This version of the form is not currently in use and is provided for reference only. Download this version of

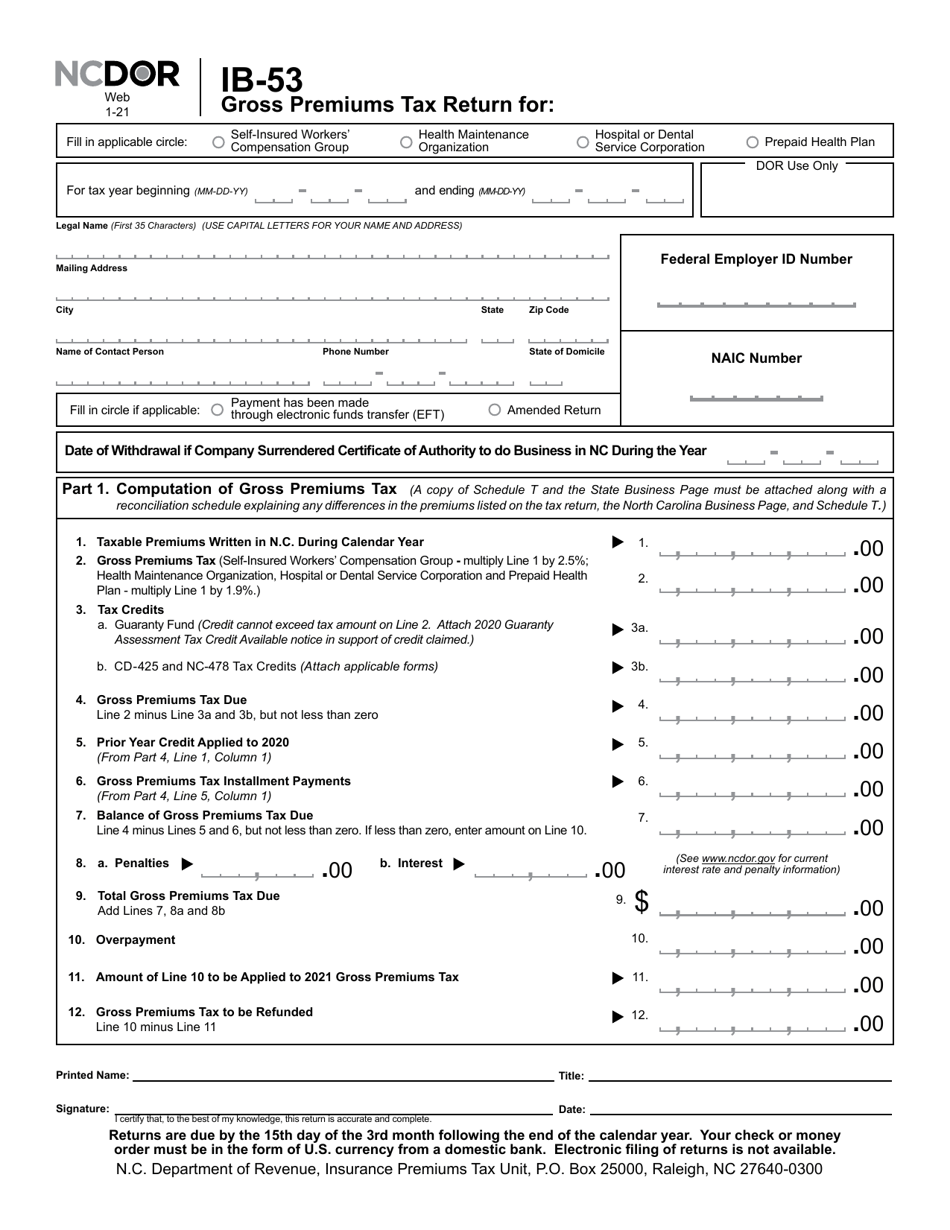

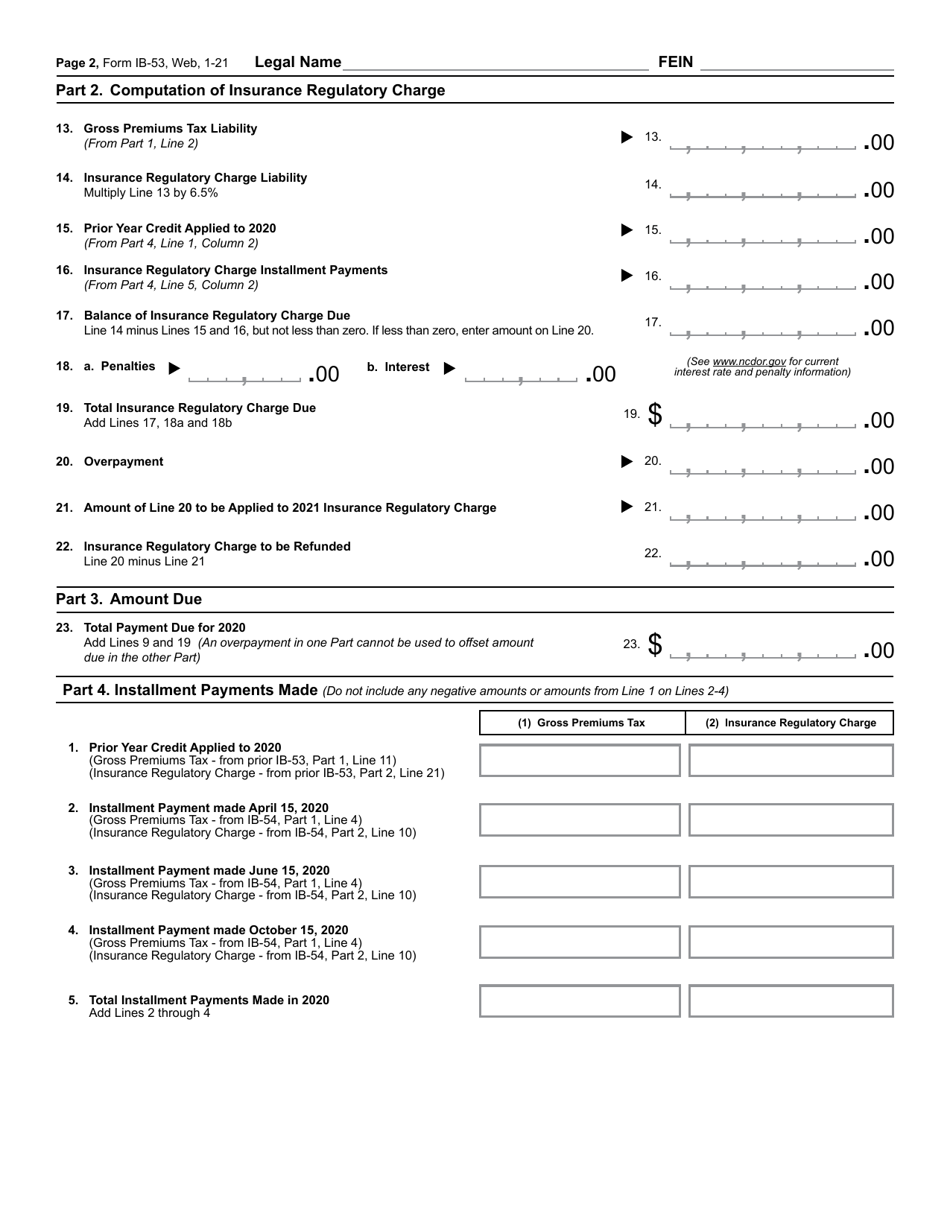

Form IB-53

for the current year.

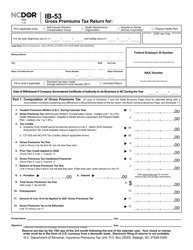

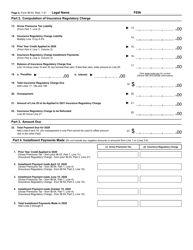

Form IB-53 Gross Premiums Tax Return - North Carolina

What Is Form IB-53?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IB-53?

A: Form IB-53 is the Gross Premiums Tax Return used in North Carolina.

Q: What is the purpose of Form IB-53?

A: Form IB-53 is used to report and remit the Gross Premiums Tax in North Carolina.

Q: Who needs to file Form IB-53?

A: Insurance companies licensed to do business in North Carolina need to file Form IB-53.

Q: What is the Gross Premiums Tax?

A: The Gross Premiums Tax is a tax imposed on insurance companies based on their gross premiums written in North Carolina.

Q: When is Form IB-53 due?

A: Form IB-53 is due annually on or before March 31st.

Q: Are there any penalties for late filing?

A: Yes, there are penalties and interest for late filing or failure to file Form IB-53.

Q: Can Form IB-53 be filed electronically?

