This version of the form is not currently in use and is provided for reference only. Download this version of

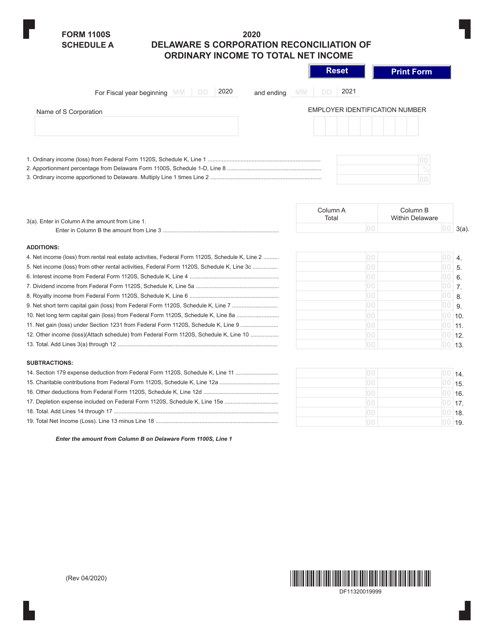

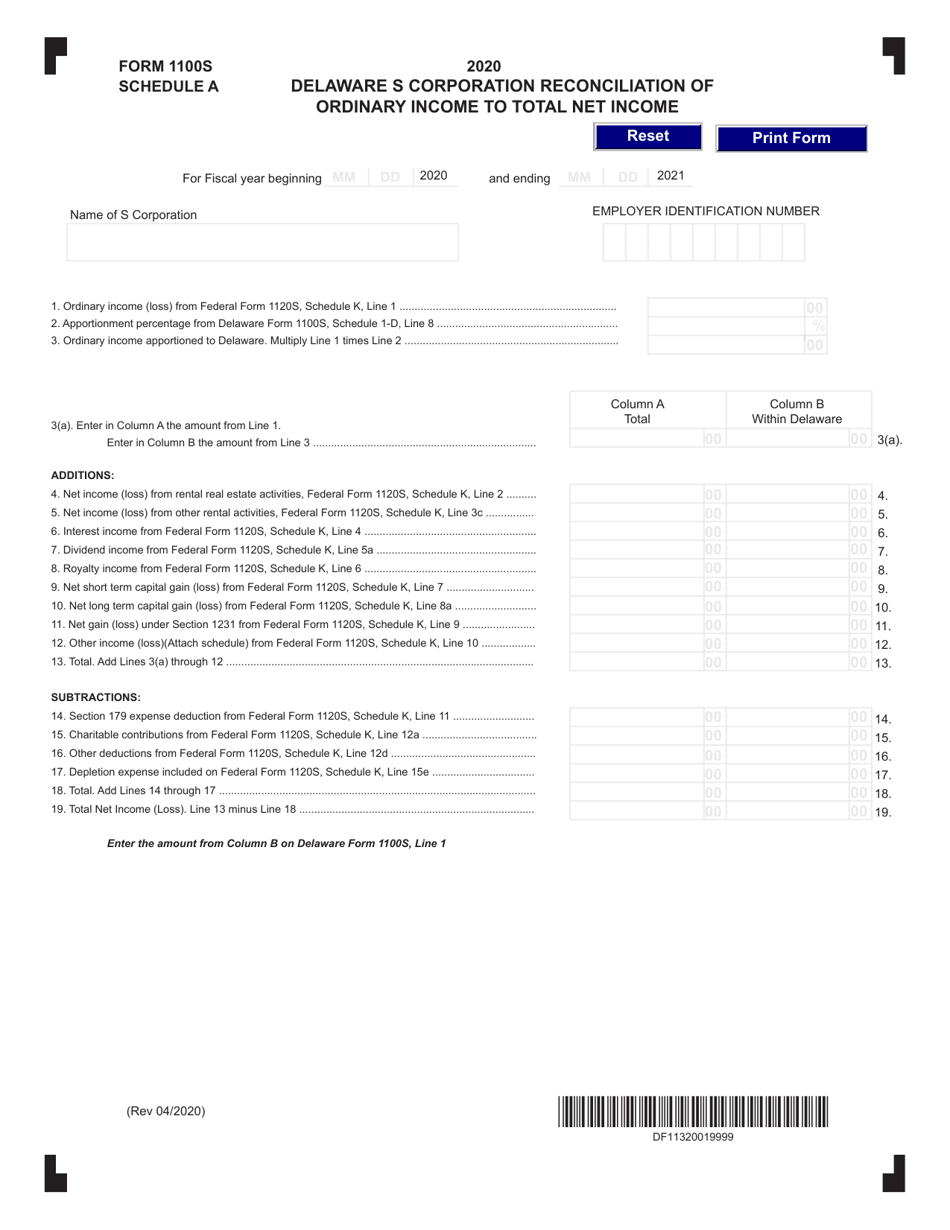

Form 1100S Schedule A

for the current year.

Form 1100S Schedule A Delaware S Corporation Reconciliation of Ordinary Income to Total Net Income - Delaware

What Is Form 1100S Schedule A?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100S?

A: Form 1100S is a tax form used by Delaware S corporations.

Q: What is Schedule A?

A: Schedule A is a section of Form 1100S used to reconcile ordinary income to total net income.

Q: What is an S corporation?

A: An S corporation is a type of corporation that passes its income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: What is ordinary income?

A: Ordinary income refers to the regular income earned from the usual activities of a business, such as revenue from sales.

Q: What is total net income?

A: Total net income is the overall profit or loss of a business after all expenses, deductions, and taxes have been accounted for.

Q: Why is reconciliation necessary?

A: Reconciliation is necessary to align the reported ordinary income with the total net income of an S corporation.

Q: What information is required for Schedule A?

A: Schedule A requires information about adjustments, deductions, and other items that affect the calculation of total net income.

Q: Who needs to file Form 1100S Schedule A?

A: Delaware S corporations are required to file Form 1100S and complete Schedule A.

Q: When is the deadline to file Form 1100S Schedule A?

A: The deadline to file Form 1100S Schedule A is typically March 15th of the following tax year for calendar year filers.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100S Schedule A by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.