This version of the form is not currently in use and is provided for reference only. Download this version of

Form IB-83

for the current year.

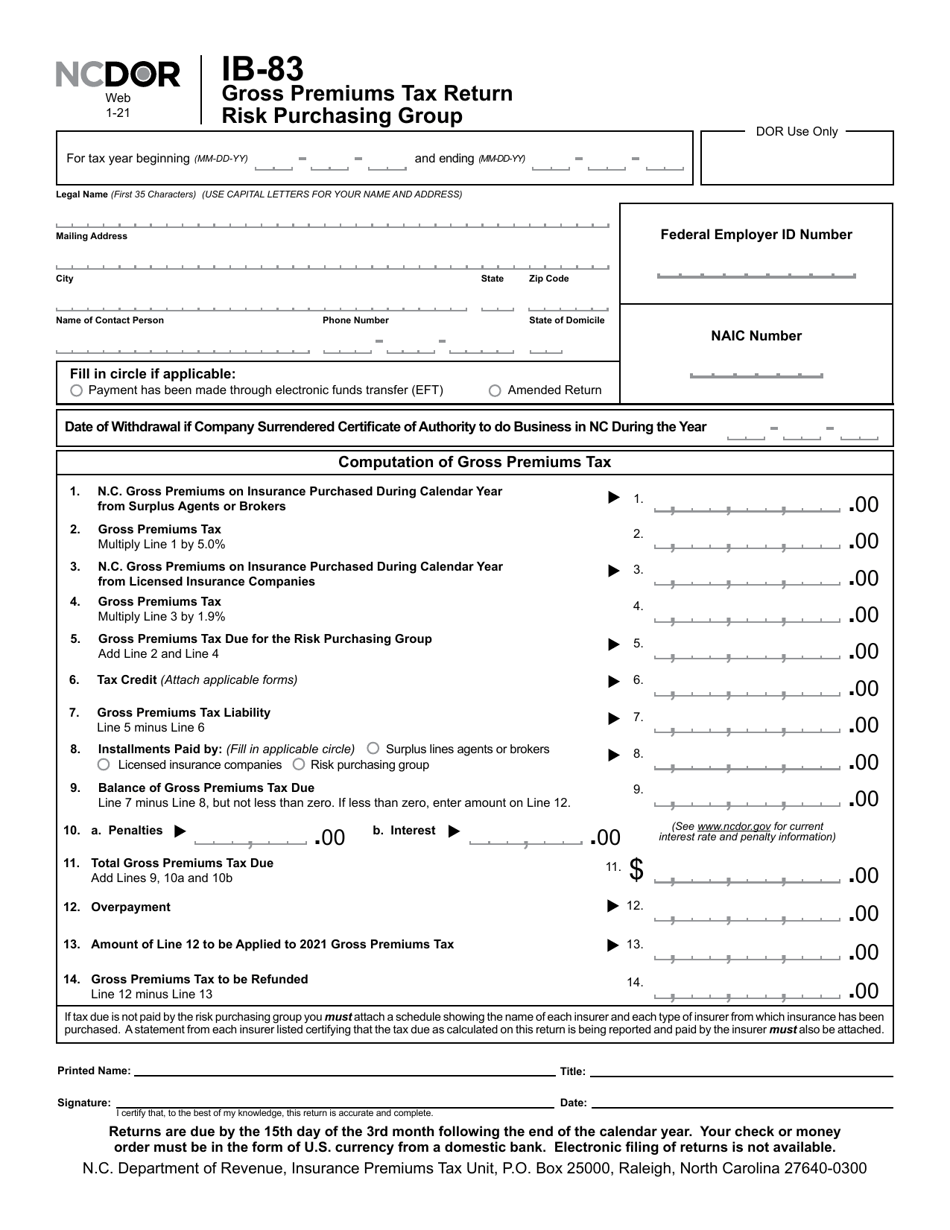

Form IB-83 Gross Premiums Tax Return Risk Purchasing Group - North Carolina

What Is Form IB-83?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-83?

A: Form IB-83 is the Gross Premiums Tax Return for Risk Purchasing Group in North Carolina.

Q: What is the purpose of Form IB-83?

A: The purpose of Form IB-83 is to report and pay the gross premiums tax for risk purchasing groups operating in North Carolina.

Q: Who needs to file Form IB-83?

A: Risk purchasing groups operating in North Carolina need to file Form IB-83.

Q: What is a risk purchasing group?

A: A risk purchasing group is an entity that purchases liability insurance on behalf of its members who share similar risks.

Q: What is the gross premiums tax?

A: The gross premiums tax is a tax imposed on the gross premiums received by insurance companies or risk purchasing groups.

Q: How often should Form IB-83 be filed?

