This version of the form is not currently in use and is provided for reference only. Download this version of

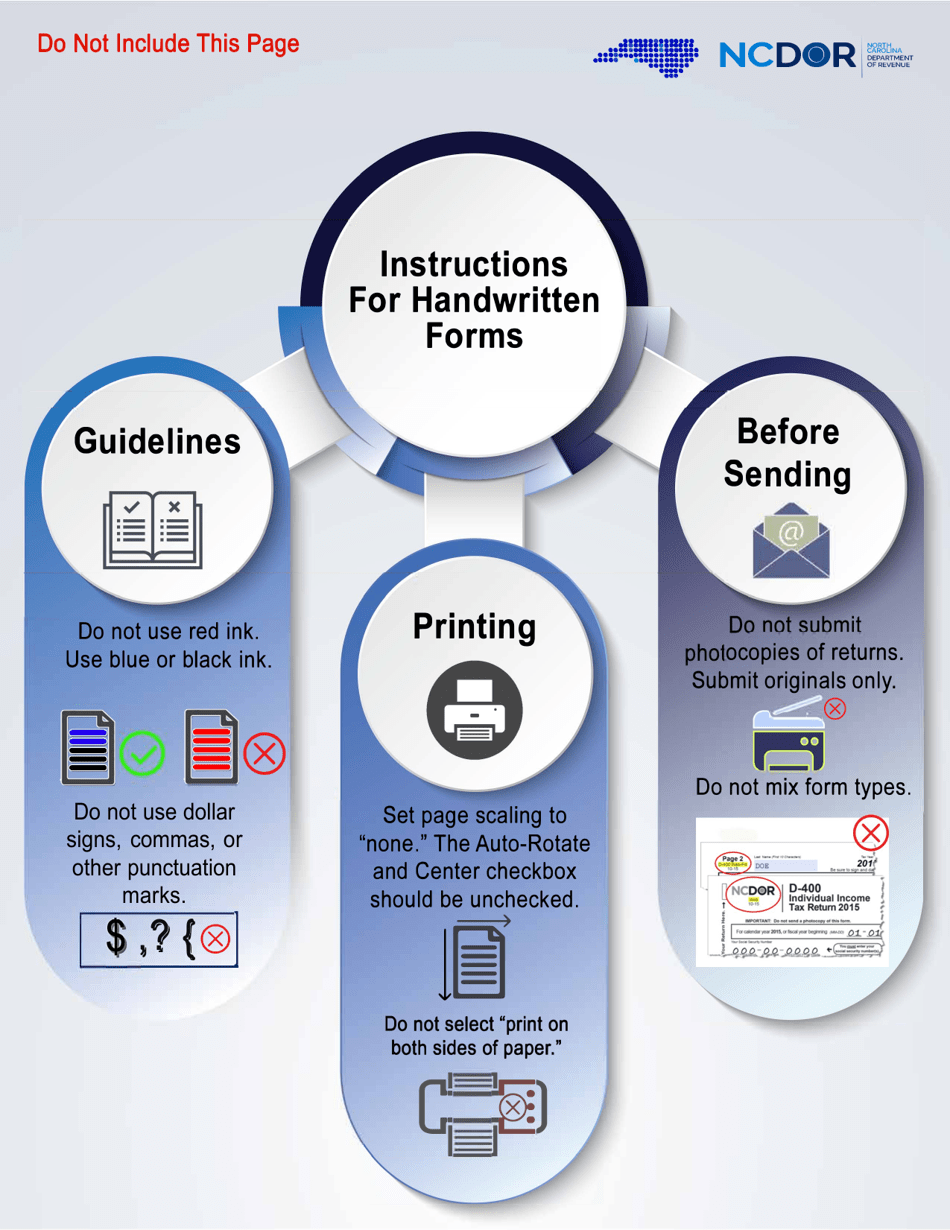

Form IB-54

for the current year.

Form IB-54 Installment Payment - North Carolina

What Is Form IB-54?

