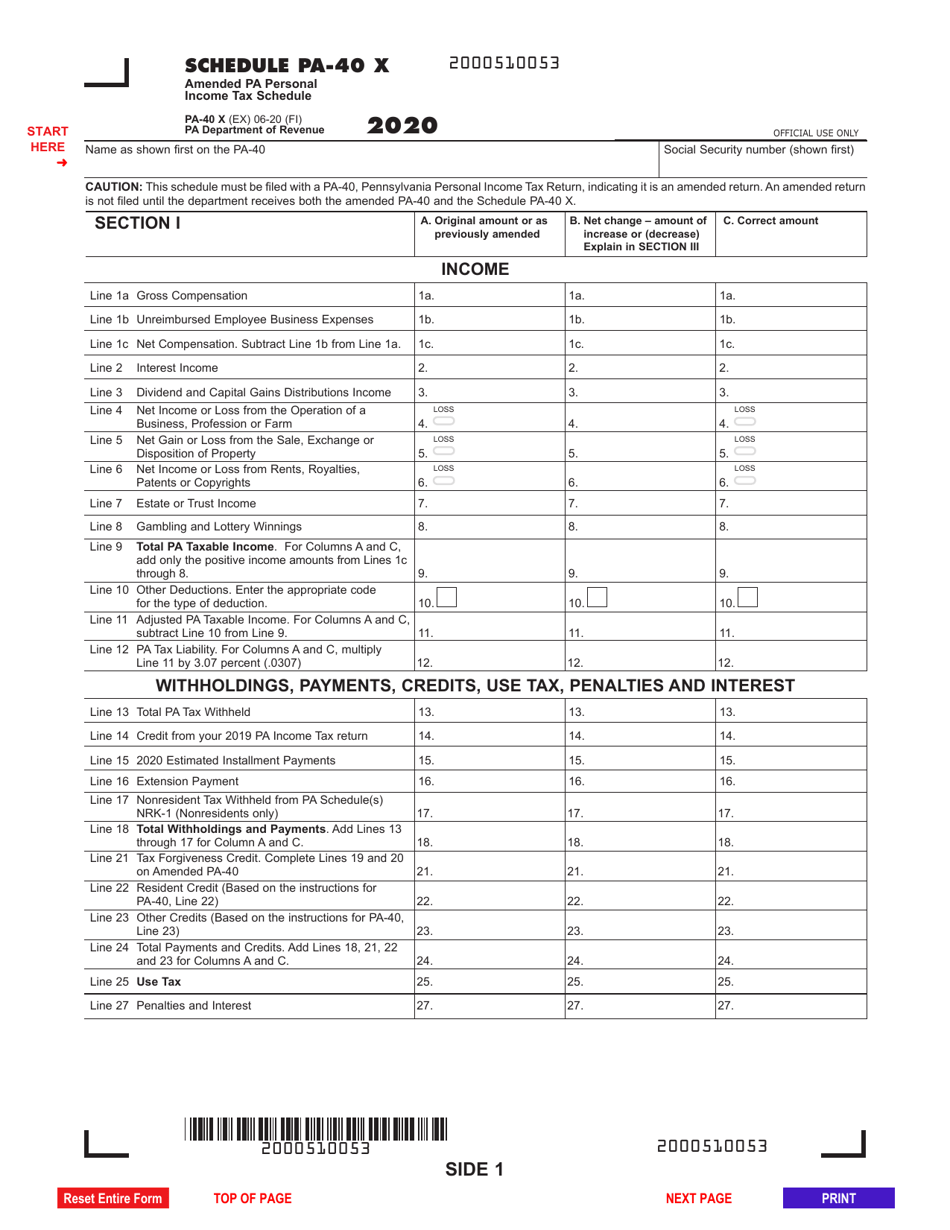

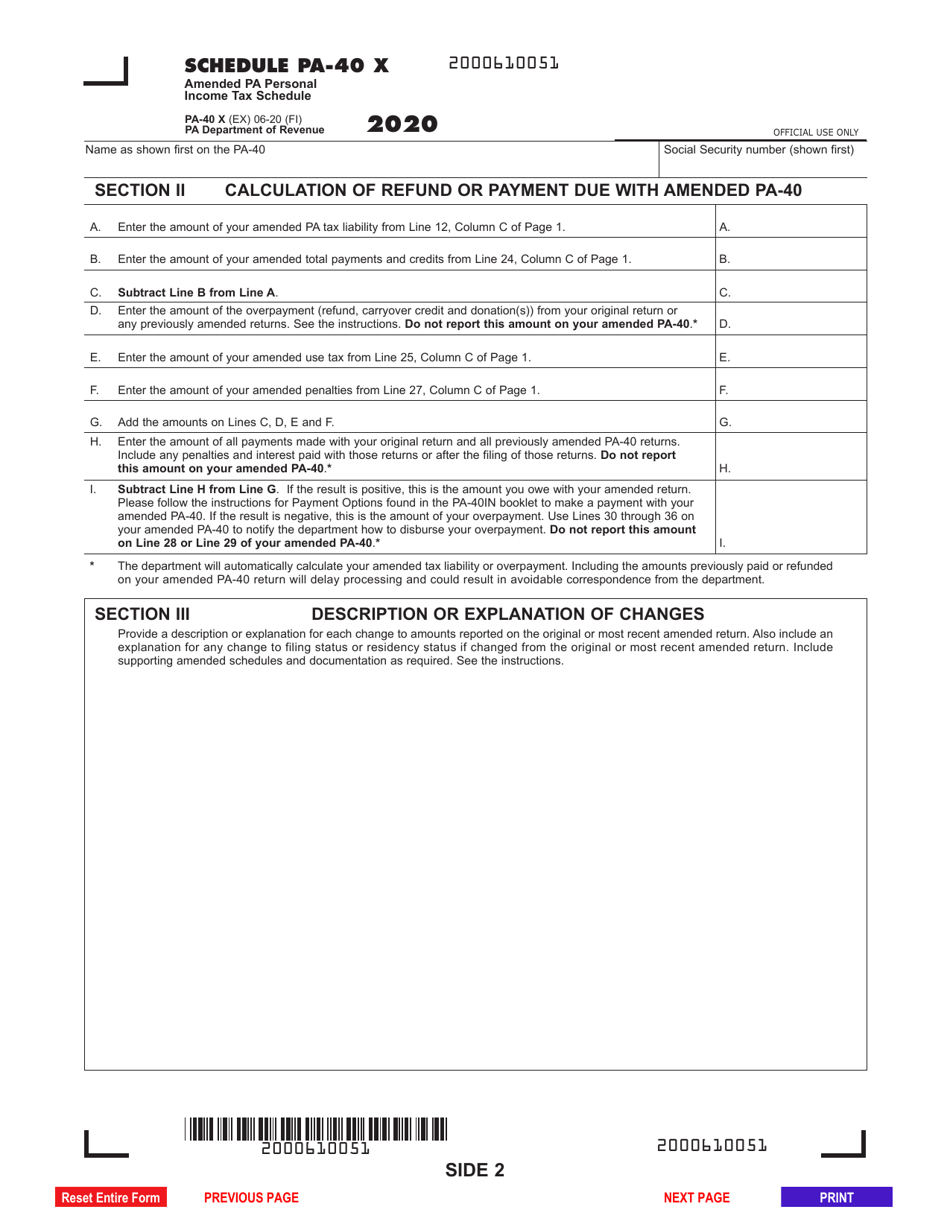

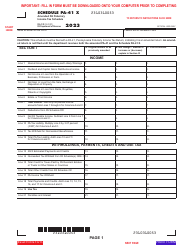

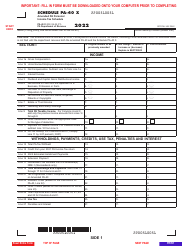

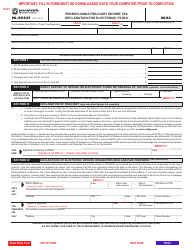

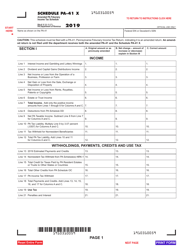

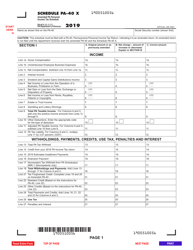

Form PA-40 Schedule PA-40 X

for the current year.

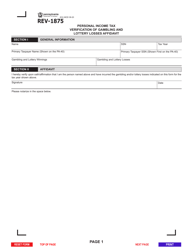

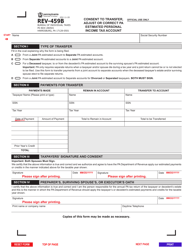

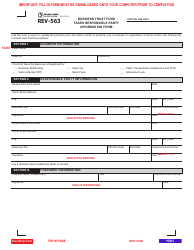

Form PA-40 Schedule PA-40 X Amended Pa Personal Income Tax Schedule - Pennsylvania

What Is Form PA-40 Schedule PA-40 X?

