This version of the form is not currently in use and is provided for reference only. Download this version of

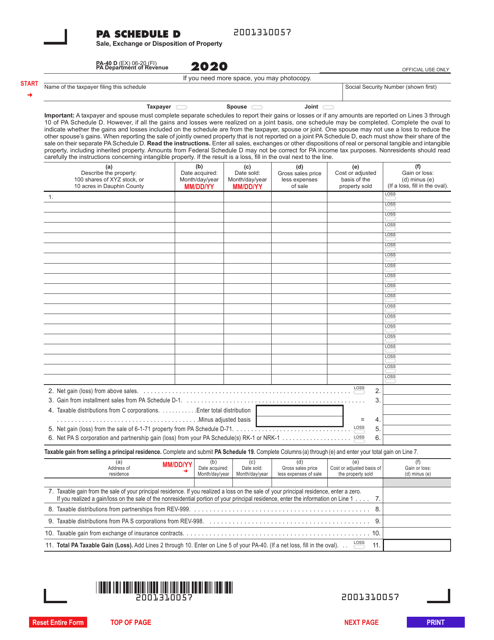

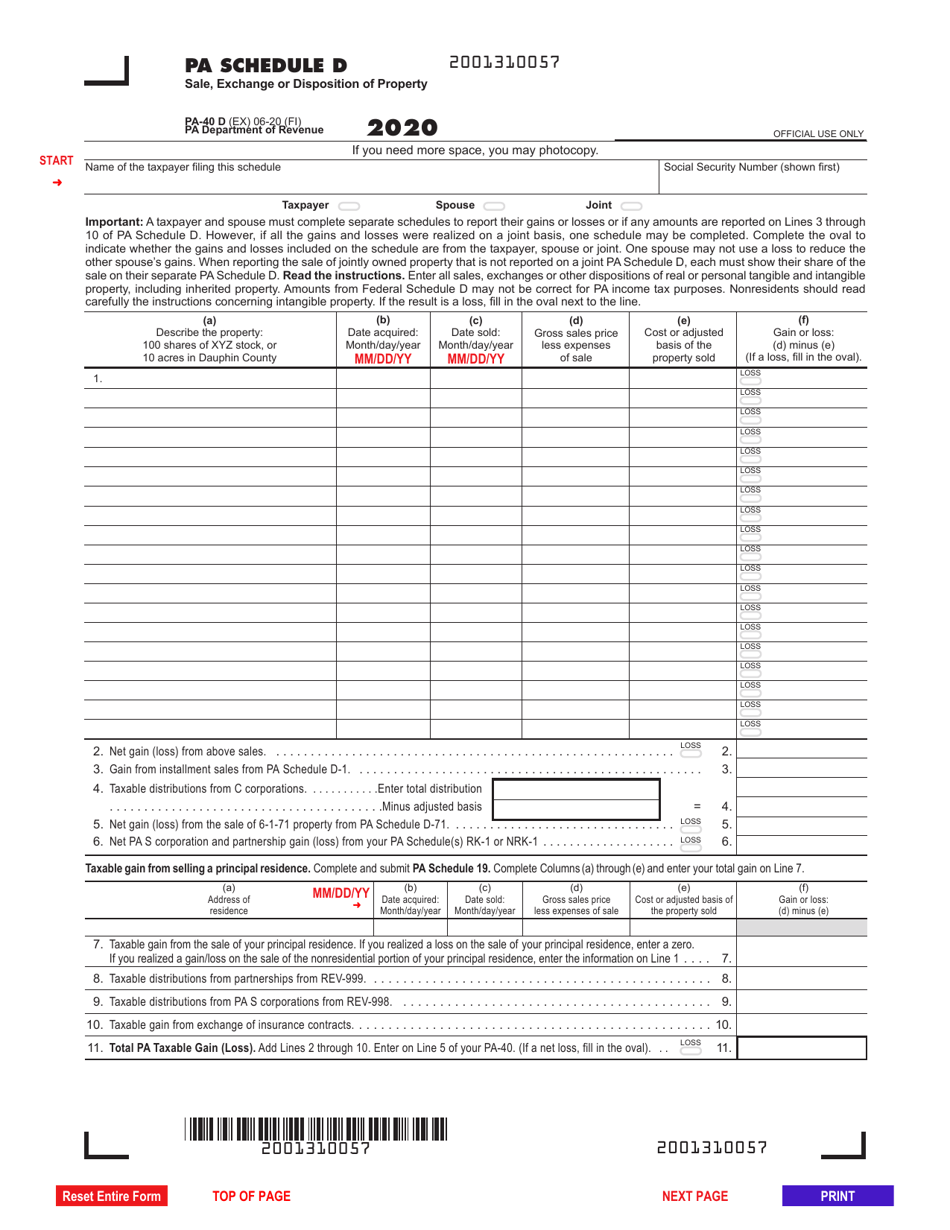

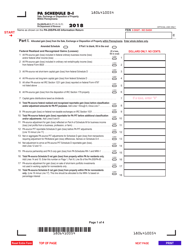

Form PA-40 Schedule D

for the current year.

Form PA-40 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-40 Schedule D?

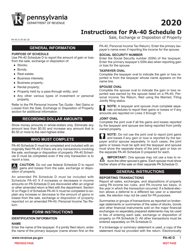

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule D?

A: Form PA-40 Schedule D is a form used in Pennsylvania to report the sale, exchange, or disposition of property for individuals.

Q: Who needs to file Form PA-40 Schedule D?

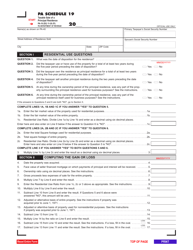

A: Individuals who have sold, exchanged, or disposed of property in Pennsylvania need to file Form PA-40 Schedule D.

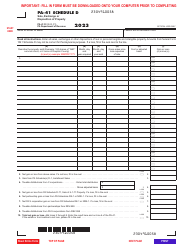

Q: What information is required on Form PA-40 Schedule D?

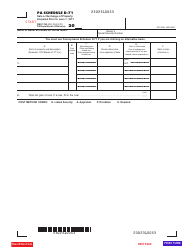

A: Form PA-40 Schedule D requires details about the property, the date of sale, the sales price, and any adjustments or gain or loss.

Q: When is Form PA-40 Schedule D due?

A: Form PA-40 Schedule D is due on the same date as your Pennsylvania personal income tax return, which is typically April 15th.

Q: Are there any exceptions to filing Form PA-40 Schedule D?

A: There are certain exceptions for transactions such as the sale of a personal residence or certain small business assets. Check the instructions for Form PA-40 Schedule D for more details.

Q: Can I file Form PA-40 Schedule D electronically?

A: Yes, you can file Form PA-40 Schedule D electronically if you are filing your Pennsylvania personal income tax return electronically.

Q: Do I need to include supporting documents with Form PA-40 Schedule D?

A: You may need to include supporting documents such as a settlement statement or receipts to verify the information reported on Form PA-40 Schedule D. Keep these documents for your records in case of an audit.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.