This version of the form is not currently in use and is provided for reference only. Download this version of

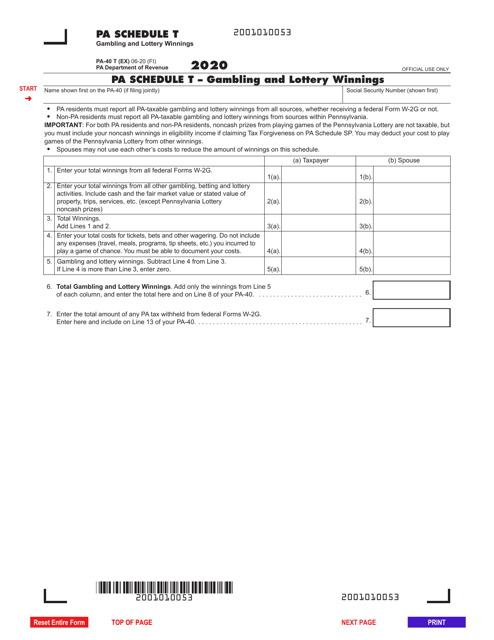

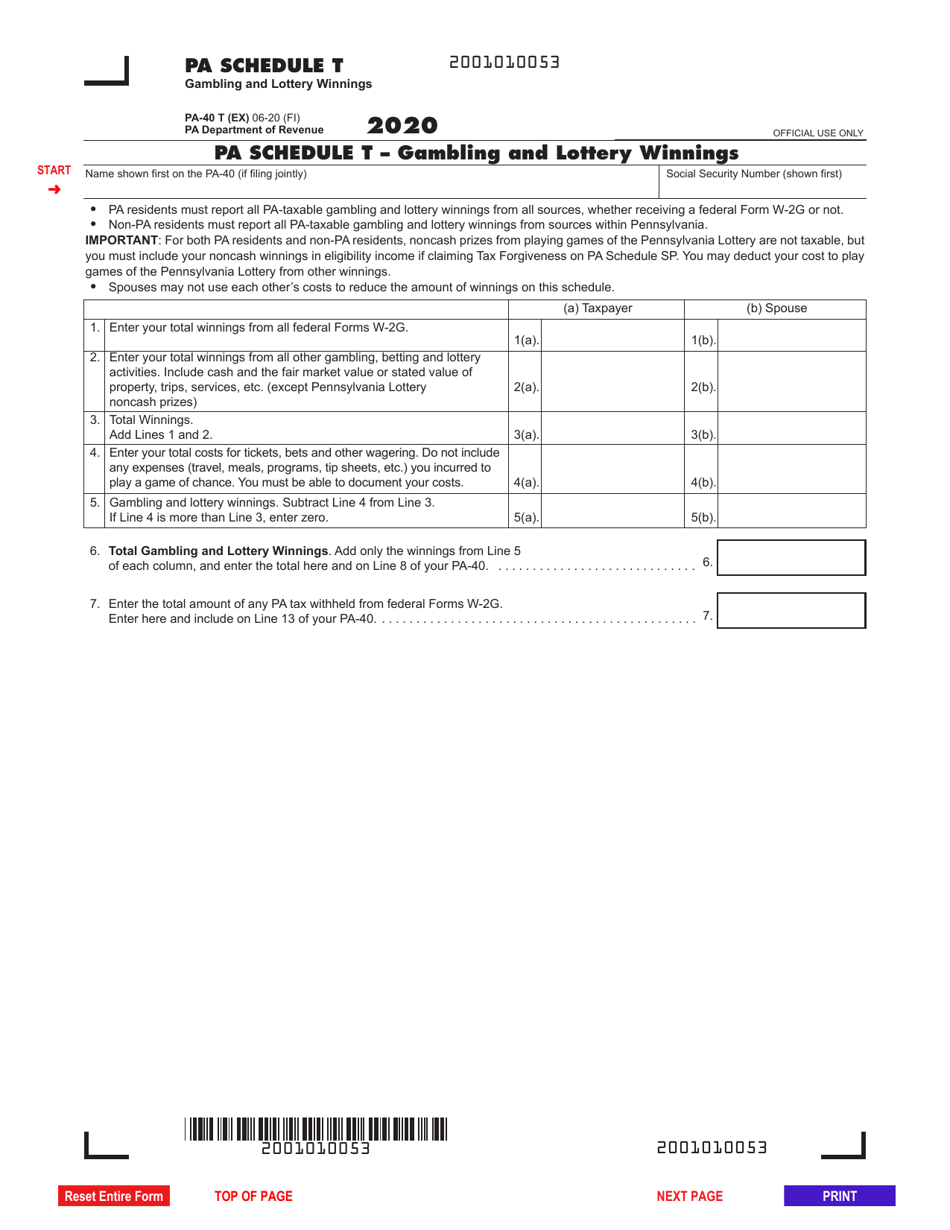

Form PA-40 Schedule T

for the current year.

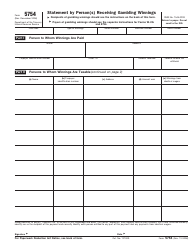

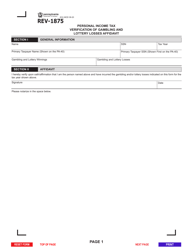

Form PA-40 Schedule T Gambling and Lottery Winnings - Pennsylvania

What Is Form PA-40 Schedule T?

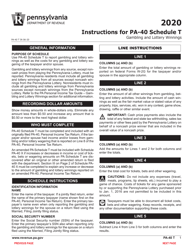

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule T?

A: Form PA-40 Schedule T is a tax form used by residents of Pennsylvania to report gambling and lottery winnings.

Q: Who needs to file Form PA-40 Schedule T?

A: Residents of Pennsylvania who have gambling or lottery winnings within the tax year need to file Form PA-40 Schedule T.

Q: What is considered gambling or lottery winnings?

A: Gambling or lottery winnings include but are not limited to casino winnings, lottery prizes, and winnings from horse racing or other gambling activities.

Q: Can I e-file Form PA-40 Schedule T?

A: Yes, Form PA-40 Schedule T can be e-filed along with the Pennsylvania personal income tax return.

Q: When is the deadline to file Form PA-40 Schedule T?

A: Form PA-40 Schedule T is generally due on the same date as the Pennsylvania personal income tax return, which is typically April 15th, unless that date falls on a weekend or holiday.

Q: Do I need to include documentation of my gambling or lottery winnings with Form PA-40 Schedule T?

A: Yes, it is important to keep records and documentation of your gambling or lottery winnings to support the information reported on Form PA-40 Schedule T. However, you do not need to submit these documents with your tax return unless requested by the Pennsylvania Department of Revenue.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule T by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.