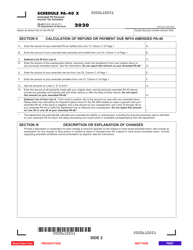

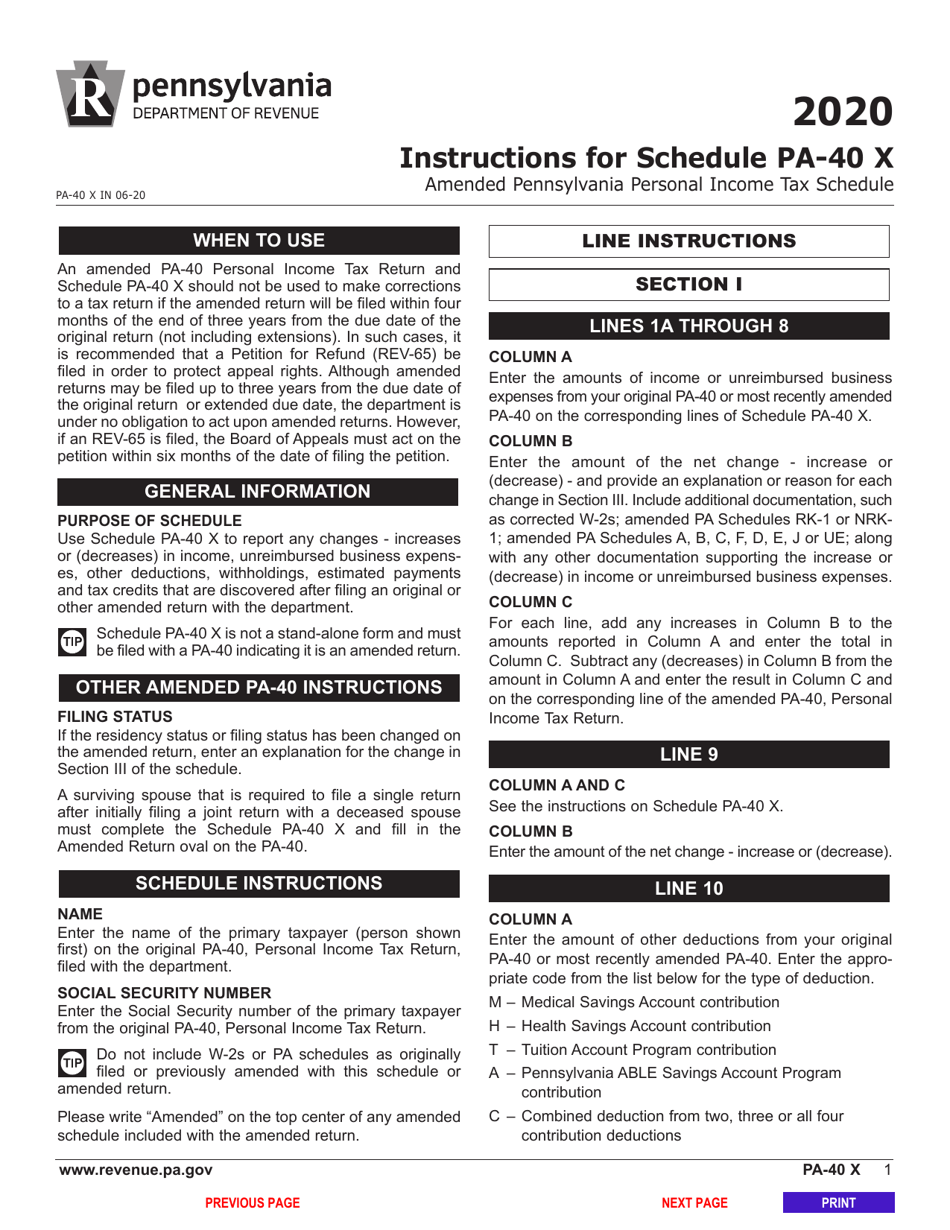

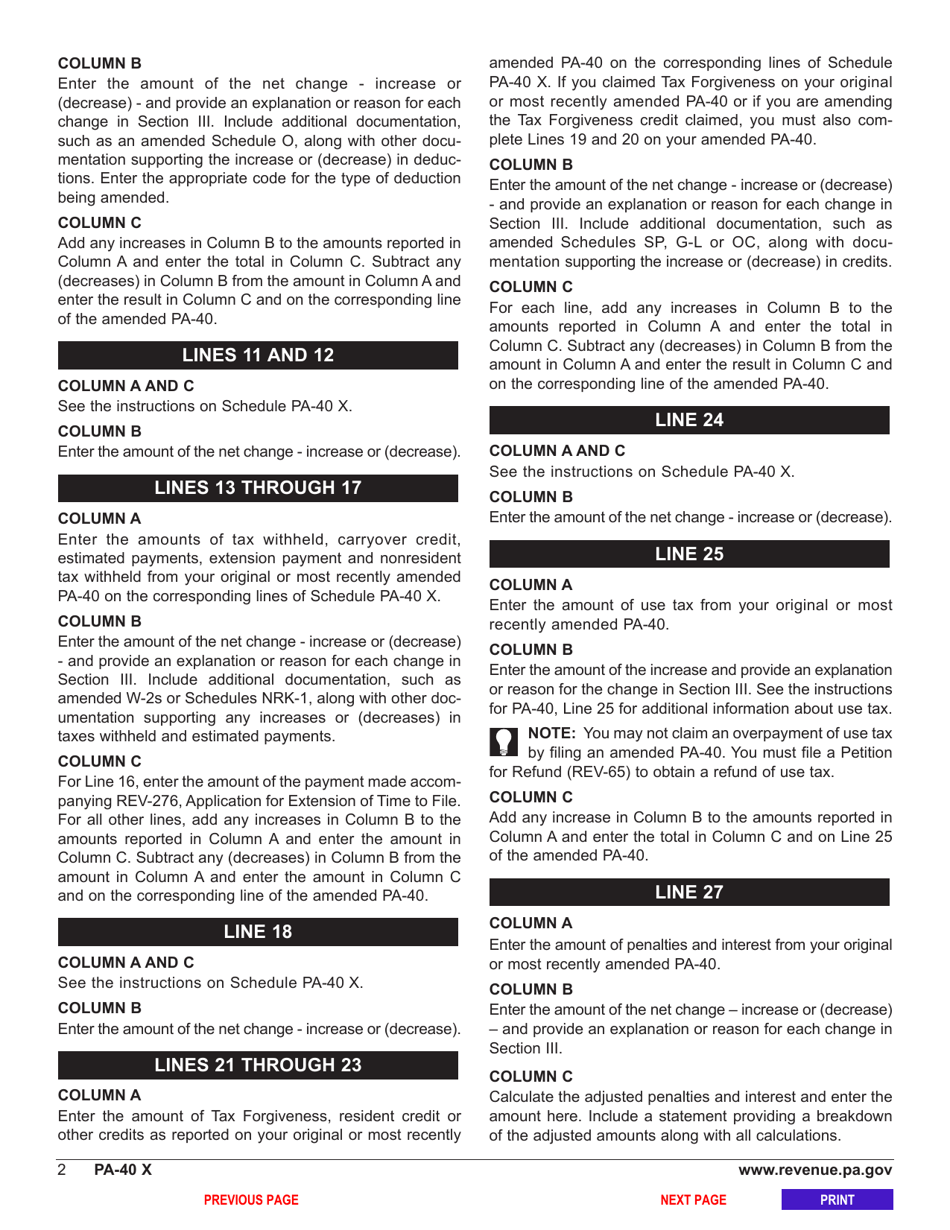

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule PA-40 X?

A: Form PA-40 Schedule PA-40 X is the Amended PA Personal IncomeTax Schedule used in Pennsylvania.

Q: When is Form PA-40 Schedule PA-40 X used?

A: Form PA-40 Schedule PA-40 X is used when amending your Pennsylvania Personal Income Tax return.

Q: What is the purpose of Form PA-40 Schedule PA-40 X?

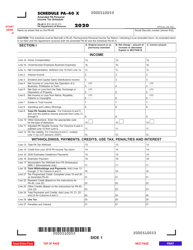

A: The purpose of Form PA-40 Schedule PA-40 X is to report changes or corrections to a previously filed Pennsylvania Personal Income Tax return.

Q: Is there a deadline for filing Form PA-40 Schedule PA-40 X?

A: Yes, Form PA-40 Schedule PA-40 X must be filed within 3 years from the original due date of the Pennsylvania Personal Income Tax return being amended.

Q: Are there any fees associated with filing Form PA-40 Schedule PA-40 X?

A: No, there are no fees associated with filing Form PA-40 Schedule PA-40 X.

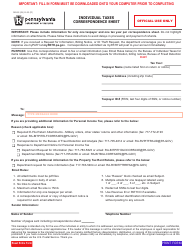

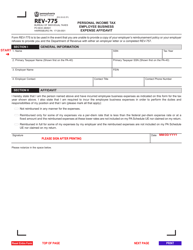

Q: Do I need to include any supporting documents with Form PA-40 Schedule PA-40 X?

A: Yes, you may need to include supporting documents such as W-2 forms or other relevant tax documents.

Q: Can Form PA-40 Schedule PA-40 X be e-filed?

A: No, Form PA-40 Schedule PA-40 X cannot be e-filed and must be filed by mail.

Q: What should I do if I made a mistake on my Pennsylvania Personal Income Tax return?

A: If you made a mistake on your Pennsylvania Personal Income Tax return, you should file Form PA-40 Schedule PA-40 X to correct the error.

Q: Is there a penalty for filing Form PA-40 Schedule PA-40 X?

A: There may be penalties and interest assessed if you owe additional taxes as a result of filing Form PA-40 Schedule PA-40 X, so it is important to review your amended return carefully before filing.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule PA-40 X by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.