This version of the form is not currently in use and is provided for reference only. Download this version of

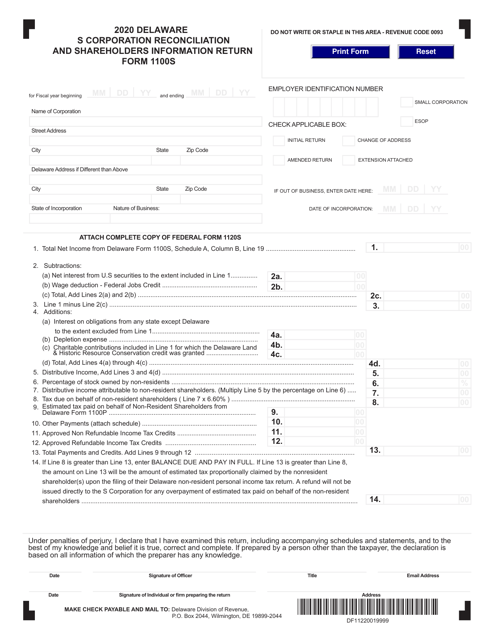

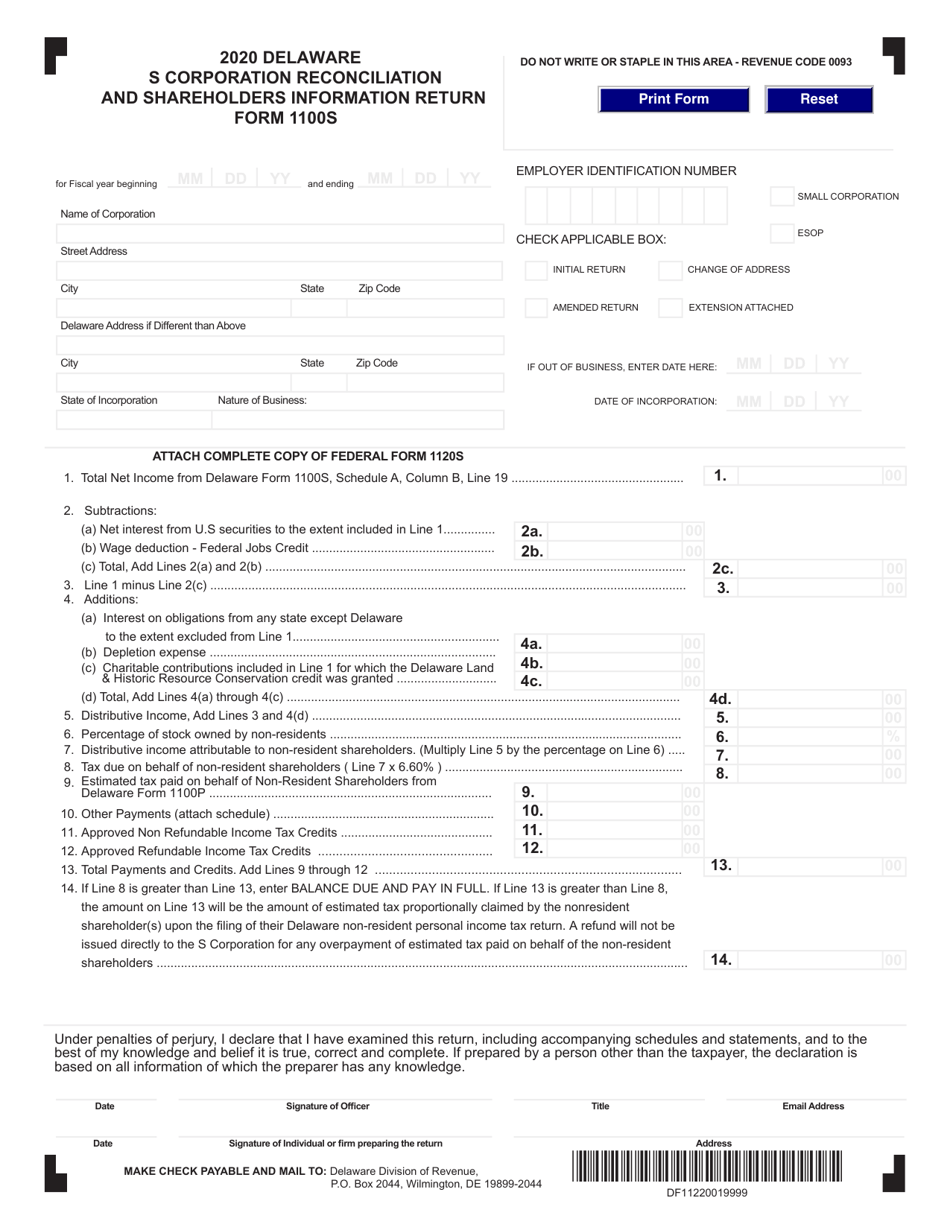

Form 1100S

for the current year.