A: Yes, insurance companies can file Form IB-53 electronically through the North Carolina Department of Revenue's eFile & Pay system.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the North Carolina Department of Revenue;

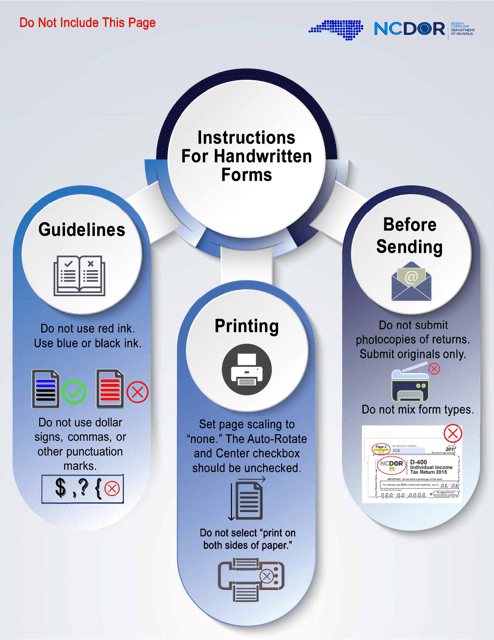

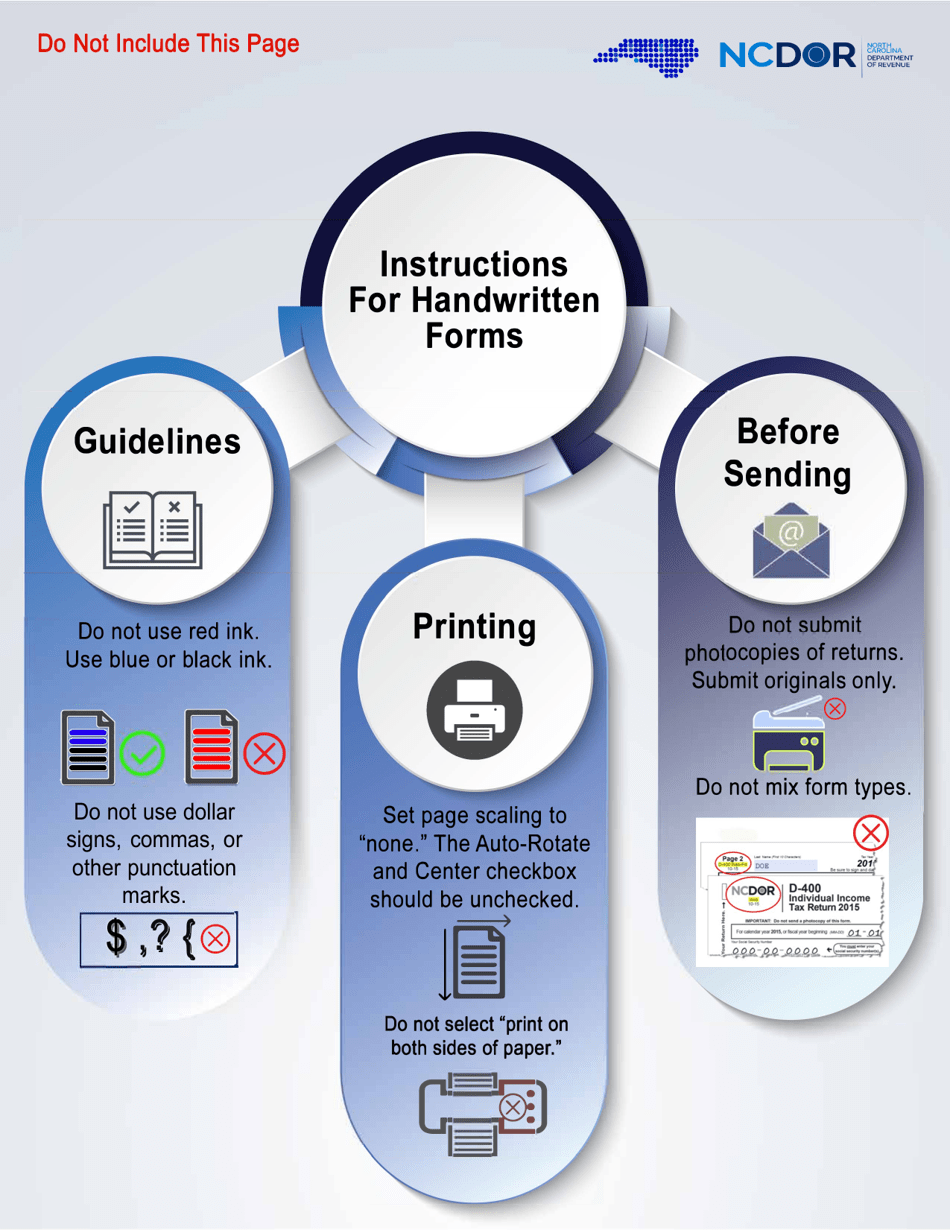

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IB-53 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.