This version of the form is not currently in use and is provided for reference only. Download this version of

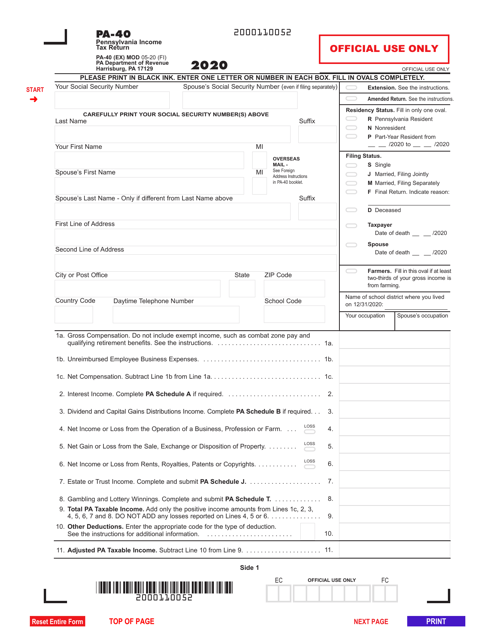

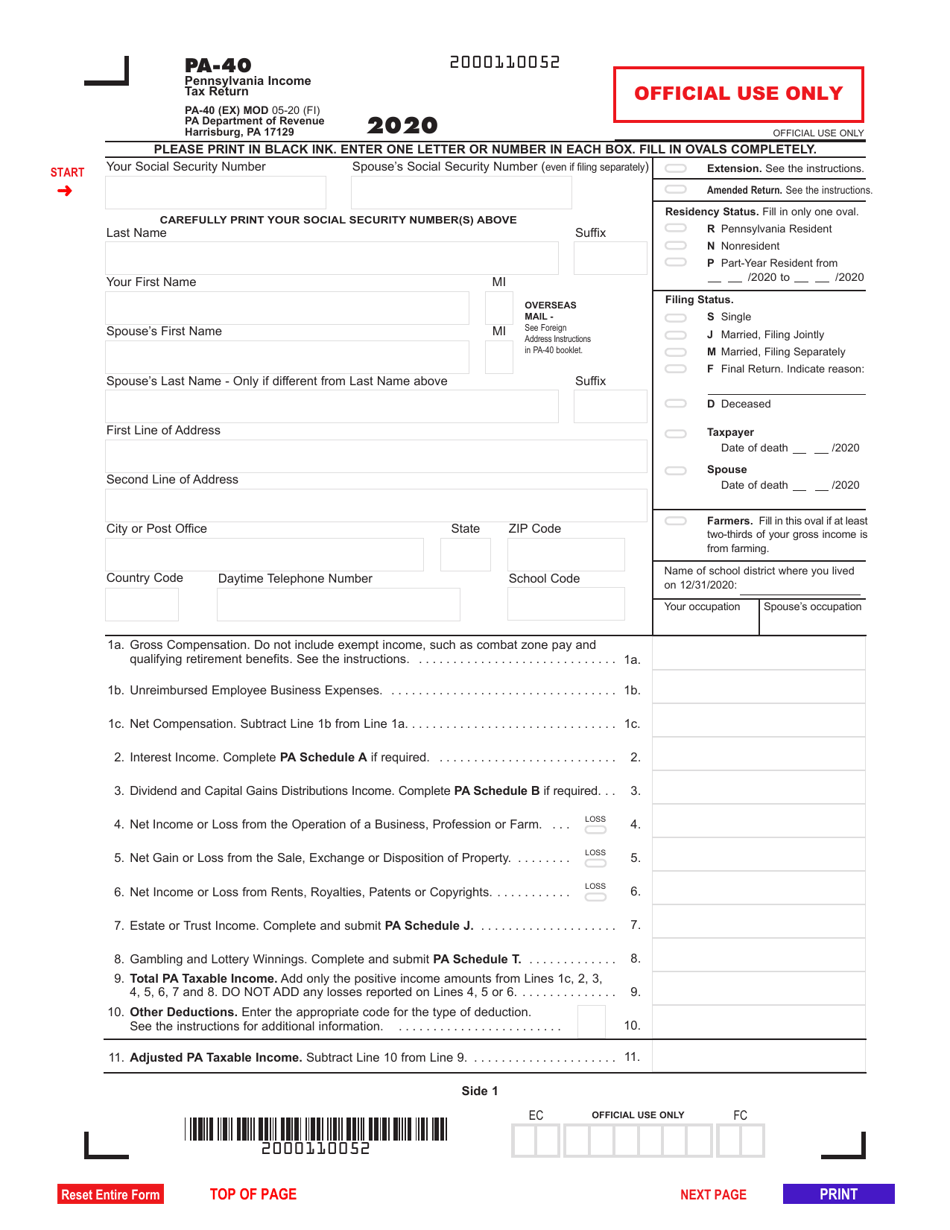

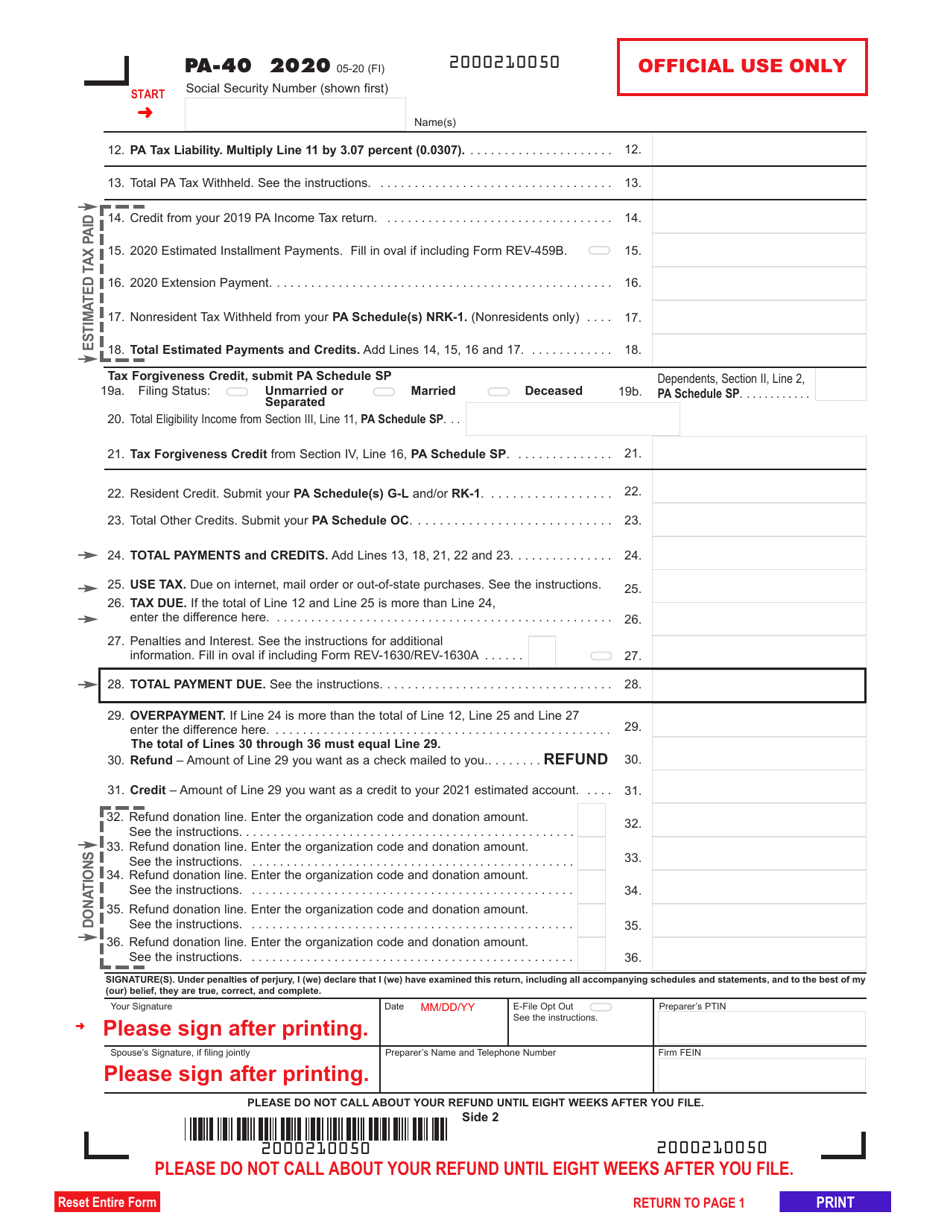

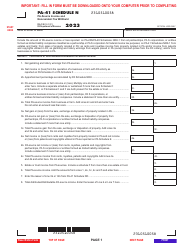

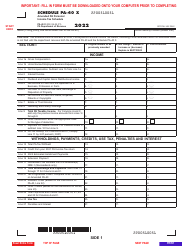

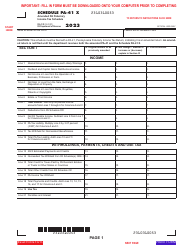

Form PA-40

for the current year.

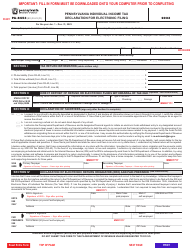

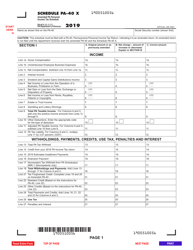

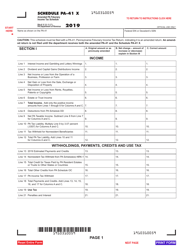

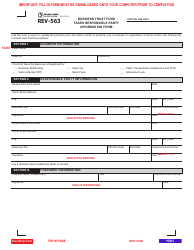

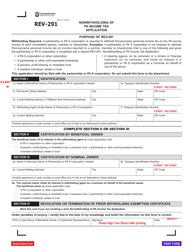

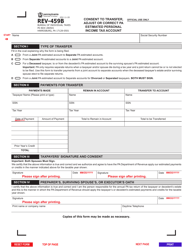

Form PA-40 Pennsylvania Income Tax Return - Pennsylvania

What Is Form PA-40?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PA-40?

A: The Form PA-40 is the Pennsylvania Income Tax Return.

Q: Who needs to file Form PA-40?

A: Any resident of Pennsylvania who earned income during the tax year must file Form PA-40.

Q: What information is required on Form PA-40?

A: Form PA-40 requires basic personal information and details about your income and deductions.

Q: When is the deadline to file Form PA-40?

A: Form PA-40 must be filed by April 15th of each year.

Q: What if I don't owe any taxes?

A: Even if you don't owe any taxes, you still need to file Form PA-40 if you earned income in Pennsylvania.

Q: Are there any exemptions or deductions available on Form PA-40?

A: Yes, Form PA-40 provides various exemptions and deductions that may help reduce your tax liability.

Q: Can I file Form PA-40 jointly with my spouse?

A: Yes, married couples have the option to file a joint return using Form PA-40.

Q: What happens if I don't file Form PA-40?

A: Failure to file Form PA-40 may result in penalties and interest charges.

Q: Can I amend my Form PA-40 if I made a mistake?

A: Yes, you can amend your Form PA-40 if you made a mistake or need to make changes to your original return.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.