This version of the form is not currently in use and is provided for reference only. Download this version of

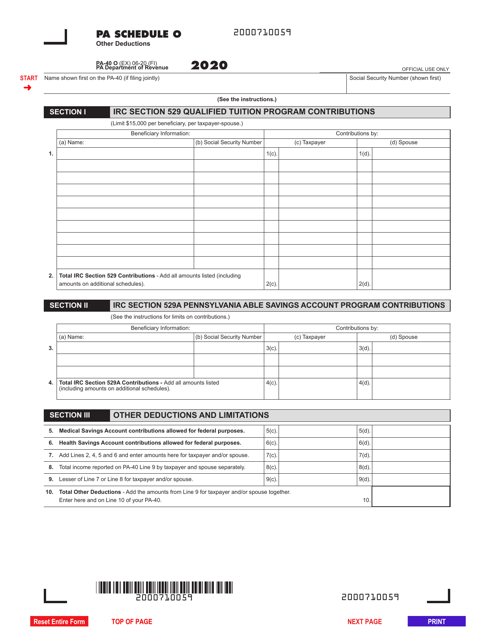

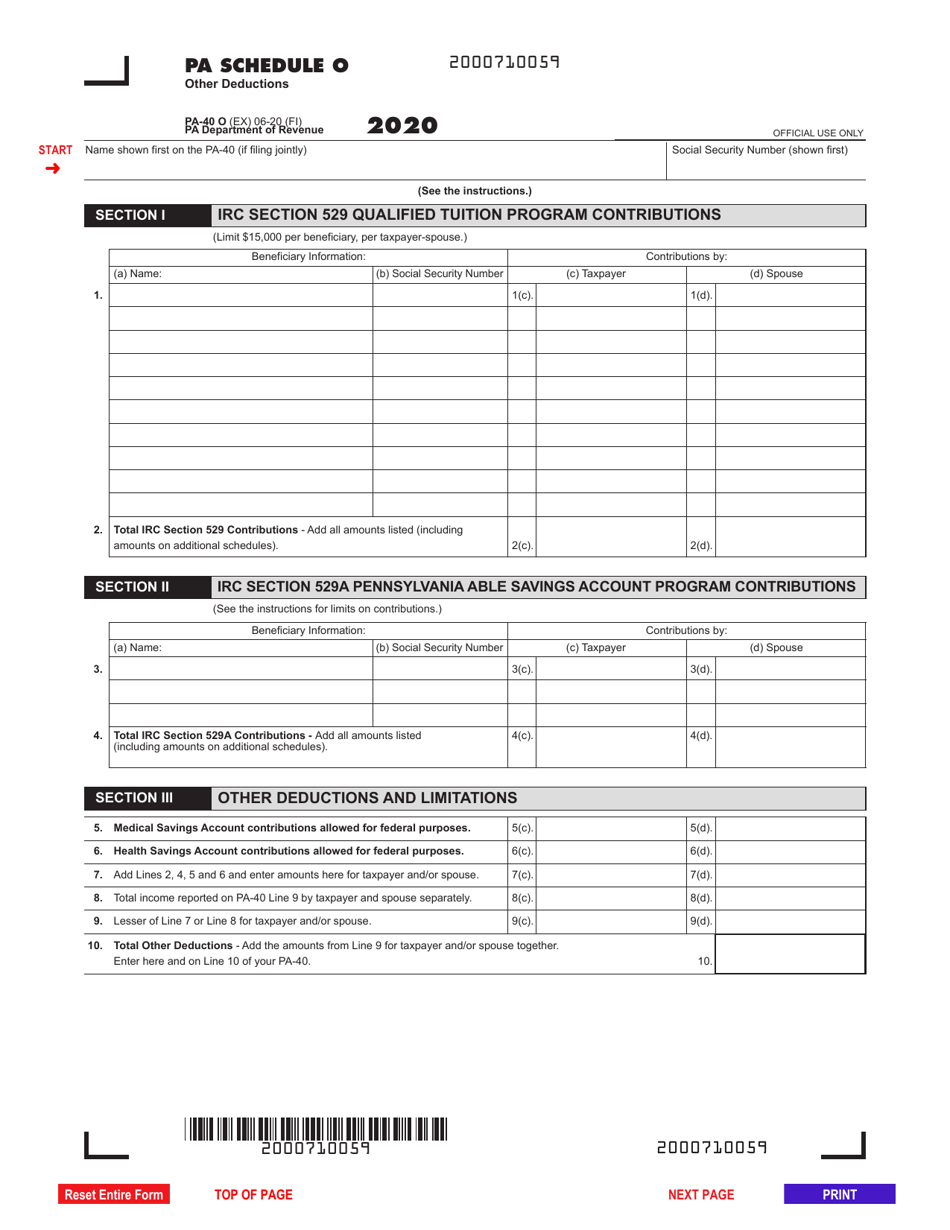

Form PA-40 Schedule O

for the current year.

Form PA-40 Schedule O Other Deductions - Pennsylvania

What Is Form PA-40 Schedule O?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule O?

A: Form PA-40 Schedule O is a form used by Pennsylvania residents to itemize and claim other deductions on their state tax return.

Q: What kind of deductions can be claimed on Form PA-40 Schedule O?

A: You can claim deductions such as medical expenses, charitable contributions, casualty and theft losses, certain taxes, and other miscellaneous expenses on Form PA-40 Schedule O.

Q: Do I need to file Form PA-40 Schedule O?

A: You only need to file Form PA-40 Schedule O if you have eligible deductions to claim that are not included on the standard deduction amount.

Q: When is the deadline to file Form PA-40 Schedule O?

A: The deadline to file Form PA-40 Schedule O is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Can I e-file Form PA-40 Schedule O?

A: Yes, you can e-file Form PA-40 Schedule O if you are filing your Pennsylvania state tax return electronically.

Q: Is there a fee to file Form PA-40 Schedule O?

A: No, there is no separate fee to file Form PA-40 Schedule O. However, there may be a fee if you choose to use a tax preparation service or software.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule O by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.