A: Form IB-83 should be filed annually.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there are penalties for late or incorrect filing. It is important to file Form IB-83 accurately and on time to avoid penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

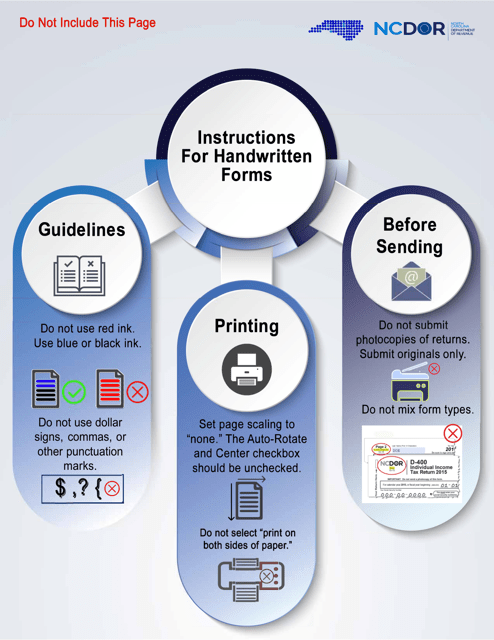

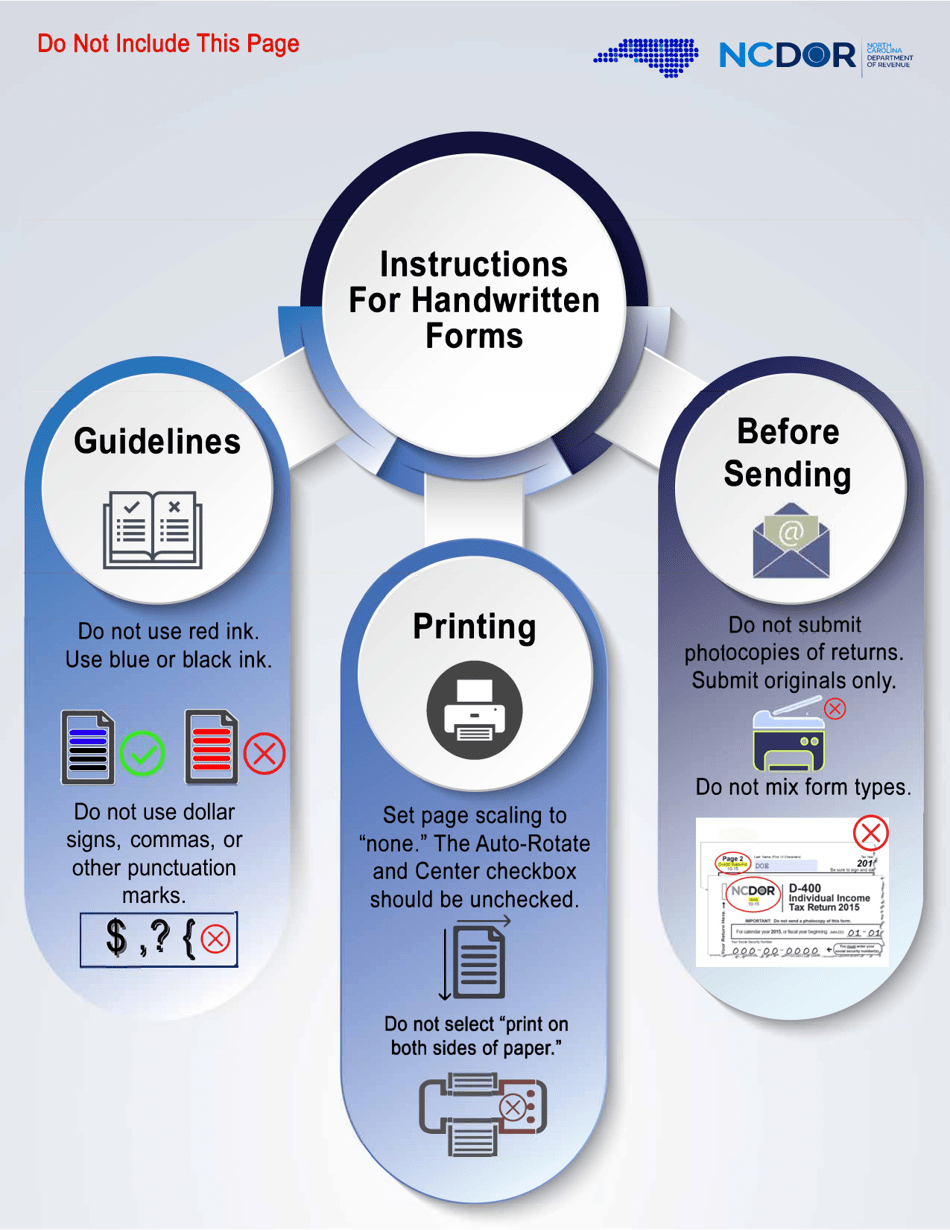

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-83 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.