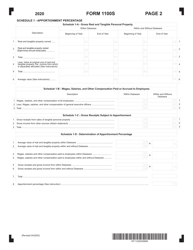

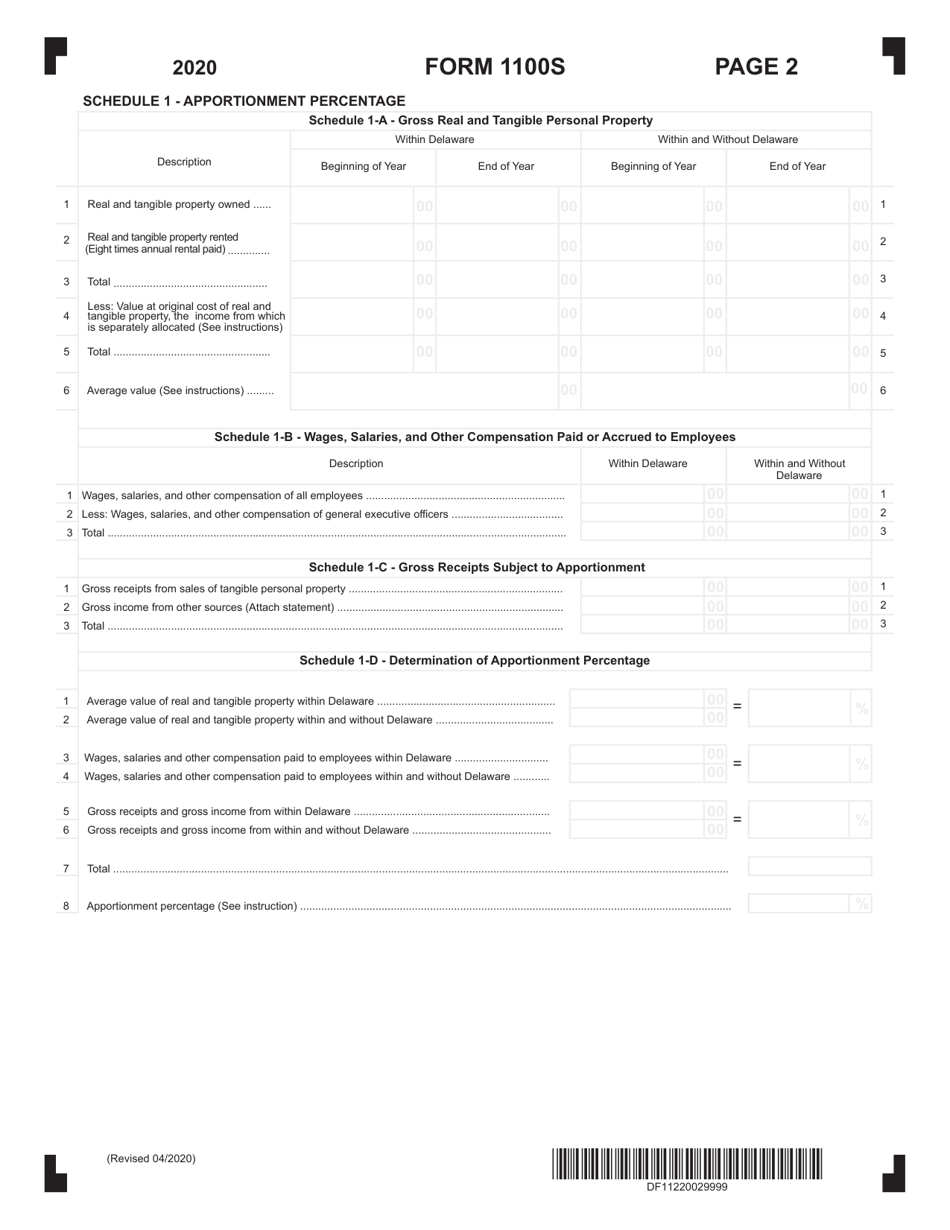

Form 1100S S Corporation Reconciliation and Shareholders Information Return - Delaware

What Is Form 1100S?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1100S?

A: Form 1100S is the S Corporation Reconciliation and Shareholders Information Return.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that has elected to be treated as a pass-through entity for tax purposes.

Q: Who needs to file Form 1100S?

A: S Corporations in Delaware need to file Form 1100S.

Q: What is the purpose of Form 1100S?

A: The purpose of Form 1100S is to report the income, deductions, and credits of an S Corporation.

Q: What information is required on Form 1100S?

A: Form 1100S requires information about the corporation's shareholders, income, deductions, and credits.

Q: When is Form 1100S due?

A: Form 1100S is due on or before the 15th day of the third month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form 1100S?

A: Yes, there may be penalties for late filing or failure to file Form 1100S.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1100S by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.