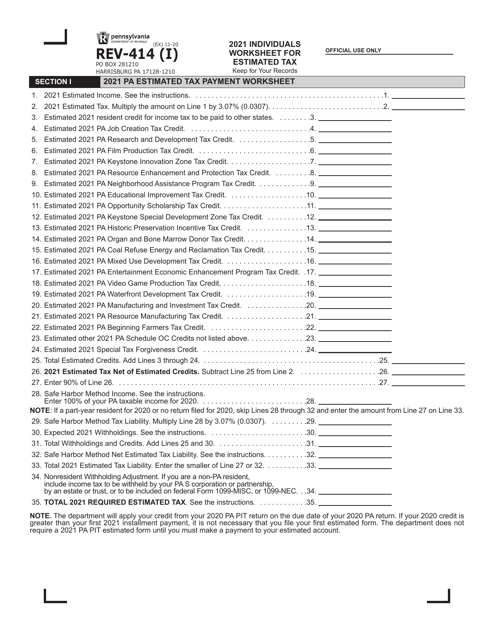

This version of the form is not currently in use and is provided for reference only. Download this version of

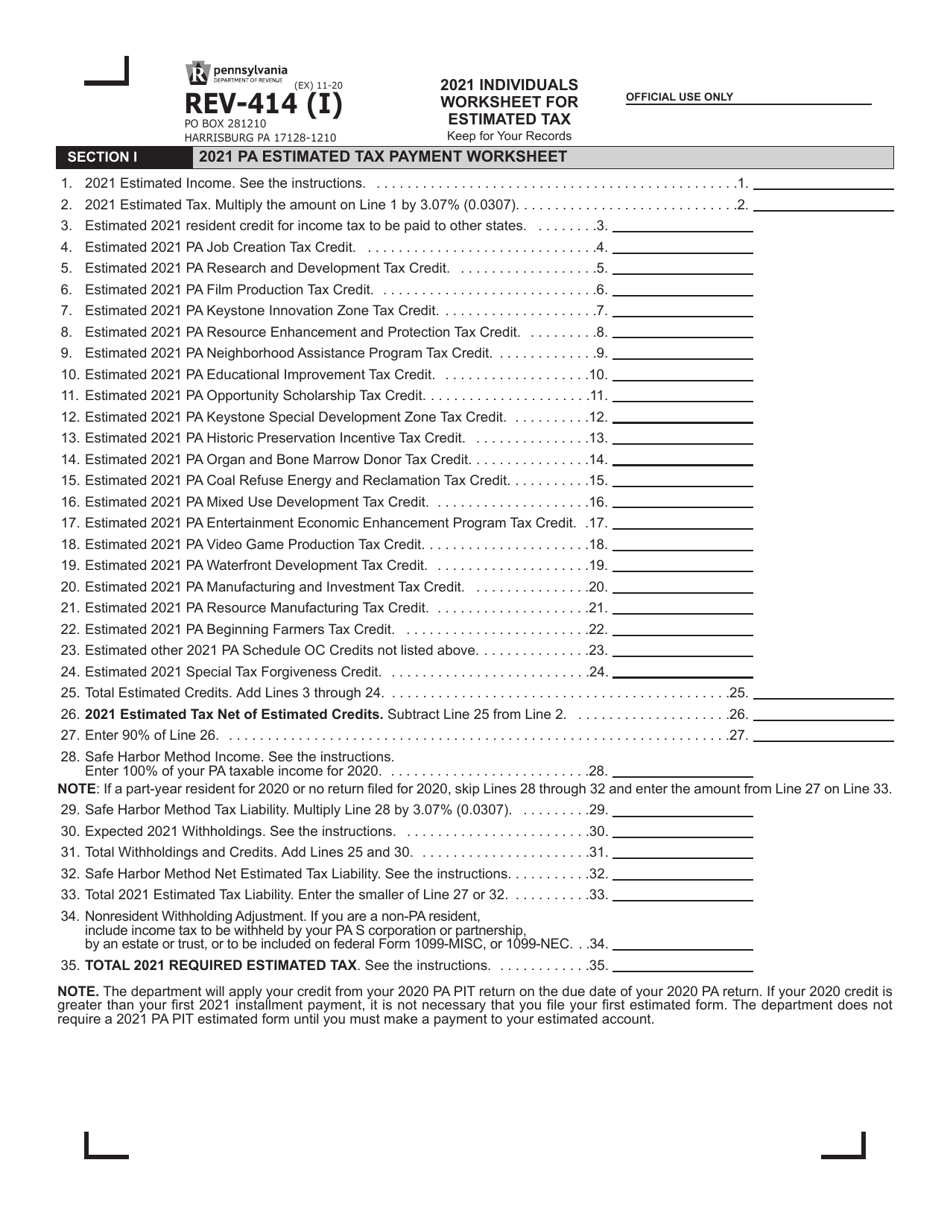

Form REV-414 (I)

for the current year.

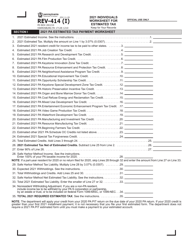

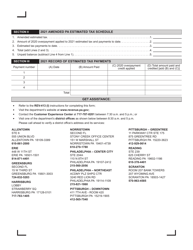

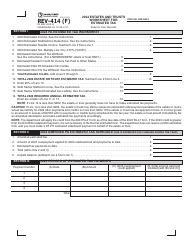

Form REV-414 (I) Individuals Worksheet for Estimated Tax - Pennsylvania

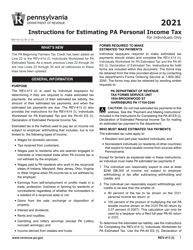

What Is Form REV-414 (I)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-414 (I)?