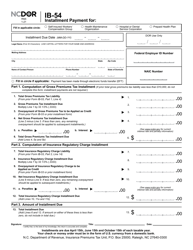

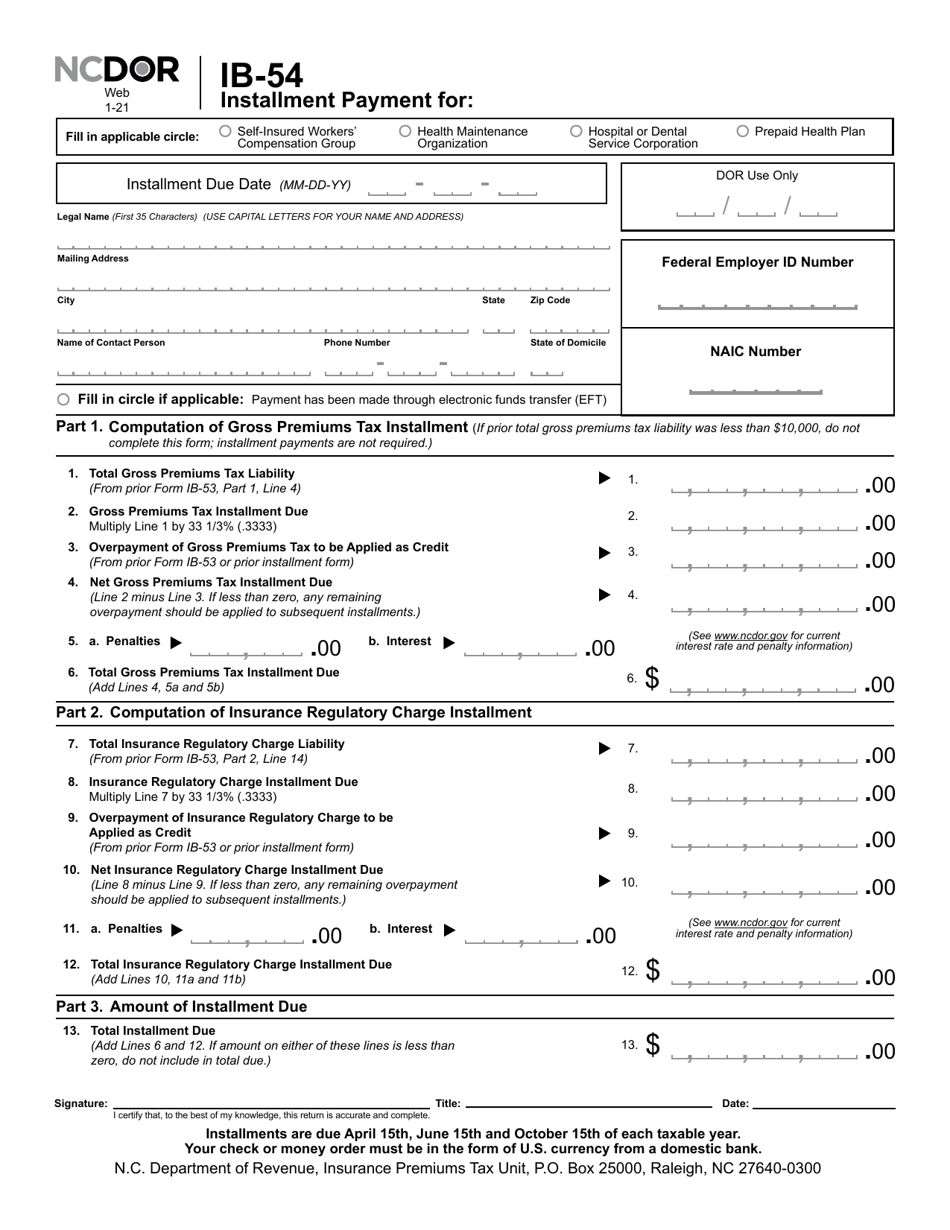

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-54?

A: Form IB-54 is the Installment Payment form used in North Carolina.

Q: What is the purpose of Form IB-54?

A: Form IB-54 is used to request an installment payment plan to satisfy a tax debt owed to the State of North Carolina.

Q: Who can use Form IB-54?

A: Any individual or business who owes unpaid taxes to the State of North Carolina may use Form IB-54.

Q: What information is required on Form IB-54?

A: Form IB-54 requires information such as the taxpayer's name, address, tax types owed, and proposed payment plan details.

Q: What happens after I submit Form IB-54?

A: After submitting Form IB-54, the North Carolina Department of Revenue will review the request and notify the taxpayer of their decision.

Q: Are there any fees associated with Form IB-54?

A: There may be fees associated with setting up an installment payment plan using Form IB-54. These fees are determined by the North Carolina Department of Revenue.

Q: Can I change my installment payment plan after it is approved?

A: Yes, it is possible to make changes to an approved installment payment plan by contacting the North Carolina Department of Revenue.

Q: What happens if I miss a payment on my installment plan?

A: If a payment is missed on an approved installment plan, the taxpayer may be subject to penalties and interest on the unpaid balance.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-54 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.