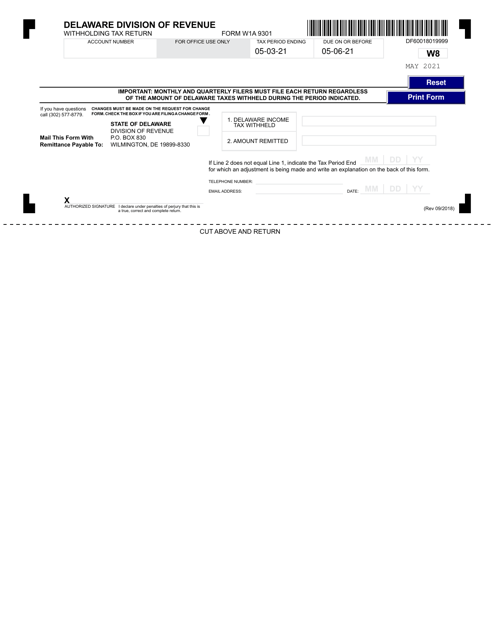

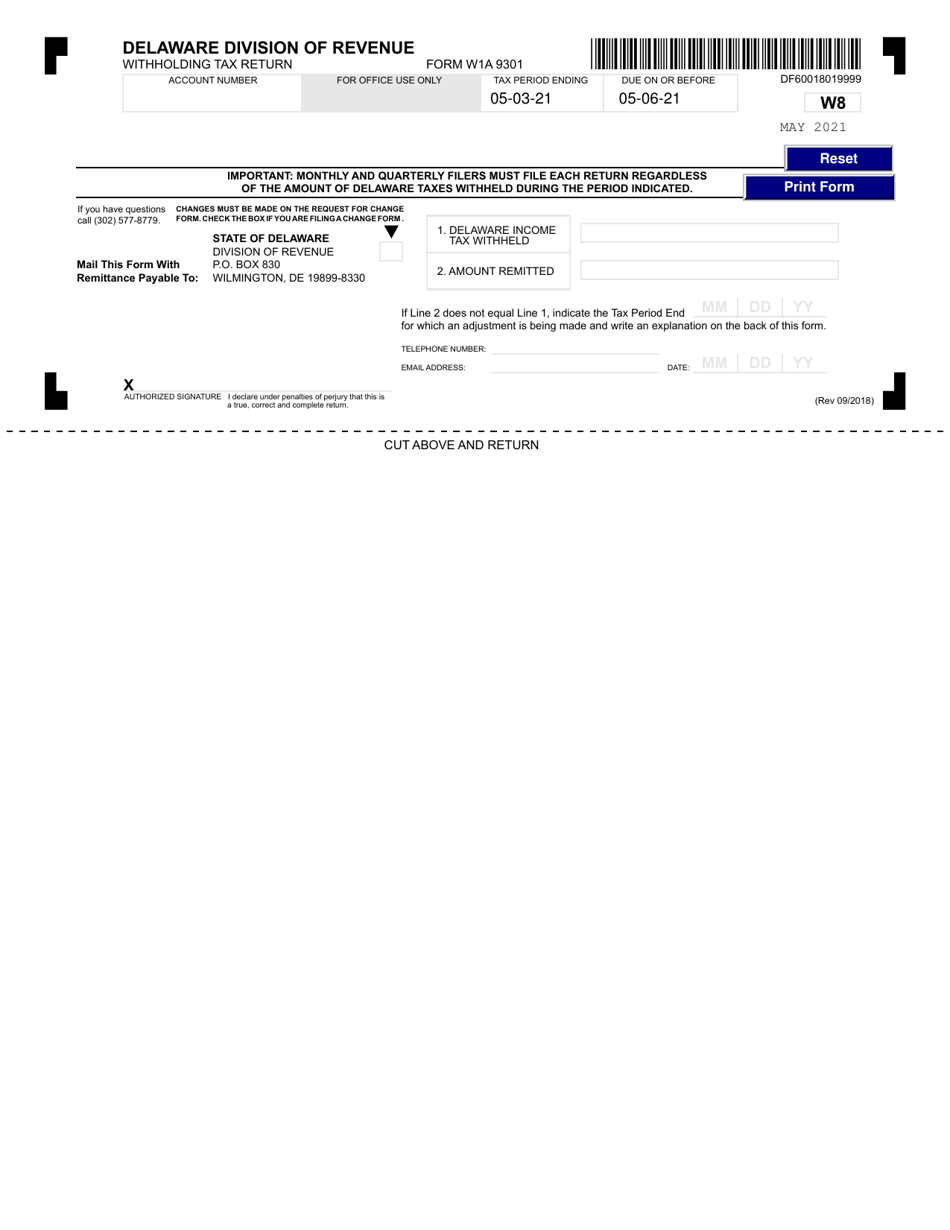

Form W1A 9301 8th Monthly Withholding Reporting Form - May - Delaware

What Is Form W1A 9301?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W1A?

A: Form W1A is the 8th Monthly Withholding Reporting Form.

Q: What is the purpose of Form W1A?

A: The purpose of Form W1A is to report monthly withholdings.

Q: Who needs to file Form W1A?

A: Employers in Delaware who withhold taxes from employee wages must file Form W1A.

Q: What is the due date for filing Form W1A?

A: Form W1A is due on a monthly basis. The specific due date for May can be found on the form.

Q: Are there any penalties for not filing Form W1A?

A: Yes, there may be penalties for late or non-filing of Form W1A. It is important to file on time to avoid penalties.

Form Details:

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W1A 9301 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.