A: Form REV-414 (I) is the Individuals Worksheet for Estimated Tax in Pennsylvania.

Q: Who needs to fill out Form REV-414 (I)?

A: Individuals who need to make estimated tax payments in Pennsylvania.

Q: What is the purpose of Form REV-414 (I)?

A: The purpose of Form REV-414 (I) is to help individuals calculate their estimated tax payments for Pennsylvania.

Q: When is Form REV-414 (I) due?

A: Form REV-414 (I) is due on April 15th of each tax year.

Q: Can I submit Form REV-414 (I) electronically?

A: Yes, you can submit Form REV-414 (I) electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: What information do I need to fill out Form REV-414 (I)?

A: You will need to have your income, deductions, and tax credits information available to fill out Form REV-414 (I).

Q: Do I need to file Form REV-414 (I) if I am not required to make estimated tax payments?

A: No, you only need to fill out Form REV-414 (I) if you are required to make estimated tax payments in Pennsylvania.

Q: Is there a penalty for not filing Form REV-414 (I) if I am required to?

A: Yes, there may be a penalty for not making estimated tax payments or for underpayment of estimated tax in Pennsylvania.

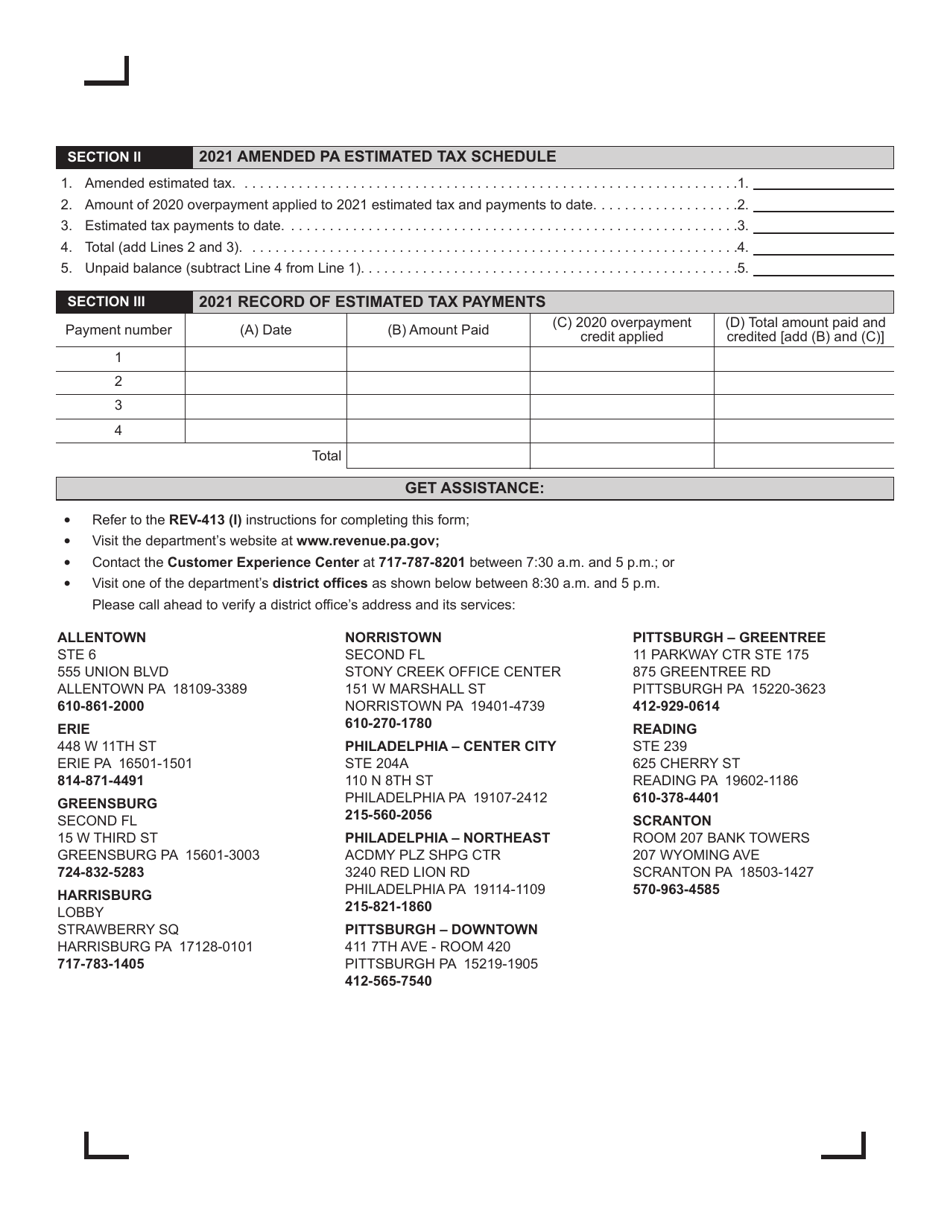

Q: Can I make changes to my estimated tax payments after submitting Form REV-414 (I)?

A: Yes, you can make changes to your estimated tax payments by submitting an amended Form REV-414 (I) to the Pennsylvania Department of Revenue.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV-414 (I) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.